This article explains the steps to retrieve the deductor user ID from the TRACES portal. To avail of the services on TRACES, it is mandatory to register on the portal. A registered deductor can login to TRACES to file TDS Returns, file correction returns, and download TDS documents. He/She can login to the TRACES account using user id, password, and TAN. If he forgets the user id or password, he has the option to reset it or retrieve it from the TRACES portal.

Steps to Retrieve the User ID or change the User ID on TRACES

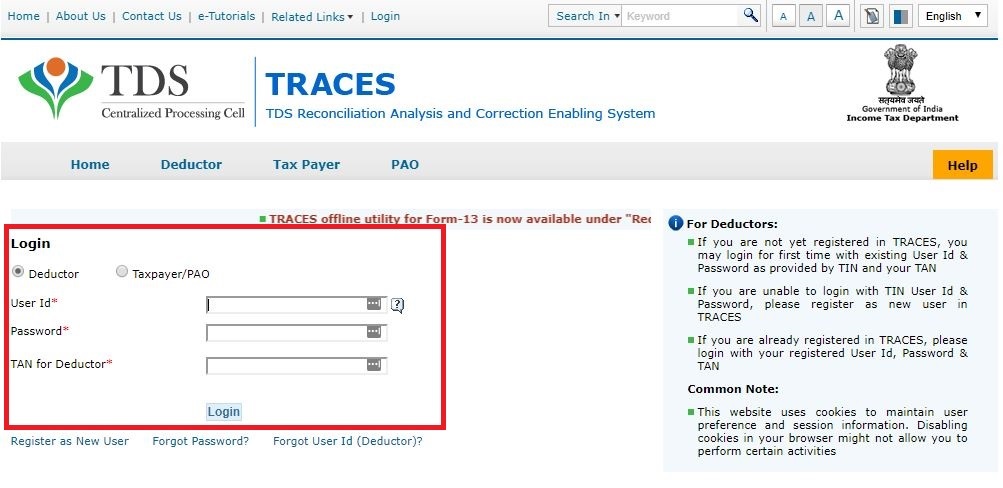

- Visit the TRACES portal

Go to the TRACES website. The home page of TRACES will appear on screen. Click on ‘Continue’ on to proceed further

- Forgot User ID

Click on Forgot User ID > Deductor on the home page or click on Forgot User Id (Deductor) on the login page

- Enter TAN of deductor

Enter TAN of Deductor, captcha text, and click on Proceed. You can search for TAN using the service of ‘Know Your TAN‘ on incometaxindiaefiling.gov.in

- Enter the token number

The system auto-populates a Financial Year, Quarter and Form Type. You need to complete the KYC verification for the same. Enter the Token Number of a Regular (Original) TDS Return

Note: Enter the Token Number manually. Do not Copy/Paste. Enter Token Number of an original TDS return and not corrected return

- Enter CIN details

Under Part 1, enter Challan Identification Number (CIN) details of a challan used in the TDS return:

1. BSR Code or Receipt Number

2. The date on which tax is deposited – enter in dd-mm-yyyy format eg: 10-Jan-2019

3. Challan serial number or DDO serial number – 5 digit number eg: 00025

4. Challan amount or Transfer voucher amount – enter the amount with decimal places eg: 1569.00

5. CD Record Number – It is not mandatory to enter this. It should be filled when the same challan is mentioned more than once in the statement (TDS Return)

- Enter PAN amount combination

Under Part 2, enter a unique PAN-Amount Combination for Challan.

If there is no valid PAN in the challan details, select the checkbox:

PAN as in Statement – Enter the valid PAN reported in TDS Return. You can enter details of a maximum of 3 valid PANs. If there are less than three combinations, enter all combinations (one or two)

Total Amount Deposited – Enter the TDS deposited for the PAN.

Enter the amount with decimal places eg: 1569.00

Examples of unique PAN-Amount Combination:

Condition 1: – PAN: AAAAA0000N and Amount: Rs.1000, Rs.1000 and Rs.2000, then fill details as

a) AAAAA0000N & 1000.00

b) AAAAA0000N & 2000.00

Condition 2: – PAN AAAAA0000N and Amounts: Rs.1000, Rs.1000, Rs.1500 and Rs.2000, then fill details as

a) AAAAA0000N & 1000.00

b) AAAAA0000N & 1500.00

c) AAAAA0000N & 2000.00

- Authentication code

The system validates the KYC information and generates an Authentication Code which is valid for the same calendar day for same form type, financial year and quarter

- Enter the OTP

The registered mobile number of the Deductor will be auto-populated on the screen. You can edit the value and click on ‘Proceed’ for OTP (One-Time Password). Enter the OTP and click on Next.

