A resident is a Non-Resident Indian (NRI) if they have stayed overseas for more than 120 days. The law also states that a person is a resident if he/she has been in India for more than 60 days in the year in question and 365 days during the four years prior to that year. Hence, the NRI can also apply for their PAN card. Therefore, in the case of the NRI, the Assessing Officer (AO) code pertaining to the International Taxation Directorate should be used. In case the applicant is unaware of the correct AO code, then the applicant can select the default international taxation AO code of Delhi Regional Computer Center (RCC) (at present DLC – C – 35 – 1).

Steps to Apply for PAN Card for NRI

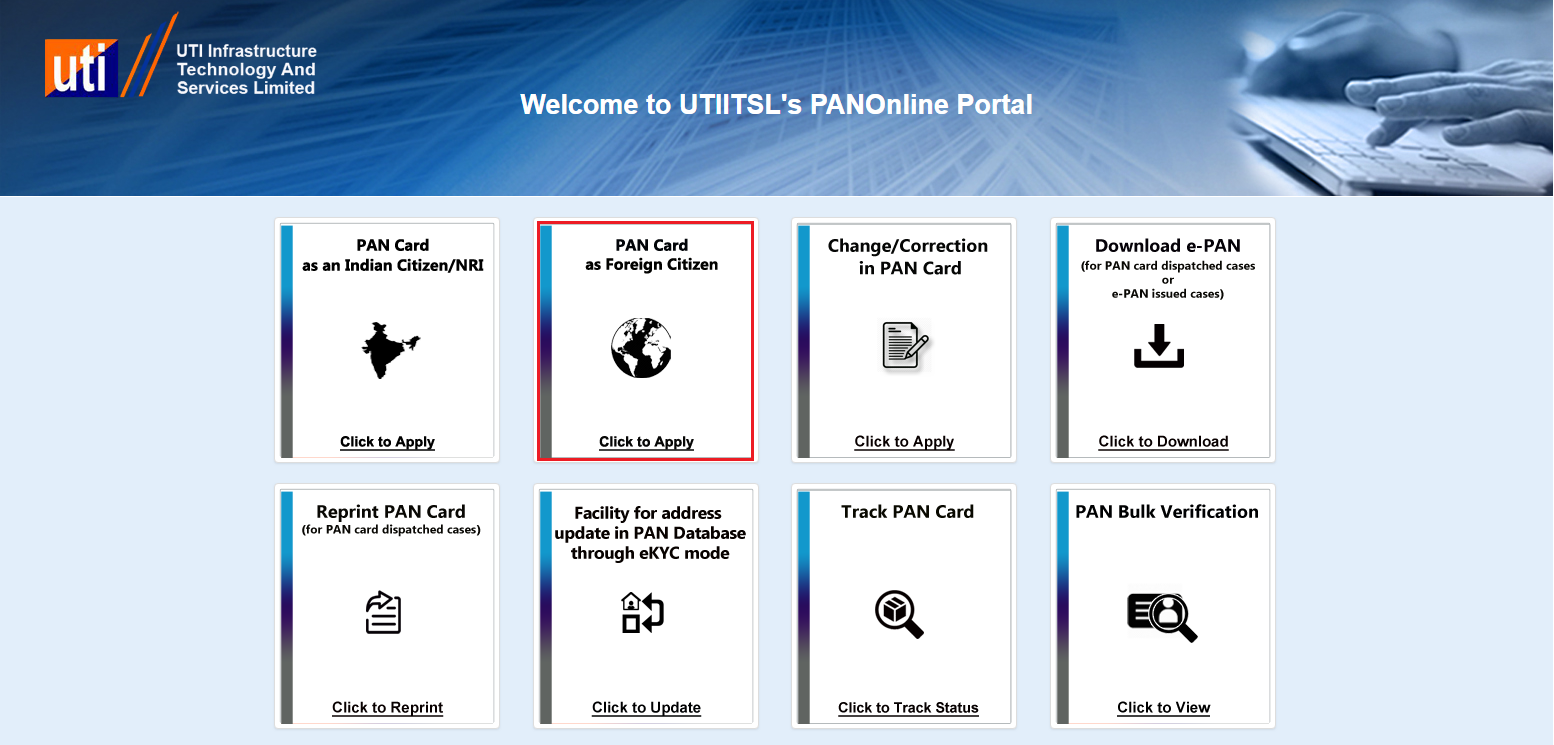

- Visit the UTIITSL portal

Visit the UTIITSL portal to start the process

- Select “For PAN Cards > Apply PAN Card“

Click on the “For PAN Cards > Apply PAN Card” option from the dashboard.

