The taxpayers can apply for a change or correction in their PAN if the details reflected on it or incorrect or wrong. The application for Change/Correction in PAN can be made online through TIN-NSDL by filing Form 49A. Moreover, both citizens, as well as non-citizens of India, can apply for Change/Correction in PAN through TIN-NSDL.

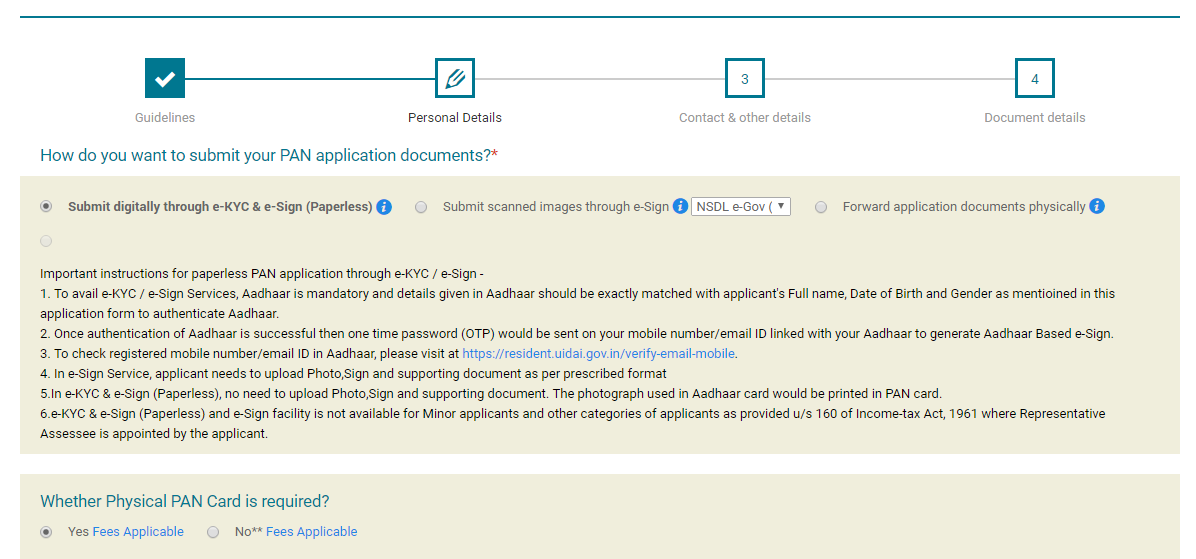

The applicant will receive a token number after a successful application. The following 3 options are present to submit supporting documents:

- Submit digitally through e-KYC and e-Sign

- Submit scanned images through e-Sign

- Forward application documents physically

Steps to Apply for Change/Correction in PAN

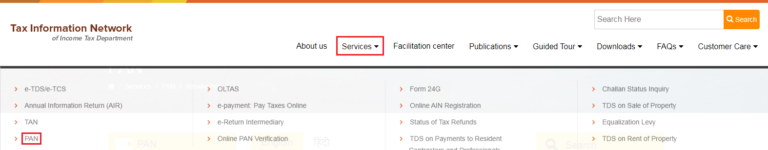

- Visit the TIN-NSDL portal.

Click on the Services > PAN option from the dashboard.

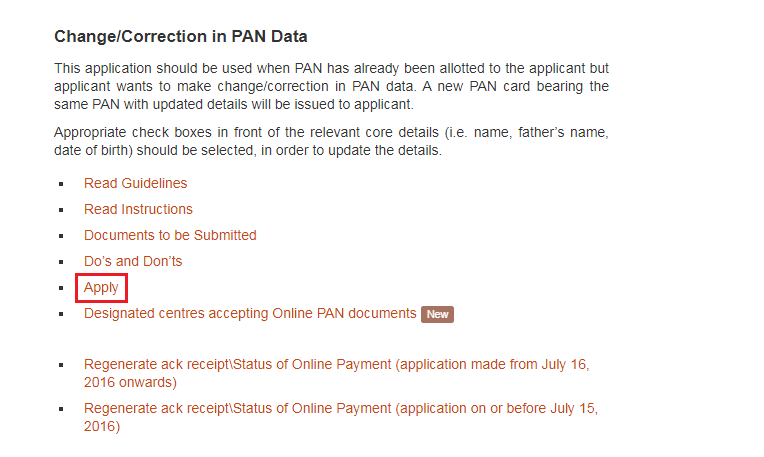

- Scroll down the page till you reach the “Change/Correction in PAN Data” section.

click on the “Apply” option.

