A Deductor can make PAN correction for TDS Return filed FY 2007-08 onwards. For corrections in PAN master, personal information, deductee details, and challan details, there is no need to request for Conso file. Deductor can make a correction using the service ‘Request for Correction’ on TRACES. In the case of a paper return, you cannot opt for online correction.

The Deductor can make online PAN Correction in the TDS return if he/she meets the following criteria:

- Deductor has registered the DSC of the Authorised Person on TRACES

- The Statement Status for which PAN Correction is required should be ‘Processed’

Steps to make Online PAN Correction in TDS Return on TRACES

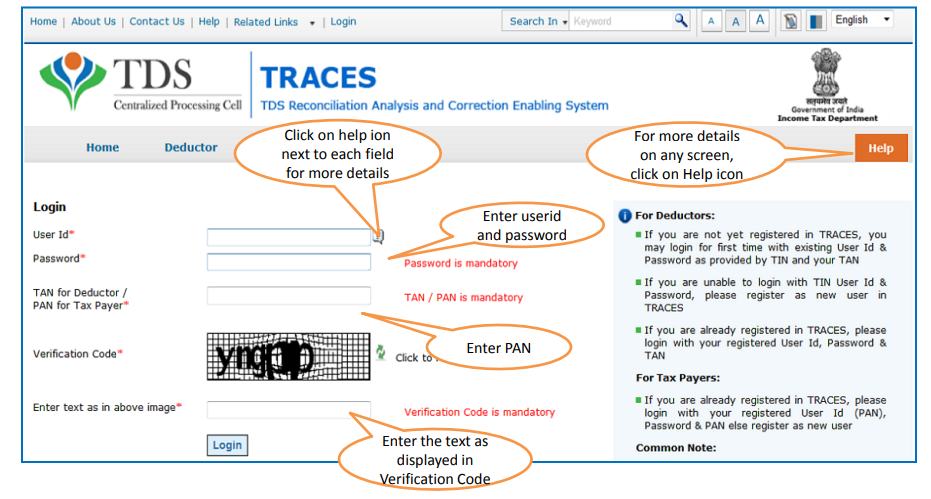

- Log in to TRACES

Log in to TRACES – Enter User Id, Password, TAN or PAN and captcha

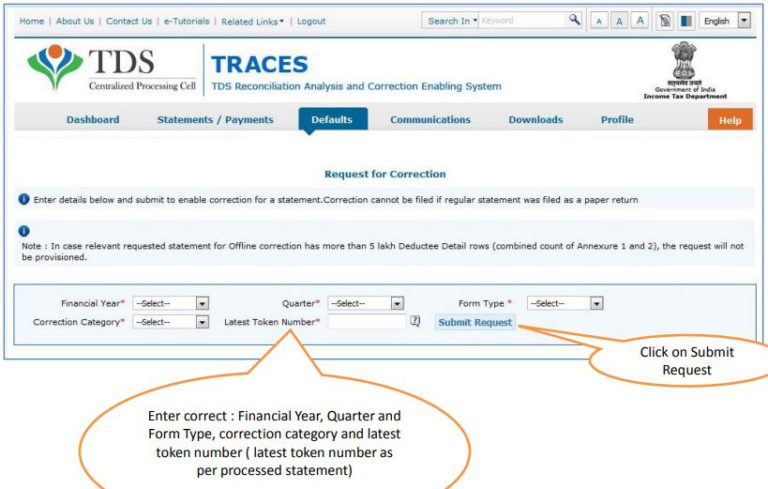

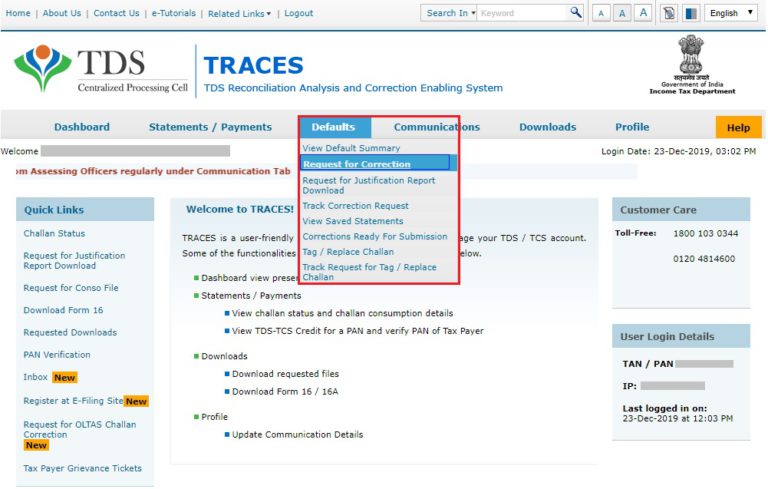

- Navigate to request for correction

Go to Defaults > Request for Correction

- Enter the required details

Enter the required details – Financial Year, Quarter, Form Type, correction category, and latest accepted Token Number. Click on ‘Submit Request’

1. If the regular statement was a paper return, you cannot request for correction

2. Form Type – 24Q, 26Q, 27Q, 27EQ

3. The token number should be of the latest processed statement

4. Correction category should be ‘Online’

- Request number

The system generates a Request Number. To track the request status, go to Defaults > Track Correction Request

