The Finance Minister, Nirmala Sitharaman had presented the budget 2020 on the 1st of February 2020. The record-breaking 2 hours and the 30-minute speech by the Finance Minister had many major announcements. The major highlights of the budget 2020 that have been covered under this article are as follows:

New Tax Regime v/s Current Tax Regime

Income Tax Slab Rates

According to the Finance Minister, the taxpayers now have the option to either continue with the current tax regime or join the new tax regime in the upcoming Assessment Year. The major difference between both of these tax regimes is the exemptions and deductions. The given below tables shows the slab rates under both the tax regimes:

| Income Range | Current Income Tax Rates | New Income Tax Rates |

| Up to INR 2,50,000 | NIL | NIL |

| INR 2,50,001 to INR 5,00,000 | 5% | 5% |

| INR 5,00,001 to INR 7,50,000 | 20% | 10% |

| INR 7,50,001 to INR 10,00,000 | 20% | 15% |

| INR 10,00,001 to INR 12,50,000 | 30% | 20% |

| INR 12,50,001 to INR 15,00,000 | 30% | 25% |

| Above INR 15,00,000 | 30% | 30% |

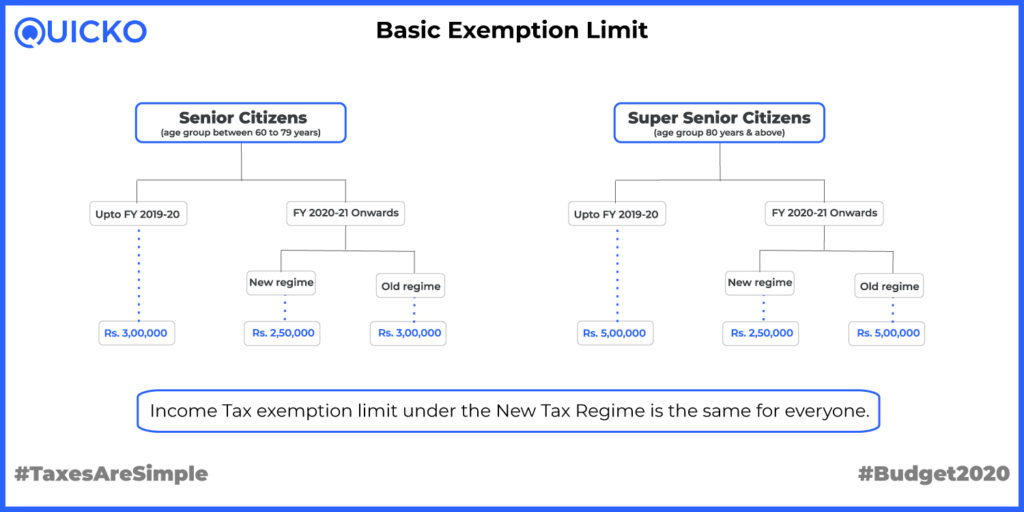

The Finance Minister announced that under the new tax regime, the basic tax exemption limit will remain the same for all assessees including the senior citizens. Therefore, in case you opt for the new regime, there will be no higher tax exemption for the senior and super senior citizens.

Changes in Deductions and Exemptions

According to the announcement made in the budget 2020, there have been major removals of tax exemptions and deductions. This has made compliance tax less tedious. Here is the list of what deductions have stayed and what deductions have been removed:

