What is PAN?

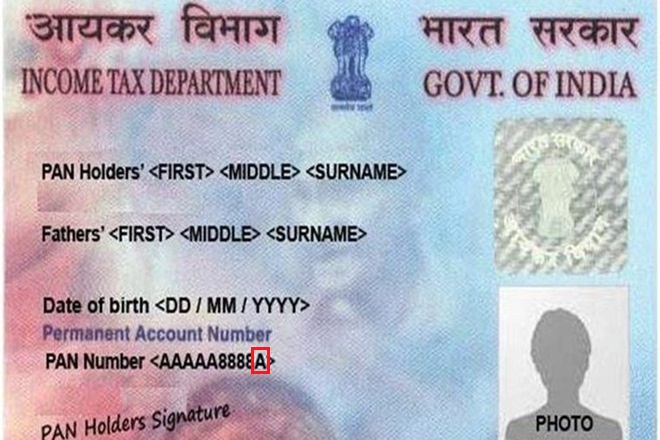

Income Tax Department (ITD) issues Permanent Account Number or PAN card an alphanumeric ID in a form of card to any “person” who applies for it or to whom the department allows the number without an application.

PAN enables the department to link all transactions of the “person” with the department. These transactions include tax payments, TDS/TCS credits, returns of income/wealth/gift/FBT, specified transactions, correspondence, and so on. PAN, thus, acts as an identifier for the “person” with the Tax Department.

Use of PAN card

- The PAN Card is important to conduct transactions of sale or purchase of assets, of any immovable property having a value at INR 5,00,000 or more, during sale and purchase of motor vehicles having more than two wheels

- It is mandatory to provide the PAN card since Jan 1st, 2016 to open a bank account

- Taxpayers require a PAN Card for phone connection

- Furthermore, you also require it to procure a new gas connection

- You need it to make a one-time payment against a bill of the amount exceeding INR 25,000 in any hotel and restaurant

- A payment in cash exceeding the amount of INR 25,000 while traveling to any foreign country requires a PAN card

- PAN card helps in the deduction of fraudulent transactions. It also reduces tax evasion and provides transparency in transactions between buyers and sellers

- Moreover, it is mandatory to provide the PAN card details for every transaction that takes place with the ITD

- It is also mandatory for numerous other financial transactions such as availing of institutional financial credits, purchase of high-end consumer items, foreign travel, a transaction of immovable properties, dealing in securities, etc.

- PAN Card is a valuable means of photo identification accepted by all Government and Non-Government institutions in the country