- Search the request

Search the request using Request Number, Date or View All:

1. Available – The correction request is accepted. The statement is now available for correction. Click on the hyperlink to go to the validation screen to proceed with the correction

2. In Progress – The correction request is accepted and you are already working on a statement. Click on the hyperlink to go to the validation screen to proceed with the correction

3. Rejected – The correction request is rejected. Click on ‘View Rejection Reason’ to check the reason for the rejection

Note: If the status is ‘Submitted’, please wait for 24 to 48 hours for the status to change to ‘Available

- KYC Validation

Complete the KYC Validation using either of the below options:

Option 1: KYC Validation using DSC

Option 2: Normal KYC Validation without using DSC - Type of correction

Once the system validates the KYC details, the File Correction screen will appear. Select the Type of Correction as the ‘PAN Correction’ from the drop-down list.

- Required corrections

Make the required corrections in the selected file. Click on ‘Submit Correction Statement‘

PAN Correction – Invalid PAN Annexure 1

1. Enter the PAN as per the statement

2. Search the PAN using CD (Challan Detail) Record Number or DD (Deductee Detail) Record Number

3. A list of invalid PANs in the statement will appear

4. Select the row and enter a valid PAN in the filed of ‘Changed PAN’

5. Name as per PAN master will be populated in column ‘Name as per changed PAN’

6. If the PAN is invalid, an error message appears

7. If the PAN is valid, the Action Status changes to ‘Saved’

- Action summary

Action Summary with the summary of all corrections will be displayed. Click on the hyperlink to view the edited details. Once you verify the details, click on ‘Confirm’

- Submit for processing

Click on ‘Submit for Processing‘ to submit your correction. This feature is available to an Admin User only

- Attach DSC

Attach DSC i.e. Digital Signature Certificate of the Authorised Person. The system generates a 15 digit token number. You can check the status under the Statements / Payments tab. To use DSC on TRACES, it is mandatory to download and install WebSocket emSigner.

FAQs

1. Deductor can update a valid PAN of a Deductee with another valid PAN only once

2. Deductor can update an invalid PAN in the regular statement with a valid PAN but not with another invalid PAN

Yes. For correction in Personal Information on TRACES, DSC is mandatory. For Challan Correction i.e. correction in challan details, you do not require a DSC. In the case of Personal Information Correction or PAN Correction, you require a DSC. You can apply for DSC of Class II with 2 years validity

PAN correction category will not be visible if:

1. You have not registered the DSC in the Profile. Register DSC of the Authorised Person to resolve this issue

2. You have registered the DSC after initiating an online correction, please Logout and Login again. Cancel the existing online correction request and resubmit the request again

Deductor should do PAN Correction when the following PAN errors occur:

1. PAN is structurally invalid

2. PAN not available with CPC(TDS)

3. Valid PAN is not mentioned in the Statement at all. E.g. in case of PANNOTAVBL

Hey @HarishMehta

Taxpayers or deductee cannot directly download form 16/form16A, the option to download Form 16/ 16A has been given to the Deductor. So, if you need Form 16 / 16A for TDS deducted by your current or previous employer or deductor you will have to contact them for the same. There is no option available on TRACES whereby you can download it yourself.

Hope this helps!

Hey @Dia_malhotra

Yes, individuals can still register as a taxpayer on TRACES even if they do not have TAN of the deductor by providing:

• Assessment Year

• Challan Serial Number and

• Amount of tax you have paid

Hope this helps!

In my Justification Report it shows an interest payable error whereas I’ve already paid the interest for that particular month According to the regulations what could be the reason for this?

Hi @saad,

According to regulations, interest payment default/errors may arise due to error in challan details , short deduction, short payment, late deposit of TDS amount. Here, you can file correction statement and revise the return.

Hope this helps!

@AkashJhaveri @Saad_C @Kaushal_Soni @Divya_Singhvi @Laxmi_Navlani can you help with this?

Hey @raopreetham, the first thing I would recommend you to do is to run the Emsigner as an administrator. Also, if it still does not seem to work, install the below mentioned JAVA fixer software and run it as an administrator and hopefully this would resolve your issue.

https://johann.loefflmann.net/downloads/jarfix.exe

The USB e-pass 2003 token device is particular type of a DSC.

hello, i want to cancel the TDS on sale of property (26QB) which i created in hurry. i have made login and tried the TRACES refund option. But the total amount of TDS is “Consumed” and Max refund amount is zero.

What is my option now? TDS was paid on 16th Oct ( 6 days back). Hoping for a solution on this.

Hi @nisshant

26QB is the challan cum return statement. As soon as you file the form, TDS amount paid by you gets utilized. There are few corrections that are allowed in form 26QB. You can refer to the article below. You cannot get the refund of the taxes paid through an online method. You can contact concerned Assessing Officer (AO) of the Income Tax Department (ITD).

You can also contact Aaykar Sampark Kendra (ASK) on Toll Free No. 1800-180-1961 to ask for help.

Hope this helps!

Hi @Jatin_Sahu

Yes, you can file 26QB correct request with registering a DSC and file te new request.

Here’s a read for your reference on TRACES: Form 26QB Correction DSC/ AO Approval - Learn by Quicko