It is known that filing an ITR requires a dozen documents, which are essential for a person’s tax liability. Form 26AS is one such document which is a consolidated tax credit statement. It is important to know the details relating to this form to be able to file a return accurately.

What is Form 26AS?

Form 26AS is an annual consolidated credit statement that provides the details of the taxes deposited with the government by a taxpayer. Form 26AS can be accessed by a taxpayer from the Income Tax Portal using the PAN.

What does it include?

From AY 2023-24 onwards, Form 26AS will include every transaction where tax has been deducted (TDS) from a person’s income, be it by their employer or a bank, or any other person, and tax that has been collected (TCS) from a person. Ins short, it contains:

With this document, it is ensured that accurate tax has been deducted/collected from the taxpayer’s income and has been deposited with the government.

- Details of Tax Deducted at Source (TDS) from the taxpayer’s income.

- Details of Tax Collected at Source (TCS) from taxpayer’s payments.

It is a very important document to have while filing ITR. However, you would not want to miss out on tax credits while filing ITR. You can download Form 26AS from the Income-tax e-filing website. The file that the user downloads are password protected. Form 26AS password is the D.o.B (Date of Birth) of the deductee.

CBDT Announcement Regarding New Form 26AS & AIS

The Ministry of Finance has released a new avatar of Form 26AS applicable from 1st June 2020. The notification states that Form 26AS will be divided into two parts; Part A and Part B. Form 26AS contains basic personal information of the taxpayer such as PAN, name, address, etc of the taxpayer. This helps taxpayers file their ITR with all the basic details available in Form 26AS.

Furthermore, the ITD has introduced the AIS (Annual Information Statement) will now incorporate all the information related to the following:

| Sl. No. | Nature of Information |

| 1. | Information relating to specified financial transactions (Property & Share Transaction Details) |

| 2. | Information relating to the payment of taxes (advance tax & self-assessment tax) |

| 3. | Information relating to demand and refund |

| 4. | Information relating to pending proceedings |

| 5. | Information relating to completed proceedings |

| 6. | Any other information in relation to sub-rule (2) of rule 114-I |

| 7. | Information related to foreign remittances |

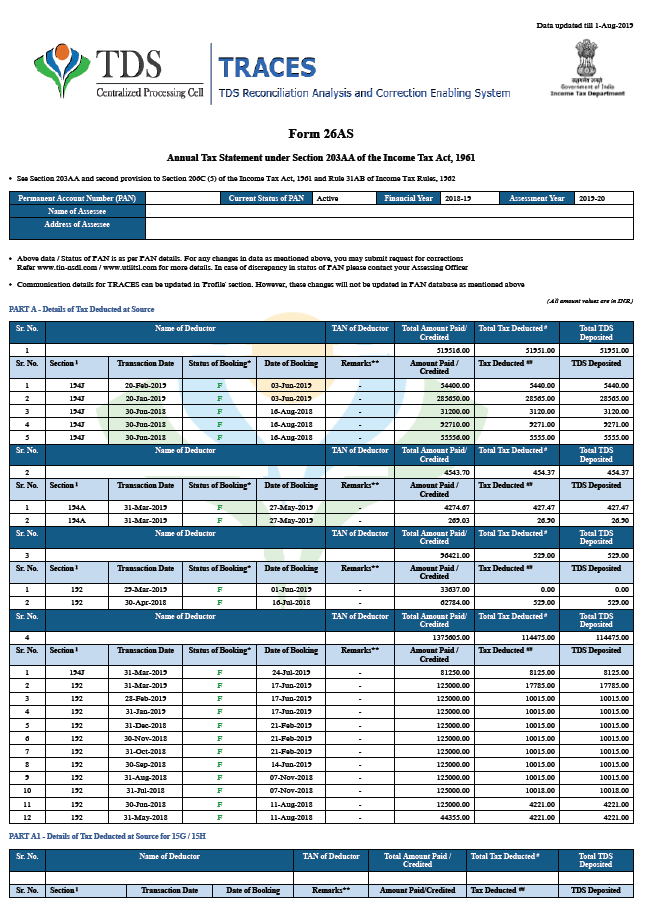

Sample Form 26AS: Annual Tax Statement

Components of Form 26AS Tax Credit Statement

- Part A

- Contains the details regarding Tax Deducted at source including Name and TAN of Deductor, Total Amount Paid, Tax Deducted, and Deposited.

