The highest number of taxpayers in India are Salaried individuals. So, let’s understand the salary components and the taxability of salary income which in turn can help them figure out how to save taxes.

- What is Income from Salary?

- Difference between CTC and Take Home Salary

- Understanding Salary Slip and its Format

- Retirement Benefits:

- Relief Under Section 89

- Why Should Salaried Person File ITR?

- Which ITR should a Salaried Person File?

- How to Calculate the Tax on Income from Salary?

- Tax Rates applicable for Income from Salary

- Document Checklist for Filing ITR for Income from Salary

- FAQs

What is Income from Salary?

Salary Income is the paycheque you get every month from your employer. An amount received from your employer in the form of bonus, allowance, perquisites, etc. is a part of your Salary Income only.

Pension received by you after your retirement (not family pension) is also a part of the head Salary Income.

Below are the components of salary income:

- Wages

- Annuity or Pension

- Gratuity

- Fees, Commission, allowances, perquisites or profits in lieu of salary

- Advance of Salary

- Amount transferred from unrecognized provident fund to recognized provident fund

- Contribution of the employer to a Recognised Provident Fund in excess of the prescribed limit

- Leave Encashment

- Compensation as a result of variation in Service contract etc.

Moreover, this is an inclusive and not an exhaustive list.

A salaried individual can file ITR 1, ITR 2, ITR 3, and ITR 4. Of course, the applicability of ITR depends upon all the sources of income but salary income can be filed in all these ITRs.

Difference between CTC and Take Home Salary

CTC stands for Cost to Company, which is the cost company bears for an employee. CTC includes the basic salary, all the allowances/ benefits and the employer’s contribution to retirement benefits. Allowances and benefits include HRA, LTA, Special Allowance, Free Meals, etc. and retirement benefits include the Employee Provident Fund (EPF), Gratuity, etc. Additionally, the employer might offer you certain benefits in form of medical insurance, food coupons, phone bills reimbursed, etc. Therefore, the total cost to the company includes all such benefits along with your salary.

Here is the example of components of CTC mentioned in your offer letter:

| Component | Amount (in INR) |

|---|---|

| Basic salary | 3,50,000 |

| HRA | 1,00,000 |

| Special Allowance | 80,000 |

| Performance Bonus | 50,000 |

| Medical Insurance | 5,000 |

| PF (12% of Basic Pay) | 30,000 |

| Total CTC | 6,15,000 |

However, your take-home salary shall include your gross salary minus allowable exemptions minus income tax liability.

Your taxable salary will look like this for CTC mentioned above:

| Component | Amount (in INR) |

|---|---|

| Basic salary | 3,50,000 |

| HRA | 1,00,000 |

| Special Allowance | 80,000 |

| Performance Bonus | 50,000 |

| Total Salary | 5,80,000 |

| Less: PF (12% of Basic Pay) | (30,000) |

| Less: Tax Liability | (23,400) |

| Total Taxable Salary (Take home salary) | 5,26,600 |

Understanding Salary Slip and its Format

A salary slip in layman’s terms is a document issued by employers to their employees every month which contains a salary breakdown including Basic Salary, HRA, LTA, Bonus paid, deductions and other components.

Salary Slips are generally given to the employees via email or are delivered on paper.

Importance of Salary Slip

Salary Slip acts as a legal document of employment and helps employees seek loans, future employment, tax planning, and government subsidies.

- Proof of Employment

- A salary slip serves as legal proof of employment and against the salary claimed. Since the salary slip includes the last drawn salary and designation therefore it can be submitted while applying for travel visas or universities and colleges.

- Income Tax Planning

- It contains the monthly break-up of earnings and deductions. It also has components that include tax deductions. TDS helps an employee plan their tax liability in advance. The tax is calculated on the take-home salary based on income tax slabs.

- It helps in availing maximum benefits of tax deductions, rebates, allowances, and concessions within the accepted bounds under the Income Tax Act of 1961.