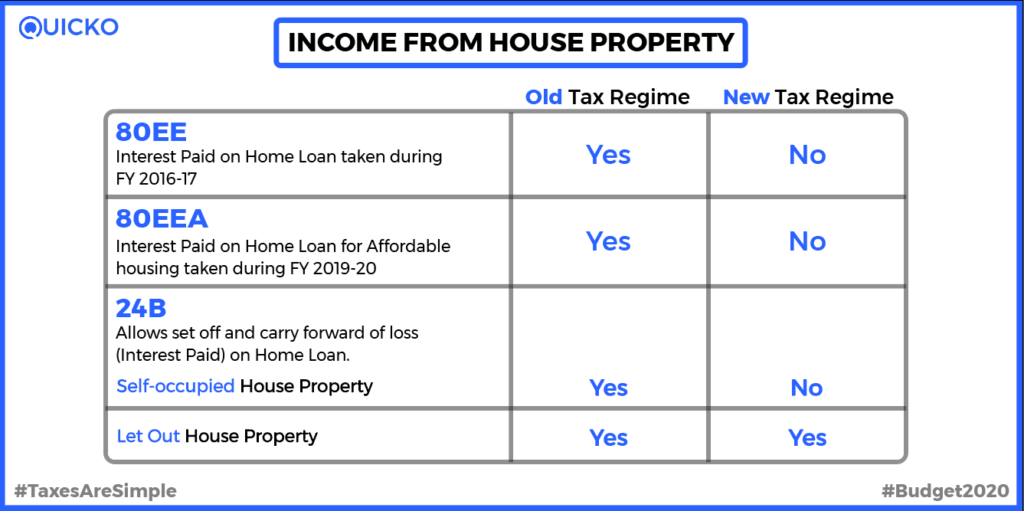

Changes under Income from House Property

Changes in Deductions on Home Loan interest- Section 24(b)

No claim of home loan Interest on Self Occupied House Property: Individuals who have taken a home loan on their self-occupied property and are paying interest on it, can not claim that interest deduction under Section 24(b).

A claim of home loan Interest on Rental House Property: Under the new income tax regime, individuals can claim interest on home loans for let out property only up to the amount of their rental income.

The setting off losses from house property

As per the new income tax regime, losses from house property can only be set off against other income from house property. Moreover, losses from income from house property cannot be carried forward in the new income tax regime.

Deduction for first-time Homebuyers

Deduction u/s 80EE & Section 80EEA gives relief on interest paid on home loans for first time home buyers. This deduction is no longer available for taxpayers following the new income tax regime.

Other Important Highlights of the Budget 2020

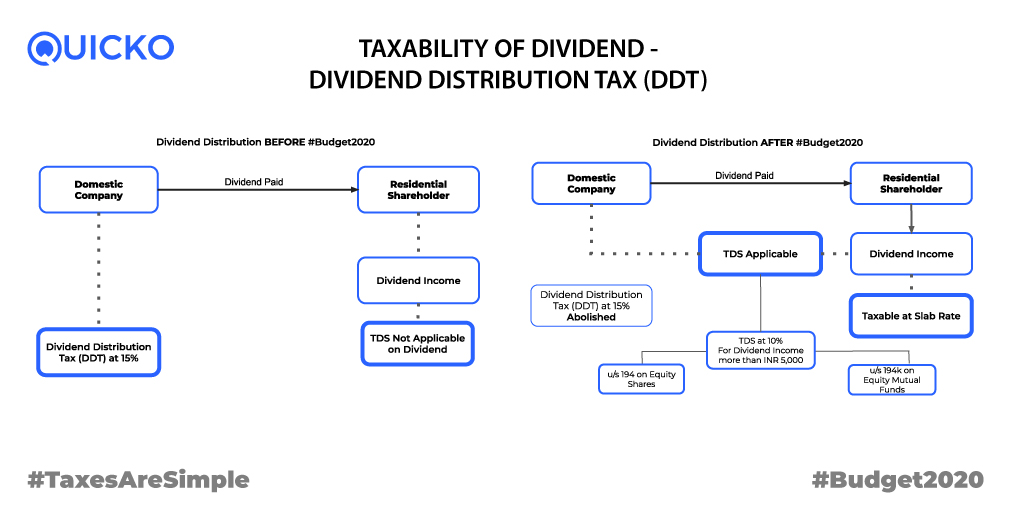

Dividend Distribution Tax (DDT)

Dividend Distribution Tax (DDT) has been abolished for the companies. However, the dividend is now taxable for the shareholders at the rate of 15%.

Corporate Tax

Tax on co-operative societies has been reduced from 25% to 22% without exemptions. Additionally, manufacturing startups will have to pay a 15% tax if they have registered after 1 October 2019, as long as they commence operations by 31 March 2023.

Foreign Portfolio Investment (FPI)

Foreign Portfolio Investment (FPI) is an investment by non-residents in Indian securities including shares, government bonds, corporate bonds, convertible securities, infrastructure securities etc. Post budget 2020, the limit in corporate bonds has been raised from 9% to 15%.