- Part A1

- Contains the details regarding Tax Deducted at Source in case Form 15G / 15H has been submitted by the deductee.

- Part A2

- Contains the details regarding Tax Deducted at Source on Sale of Immovable Property u/s 194IA, TDS on Rent of Property u/s 194IB, and TDS on Payment to resident contractor & professional u/s 194M. (For the seller/landlord of Property/payee of resident contractor & professional)

- Part B

- It has the details regarding Tax Collected at Source. Entries in Form 26AS will show the seller details of who has collected tax from you.

From AY 2023-24 onwards, these details shall be available in the AIS (Annual Information Statement).

- Part C: Contains the details of any Taxes paid other than TDS/TCS, i.e., Advance Tax, Self-assessment Tax.

- Part D: Contains details of Paid Refund. This section contains any information related to refunds in that assessment year.

- Part E: Contains details of SFT Transactions. Banks and other financial institutions must report high-value transactions to the tax authorities. High-value purchases of mutual funds, property purchases, and corporate bonds are all reported here.

- Part F: If you have bought a property/paid rent to the tenant/paid for contractual work or professional fees and deducted TDS on such payments. This section will show details of the TDS deducted & deposited by you.

- Part G: This part shows TDS defaults (after processing of TDS returns). However, they do not include demands raised by the assessing officer.

- Part H: This part shows the turnover of the taxpayer as reported in the GSTR-3B return.

Form 26AS Download: Step by Step Guide

Follow the steps given below to download Form 26AS

- Login to the Income Tax e-Filing portal

You will land on the dashboard of the new income tax portal.

- Navigate to eFile

Click on eFile and then click on income tax returns from the dropdown.

- View Form 26AS

Now, click on View Form 26AS from the dropdown.

- Disclaimer

Click on confirm.

- Navigate to TRACES

Once you are redirected to TRACES, you will have to click on proceed to the disclaimer that appears on the screen.

- View Form 26AS option

Click on the option to View Tax Credit (Form 26AS).

- Download Form 26AS

Select the appropriate assessment year and “Text” under the view as option and click on the option to export the document as a PDF.

How to View Form 26AS?

Individuals have the option to view Form 26AS from the TRACES portal and can also download it as shown in the previous section. The Income Tax Form 26AS is linked with the PAN. Taxpayers can view Form 26AS by using net banking from the FY 2008-2009. They can view the Tax Credit Statement only if the PAN is linked to the particular account. This facility is available for free.

Actual TDS and TDS Credit in Form 26AS do not match

Every person deducting tax at source has to furnish the details of tax deducted by them to the IT Department. On the basis of the details of TDS provided by the deductor, the Income Tax Department will update Form 26AS of the deductee.

Often the actual amount of TDS and TDS credit as appearing in Form 26AS may differ and it may happen that the TDS credit appearing in Form 26AS may be less as compared to the actual TDS, this may happen due to reasons like non-furnishing of TDS details to the IT Department by the deductor, deducting the tax in incorrect PAN, etc. If a discrepancy is due to the deductor, then they may file the TDS/TCS correction statement and correct the same.

The Income Tax Department updates the TDS details in Form 26AS on basis of details provided by the person deducting the tax (i.e., the deductor), hence, if there is any default on the part of the deductor like non -furnishing of TDS details (i.e., TDS return) to the ITD, deducting the tax in incorrect PAN, etc. then Form 26AS will not reflect the actual TDS. The taxpayers are advised to confirm the tax credit appearing in Form 26AS and should reconcile the difference if any.