- Acquiring Loans

- The salary slip helps in setting a credit limit since it serves as legal proof of the credit-paying ability of an employee. Further, availing of loans, credit cards, mortgages, and other borrowing is based on the salary slip.

- Access to Government Subsidies

- The salary slip can be used to avail of certain free services. Such services include medical care, food grains, etc.

Sample Salary Slip Format

Salary Format and its Taxability

| Serial No. | Component | Definition | Taxability |

|---|---|---|---|

| 1 | Basic salary | This is the fixed component of your salary. It is also the basis for other components of Salary. | It is 100% taxable. And a part of your take-home salary. |

| 2 | Dearness Allowance (DA) | Only Government employees get DA. DA is paid to counter the inflation impact. It is calculated as a percentage of the Basic Salary. | It is 100% taxable. And a part of your take-home salary. |

| 3 | Granted to cover the cost of travelling between home and work. |

The lower of the following will be exempt from tax: 1. INR 1600 per month or In the case of handicapped employees exemption of up to INR 3200 per month is allowable. |

|

| 4 | HRA is paid to meet the house rent expense. This may consist of 40% – 50% of your basic salary. |

The lower of the following will be exempt from tax: In the case No rent is paid then HRA will be 100% taxable. *50% if staying in a metro city. |

|

| 5 | It allows an employee to take on a trip within India. The allowance is based on actual expenditure incurred. An employee can take two trips in a block period of four years. |

The exemption is allowed for the actual expenditure incurred for the trip subject to certain limits. Any expenditure incurred during the trip for purposes other than travel will not be exempt LTA. |

|

| 6 |

Children Education Allowance |

This allowance is granted to promote the education of children in India by the Income tax department. |

The amount of exemption will be a maximum of INR 100 per month per child (Maximum allowable for 2 children) |

| 7 |

Children Hostel Allowance |

To promote a higher literacy rate this allowance is granted to individuals whose children stay in a hostel for education. |

The amount of exemption will be a maximum of INR 300 per month per child (Maximum allowable for 2 children) |

| 8 |

Underground Allowance (Mines) |

This allowance is granted to employees working in underground mines. |

The amount of exemption allowable is a maximum of INR 800 per month. |

| 9 |

Tribal area Allowance |

This allowance is provided to the residents of scheduled, hilly and agency areas such as Madhya Pradesh, Tamil Nadu, Karnataka, Uttar Pradesh, Odisha, Tripura and Assam. |

An employee can get an exemption of a maximum of INR 200 per month. |

| 10 |

Island Duty Allowance |

This allowance is granted to members of the armed forces who are assigned duties on islands. |

The maximum amount of exemption allowed to such employees is INR 3,250 per month |

| 11 |

Allowance to employees of Transport undertaking |

This allowance is granted by roadways, railways and airways in place of the daily allowance. |

The amount of exemption allowable shall be least of following: 1. 70% of the amount received as allowance. 2. INR 10,000 per month. |

| 12 |

Travelling or Tour Allowance/ Conveyance Allowance/ Uniform Allowance/ Daily Allowance/ Helper Allowance (for office Purpose)/ Research Allowance |

These allowances are granted to meet with the respective expenses. |

Total amount spent will be the exempt amount. |

| 13 | Special Allowance and Performance Bonus |

These allowances are over and above your Basic Salary. A performance bonus is usually linked to your past performance and is usually paid once or twice a year. | It is 100% taxable. And a part of your take-home salary. |

