The Income Tax Department verifies the details provided in the return filed by the taxpayer. If any discrepancies exist, the department issues a notice or intimation to the taxpayer, instructing them to make corrections. However, before commencing any assessment procedure, the department provides a notice u/s 143(1)(a) mentioning the proposed adjustments to be made in the return. Once the taxpayer responds to the notice, the department initiates the assessment procedures and issues a final order.

What is Notice u/s 143(1)(a)

Section 143(1)(a) notice of proposed adjustments involves the electronic processing of tax returns by the Centralized Processing Center in Bengaluru. This is not a final assessment but a preliminary communication of the tax calculation based on the provided information. This notice may indicate any discrepancies or adjustments in the filed income tax return, allowing the taxpayer to respond before a final assessment is made.

Such notice is issued for the following reasons:

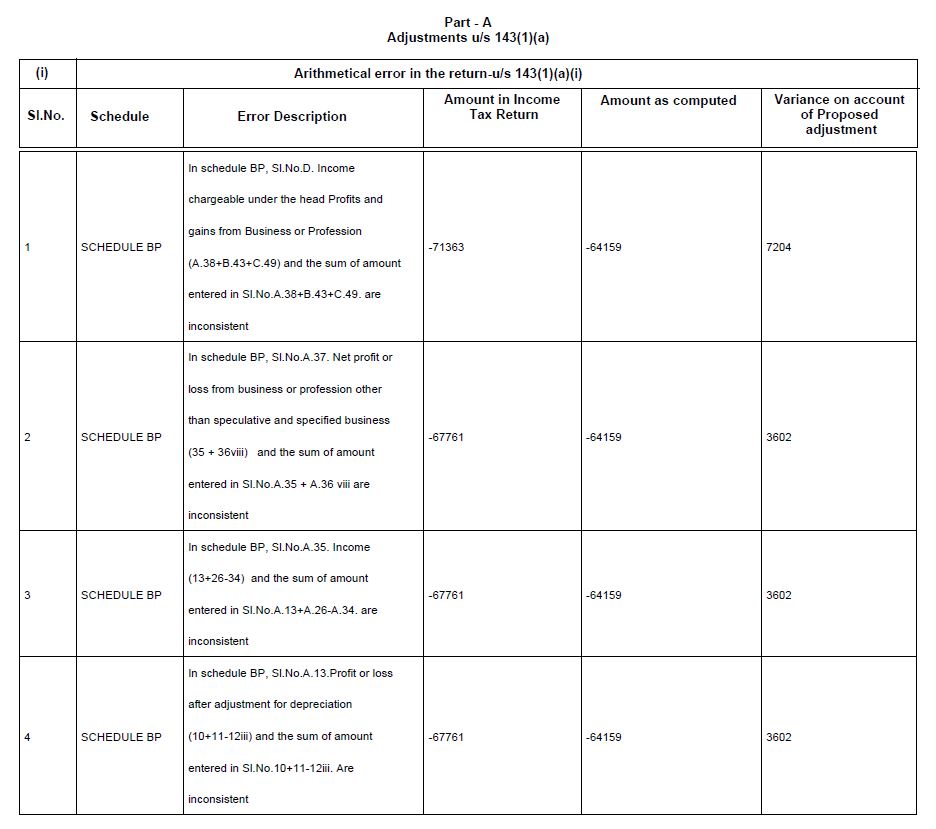

| Section | Reason |

| 143(1)(a)(i) | Arithmetical Error in ITR |

| 143(1)(a)(ii) | Incorrect Claim in ITR |

| 143(1)(a)(iii) | Disallowance of loss claimed in ITR |

| 143(1)(a)(iv) | Disallowance of expense claimed in ITR |

| 143(1)(a)(v) | Disallowance of deduction claimed in ITR |

| 143(1)(a)(vi) | Addition of income appearing in Form 26AS, Form 16 or Form 16A |

Notice u/s 143(1)(a)(i)

Notice under this sub-section is issued when there is an arithmetical error in the return. The notice specifies the income categories where discrepancies exist between the calculations based on the taxpayer’s filed return and the department’s calculations.