Steps to Convert Tax Credit Statement Text File to Excel Format

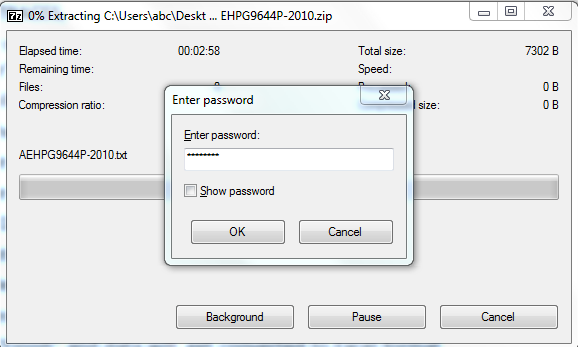

- After downloading the file from the TRACES portal, extract the files and use the Date of Birth (D.o.B) of the deductee as the password to open the file.

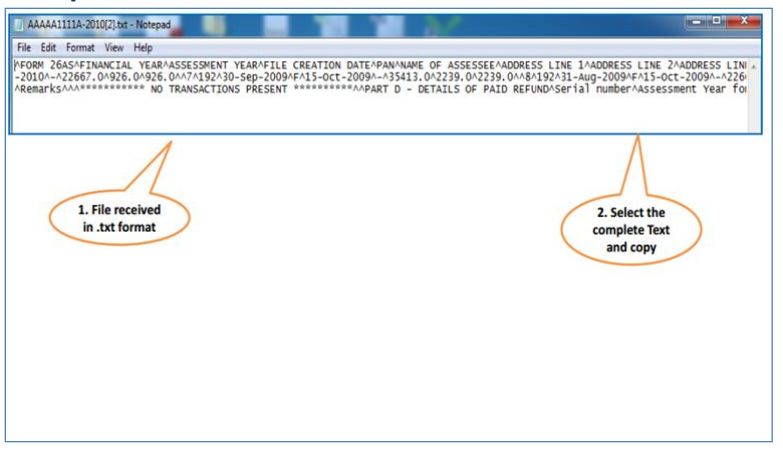

- Hence, copy the entire data from the text file.

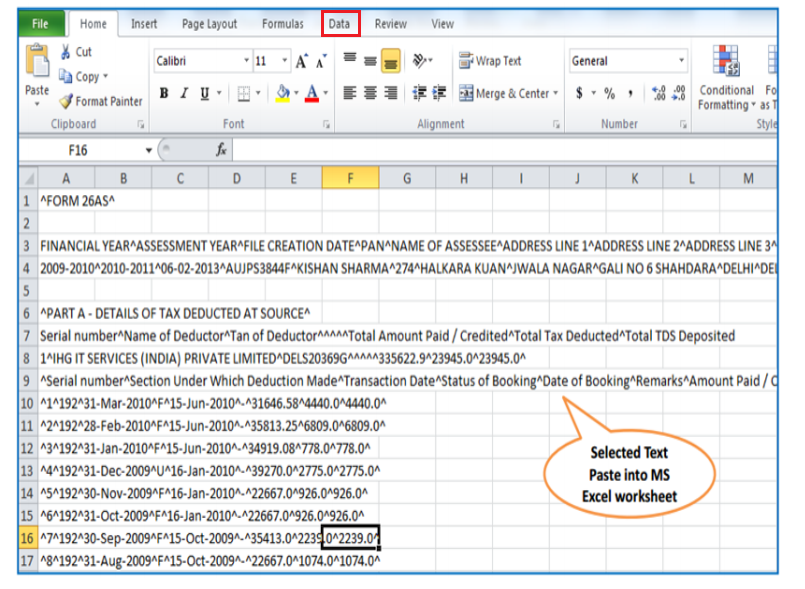

- Paste the data into the MS Excel Worksheet. Furthermore, choose the “Data” option from the excel dashboard.