- Select “PAN Card as Foreign Citizen“

Click on the “PAN Card as Foreign Citizen” option.

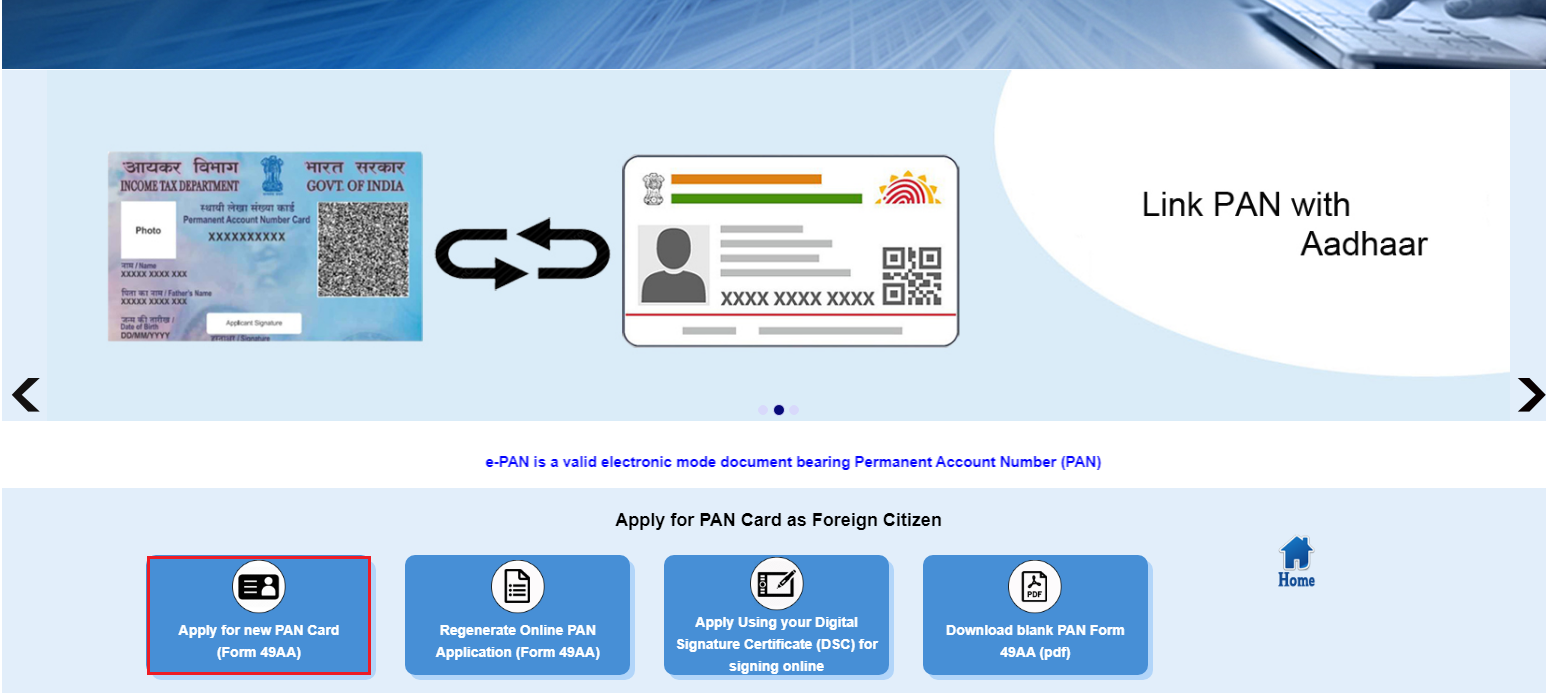

- Click on the “Apply for New PAN Card (Form 49AA).”

Hence, of the four options given, click on the “Apply for New PAN Card (Form 49AA).” You can also download the blank PAN Form (49AA) by clicking on the fourth option.

