A Section 8 Company is registered as a limited company under section 8 of Companies Act, 2013. It holds the licence from Central Government.The main purpose of establishing a section 8 company is to promote non-profit objectives. In case of incorporation as a public limited company there should be minimum three directors. And two directors in case of incorporation as a Private Limited Company. In procedure for incorporation of Section 8 company various forms are to filed with MCA.

The main purpose of a Section 8 company is to promote non-profit objectives such as:

- Trade,

- Commerce,

- Arts,

- Charity,

- Education,

- Religion,

- Environment protection,

- Social welfare,

- Sports,

- Research, etc.

Procedure for Incorporation of Section 8 Company

To register a company under Section 8 you need to just follow these steps:

- Obtain a DSC of the proposed Directors of the Section 8 Company.

Obtain DSC of at least one director to sign the E-forms related to incorporation.

- Once a DSC is received. File Form DIR-3 with the ROC for getting a DIN.

For DIN application you will require Identity Proof and Address Proof

- Once the DIR-3 is approved.

ROC will allot a DIN to the proposed directors.

- Draft MOA and AOA

It should be noted that the main objects should match with the objects shown in RUN Form

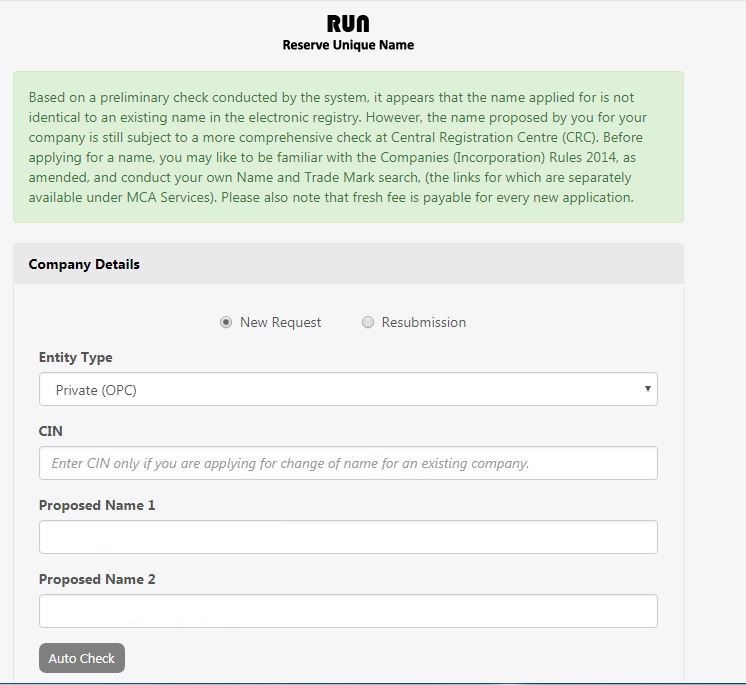

- File Form RUN for reservation/availability of company name.

Applicants can access the free name search facility of existing companies available on the MCA portal

- After approval, file Form INC-12 with the ROC

For application of licence for the Section 8 company.

- Once the Form is approved by Central Government, a license under section 8 will be issued in Form INC-16.

The Registrar shall have power to include in the license such other conditions as may be deemed necessary by him

- After obtaining the license, file SPICE Form 32 with the ROC for incorporation

Along with the required attachments.

FAQs

The maximum number of members in case of a private limited company can be 200. Further for a public limited company, there is no such limit.

The documents to be enclose with the application include:

a. Draft of MOA as per Form INC-13

b. Draft AOA

c. Declaration as per Form INC-14 (Declaration from Practicing Chartered Accountant)

d. Declaration as per Form INC-15 (Declaration from each person making application )

e. An estimate of future annual Income & Expenditure for next 3 years. Specifying the sources of the income and the objects of the expenditure.

Every subscriber shall sign the subscription pages of the MOA and AOA of the company. Along with his name, address, and occupation. This shall be in the presence of at least one witness who shall attest the signature and sign and add his name, address, and occupation.

Following are the documents to be attached with SPICE Form 32:

1. E- MOA and E -AOA.

2. INC-9 Affidavit and declaration by all subscribers and directors.

3. Declaration of deposits.

4. KYC of all Directors

5. Form DIR-2 along with a copy of the PAN Card and address proof of the directors.

6. Consent letter of all the directors.

7. Interest in other entities of the directors.

8. Copy of Utility bills (Not Older than 2 months).

9. NOC from the owner of the property if the premise is on lease/rent.

Hello @Dixita

SPICe+ is an integrated Web form for incorporating a company offering 10 services. Through SPICe+ (INC-32), you can apply for the name of your company, incorporation of the company, DIN of the directors, PAN and TAN registrations, PF and ESI registration of the company, GST registration, Professional Tax (only in Maharashtra), open a bank account.

You can incorporate any kind of Company through SPICe+, whether public, private, Section-8, OPC, etc.

Hope this helps!

Hi @Krish_Krish, you can go through the following article to understand how and where to apply for the process. It shall give you clarity on what you need to do while registering. Feel free to ask if you have any other queries. Hope this helps.

Is it mandatory to open a bank account with SPICe +?

Hey @Dixita

Yes, all the new companies getting incorporated through SPICe + need to compulsorily open a bank account in form AGILE PRO

Hope this helps!