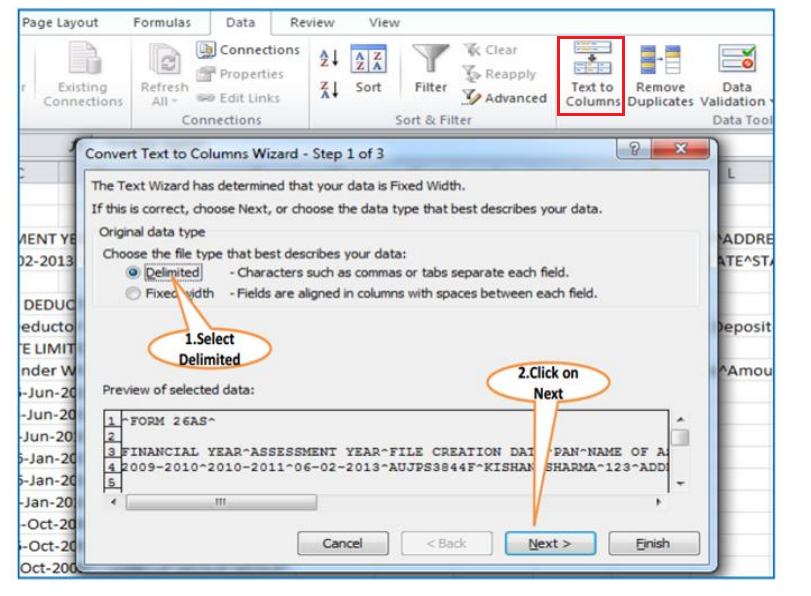

- Select the “Text to Columns” option from the dashboard options. Hence, click on the “Delimited” check-box and go to the next step.

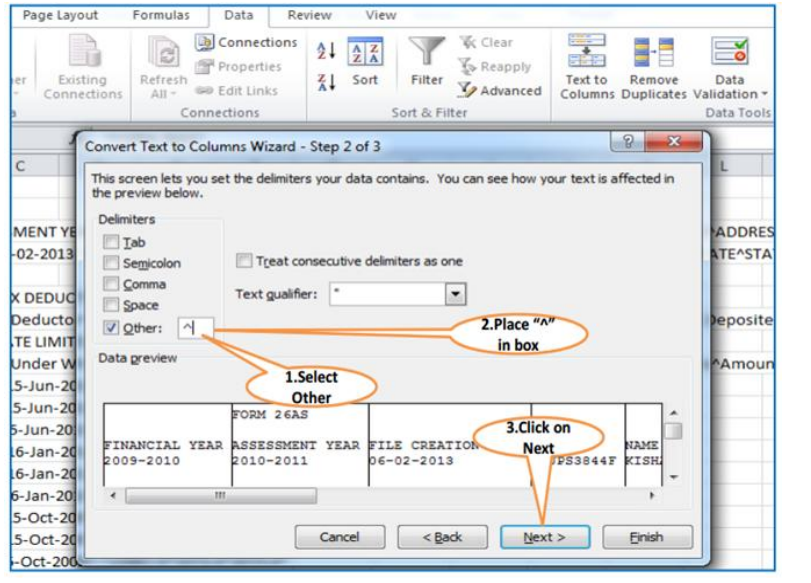

- Under the “Delimiters” section, choose the “Other” option and enter the ‘^’ symbol in the empty space. Furthermore, click on the “Next” option.