Deductions Component and its Taxability

| Serial No. | Component | Definition | Taxability |

|---|---|---|---|

| 1 | Professional Tax | It is a tax on employment. This tax is deducted from your salary by the employer and deposited to the state government. | Professional Tax is allowed as a deduction from your salary income. |

|

2 |

Employee’s Provident Fund (EPF) | Usually, 12% of your basic salary goes towards the Employee’s provident fund. This amount is matched by the employer subject to certain limits which may vary as per company policies. | This is a forced investment since every company with over 20 employees, has to contribute towards PF. It is allowed as a deduction from total income. |

| 3 | Tax Deducted at Source (TDS) | Based on your total taxable income, your tax is calculated as per the applicable slab rate. This tax is deducted from your salary by your employer and deposited to the Government on your behalf. You can find your TDS from form 16, part A which is generated by TRACES and provided to you by your employer. | This amount represents the tax deducted from your salary and deposited to the government by your employer. This can be lowered by utilizing the deduction limits optimally. |

Standard Deduction:

The standard deduction was introduced for salaried taxpayers under Section 16 of the Income Tax Act. It allows salaried individuals to claim a flat deduction from income irrespective of actual expenses incurred by the employees. It has been introduced to bring parity between salaried employees and self-employed individuals. While self-employed individuals can claim various business-related expenses as deductions that bring down their taxable income, no such benefit could be claimed by most salaried individuals. It is a flat deduction of INR 50,000/- from AY 2020-21 to your “Income taxable under the head salaries”.

The eligible amount for this deduction cannot exceed the salary amount. The maximum amount of deduction will be:

- INR 50,000/- or

- Salary amount whichever is lower.

Note: This deduction is not available under New Tax Regime.

Impact of standard deduction on Pensioners

As per a recent clarification issued by the Income Tax Department, if a taxpayer has received income from a pension from the former employer, it shall be taxable under the head “Salaries”. Therefore, taxpayers receiving a pension from their ex-employers are eligible to claim a standard deduction of INR 50,000 or the amount of pension, whichever is less. Further, the benefit of this deduction will be allowed to pensioners only if it is taxable as salary income. In case it is charged to tax as other source income then the benefit of the standard deduction will not be available.

Retirement Benefits:

Pension

The employer pays a certain amount to its employee after retirement on a periodic basis for the services rendered by them during their job. This is known as Pension and it is taxable under the head Income From Salary.

There are mainly two types of pension:

- Uncommuted Pension: A periodical payment of pension received by the employee after retirement. Uncommuted pension is fully taxable to Government and Non-Government employees under the head Income from Salaries.

- Commuted Pension: A lump sum payment received by the employee at the time of retirement. In the case of Government employees commuted pension is fully exempt. Whereas in the case of non-government employees it is as follows:

| Particulars | Tax Treatment |

| Gratuity Received by pensioner | ⅓ of the pension which he is normally entitled to receive is exempt from tax |

| Gratuity Not Received by pensioner | ½ of the pension which he is normally entitled to receive is exempt from tax |

Note that ‘pension’ and ‘family pension’ are two separate things. An employer receives a pension after his/her retirement, and therefore, it is taxable under the head Salary. Whereas family pension is received by the nominated family members of the employee after his death. Additionally, for family members who receive a family pension, it is taxable under the head Income from Other Sources.

Gratuity

Gratuity is a retirement benefit provided by employer to employee. An employee becomes eligible for this compensation on completion of five years of service at that organisation. However, it is paid only at the time of retirement or resignation and for that employees are classified into two categories:

- Government employees: Gratuity received by a government (central/ state/ local) employee is fully exempt from tax for himself or his family.

- Non-Government employees: In case of non-government employees the tax treatment is different based on the applicability of the Payment of Gratuity Act to the employer.

Employee covered under the Payment of Gratuity Act:

Least of the following amount will be exempt from tax:

- Actual gratuity received

- INR 20 Lakhs

- Last drawn salary (Basic + DA)* number of years of completion of service* 15/26

Note: While calculating number of completed years any fraction of year in excess of 6 months should be taken as a full year. For instance, if the period served is 10 years and 7 months, the number of years completed to be taken is 11.

Employee not covered under the Payment of Gratuity Act:

Least of the following amount will be exempt from tax:

- Actual gratuity received

- INR 20 Lakhs

- Last 10 month’s average drawn salary (Basic + DA)* number of years of completion of service* 1/2

Note: While calculating number of completed years any fraction of year has to be ignored. For instance, if the period served is 10 years and 10 months, the number of years completed to be considered will be 10.

