Filing your ITR is not the last step of the process. It is equally important to e verify ITR within 30 days of filing it. The Income Tax Department (ITD) processes your return only if the ITR is verified and then issues eligible refunds to the taxpayers. Moreover, if you do not verify your return, it will be treated as an invalid return i.e. in this case, you will have to file a belated return.

- Pre-requisites to verify ITR

- How to e verify Return without Logging in to the e-Filing Portal

- How to e-verify ITR by Logging into the e-Filing Portal?

- Methods to e verify ITR

- e Verify ITR using Aadhaar OTP

- e Verify using Electronic Verification Code – EVC

- e Verify ITR using Bank Account

- e Verify ITR using Demat Account

- e Verify ITR using Net Banking

- e Verify ITR using DSC

- Verify ITR using Bank ATM – Offline Method

- Send ITR-V to CPC

- FAQs

Pre-requisites to verify ITR

- Registered user on the e-Filing portal with valid user ID and password.

- Acknowledgment Number (to e-verify ITR without logging in to the e-Filing portal)

- You have filed a return and selected e-verify later or an ERI has filed the return on your behalf (to e-Verify ITR)

- Returns whose verification is pending for more than 30 days (after providing an appropriate reason for the delay)

How to e verify Return without Logging in to the e-Filing Portal

- Go to the e-Filing portal homepage and click e-Verify Return under Quick Links

- On the e-Verify Return page, enter your PAN, select the Assessment Year, enter the Acknowledgment Number of the ITR filed and Mobile Number available with you, and click Continue

- Enter the OTP and submit it to complete the process of verifying your return.

How to e-verify ITR by Logging into the e-Filing Portal?

Given below are the steps to e-verify the ITR on the Income Tax e-Filing Portal.

- Visit the e-Filing portal

Login using user ID and password.

- e-Verify Return option

Click on e-File > Income Tax Return > e-Verify Return

- Select the e-Verify option for the appropriate return

On the e-Verify Return page, click e-Verify against the unverified return.

- Methods to Verify ITR

Choose one of the options explained below to e verify the ITR.

- Condonation Request

If you e verify ITR after 30 days of filing, you will have to file a condonation request.

Methods to e verify ITR

It is important to e verify ITR within 30 days. The CBDT had reduced the time for verification of ITR from 120 days to 30 days with effect from 1st August 2022.

You can either complete the process of verification online by e-verification or by physically submitting the ITR-V to CPC, Bangalore.

E-Verify your ITR (immediately after filing) or any other Income Tax related submissions/ services /responses/ requests using the following options:

| S.No | Methods |

| a | Aadhaar OTP |

| b | EVC through a pre-validated Bank Account |

| c | EVC through pre-validated Demat Account |

| d | Net Banking** |

| e | DSC |

| f | Generate EVC through the Bank ATM option (offline method) |

e Verify ITR using Aadhaar OTP

To verify your ITR using this method, you will be required to link your Aadhaar to your registered mobile number. Moreover, you must also link your PAN to your Aadhaar.

- On the e-Verify page, select I would like to verify using OTP on mobile number registered with Aadhaar and click Continue

