Arrears of Salary means the outstanding salary of the previous period received during the current year. There may be a revision in the Salary of an employee from retrospective effect or disputed salary released later on by the employer.

What is arrears of Salary?

Arrears of Salary refers to any outstanding due of the previous period paid later on in a different assessment year. Further, salary may have been revised but increments can be paid at a later date or increment could be revised retrospectively. Therefore, in such cases, the differential amount paid in the subsequent period is known as salary arrears. The employer mentions it separately in the salary slips and part B of Form 16.

Taxability of Salary Arrears

Arrears of salary is treated as salary income in the ITR. They are taxable in the year of receipt. However, the taxpayer may be worried about paying taxes at a higher rate because of a higher tax bracket in the year of receipt or due to a change in the applicable slab rate. In such a situation the taxpayer can claim relief under Section 89(1).

For Example:

Arjun’s salary is INR 50,000 per month. His employer raised the salary to INR 60,000 per month in April 2020 effective from March 2020. Since the salary for March 2020 would already be paid, the additional INR 10,000 is paid in April 2020. This is called Salary Arrears.

Relief under Section 89(1)

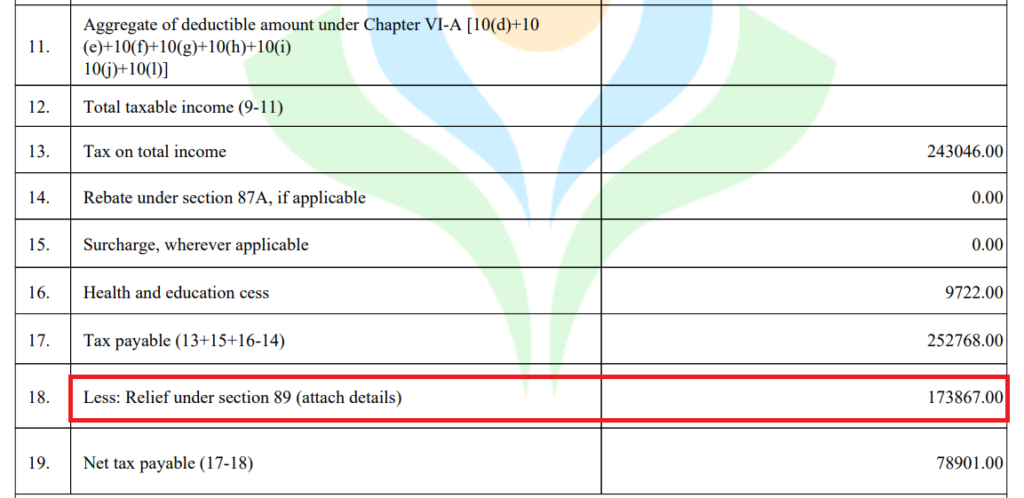

A taxpayer receiving any portion of the salary in arrears or in advance or receiving profits in lieu of salary can claim relief under Sec 89(1) of the Income Tax Act.

If the total income of a taxpayer includes any past salary paid in the current financial year and the tax slab rates are different in both years, this may lead to higher tax dues. Thus, the Income Tax Act allows relief u/s 89(1) to save the taxpayer from any additional tax liability due to delay in receiving income.

Moreover, the employer calculates relief under Sec 89(1) and mentions it in Part B of Form 16. Further, the employee can claim relief under Sec 89(1) by filing Form 10E on the income tax website.

File Form 10E

It is mandatory to file Form 10E in order to claim the benefits under section 89(1). The taxpayer needs to file this form online on the income tax e-filing portal.

Calculation of Tax Relief under Section 89(1) for Salary Arrears

Let us understand the steps to calculate tax relief u/s. 89(1) with an example:

Arjun’s salary is INR 4,80,000 (40,000 per month) for FY 2019-20. His employer raised the salary to INR 7,80,000 (65,000 per month) in April 2020 which is effective from March 2020.

Therefore, the year of Receipt would be FY 2020-21 and the year of Accrual would be FY 2019-20. Hence, the arrears would amount to INR 25,000 for March 2020.

- Tax Liability on total income including arrears for the year of receipt

Calculate tax liability on total income including salary arrears in the year of receipt

Year of Receipt = FY 2020-21

Total Income (including arrears) = INR 8,05,000

Tax Liability = INR 76,440 - Tax Liability on total income excluding arrears for the year of receipt

Calculate tax liability on total income excluding arrears in the year of receipt

Year of Receipt = FY 2020-21

Total Income (excluding arrears) = INR 7,80,000

Tax Liability = INR 71,240 - Difference between Step 1 & Step 2

Calculate the difference in tax liability between step 1 and step 2

Difference in tax liability = 76,440 – 71,240 = INR 5,200 - Tax Liability on total income excluding arrears for the year of accrual

Calculate tax liability on total income excluding additional salary i.e. salary arrears of the financial year to which arrears are related

Year of Accrual = FY 2019-20

Total Income (excluding arrears) = INR 4,80,000

Tax Liability = NIL - Tax Liability on total income including arrears for the year of accrual

Calculate tax liability on total income including additional salary i.e. salary arrears of the financial year to which arrears are related

Year of Accrual = FY 2019-20

Total Income (including arrears) = INR 5,05,000

Tax Liability = INR 14,040 - Difference between Step 4 & Step 5

Calculate the difference between step 4 and step 5

Difference in tax liability = 14,800 – 0 = INR 14,800 - Relief = Step 3 – Step 6

Tax Relief u/s 89(1) = Step 3 – Step 6. If the amount in step 6 is more than step 3, no tax relief is allowed

Tax Relief = NIL

Note: The above calculation is as per the old tax regime.

Additionally, you can calculate tax relief under Sec 89(1) by using the calculator of Income Tax Department – Relief under Section 89(1)

Income Tax Notice for Non-Filing of Form 10E

From the financial year 2014-15 (the assessment year 2015-16), ITD has made it mandatory to file Form 10E if you want to claim relief under section 89(1). Taxpayers who have claimed relief under section 89(1) but have not filed Form 10E have received an income tax notice from the tax department.

FAQs

Arrears or Salary advances are taxable in the year of receipt. The income tax department allows tax relief u/s 89 of the Income Tax Act to save the taxpayer from the additional tax burden. Thus, the employer will calculate relief u/s 89 and report in Form 16. The employee can claim such relief in the ITR.

An employee who has received arrears in salary can save tax on such additional income in the following ways:

* Calculate the relief u/s 89(1)

* File Form 10E to claim relief u/s 89(1)

Form 10E has to be filed before filing of the Income Tax Return