Leave Encashment Salary

As the name suggests, it is the encashment of unutilised leaves. You need to check for the company’s policy for leave encashment as some employers allow to carry forward a number of leave days and encash them while others prefer to finish them in the same year only. Leave encashment salary received during employment is fully taxable for all employees. If it is received at the time of retirement then the exemption for employees shall be as following:

- Government employees: Leave encashment salary received shall be fully exempt from tax.

- Non- government employees:

Least of the following amount shall be exempt from tax:

- Actual amount received

- INR 3 Lakhs

- Last 10 month’s average salary (Basic + DA + Turnover Commission)

- Amount equal to salary earned as leave encashment earned (total earned leaves shall not exceed 30 days for every year of service rendered)

Voluntary Retirement Scheme

Any compensation received at the time of voluntary retirement is exempt u/s. 10(10C) subject to fulfilment of the following conditions:

As per this section, the amount that an employee receives for his/her service in;

- public sector or any other firms,

- authority established under the Central, State or Provincial Act,

- Co-operative Societies,

- Local Authority,

- Universities, IITs and Notified Management Institutes etc are considered to be exempt to the lowest of the following:

- Three months’ salary (Basic + DA + Turnover Commission) for each completed year of service (While calculating the number of completed years any fraction of the year has to be ignored)

- Salary at the time of retirement multiplied by the balance months of service left before the date of retirement

- INR 5,00,000

- Actual amount received

Note: Section 10(10C) and section 89 are mutually exclusive. It means that an individual can only claim either exemption u/s 10(10C) or relief u/s 89. Moreover, if one claims an exemption or relief in any assessment year then it cannot be claimed again in any other assessment year.

Who is Eligible to Claim VRS?

The list of eligible employees as per Sec 10(10C) who can claim VRS Exemption includes employees of ‘any other company’. Thus, private sector employees can claim exemption subject to the following conditions as per Rule 2BA:

- An employee has completed 10 years of service or completed 40 years of age (Does not apply to public sector employees)

- Can be claimed by all employees including workers and executives except directors

- VRS Scheme is initiated for a reduction in the existing strength of the employees so any vacancy caused by the VRS is not to be being filled up

- The retiring employee shall not be employed in another company belonging to the same management

Relief Under Section 89

Section 89 provides relief to mitigate the additional tax burden that may arise because of a large sum of money that is suddenly paid in advance (in the form of VRS) or in arrears in a particular year. Individuals who wish to claim a relief u/s 89 must make sure to file form 10E before filing their income tax online.

Following are the steps to calculate refile under section 89:

- Calculate the total tax payable

Firstly, calculate the total tax payable on the income, which includes additional salary, arrears or compensations, in the year you receive the compensation - Compute the tax rate

Now, Calculate the tax rate on total taxable income during the year in which you receive the compensation - Calculate the tax on total income

Next, calculate the tax on total income by adding 1/3rd of the VRS amount received in each of the three preceding previous years immediately preceding the year in which the VRS is received. - Compute the rate of tax

Now, Calculate the rate of tax for each preceding three years individually. - Compute the average rate of tax

Next, compute the average rate of tax for the three preceding years. - Amount of Relief

Finally, calculate the amount of relief = VRS amount X [Step 2 – Step 5]

Why Should Salaried Person File ITR?

It is mandatory to file the ITR if the gross total income exceeds the limit of INR 2,50,000 in the FY, subject to certain conditions. The limit for senior citizens is INR 3,00,000. Furthermore, it is also important to file an ITR for such individuals to:

- Avail tax refunds

- Has assets outside of India

- Required to carry forward loss under any other head of income, etc

Which ITR should a Salaried Person File?