- Reset your password

User Id and Email Id will be auto-populated on the screen. You can now reset your password and click on ‘Confirm’

- Confirmation message

Confirmation message ‘Registration request successfully submitted’ will appear on the screen.

- Activation link

Click on the Activation link within 48 hours to avoid deactivation. On the activation link screen, enter the new User Id, code sent on email and code sent on mobile. Click on Submit. You can also request for resending activation link and code.

- Login to your TRACES account

You can now login to your account on TRACES as a Deductor

FAQs

Yes. You can change your User ID on TRACES. Follow the process of ‘Forgot User Id’ to change your user id. Click on ‘Forgot User ID’ on the login page, complete KYC verification, enter the registered mobile, generate and enter the OTP. You can then edit the user name and activate the account using the activation link sent on email and mobile. To refer to the process in detail, refer to the article above.

If you have tried to login into the account five consecutive times with incorrect login details, the system would lock the account. You should wait for 1 hour for the account to be unlocked again. The deductor can use the ‘Forgot Password’ option to reset a new password to login into the account.

To change the password of your account on TRACES, follow the process of ‘Forgot Password’. Click on ‘Forgot Password’ on the login page, complete KYC verification, enter the registered mobile, generate and enter the OTP. You can then create a new password. A notification intimating the change in password will be sent on email and mobile. To refer to the process in detail, refer to the article above.

Hey @HarishMehta

Taxpayers or deductee cannot directly download form 16/form16A, the option to download Form 16/ 16A has been given to the Deductor. So, if you need Form 16 / 16A for TDS deducted by your current or previous employer or deductor you will have to contact them for the same. There is no option available on TRACES whereby you can download it yourself.

Hope this helps!

Hey @Dia_malhotra

Yes, individuals can still register as a taxpayer on TRACES even if they do not have TAN of the deductor by providing:

• Assessment Year

• Challan Serial Number and

• Amount of tax you have paid

Hope this helps!

In my Justification Report it shows an interest payable error whereas I’ve already paid the interest for that particular month According to the regulations what could be the reason for this?

Hi @saad,

According to regulations, interest payment default/errors may arise due to error in challan details , short deduction, short payment, late deposit of TDS amount. Here, you can file correction statement and revise the return.

Hope this helps!

Hi

I am not able to register the DSC despite many trials. I keep getting the error:

‘Error in establishing connection with TRACES Websocket Esigner. Please ensure that WebSigner Setup is installed and service is running on your machine and there are no proxies enabled on the browser while doing DSC activities’

Could you kindly help. I have tried all the instructions, as per below:

I have un-installed any previous versions of Java and emsigner.

I have installed Java 8, update 162 and 32 bit version on my Windows 10 machine

Downloaded TRACES-WebSigner-V2.0 and installed emsigner. The emsigner is running on my system.

Google Chrome is up to date. (Version 92.0.4515.131)

I have the DSC driver (e-pass 2003) installed.

I have rebooted and made sure the websigner (emsigner) is running.

When I go to my profile → Signature section, no window pops up, nothing loads, and if I click on ‘Request DSC’, I get the above error.

Could you point to me what I can do to make this work please. Do I need any physical device to generate tokens? I am logging in from the nri traces webpage. Thanks.

Preetham

@AkashJhaveri @Saad_C @Kaushal_Soni @Divya_Singhvi @Laxmi_Navlani can you help with this?

Hey @raopreetham, the first thing I would recommend you to do is to run the Emsigner as an administrator. Also, if it still does not seem to work, install the below mentioned JAVA fixer software and run it as an administrator and hopefully this would resolve your issue.

https://johann.loefflmann.net/downloads/jarfix.exe

The USB e-pass 2003 token device is particular type of a DSC.

Facing issues with TRACES Portal or registration? Get quick solutions for PAN verification, Form 26AS access, and TDS compliance all in one place.

Need help registering or navigating TRACES? Understand the steps for hassle-free TDS filing and compliance management.