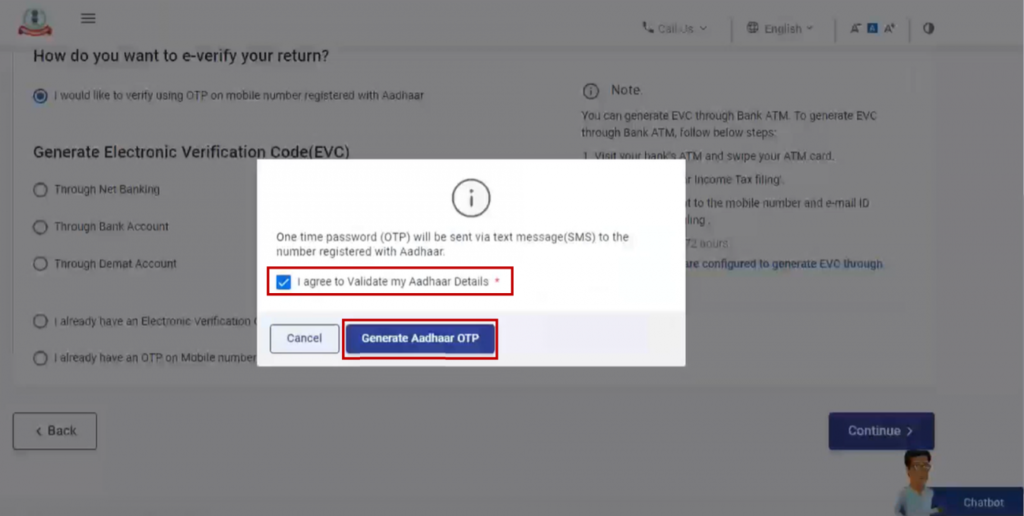

- On the Aadhaar OTP page, select the I agree to validate my Aadhaar Details checkbox and click Generate Aadhaar OTP

- Enter the 6-digit OTP received on your mobile number registered with Aadhaar and click Validate

You can also choose the option to e verify your return using the existing Aadhaar OTP by clicking on the option “I already have an OTP on Mobile number registered with Aadhaar” and enter the 6 digit OTP.

e Verify using Electronic Verification Code – EVC

- On the e-Verify page, select I already have an Electronic Verification Code (EVC)

- Enter EVC in the Enter EVC textbox and click Continue

e Verify ITR using Bank Account

This facility is only applicable to certain banks. Moreover, you would also need to prevalidate your bank account on the portal. The process of prevalidation is successful only if the PAN matches the bank account records.

- On the e-Verify page, select Through Bank Account and click Continue

- Enter the EVC received on your mobile number and email ID registered with your bank account in the Enter EVC textbox and click e-Verify

e Verify ITR using Demat Account

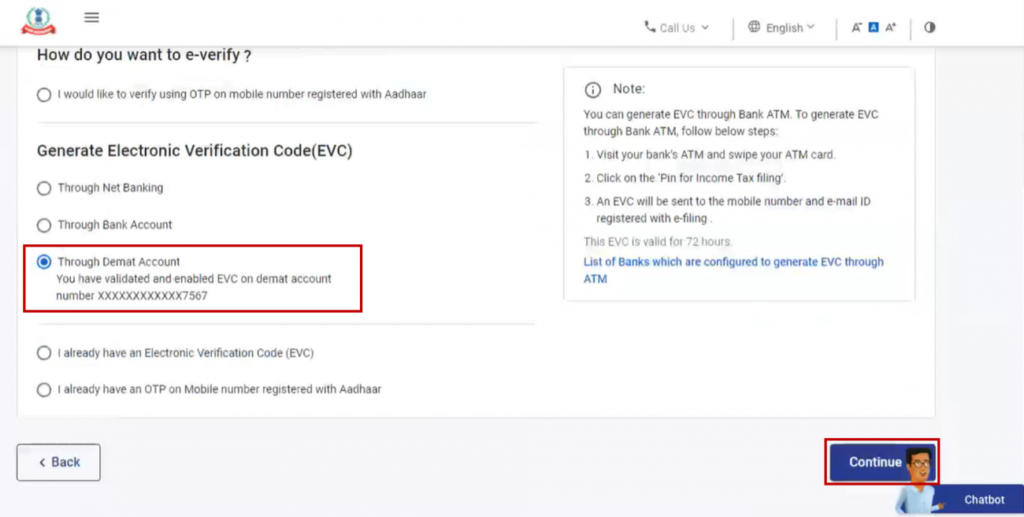

This method is similar to the Bank Account method. In this case, too, you will have to prevalidate your Demat Account on the Income Tax e-Filing portal. This process takes 1-2 hours and in case of any error, you receive an e-Mail on the registered e-Mail ID. Hence, you can generate an EVC to complete the process of ITR verification.

