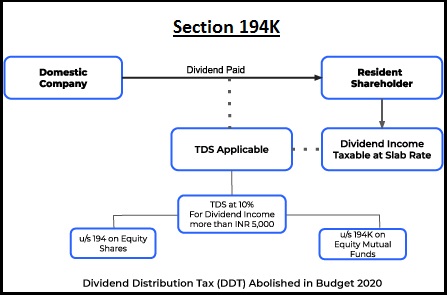

FM Nirmala Sitharaman introduced Section 194K in the Finance Act 2020. This section requires tax deduction on payments for mutual fund units made to resident individuals within a set limit. It eliminates the Dividend Distribution Tax – DDT. Earlier, mutual fund payouts were taxed twice—first, when the company paid the Asset Management Company (AMC) and again, when the AMC distributed them to unit holders.

What is Section 194K?

In Section 194K, the dividend received on mutual funds which were earlier exempt under Section 10(35) of the Income Tax Act is now taxable at slab rates. Since the income would be taxable in the hands of the shareholder, TDS would be applicable.

The person paying dividends on mutual funds should deduct TDS u/s 194K. The deduction is at 10% on the number of dividends, only if a resident shareholder’s total dividend in a financial year exceeds INR 5,000. Section 194K of the Income Tax Act is applicable from 1st April 2020 i.e. FY 2020-21 onwards.

What is the meaning of ‘Income’ under Section 194K?

As per the Income Tax Act, ‘Income’ includes dividends paid on units of mutual funds specified under 10(23D) of the Income Tax Act, units of mutual funds from a specified company, or units of mutual funds from the administrator of the specified undertaking.

There was confusion about whether the TDS under Section 194K on “Income from Mutual Funds” would include only dividends, or also include capital gains on the sale of MFs. On 4th Feb 2020, CBDT issued a clarification on this issue.

CBDT Clarification – TDS at 10% should be deducted from Dividend Income only and not on Income from Capital Gains on the sale of Mutual Funds.

Analysis of Section 194K

- Deductor

- Mutual Funds distributing dividends to the investors of equity mutual funds should deduct TDS on such dividends. The deductor must deposit the TDS and file the TDS Return on TRACES.

- Deductee

- Shareholder residents in India earning dividend income on equity mutual funds will receive the amount after TDS under Section 194K of the Income Tax Act. Shareholder residents in India earning dividend income on equity shares will receive the amount after TDS under Section 194. NRI investors/shareholders, earning dividend income will receive the amount after the deduction of TDS under Section 195.

- Nature of Payment

- Sec 194K covers the Payment of Dividends on Equity Mutual Funds to a resident shareholder exceeding INR 5000 in a financial year.

When to Deduct TDS?

TDS shall be deducted at the time of credit of income to the payee account or at the time of payment, whichever is earlier. If the payee of the amount credits the amount to a “suspense account” or any other account, it is considered a ‘deemed payment, and the payer must deduct TDS on such credit.

Rate of TDS u/s 194K

The deductor should deduct TDS u/s 194K of the Income Tax Act at the rate of 10% if the dividend amount exceeds INR 5000. The rate of TDS will be 20% in case the payee doesn’t furnish their PAN.

TDS Certificate

The deductor shall issue Form 16A to the deductee as a Tax Credit Certificate of the amount deducted as TDS. The Deductor can download Form 16A from the TRACES. Using Form 16A, the deductee can claim credit for the tax deducted while filing Income Tax Return.

TDS Return

After depositing TDS with the income tax department, the deductor should file Form 26Q on TRACES. The details of the dividend payment are part of this report. The deductor, after filing the report, should provide Form 16A to the deductee.

FAQs

Sec 194K mentions TDS on ‘Income’ from Mutual Funds. There was confusion about whether capital gains income on the sale of MFs should be subject to TDS u/e 194K. However, the CBDT issued an official clarification on 02nd February 2020. Therefore, TDS needs to be deducted at 10% on Dividend Income only. Additionally, it is not applicable for Income from Capital Gains on the sale of Mutual Funds.

Section 195 applies to the dividend paid to NRI investors/shareholders, as per provisions of the Income Tax Act. Hence, TDS needs to be deducted from the dividend at 20% on equity shares and equity mutual funds.

Hey @Dia_malhotra

As per section 194A, TDS on interest other than interest on securities is required to be deducted by any person other than Individual or HUF at the rate of 10%, when paid to a resident. No surcharge, education cess or SHEC shall be added to the above rate.

Hope this helps!

Hey @HarishMehta

TDS u/s 194J needs to be deducted by deductor other than an individual or a HUF, @ 10% on any amount paid or payable to any which is in excess of INR 30,000 as:

Hope this helps!

Hello @the_AK,

Against gross income, you can claim business expenses that you have incurred for earning that income. So you can claim this service fee as a business expense from the gross income received by you.

Hope this helps!

Hey @Bharti_Vasvani can you please help here?

Hello @Anuj_Agarwal,

TDS will be deducted by the company when the interest is actually paid on the securities, so at that time whoever is the owner of such security shall receive the interest and can claim credit of interest.

Hope this helps!

Hey @Anuj_Agarwal,

You can check out this article for more clarity:

Hope this helps!

I have respectable salary income and 1000 insurance commission…ie old commission…not claiming any expenses…can i show it as other income in itr1 or have to file itr 3

Hi @Shivam_B

If you have income from salary and income from insurance commission (business income), then you will be required to file ITR 3.

Itr 3 is so big…have to pay heavy charges…for filing…will it be defective if i do so ie reporting 1000 as other income in itr1 along with salary income…have closed down the insirance work since yesrs…i even contacted commssiom giving broker and closed my commission account…still they are showing in 26as wheress i am not receiving in real

Hi @Shivam_B

As per the recent utilities, ITD gives you the option to select only the schedules applicable to you while filing ITR.

Thus, you are not required to go through the entire ITR 3 form. You can also prepare and file ITR on Quicko, where you can upload form 16 and add commission income under the head “Business & Profession” and file ITR 3, without any charges as Quicko is a DIY platform helping individuals to file taxes.