The Permanent Account Number (PAN) is an alphanumeric ID in a form of card to any person who applies for it. The PAN is issued by the Income Tax Department (ITD). The TIN-NSDL portal provides a facility for the application of the PAN card over the internet through its online services. The applicants can also apply for the PAN in an offline manner. There are 2 types of applications for PAN:

- Application for PAN allotment:

- The application form is used when the applicant has never applied for a PAN or does not have PAN allotted to him/her. In this case, the applicant can fill Form 49A if they are Indian citizens. This also includes those applicants who are located outside of India. Furthermore, Form 49AA is to be filed by foreign citizens who are applying for the PAN.

- Application for new PAN Card or/and Changes or Corrections in PAN Data:

- This can be applied by applicants who already have a PAN card but wish to obtain the new PAN card or need to make any changes or corrections in their PAN card. This form can be filed by Indian citizens as well as foreign citizens.

Steps to Apply for PAN card on NSDL Website

- Visit the TIN-NSDL portal.

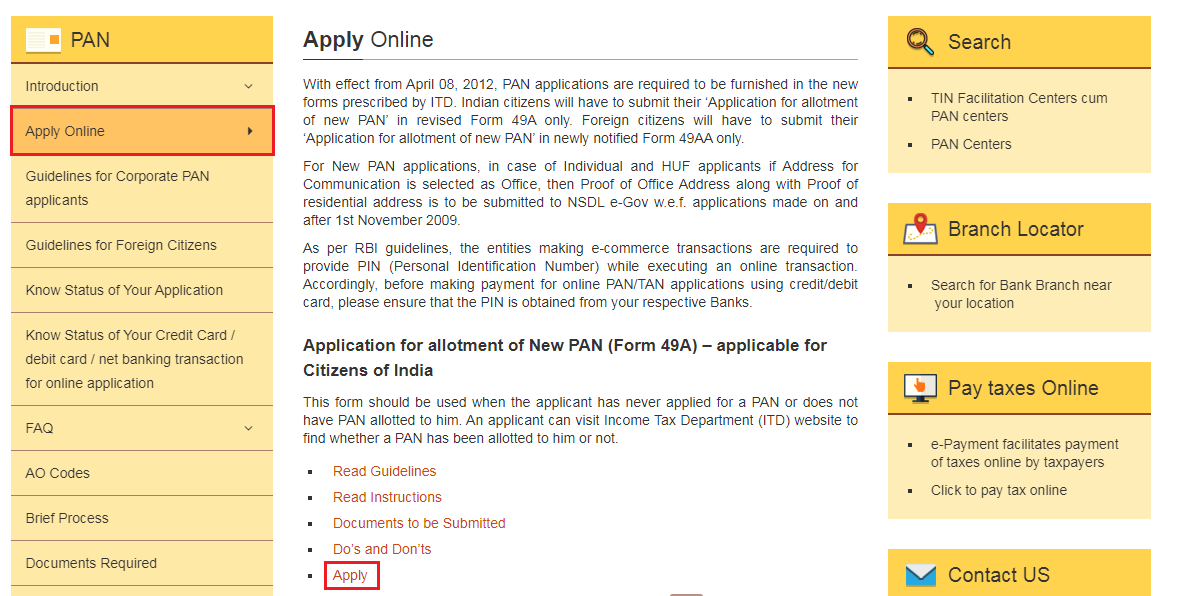

Click on the Services > PAN option from the dashboard of the TIN-NSDL portal

- Click on the “Apply” option.

As discussed earlier, Form 49A is for the citizens of India, and Form 49AA is for the foreign citizens.

- Fill in the following details manually or select the options from the drop-down list as required:

1. Application Type

2. Category

3. Title

4. Last Name/Surname

5. Date of Birth (D.o.B)

6. e-Mail ID

7. Mobile Number

8. Captcha Code (from the image given) - Click on the “Submit” option

Once the required details are filled in, click on the “Submit” option.

- Click on the link to continue your PAN Application process

Hence, a token number will be generated. You will be required to click on the link to continue with your PAN Application.

- Thus, we move to the “Personal Details” page. You will have to choose from one of the following options given to you:

1. Submit digitally through e-KYC and e-Sign

2. Submit scanned images through e-Sign

3. Forward application documents physically - Hence, after filling in the required details we move to the “Contact and other Details” section.

Furthermore, you will be given an option to obtain the physical card. If you wish to not go for the physical card, it is mandatory to enter your e-Mail ID as you’ll receive the digitally signed e-PAN card.

- Select the appropriate check-box from the given sections.

Select the appropriate options from the “Source of Income” and “Address for Communication” sections.

- Enter the appropriate country code (ISD Code) under the “Telephone Number & Email ID Details” section.

The other mandatory fields will be pre-filled. Thus, click on the “Next” option.

- We move to the “AO Code” section.

Fill in the following details in the respective field to receive the AO details:

1. Applicant type

2. State

3. City

- Therefore, fill in the appropriate details of the AO in the respective field and click on the “Next” option. We move to the “Document Details” page.

The following supporting documents have to be submitted:

1. Proof of Identity

2. Proof of Address

3. Proof of D.o.B - Choose the type of applicant from the drop-down list.

Fill in the details under the “Place” tab and click on the “Submit” option.

- Submit the documents mentioned below if you have chosen the “Submit digitally through e-KYC and e-Sign” option after step 8,

1. Digital Photo

2. Digital Signature

3. Supporting Documents

Hence, after completing the payment process, it takes approximately 15-20 days for the Department to process the application and issue the PAN card. You can also track your PAN card if you wish to do so.

Documents Required for HUF PAN card

- Photo Identity Proof of Karta: (Aadhaar, Driving License, Passport, etc)

- Address Proof : (Aadhaar, Passport, Electricity Bill, Bank Statement, etc)

- Date of Birth Proof of Karta: (Aadhaar, Driving License, Passport, School Leaving Certificate, etc)

- An affidavit by the Karta of the HUF stating name, father’s name, and address of all the coparceners

- Other supporting documents

FAQs

The charges for applying for PAN is INR 93 (Excluding Goods and Services tax) for Indian communication address and INR 864 (Excluding Goods and Services tax) for foreign communication address. Payment of application fee can be made through credit/debit card, demand draft, or net-banking.

The photo and signature are very important in the PAN card. It is required for verification at the time of availing any financial service such as a loan, credit card, investment, etc.

Yes. All existing holders and new applicants have to link their Aadhaar card to their PAN card for filing their returns starting F.Y. 2019-2020. Some of the benefits of linking the PAN card to the Aadhaar card are as follows:

1. Getting rid of fake PAN card

2. Identify tax evaders

3. Ease of filing tax returns