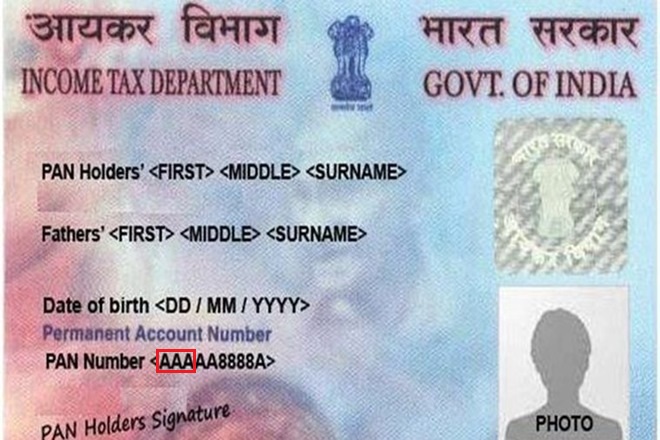

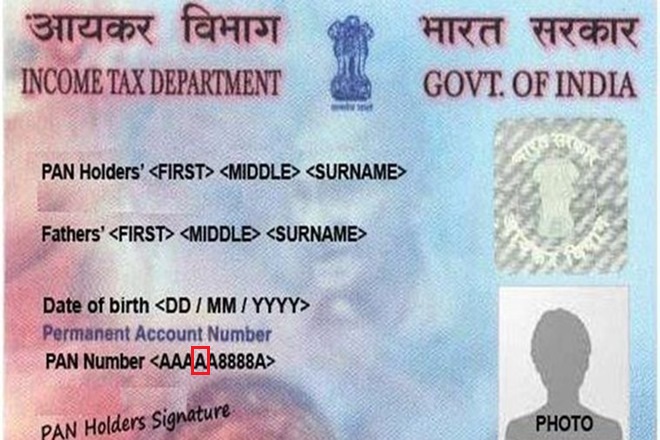

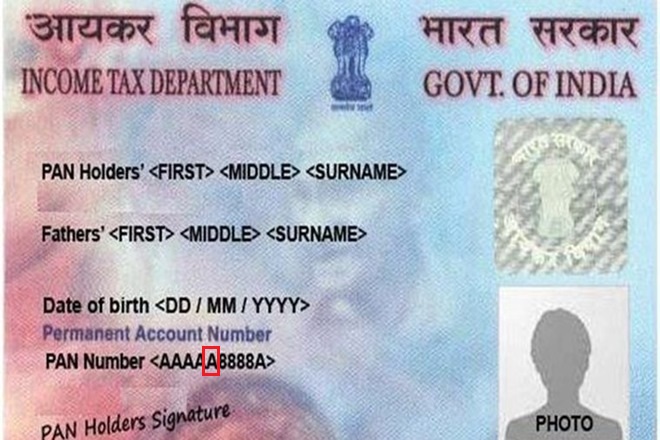

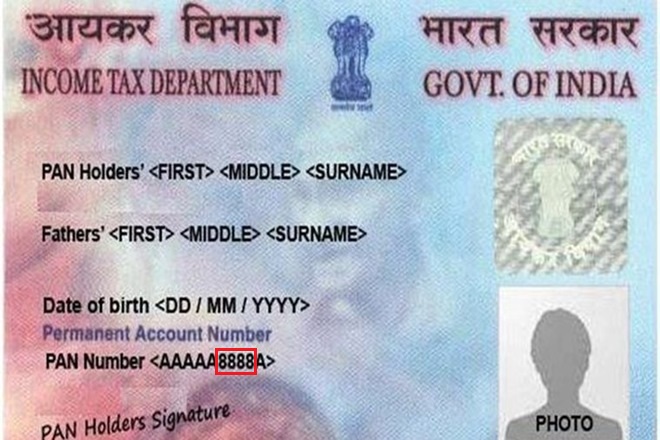

Understand PAN Number

- A typical example of a PAN is: ABCPS1234A

- The first five characters are letters, the next four are numerals, and the last character is a letter.

- Out of the first five characters, the first three characters represent the alphabetic series running from AAA to ZZZ. (eg. ALWPG5809L)

- The fourth character represents the status of the PAN holder. (eg. ALWPG5809L). The PAN cardholders have a unique definition:

- A — Association of Persons (AOP)

- B — Body of Individuals (BOI)

- C — Company

- F — Firm

- G — Government

- H — HUF (Hindu Undivided Family)

- L — Local Authority J — Artificial Judicial Person

- P — Individual

- T — AOP (Trust)

- The fifth character represents the first character of the PAN holder’s last name/surname in the case of an individual. In the case of non-individual PAN holders, the fifth character represents the first character of the PAN holder’s name (E.g. ALWPG5809L).

- The next four characters are sequential numbers running from 0001 to 9999 (E.g. ALWPG5809L).

- The last character, i.e., the tenth character is an alphabetic check digit (E.g. ALWPG5809L).

The combination of all the above items gives the PAN a unique identity.

PAN card Application Methods

Apply for PAN card Online

One can apply for PAN in an online manner in two ways:

- Apply via TIN-NSDL or,

- Apply via UTIITSL

Offline Method to Apply for PAN card

If you wish to physically submit the application, then you have to:

- Download the FORM 49A.

- Go through the Instructions before Filling in FORM-49A.

- Attach the Supporting Documents for PAN

- Submit the duly filled form along with the supporting documents and prescribed application fees at the PAN application center.

- Upon submission, an applicant will receive an acknowledgment in the form of a unique number on acceptance of the application form. This number can be used for tracking the status of the application.

FAQs

If the PAN card is lost then you can apply for duplicate PAN card by submitting the Form for “Request for New PAN Card Or/ and Changes or Correction in PAN Data” and a copy of FIR may be submitted along with the form.