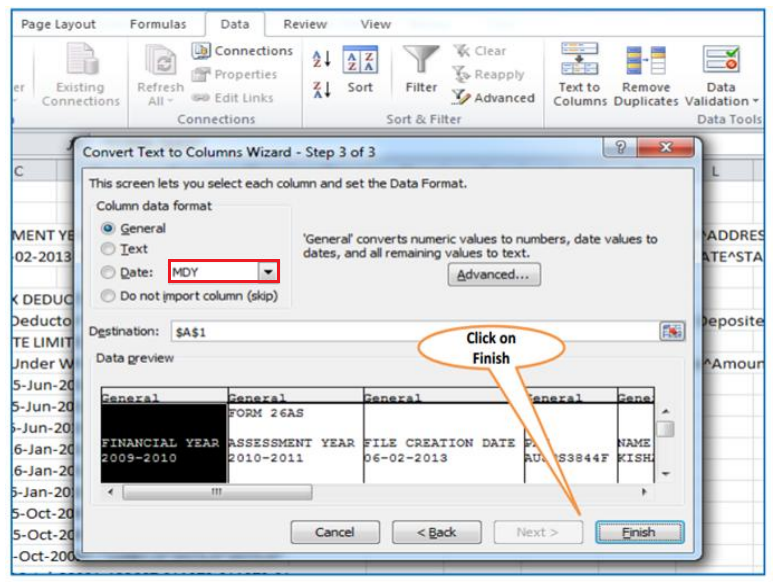

- Select the “MDY” option “Column Data Format” drop-down list and hence, click on the “Finish” option.

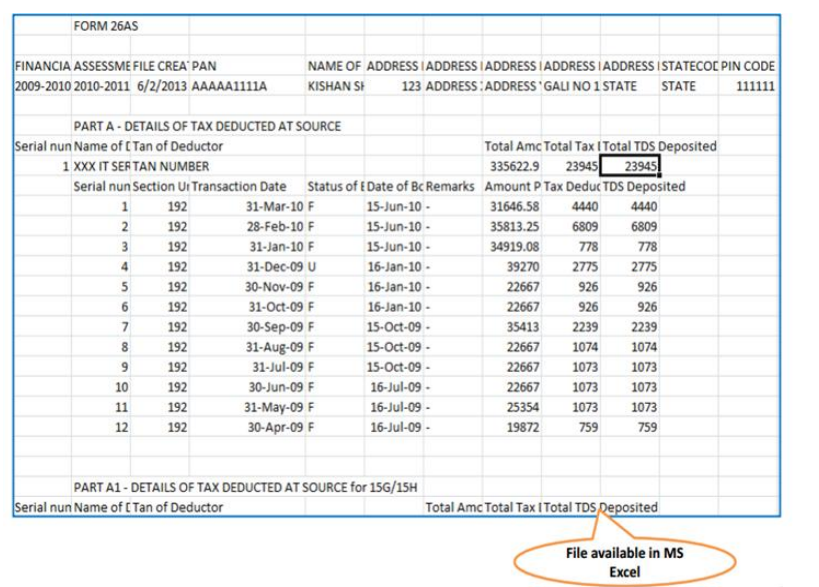

- Therefore, we can see the form in the excel sheet format:

FAQs

Yes, the TDS credit in your case will be reflected in your Form 26AS, and, hence you can claim the same while filing ITR. However, the claim of TDS to be made in your return of income should be strict as per the TDS credit being reflected in Form 26AS.

Non-reflection of TDS credit in Form 26AS can be due to several reasons such as non-filing of the TDS statement by the payer, quoting incorrect PAN of the deductee in the TDS statement filed by the payer. Thus, in case of a non-reflection of TDS credit, the payee has to contact the payer for ascertaining the correct reasons for the non-reflection of the TDS credit.

There can be one or more of the following reasons for ‘U’-unmatched status.

Deductor/Collector did not file TDS/TCS Return.

Deductor/Collector has not/incorrectly quoted your PAN in the TDS/TCS Return.

You have not provided your PAN or your provided PAN is incorrect.

Take the following steps in such cases:

Cross-check the TDS information with Form-16 &/or Form-16A.

Ask your deductor to revise the TDS return.

Once they do it and it’s submitted to the department, ask them to update your TDS details.

You cannot rectify the errors yourself in form 26AS. The only way rectification can be done is by informing the deductor to file a correct TDS return.