Notice u/s 143(1)(a)(ii)

Under this sub-section, the notice is issued when there is an incorrect claim in the filed Income Tax Return.

Incorrect claim means:

- The information provided in one part of the Income Tax Return doesn’t match with any other part of the return.

- The required information that should be disclosed in the return has not been provided.

- Deduction claimed while filing the return exceeds the specified statutory limit as per the Act.

Notice u/s 143(1)(a)(iii)

As per the Income Tax Act, the taxpayer cannot carry forward the loss if they file the income tax return after the prescribed due date. If the taxpayer filed the return after the due date u/s 139(1) and still claims losses, then the department will issue a notice under section 143(1)(a)(iii) to disallow such loss.

Notice u/s 143(1)(a)(iv)

This notice is issued when an expense has been incorrectly claimed in the ITR filed. If the audit report disallows the expenses, and the taxpayer claims the same expenses while filing the return, then it will be disallowed.

Notice u/s 143(1)(a)(v)

Under this sub-section, the notice is issued when a deduction has been incorrectly claimed in the ITR filed. There are certain deductions such as Sec10AA and Sec 80H to Sec 80RRB under chapter VI-A that the taxpayer can not claim if they filed the ITR after the due date u/s 139(4). However, if they have claimed the same, then the department will issue a notice u/s 143(1)(a)(v).

