After completing the assessment or re-assessment process, the Income Tax Department takes on the responsibility of determining whether any additional amount needs to be paid by a taxpayer. In case, there is any outstanding liability, the department issues a demand notice under section 156 of the Income Tax Act. This notice specifies the interest, penalties, fines, and any other charges that the taxpayer must pay, along with a time limit for payment.

Notice for Outstanding Demand u/s 156?

If any order is passed under the Income Tax Act and there is an outstanding liability then a notice u/s 156 is issued to the taxpayer. Notice for the sum payable u/s 143(1), 200A (1), 206CB (1), etc., will also be considered as Demand Notice u/s 156. The taxpayer has to pay the amount specified in the notice within 30 days of receipt of the notice.

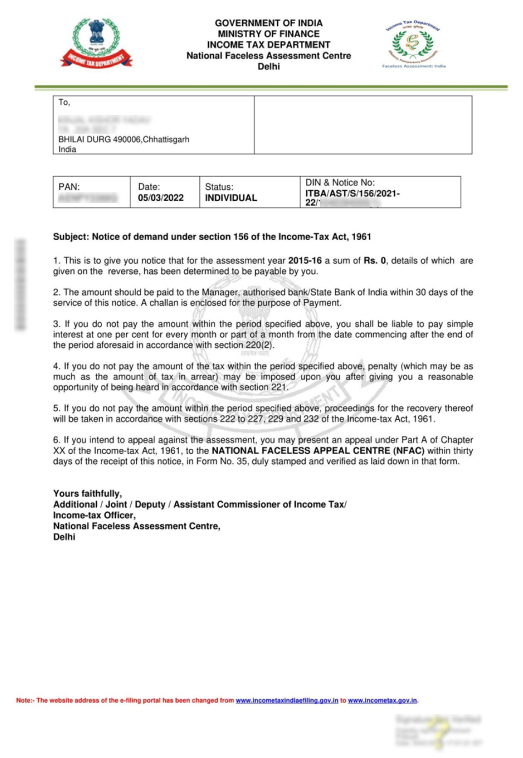

Sample Notice under section 156

How to Respond to Outstanding Tax Demand Notice?

For submitting a response to outstanding demand, the taxpayer can follow below-mentioned steps:

- Log in to the e-Filing Portal

Log in to the e-Filing portal. Navigate to Pending Actions > Response to Outstanding Demand to view a list of your outstanding demands from the dashboard.

- If you agree pay the demand amounts before submitting a response.

Click on Pay Now to make payment of outstanding demand.

- Submit Response

If the taxpayer has not paid the demand or disagrees with the demand then they can submit their response accordingly.

Further, the taxpayer has the following options available for submitting a response to the demand notice issued u/s 156.

- Agree with demand.

- Fully disagree with demand.

- Partially disagree with demand.

Option 1: Agree with Demand

Part A- Demand is correct but payment is pending.

If you agree with the demand notice, you can select the Demand is Correct option. Moreover, you get an opportunity to pay the dues from here only by selecting Not Paid Yet option. Once the payment is done, the response to the demand will be submitted automatically.

Part B: The demand is correct and amounts are already paid.

On the Response to Outstanding Amount page, select the Demand is Correct option and the disclaimer. Then click on the checkbox with Yes, Already paid and Challan has CIN, and Click on Add Challan Details.

Here, input the challan details. After entering the details, upload a copy of the challan (PDF). Once you save the challan details, the system will display a success message along with the transaction ID on the next tab.

Option 2: Fully Disagree with demand.

If you disagree with the demand notice, select Disagree with the demand (Either in full or in part) option and click on Add Reasons.

Then, select the reason(s) for your disagreement from the options and click Apply. (You can select one or more options)

After selecting the appropriate reasons for your disagreement, select each reason you listed on the Response to Outstanding Amount page and enter the appropriate explanation for disagrrement. Once the explanation is saved, submit the response.

Option 3: Partially disagree with Demand.

If taxpayer belives that the outstanding demand is partially correct then they need to submit the reason for disagreement. And for the part of the amount for which the taxpayer agrres they need to make payment.Once the payment is successful, the system will take you to the Response to Outstanding Amount page.In there submit your response. Once the submission is successful, the system will display a success message along with a Transaction ID.

Time limit to respond

The taxpayer has to pay the outstanding demand within 30 days from the date of service of notice. However, in a few cases assessing officers can reduce the period to 30 days where AO feels it is detrimental for the department to allow such a period for payment with the prior approval of the joint commissioner.

Further, the taxpayer can also make an application for an extension of the period or for making payment of demand in installments. But in such cases, the taxpayer has to make the application before the end of the 30 days.

Consequences of delay

- Interest u/s 220(2) – Interest at a rate of 1% per month or part of the month will be payable after the expiry of 30 days. Such interest shall be payable by the taxpayer even if the AO has approved the application for an extension of the time period.

- Penalty u/s 221 – AO can impose a penalty up to the amount of demand in the outstanding demand notice. However, the AO has to provide a reasonable opportunity of being heard to the taxpayers. Hence, if the taxpayer proves that the default was for bonafide reasons, no penalty shall be levied.

FAQs

If the assessee disagrees with the tax demand notice then the department can challenge the same to the next higher authority.

To download or view the demand notice, you need to log in to the e-filing portal. Once you are in your profile, you can find the demand notice under pending actions > Response to outstanding demand tab.

If the assessee does not pay the amount specified in the demand notice within 30 days of service of notice then the assessee becomes the assessee in default.

If you do not respond, the demand will be confirmed and will be adjusted against your refund (if any) or will be shown as a demand payable against your PAN (in case no refund is due).

The taxpayer can download the challan from the ITD e-filing portal by navigating to e-file>e-pay tax>payment history.