Employers are liable to deduct TDS on the salary payments to employees if the total income of the employee exceeds the basic exemption limit. The employer issues Form 16 i.e. TDS certificate to employees every financial year as proof of the TDS deducted and deposited on their salary income. The due date to issue Form 16 is 15th June from the end of the financial year. Thus, the employers must issue form 16 for FY 2021-22 (AY 2022-23) by 15th June 2022.

Update Regarding Form 16 FY 2020-21 (AY 2021-22) onwards

The major change in Form 16 with respect to the new regime is in Part B of Form 16 where section A (the first line of Form 16) asks ‘Whether opting for taxation under Section 115BAC?’ to which there are options of selecting ‘Yes’ or ‘No’.

What is Form 16?

It is a certificate of TDS on a salary that contains details of income earned and the taxes deducted. It is divided into two parts: Part-A and Part-B. The employer can download Form 16 Part A and Part B from their account on TRACES.

It is easier to file your Income Tax Return using Form 16. You can simply upload it on Quicko and ITR will be prepared automatically. Other important income tax documents include Form 26AS, Form 12BB, Form 10BA, and Form 15G/15H.

Form 16 Format – FY 2021-21 (AY 2021-22)

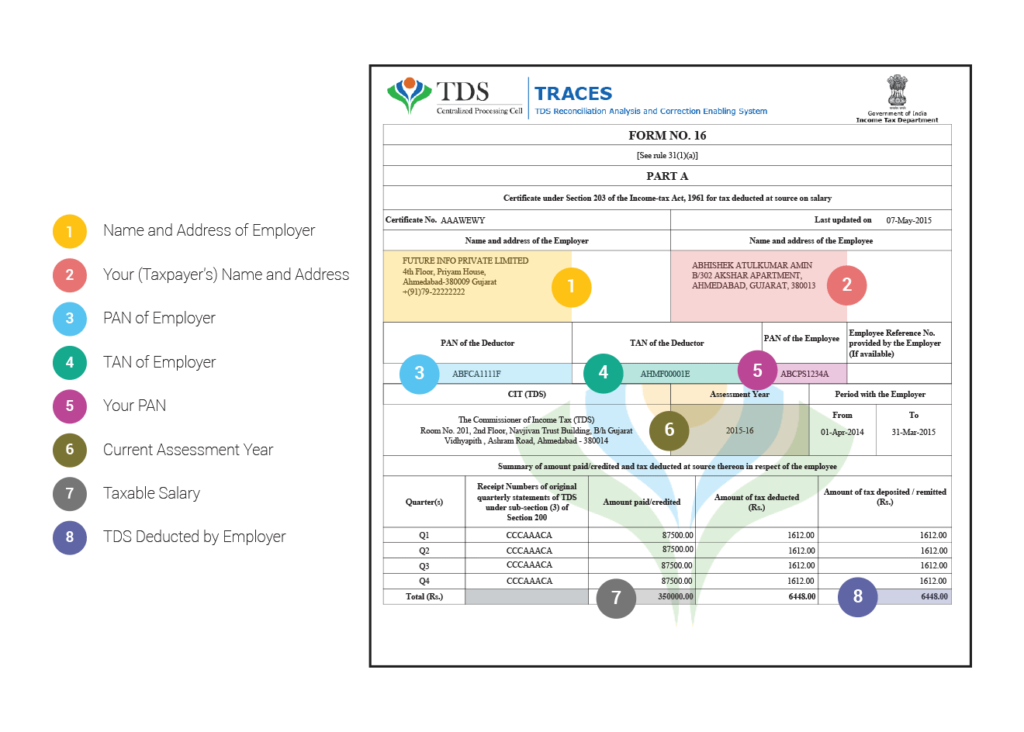

Form 16 – Part A

It contains details of TDS deducted by an employer. Part-A is generated by TRACES.