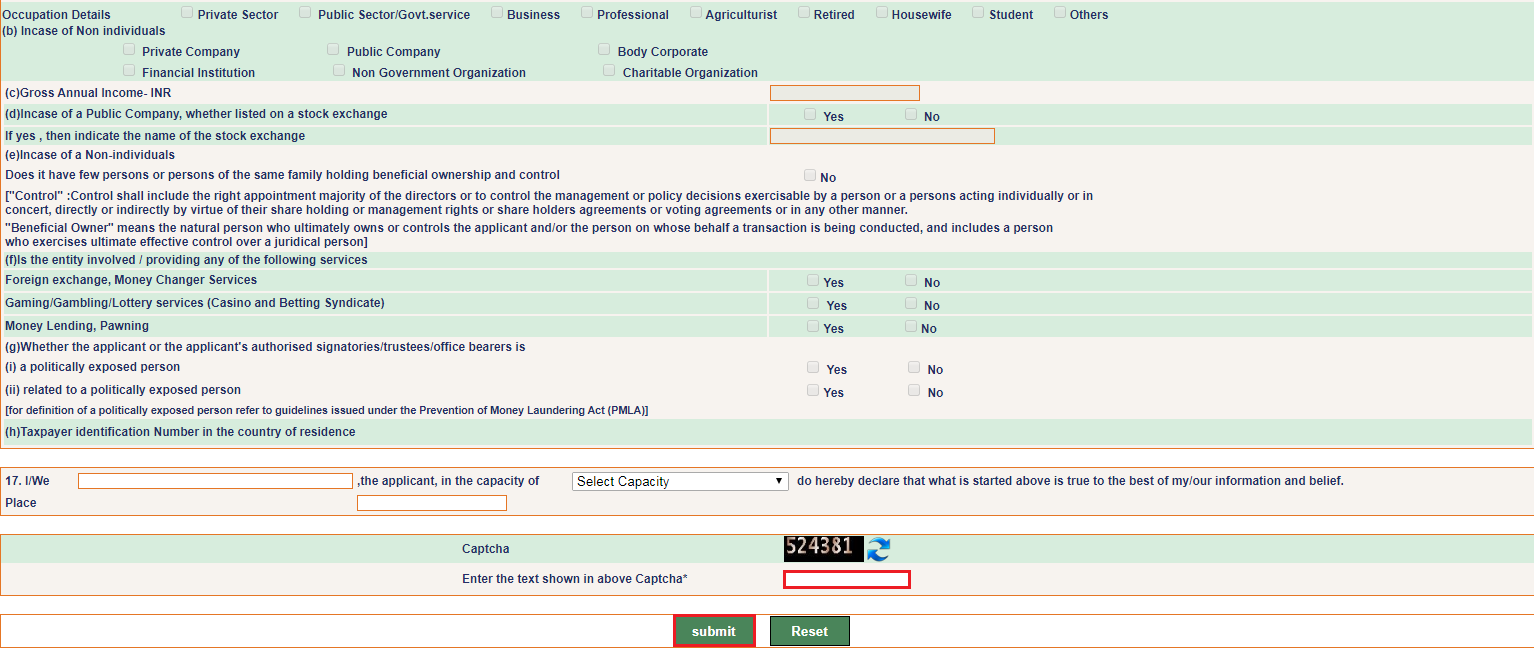

- Fill up all the details required for applicant

Thus, we move to the Form 49AA page. Fill up all the details required in the respective fields.

- Enter the captcha code and then “Submit” .

Finally, enter the captcha code from the image given and click on the “Submit” option.

After submitting the Form 49AA, it will redirect you to the payment page. Upon successful completion of the payment process, the process of the PAN card will be initiated.

FAQs

Yes. “Individual” applicants should affix two recent color photographs with white background (size 3.5 cm x 2.5 cm) in the space provided on the form. The photographs should not be stapled or clipped to the form. The applicant should sign across the photograph affixed on the left side of the form in such a manner that portion of signature is on the photo as well as on form. The clarity of the image on the PAN card will depend on the quality and clarity of the photograph affixed on the form.

NRI applicants are required to submit the following documents when applying for a PAN card:

– 2 recent passport-sized photographs

– Copy of passport

– Overseas address proof and a copy of overseas bank statement

No, it is not mandatory for all NRIs to have a PAN, but those who have a source of income in India need to have a PAN in order to file their taxes. This income could be in the form of rent, dividends from shares, returns from mutual funds, etc.