The Income Tax Department (ITD) requires salaried individuals to file the ITR 1 Form. In this case, their total salary should be under INR 50 lakhs, inclusive of both salary income and income from other sources. Furthermore, the individual should not have more than one house property and their income from agriculture (if any) should not exceed INR 5,000. They can also file ITR 2 if they have income from salary, more than one house property, income from capital gains and IFOS. Individuals can file ITR 3 if they receive income from business and profession in addition to the above-mentioned incomes.

How to Calculate the Tax on Income from Salary?

Salary Income is taxable on the basis of accrual or payment whichever is earlier. Hence in simple terms even if you receive your March month’s salary in April of the next financial year it would still be taxable in the current financial year only.

Taxable Salary Income can be calculated in the following manner:

- Add up all the amounts you received from your employer

Be it in the form of remuneration, wages, gratuity, commission, allowances, perquisites, bonus, etc. - Deduct all the allowances to the extent they are exempt u/s 10

Like House rent allowance (HRA), Children’s education allowance, Leave travel concession, Uniform Allowance, etc. - Deduct section 16 deductions i.e, the Professional tax, Standard Deduction, and Entertainment Allowance

This resulting figure will be your taxable salary income.

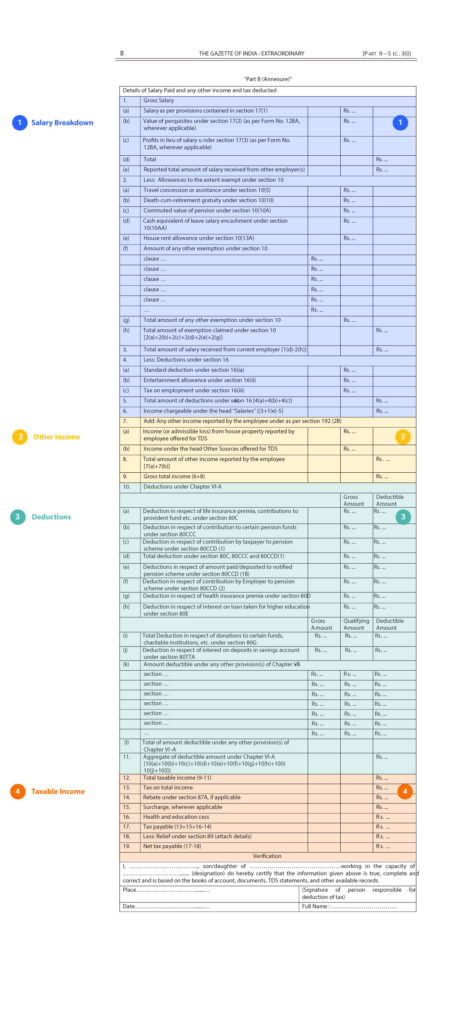

In your Form 16 Part B, this figure will be reflected against line no. 6 “Income chargeable under the head Salaries”