Part A includes the following details:

- Employer Details: Name, Address, PAN, TAN

- Employee Details: Name, PAN

- Tax details: Tax deducted and deposited on the employee’s behalf

Sample Form 16 – Part A

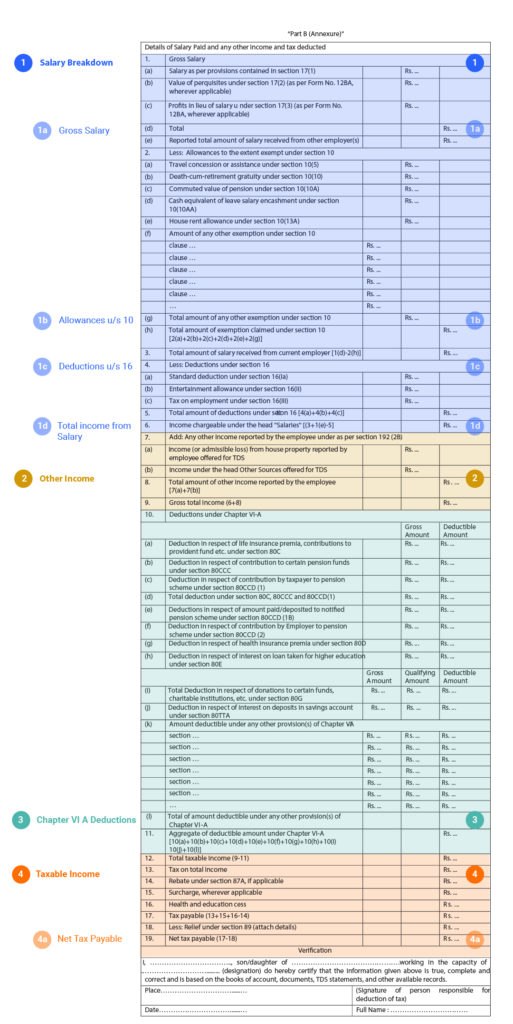

Form 16 – Part B

Part-B is an annexure containing details of Income Chargeable under the head of ‘Salary’. Salary breakdown includes allowances, perquisites, bonus, income tax deductions, Taxable Income, Taxes, and TDS. Further, from FY 2018-19 onwards, the employers must issue Form 16 Part-B in a standard format. Below is the standard format of Form 16 as per the Income Tax Department.

Sample Form 16 – Part B

Salary Breakdown

Gross Salary

Gross salary is the employee’s total remuneration. It includes basic salary, allowances, overtime, bonus, and any other amounts before any deduction is made.

- Basic Salary

- It is the predefined fixed pay that an employee receives each month. It also includes compensation like gratuity, pension, advance salary, commission, etc.

- Perquisites

- These are additional benefits provided by the employer like rent-free accommodation, concession in rent, etc. It also includes expenses incurred by the employer on behalf of the employee like medical, education, etc.

- Profits

- The amount received from a current employer or former employer in connection with their termination like a bonus, etc.

- Salary from the other employer(s)

- The current employer will include your salary from the previous employer in the Gross Salary. It is the case usually when, the employee switched jobs or has multiple employers during the financial year.

Allowances under Section 10

Additional compensation received by employees over and above their salary is Allowances. Employers give allowances to their employees to help them meet certain particular requirements. Some of the common allowances include:

- LTA i.e. Leave Travel Allowance

- For employees when they are on leave and traveling alone or with family within India

- HRA i.e. House Rent Allowance

- For employees to cover their accommodation expenses. Salaried individuals who live in rental premises can claim tax benefits for the amount of rent they pay every year

- Death-cum-retirement gratuity

- For employees covered under the Gratuity Act, 1972. There is a predefined formula to calculate the amount that is tax-exempt

- Commuted Value of Pension

- For government employees and other employees who receive a commuted pension from the employer.

- The cash equivalent of leave salary encashment is a retirement benefit for employees. There is a predefined formula to calculate the amount that is tax-exempt.

Deductions under Section 16

Tax deductions are deductible from taxable income (adjusted gross income). An employee is eligible to claim these deductions based on the investments made and expenses incurred during the year. These deductions help reduce the overall tax liability. Some of the most commonly used deductions u/s 16 are:

- Standard Deduction

- It is a flat deduction from the salary. The taxpayer requires no proof to claim the standard deduction. The standard deduction allowed for FY 2018-19 is INR 40,000 and FY 2019-20 is INR 50,000.

- Entertainment Allowance

- It is exempt only for government employees. The employee can claim an Entertainment Allowance of up to INR 5,000.

- Employment Tax

- Employment Tax is also known as professional tax. An employer pays it on behalf of the employee to the state government. It ranges from INR 2,400 to INR 2,500.

Total Income from Salary

Total Taxable Salary is after deducting the allowances u/s 10 and claiming deductions u/s 16.

Other Income

Other Incomes under this Form include:

- Income from Other Sources

- The dividend, interest income from the savings account, fixed deposit, etc.