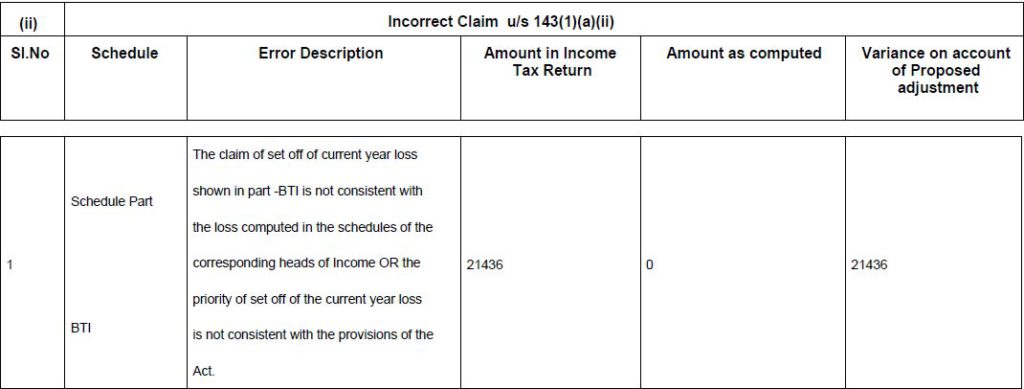

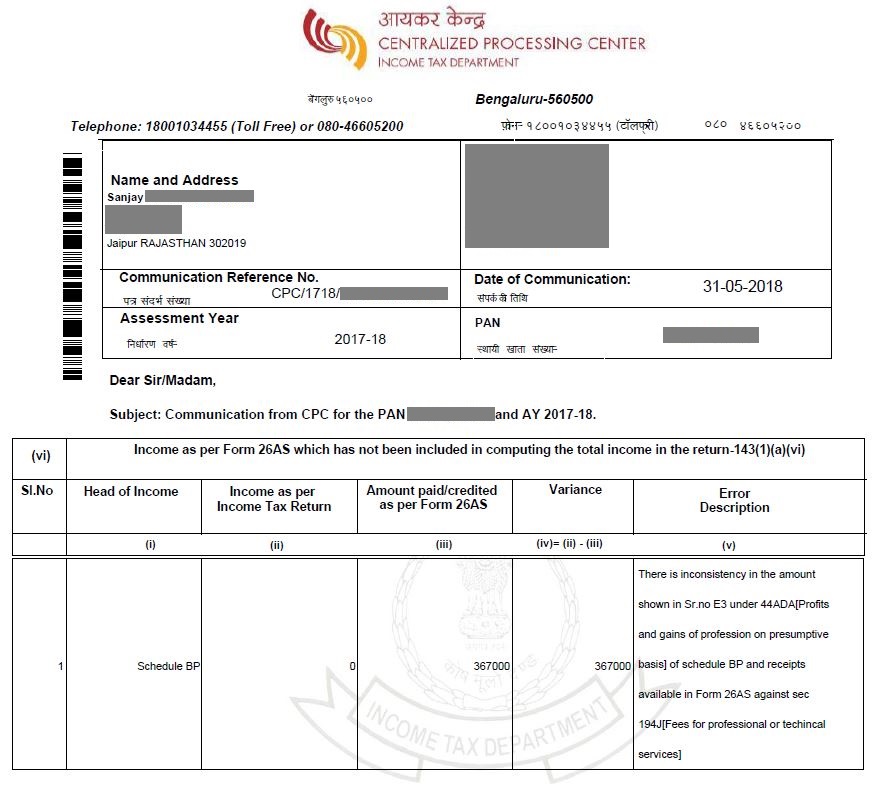

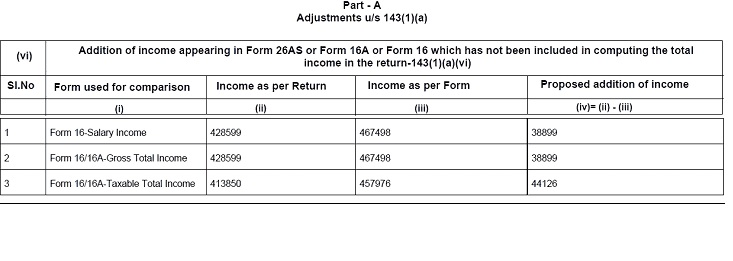

Notice u/s 143(1)(a)(vi)

The notice under this sub-section is received when there is a mismatch in details of TDS on salary as per Form 26AS or Form 16 or a mismatch in TDS as per Form 16A and income details reported in the filed Income Tax Return. There can be the following 3 possibilities:

- Business or Profession Income reported under Schedule BP in return does not match the gross receipts/ turnover in the Tax Credit Statement i.e Form 26AS.

- The salary reported under Schedule S in the return does not match the gross salary in the Tax Credit Statement i.e. Form 26AS.

- Taxable Salary in ITR does not match with the Taxable Salary as per Form 16. This indicates that the taxpayer has included an additional deduction in the ITR that doesn’t appear in Form 16.

Communication of proposed adjustment u/s 143(1)(a)

- The Central Processing Centre (CPC) at the income tax portal will send the letter of intimation under section 143(1)(a) to the registered email or mobile number.

- The notice is password-protected. The password to open is PAN in lower case and the date of birth in DDMMYYYY format. Eg: aagpr1212a02101980 for PAN: AAGPR1212A and DOB: 02/10/1980

Time Limit for issue of Communication for Proposed adjustment u/s 143(1)(a)

The income tax department can send notice within nine months from the end of the financial year in which the return is filed.

For instance, if Ms. Priya filed her income tax return on 25th July 2023, she may receive a notice under section 143(1)(a) until 31st December 2024. This period spans 9 months from the end of the financial year in which the return was filed.

If a taxpayer does not receive any intimation within such period, it means that the calculations of ITD matched with the ITR filed.

Due Date to submit response to notice u/s 143(1)(a)

If you have received a notice under section 143(1)(a), you must file a response within 30 days from the date of issue of notice.

- If you Agree to the discrepancies mentioned in the notice – You can accept the proposed adjustments.

- If you Disagree with the discrepancies mentioned in the notice – Submit a response by explaining the reasons for disagreement.

- When you Partially Agree to the discrepancies mentioned in the notice – submit a response by explaining the disagreement.

Note: In all the cases mentioned above, taxpayers have the opportunity to submit a revised return under section 139(5).