Tax Rates applicable for Income from Salary

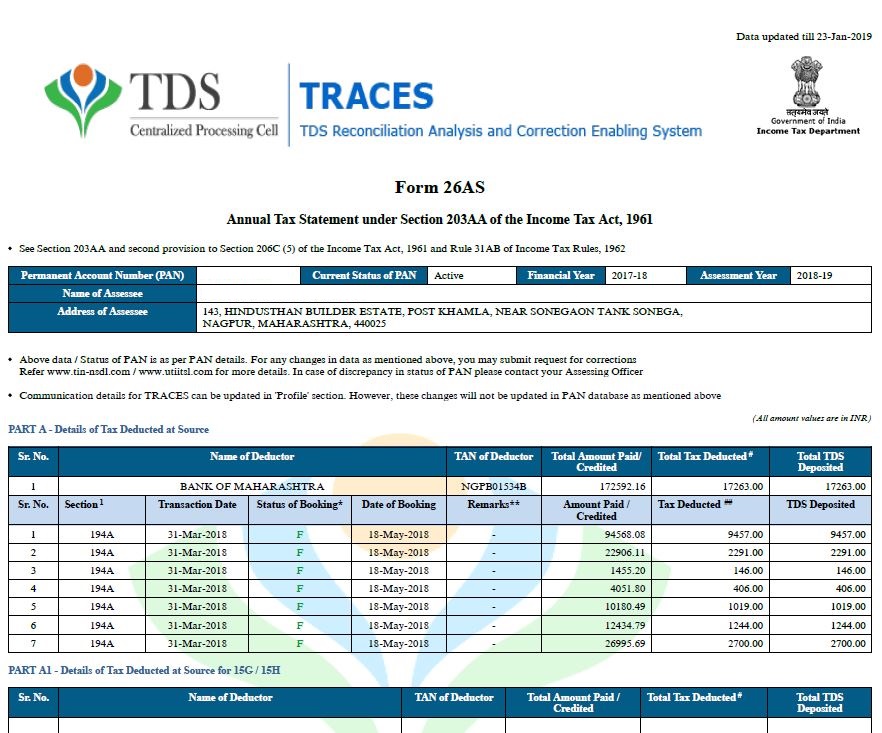

Income from Salary is taxed at the applicable slab rate. In the case of salary, TDS is deducted by an employer every month. Since the employer deducts TDS after taking into account the Investment Declaration (Form 12BB) submitted by the employee. You can know this TDS amount from your Form 26AS or Form 16 Part A.

Although it is the responsibility of the employer to deduct the tax from salary, an employee needs to calculate Tax liability while e-filing ITR. Now if the TDS deducted does not match with the tax liability that is calculated, an employee would end up paying additional tax dues.

Income tax rates for individuals below the age of 60 years are as follows under old tax regime:

| Income Slab | Tax rate (Old Tax Regime) |

|---|---|

| Up to Rs. 2,50,000* | No Tax |

| Rs. 2,50,000 to Rs. 5,00,000 | 5% |

| Rs. 5,00,000 to Rs. 10,00,000 | 20% |

| Above Rs. 10,00,000 | 30% |

*Under the old tax regime, in the case of senior citizens basic exemption limit will be Rs. 3,00,000/- and for super senior citizens, the basic exemption limit will be Rs. 5,00,000/-.

Income tax rates for individuals below the age of 60 years are as follows under new tax regime:

| Income Slab | Tax rate (New Tax Regime) (up to AY 2023-24) |

|---|---|

| Up to Rs. 2,50,000* | No Tax |

| Rs. 2,50,000 to Rs. 5,00,000 | 5% |

| Rs. 5,00,000 to Rs. 7,50,000 | 10% |

| Rs. 7,50,000 to Rs. 10,00,000 | 15% |

| Rs. 10,00,000 to Rs. 12,50,000 | 20% |

| Rs. 12,50,000 to Rs. 15,00,000 | 25% |

| Above Rs. 15,00,000 | 30% |

| Income Slab | Tax rate (New Tax Regime) (AY 2024-25 onwards) |

|---|---|

| Up to Rs. 3,00,000 | No Tax |

| Rs. 3,00,000 to Rs. 6,00,000 | 5% |

| Rs. 6,00,000 to Rs. 9,00,000 | 10% |

| Rs. 9,00,000 to Rs. 12,00,000 | 15% |

| Rs. 12,00,000 to Rs. 15,00,000 | 20% |

| Above Rs. 15,00,000 | 30% |

*Under the new tax regime, in the case of senior citizens and super senior citizens the basic exemption limit is Rs. 2,50,000/- only.

Surcharge @10% of the total income tax if total income exceeds Rs. 50 Lakhs but up to Rs. 1 Cr., Total income >Rs. 1 Cr. but up to Rs. 2 Cr. Surcharge @15%, Total income >Rs. 2 Cr. but up to Rs. 5 Cr. Surcharge @25%, and if total income exceeds Rs. 5 Cr Surcharge @37%.