- we move to the online application form. We land on the personal details section. Furthermore, you will be given an option to opt for a physical card.

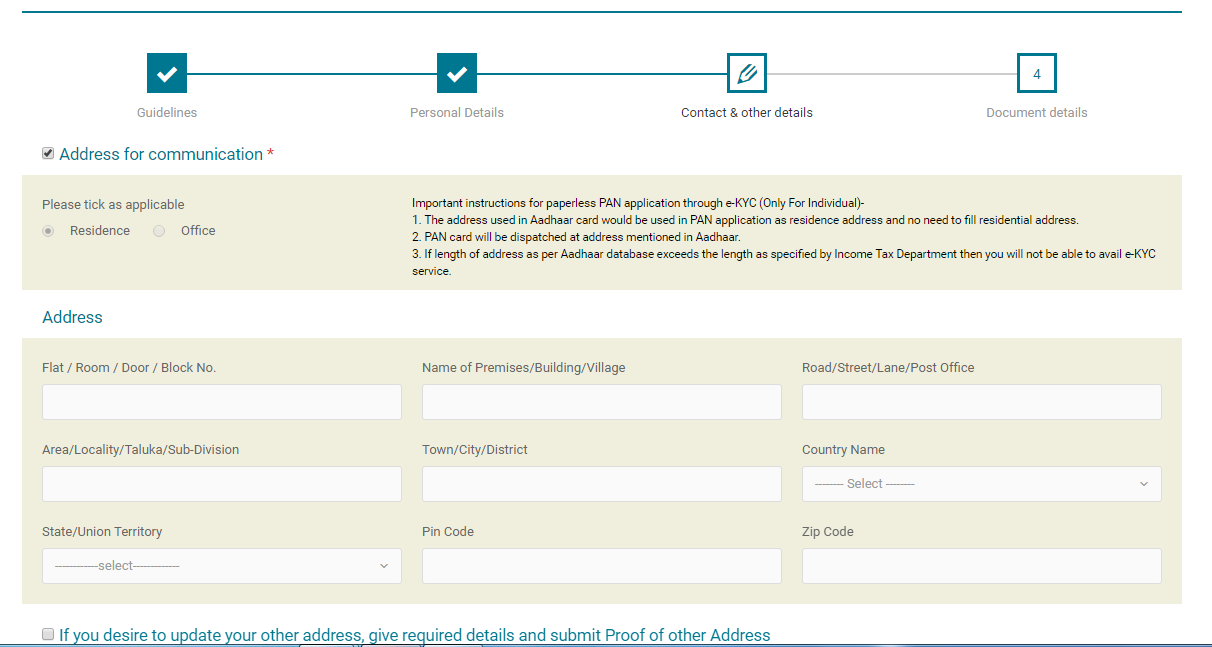

Verify the details and click on the “Next” option or click on the “Contact & Other Details” section to proceed.

- Verify the details and make required corrections or changes in this section.