- On the e-Verify page, select Through Demat Account and click Continue

- Enter the EVC received on your mobile number and email ID registered with your demat account in the Enter EVC textbox and click e-Verify

e Verify ITR using Net Banking

You can go ahead with this method if you have availed the Netbanking of your bank account. On the e-Verify page, select Through Net Banking and click Continue.

- Select the bank through which you want to e-Verify and click Continue

- Read the disclaimer that pops up on the screen and click on continue. Log in to your Net Banking using your Net Banking user ID and password. Click the link to log in to e-Filing from your bank’s website

- On successful login, you will be taken to the e-Filing Dashboard. Go to the respective ITR / Form/service and click e-Verify. Your ITR / Form / Service will be e-Verified successfully.

e Verify ITR using DSC

You will not be able to e-Verify your ITR using Digital Signature Certificate if you select the e-Verify Later option while submitting your Income Tax Return. You can use DSC as an e-Verification option if you choose to e-Verify your ITR immediately after filing.

However, if your books of accounts are audited, the return has to be e-verified using a DSC only.

- On the e-Verify page, select I would like to e-Verify using Digital Signature Certificate (DSC)

- On the Verify Your Identity page, select Click here to download emsigner utility

- After the download and installation of emsigner utility is complete, select I have downloaded and installed emsigner utility on the Verify Your Identity page and click Continue

Note: DSC needs to be registered first on the Income tax website before using it if not already registered.

- On the Data Sign page, select your Provider, Certificate and enter the Provider Password. Click Sign

Verify ITR using Bank ATM – Offline Method

Similar to the net banking method, the Income Tax Department offers this facility to generate code through the bank ATM to select banks. Therefore, the EVC generated through this process is valid for 72 hours. The code is sent to your registered mobile number.

- Visit your bank’s ATM and swipe your ATM card

- Enter PIN

- Select Generate EVC for Income tax Filing. Hence, An EVC will be sent to your mobile number and email ID registered with the e-Filing portal

- The generated EVC can be used to e-Verify the return by selecting I already have an Electronic Verification Code (EVC) as a preferred choice of e-Verification. Refer to the e Verify ITR using EVC section of this article to proceed and verify your return.

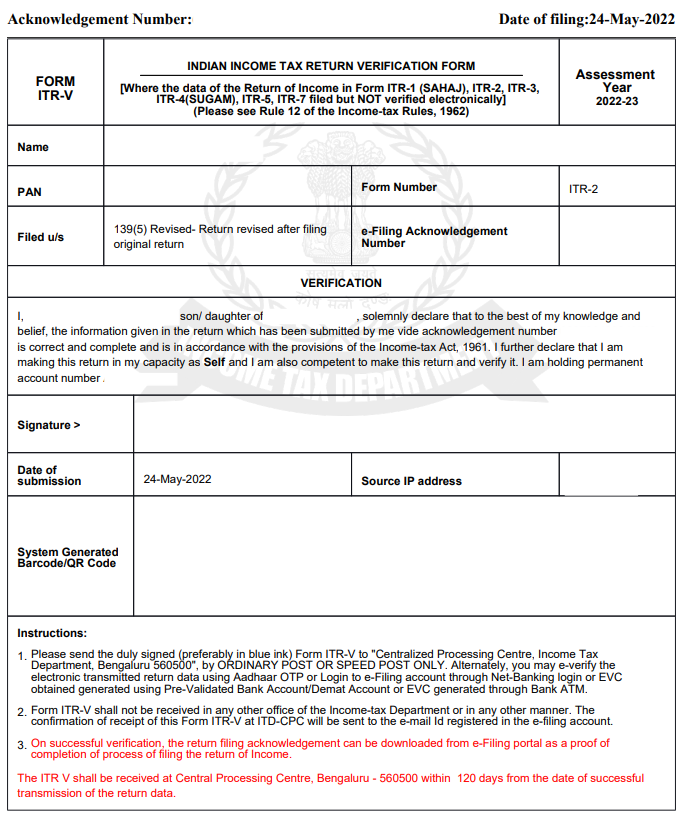

Send ITR-V to CPC

If it is not possible to electronically verify your ITR, you can physically verify it. You will have to send a signed copy of the ITR-V to Income Tax Department. Following is the list of the important points you need to remember while following this process:

- It is a one-page document that should be signed in blue ink and sent via speed post only.