Health & Education Cess @ 4% on the total of income tax and surcharge.

Document Checklist for Filing ITR for Income from Salary

Form 16 or salary certificate

Any salaried individual, whose TDS has been deducted from his salary by the employer, receives Form 16 from his/her employer. Form 16 is a detailed statement that shows the salary earned during a Financial Year along with deductions, exemptions, and tax deducted from the salary in that year. If no tax is deducted even then the employee can ask for the issue of salary certificate.

Form 26AS

Form 26AS is a consolidated Tax Credit Statement which provides the following details to a taxpayer.

- Details of taxes deducted from the taxpayer’s income.

- Details of taxes collected from taxpayer’s payments.

- Advance Taxes, Self Assessment Taxes and Regular Assessment Taxes paid by the taxpayers.

- Details of the refund received during the year.

- Details of any high-value transactions (for eg. Shares, Mutual Funds, etc.).

It is very important to check Form-26AS before e-filing the Income Tax Return because no one would want their tax credits to be unclaimed.

Salary Slip

Salary slip is given by the employer to the assessee on a monthly basis. It will also include your gratuity leave encashment as well. An Individual must keep the details of gratuity or leave encashment that has been received or is yet to be received no matter if it is taxable or not while filing their ITR.

If an individual, changes their job in the middle of the Financial Year, all Form 16 submitted by him/her should be considered.

Pension Certificate

Employee pension is also treated as salary income and therefore becomes taxable. It is wise to collect the Pension certificate through Form 16 from the bank as per requirements.

PF Passbook

Provident Funds are set up to encourage social security for employees. Employees contribute a fixed amount of their basic pay towards this fund and the employer also contributes the same amount in many cases. The entire amount credited to the employee’s account can be taxable or not taxable. But for references, they/ them should have their Provident Fund Passbook ready with all the details.

Form 12BB

Form 12BB also known as Investment Declaration/Investment proof is basically a disclosure of all their tax-saving investments in that particular Financial Year. Since the employer has to provide an accurate calculation and deduction of TDS on salary income, form 12BB should be submitted at the beginning of every financial year.

FAQs

Allowances are fixed periodic amounts, apart from salary. Therefore, they are paid by an employer for the purpose of meeting some particular requirements of the employee. For example, House Rent Allowance, Transport Allowance, Uniform Allowance, etc.

There are generally three types of allowances for the purpose of the Income-tax Act

1. Taxable allowances,

2. Fully exempted allowances and

3. Partially exempted allowances

Yes, Pension income is taxable as salary income. However, the family pension will be taxable under the head income from other sources.

Any arrears of salary received are taxable under section 15 of the Income Tax Act. It is taxable in the year of receipt under the head Income from Salary. However, relief u/s 89 is available on the same.

Salaried individual needs to file ITR-1 every year by 31st July of the next year. ITR-2 needs to be filed if the total salary is more than Rs. 50 lakhs.

Advance salary received is taxable in the year of receipt u/s 15 of the income tax act. It is taxable under the head Income from Salary and relief u/s 89 is available on the same.

Yes, a taxpayer can claim various other deductions, such as those available under tax-saving investments available under Section 80C (PPF, ELSS Funds, etc) to Section 80U.

Exemption of INR 5 lakhs is a one-time exemption, i.e. an employee can claim this exemption only once in a lifetime.

Hi, CTC or the Cost To Company is the cost company bears for an employee - it includes basic salary and other allowances like HRA, Dearness Allowance, Conveyance Allowance, etc.

Whereas, take-home salary is computed after deducting taxes & contributions from CTC.

You can refer the guide on the difference between CTC and Take Home Salary on our learn center.

query : my annual salary is 18 lakhs . how much drawings can i show in my books of accounts ? is there any criteria for the drawings amount ? can i deduct drawings as expenses from my salary ?

Hi @HIREiN

The gross salary reduced by eligible deductions u/s 10 is taxable. You cannot claim any expenses from your salary.