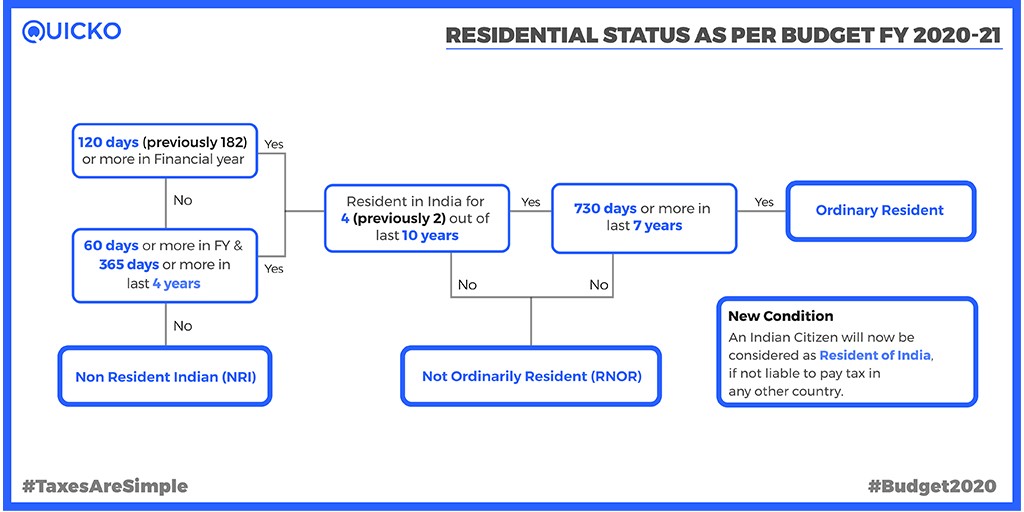

Residential Status

Residential status conditions have been amended in Budget 2020. 180 days in the previous financial year has been reduced to 120 days.

FAQs

A Self Occupied House Property is the one that you use as your own residence. This property may also be used by your children, spouse and/or parents. Since there is no Income from such House Property, the gross annual value of this property is NIL (zero).

Since the gross annual value in the case of Self Occupied House Property is zero, claiming a deduction for Home Loan interest will result in a Loss from House Property. This loss can be adjusted against income from other heads.

Deduction u/s 80EEA is available subject to given below conditions:

1. The stamp duty value of residential houses shall be up to Rs. 45 lakh.

2. The deduction can be claimed only by individual taxpayers.

3. The loan is taken from a financial institution.

4. The loan has been sanctioned between 01-04-2019 to 31-03-2020.

5. Assessee is not claiming any deduction under section 80EE.

6. The assessee owns no residential house property on the date of sanction of loan.

Yes. Domestic Company distributing dividends to a shareholder not resident in India should deduct TDS at the prescribed rates as per Section 195 of the Income Tax Act. In the case of a resident shareholder, TDS should be deducted at the rate of Sec 194 or Sec 194K.

Following are the documents required to file ITR:

1. Aadhaar

2. PAN

3. Bank account details

4. TDS Certificate (Form 16, 16A, 26AS)

5. Tax payment challan (Self-assessed or Advance tax)

6. Original notice (In case of refiling the ITR)

Do I need to use the new tax regime from my next ITR filing?

Hi @Sofiyah_Valiante ,

From FY 2020-21 onwards, you have the option to choose between the Old and New Income Tax Regime. You can report it while filing your Income Tax Return from AY 2021-22 onwards.

You can use the Income Tax Calculator to check which Income Tax Regime is better for you.

Thank you so much for your prompt reply. However i have one more doubt - I have been investing in ELSS, FD & NPS etc. What should I do? Can I still claim these deductions? under new tax regime?

Hi @Sofiyah_Valiante

After Union Budget 2020, you cannot claim any Chapter-VIA deductions under the New Income Tax Regime.

However, you can continue to claim all the deduction if you choose the Old Income Tax Regime.

You can use the Income Tax Calculator to check which Tax regime is better for you.