- You do not have to send any supporting documents along with ITR-V

- You will receive an intimation via SMS on your registered mobile number and E-mail ID once the ITD receives your ITR-V form

- The address of CPC Bangalore for speed post: CPC, Post Box No. 1, Electronic City Post Office, Bangalore – 560100, Karnataka, India

Sample ITR-V Form

FAQs

You need to verify your ITR within 30 days of filing. Failing to do so, the Income Tax Department will treat your ITR as invalid. In this case, you will have to file a belated return.

There is no e-Mail ID to contact the CPC. The only way to contact them is through the toll-free number and chargeable contact number: 1800-425-2229

No. You need to have an active demat account/bank account which needs to be pre-validated and EVC-enabled on the e-Filing portal to e-Verify your return using your demat account/bank account.

If you do not verify in time, your return is treated as not filed and it will attract all the consequences of not filing ITR under the Income Tax Act, 1961. However, you may request a condonation of delay in verification by giving an appropriate reason. Only after submission of such a request, you will be able to e-Verify your return. However, the return will be treated as valid only once the condonation request has been approved by the competent Income Tax Authority.

If I have filed a revised return, do I need to e-verify the original return or the previous return as well?

Hi @Joe_Fernandes,

If you are filing a revised return, you can only verify the latest revised return. If the previous versions of revised returns or original return is not verified, it will ve deemed to be invalid and won’t be processed by the ITD.

e-verification using Aadhaar OTP is the most widely used and fastest method to verify your return.

Hi,

I had filed and e-verified my return in November 2021. I still haven’t received my refund and got the same email. Do I need to do anything? and how long until I get my refund?

Hey @Nihal,

In case you have successfully e-verified the return, you do not need to worry and can ignore the email.

Usually, the refund takes 6-9 weeks from the ITR being processed. However, it may vary based on the case-to-case basis.

You can track your refund using this tool

Hope this helps

Hi @abhishek_ranjan

You can track you refund using this tool

hi @Archan434

No. There is no need to e-verify the ITR filed in response to defective return notice.

@Sakshi_Shah1

@AkashJhaveri

@CA_Niyati_Mistry

As per the rule ITR filing is mandatory if the Income is more than the basic exemption limit .

Query :

What is the penalty if the ITR not filed ?

Since the Tax liability is zero .

Hi @HIREiN

Income tax is mandatory in following cases:

Incase ITR is not filed:

(1) as you said : Income tax filing is mandatory in some cases …as you have mentioned above …

(2) Incase ITR is not filed : because : there are no loses incurred ; no taxable income etc ;

(3) you said : fees under section 234F may be applicable …

(4) BUT . : what if the taxable income is zero ?

because ; as you said : the quantum of the fees depends on the Taxable income of the taxpayer .

So , no fees ; no penalty ! right ?

===============================

so . even if : Income tax filing is mandatory in some cases ; if some one does not file the I.T. returns ; there is No harm in it !

am i right ?

Yes. Then there is no requirement to file. And no question of any penalty.

You may receive a notice from the tax department asking you the reason why the return has not been filed. Many people who are not filing returns are facing this situation nowadays since all information regarding interest, rent, purchase/sale of securities, immovable properties, etc is being reported in AIS (Annual Information Statement).

Then you will have to spend a lot of time and effort to comply with details requested from such a notice. So to save your time too - you can plan and file your returns well in advance of the due date.