How to File Response to Notice u/s 143(1)(a)

- Login to the e-filing portal and navigate to Pending Actions > e-Proceedings from the dashboard.

- View Notices

Click on the option to View Notice for adjustment u/s 143(1)

- Notice pdf

Click on the Notice/Letter pdf.

- Download the notice

You will be able to view the notice issued to you. If you wish to download the notice, click Download.

- Respond to Notice

Click on the option to submit a response.

- Details of the Prima Facie Adjustments

You will be able to view the details of the Prima Facie Adjustments found by CPC in your filed ITR. Click on each variance to respond.

- Provide Response

On clicking the variance, details of the variance will be there. To respond to the particular variance, click Provide Response.

- Response from dropdown

Select the relevant response from the dropdown and click Save after responding to each Prima Facie Adjustment.

- Proceed to e-verify your response

After providing all the responses, click “Back.” This action will take you to the details of the Prima Facie Adjustment that CPC found in your filed ITR. Once you respond to each variance, the system will save your responses. Click Continue, Select the Declaration checkbox, and click Proceed to e-Verify.

- Successful Verification

On successful e-Verification, a success message will be there along with a Transaction ID. You will also receive a confirmation message on your email ID registered on the e-filing.

FAQs

The tax department sends an intimation under section 143(1), acting as a communication, not a formal notice. It involves verifying if the calculations in the Income Tax Return (ITR) align with the department’s. If there’s a discrepancy, the department will issue a notice for adjustment under section 143(1)(a), requiring a response from the taxpayer within 30 days.

Generally, the IT Department sends intimation u/s 143(1) on the registered mail. However, if you have not received you can still view/ download notice u/s 143(1) by logging into your Income tax account and navigating to Pending Actions.

The taxpayer can submit a response to notice u/s 143(1)(a) online by logging into the e-filing portal.

Hey @TanyaChopra

An Intimation u/s 143(1)(a) is issued when there’s a mismatch between your tax credit statement i.e. Form 26AS and your tax return. This happens through automated checks at CPC (Centralized Processing Center) in Bangalore where your returns are processed.

You can respond to this intimation by registering and logging in to your account on the Income-tax website. You need to determine how you’re going to be responding to the intimation - there are three options available.

As you might imagine, there’s no real need to panic here as the intimation can be easily taken care of.

Hope this helped! If you have any further questions, feel free to ask.

@Sakshi_Shah1 could you help with this ?

If you agree with the tax notice issued, there is an option to pay the outstanding demand under the option of e-proceedings. You can pay the tax from that option since the option for filing a Revised Return is not available after 31st march 2022.

Read more - outstanding tax demand

@Sakshi_Shah1 can you help ?

Hey @Sahil_1186

If you have filed the original ITR u/s 139(1) before the due date, there is nothing to worry. You can carry forward the loss even if the ITR was revised. This looks like an error from the end of income tax department. They have sent system-generated notices to many taxpayers with the same query. You should submit a response to the tax notice from your account on the income tax website requesting them to re-process the ITR and allowing carry forward of loss since the original ITR u/s 139(1) was filed within the due date.

When is the notice u/s 143(1)(a)(iii) issued?

Hi @Nandana

When the return is filed after the due date u/s 139(1) and yet the loss has been claimed, notice u/s 143(1)(a)(iii) is issued to disallow such loss.

Hope this helps!

Got following Notice for AY 2021-22

“Disallowance of loss claimed, as the ITR of the previous year for which set off loss is claimed was furnished beyond the due date specified under sub-section(1) of section 139 - 143(1)(a)(iii)”

A.Y. 2020-21 Filed on :Sep 25, 2020 (loss reported)

A.Y. 2021-22 Filed on : Nov 23, 2021 (loss adjusted)

I remember date was extended for both AY.

Please help

@Sakshi_Shah1 can you help?

There is no mismatch, no additional demand and no refund in the intimation u/s 143(1), what should I do?