- Income from House Property

- Rental income from house property including flats, office spaces, farmhouses, etc. It also includes interest and principal repayment of a loan taken on self-occupied house property.

Chapter VI-A Deductions

- 80C: ELSS, Provident Fund, Life Insurance Premium, etc.

- 80CCC: Pension Funds

- 80D: Medical Insurance Premium

- 80E: Interest on Loan taken for Higher Education

- 80G: Donation to Charitable Trusts, Institution

- 80TTA or 80TTB: Interest on Savings and Deposits

Total Taxable Income

It is the total income from all income sources after claiming exempt allowances and deductions during the financial year.

Net Tax Payable

Net Income: Tax deducted on income at the slab rate. Tax includes Income Tax, Surcharge, Health & Education Cess, Interest Penalties, etc.

Tax Payable: Tax calculated at Slab Rate on Net Income. Surcharge and

Health & Education Cess is levied on it. Rebate u/s 87A and Relief u/s 89 are given based on the total income earned by an employee.

FAQs

You can file ITR-1. Any individual who earns only salary income can file ITR-1.

If your employer has not provided you with a Form 16, no need to worry. You can always download Form 26AS from the income tax e-Filing website to check your TDS credit. Further, you can use salary slips to determine taxable salary income.

A salaried individual cannot download his/her Form 16. It can only be downloaded by the deductor (employer) from his TRACES account.

Yes, you can claim deductions that are not shown in the form while filing your ITR. But make sure to keep supporting documents with you for future reference.

If someone has switched jobs during the year, he’ll have multiple Form-16. You need not worry. Just upload one, save it and add another. Quicko will add up all your salaries and deductions from multiple Form-16s.

Yes, an employer can still issue Form 16 to you. An employer will not issue Form 16 Part-A since no tax is deducted at source. However, your employer can issue Form 16 Part-B which is a salary statement.

Hey @TeamQuicko

Thanks for the blog! Just one quick question - Why do we have to report a quarterly breakdown of Dividend Income under IFOS?

Thank you!

Hey @TanyaChopra

This quarterly breakdown of Dividend Income under IFOS will help to calculate and determine penalty u/s 234C for the delay in payment of Advance Tax.

Hope this helps!

I had received dividend recently but I had noticed that TDS had been deducted. any idea as to why has it happened and is there a way I can claim this TDS?

Hey @HarshitShah

After the introduction of Budget 2020, dividend income is now taxable in the hands of the shareholder; and is also subject to TDS at 10% in excess of INR 5000 u/s 194 & 194K. Foreign Dividend is taxable at slab rates. TDS is not applicable to such dividends. The taxpayer should report such income under the head IFOS in the ITR filed on the Income Tax Website.

Hope this helps!

Hey @HarishMehta

Yes, dividend income is now taxable from FY 2021-22 onwards and it has to be reported under the head of IFOS.

You can read more about it here:

Hi @Maulik_Padh,

You need to pay Income tax on the net taxable income, i.e. after subtracting deductions, expenses, etc.

If the net taxable income is negative i.e. if there is loss, you can carry it forward when filing the ITR

Here are some of the articles which might help

Hi @ameyj

The amount of TDS deducted shall reflect in your Form 26AS only and it will also reflect the name of the deductor.

Using the name of the deductor you can find out on which share you have received the dividend and you can also cross-check the same in your bank statement.

Yes, you are right, TDS is to be deducted when the dividend paid exceeds 5000 INR in a financial year. However, the 5,000 INR limit pertains to all the dividends an individual gets in a year, or the total dividend per shareholder that a company pays out in a year, is left to interpretation, and hence registrars and share transfer agents (RTA) are not taking any chances and are deducting TDS even on small amounts.

Hope this helps

Hi @ameyj

You can submit a grievance on Income Tax Portal mentioning the issue and also attach the 26AS.

The other option is to leave it as it is and clarify it when the tax department sends the notice.

Hi @TeamQuicko

Consider that I have 10 shares each of 10 different Indian companies. Each of the 10 companies are declaring a dividend of INR 100 before the FY ends. Now I will be recieving 1000 as dividend from each company, thereby a total of 10,000.

The 5,000 dividend limit, is it applicable to each company / total dividend recieved by me in a year. If it is applicable to each company, then I would not attract TDS of 10% for dividend.

Also pl clarify, how would the company B know that I have got shares of Company A,C,D,E so on…

@Saad_C @Laxmi_Navlani @Divya_Singhvi @Kaushal_Soni @AkashJhaveri can you help with this?