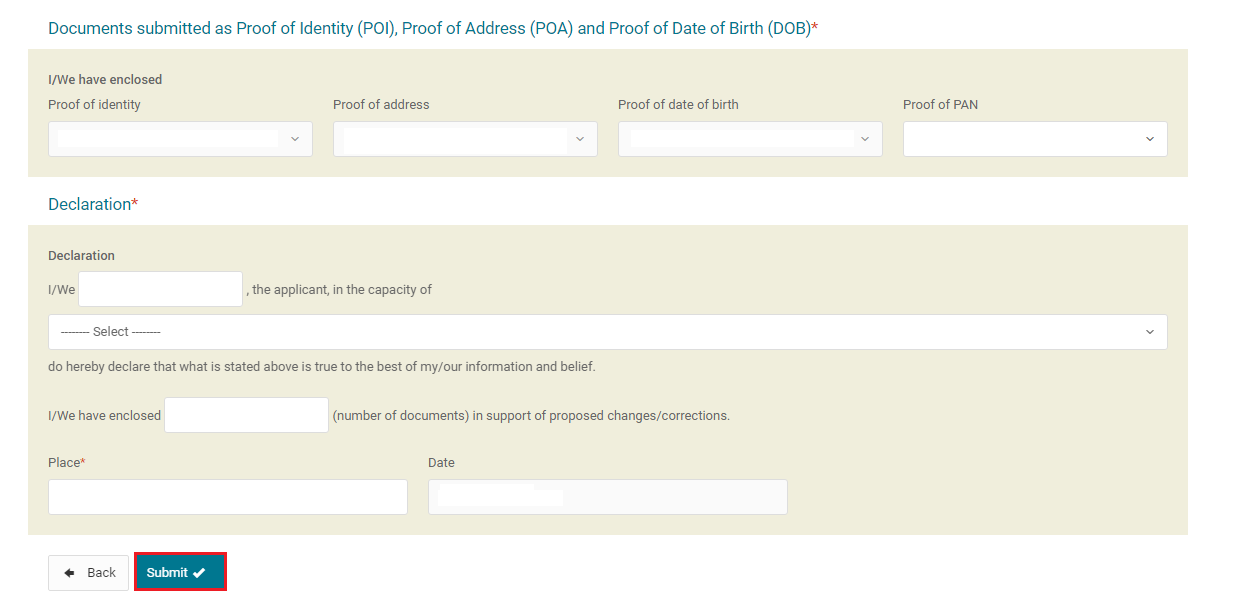

And then we move to the “Document Details” section.

- Select the supporting documents from the drop-down lists.

Fill in the declaration form and click on the “Submit” option.

- If you have chosen the e-KYC/e-Sign option under the personal details section, then you will have to upload the supporting documents in the next step.

You will have to upload your digital picture and signature to complete the application process.

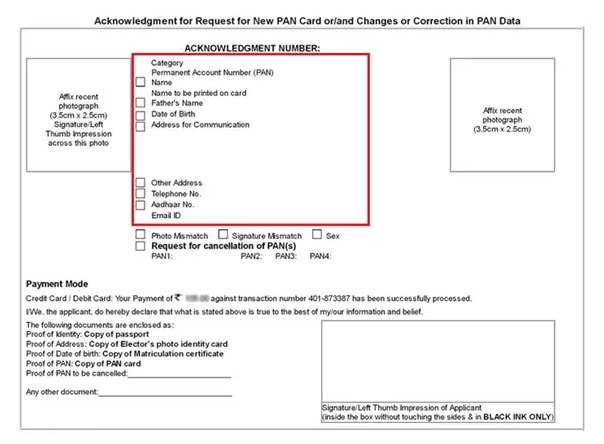

- Once the application process is complete, you will receive an acknowledgment form.

No need to send any supporting documents if you have done the e-KYC/ e-Sign process. However, for physical submission mode, individual applicants are required to affix two photographs in the space provided in the acknowledgment and cross-sign it in such a manner that a portion of the signature is on the photo as well as an acknowledgment receipt.

Additionally, the supporting documents (signed acknowledgment, proof of existing PAN, identity proof, address proof, proof of D.o.B) are to be sent to the following given address:

NSDL e-Gov at ‘Income Tax PAN Services Unit, NSDL e-Governance Infrastructure Limited, 5th Floor, Mantri Sterling, Plot No. 341, Survey No. 997/8, Model Colony, Near Deep Bungalow Chowk, Pune – 411 016‘.

FAQs

Yes. ‘Individual’ applicants should affix two recent color photographs with white background (size 3.5 cm x 2.5 cm) in the space provided on the form. The photograph should not be stapled or clipped to the form. The clarity of the image on the PAN card will depend on the quality and clarity of the photograph affixed on the form.

You can submit the application in the form “Request for new PAN card or/and Changes or Correction in PAN data” in the following cases:

– When you already have PAN but want a new PAN card,

– When you want to make some changes or corrections in your existing PAN details

An application gets processed within 15 days once the following documents are submitted:

– PAN – the PAN currently in use

– Identity Proof

– Address Proof

– Date of birth Proof(For individuals and Karta of HUF)

– Proof in support of changes sought if any

– Proof PAN surrendered if any