If the PAN card is lost and you don’t remember your PAN, then in such a case, you can know your PAN by using the facility of “Know Your PAN” provided by the Income Tax Department. This facility can be availed from the website of the Income Tax Department.

You can know your PAN online by providing the core details like Name, Father’s Name, and Date of Birth. After knowing the PAN you can apply for duplicate PAN card by submitting the “Request For New PAN Card Or/ And Changes Or Correction in PAN Data”.

Section-272B provides for penalty in case of default by the taxpayer in complying with the provisions relating to PAN, i.e., not obtaining PAN, even though he is liable to obtain PAN or knowingly quoting incorrect PAN in any prescribed document in which PAN is to be quoted or intimating incorrect PAN to the person deducting tax or person collecting tax. The penalty under section-272B is Rs. 10,000.

A person cannot hold more than one PAN. If a PAN is allotted to a person, then he cannot apply for obtaining another PAN. A penalty of Rs. 10,000/- is liable to be imposed under Section-272B of the Income-tax Act, 1961 for having more than one PAN.

If a person has been allotted more than one PAN then he should immediately surrender the additional PAN card(s).

Yes, it mandatory to provide the Assessing Officer (AO) Code in Form 49A/49AA. AO Code (i.e. Area Code, AO Type, Range Code, and AO Number) of the Jurisdictional Assessing Officer must be filled up by the applicant. These details can be obtained from the Income Tax Office or PAN Centre or websites of PAN service providers on www.utiitsl.com or www.tin-nsdl.com

How do I know the AO code and AO type for a PAN card application? Can I choose anyone listed for my state?

What are the steps to download a PAN card PDF?

I recently misplaced my PAN card and I want a new one with the old PAN number. How should I proceed?

How can I get my pan card acknowledgement number?

How can I check my PAN card details online?

Hey @TeamQuicko, what is the minimum age required for getting a PAN card?

Hey @SonalYadav,

No - you cannot randomly select your AO code and type just based on the state. In TIN-NSDL PAN application you need to select AO based on the description provided on the AO in the Help utility for AO selection after you select State and City, as shown in the image below -

So once you select State and City - you’ll see a list of AO’s with different descriptions. Most common one - if you’re salaried with income below 20 lacs as seen in this example it will be WARD 7(1)(4) in Ahmedabad, as we chose Ahmedabad as the city for this example.

Similarly AOs will be different for Government sector employees, business owners, etc. Once you select that AO, AO type and code will automatically be filled in the respective fields of your application.

If you’re still confused regarding your AO, you’re best suited to get professional help for the same. Choose Quicko’s PAN Application Plan and have your PAN application handled by professionals in hassle free manner.

Hope this helped! Feel free to reach out in case of further queries.

Hey @SonalYadav

To get an e-PAN or a PDF version of PAN card - you can:

Steps to apply for Reprint/Duplicate e-PAN via NSDL website

Note: If during the application process the session times out or you wish to continue later - you can click on Registered user tab and use your token number to resume the application

Among these options, e-KYC through Aadhaar is the easiest, since you don’t need to submit further documents as proof of your identity and your e-KYC is completed using Aadhaar OTP.

It usually takes 15–20 days to receive the duplicate PAN card.

You also get an instant e-PAN from the Income Tax Department.

Following is the sample of an e-PAN:

Hope this helps!

Hey @HarshitShah

Go to Know Your PAN and enter your Name, Date of Birth and mobile number to fetch your PAN details from Income Tax database.

Or, you can get your old PAN Number from:

Once you fetch your PAN number, you can apply for a reprint of your PAN on Quicko or on NSDL website - refer Team Quicko’s answer to How can I get a new duplicate copy of my pan card

Hope that answered your question! In case you need further assistance, feel free to send us a message or mention a comment below.

Hey @ViraajAhuja47

It is very easy to get an acknowledgement number

You can get this number Online or Offline:

If you have applied for a new Pan Card or have applied to change any data in the existing Pan Database, the acknowledgement number can be found in Pan Acknowledgement sheet or on the Pan Acknowledgement form that has been provided to you.

If you applied online for PAN, the acknowledgement number will be delivered to your given Email Id.

After getting the acknowledgement number you can track you PAN status using NSDL website.

Hope this helps!