House property is any Land or Building or land attached to the building. The land could be a courtyard, parking space, or compound. A taxpayer needs to report income earned from such Property while filing ITR. Hence it is important to keep supporting documents checklist while calculating Income tax. It also includes:

- Residential houses/Flats

- Shops

- Office space

- Factory sheds

- Farmhouses

- Godowns

- Cinema building

- Workshop building

- Hotel building etc.

File Your Tax Return

On Time , Online on Quicko.com

Open Your Account Today

File Your Tax Return

On Time , Online on Quicko.com

Open Your Account Today

You can file ITR-1 if you have earned income from one property. However, you need to file ITR-2 if you own more than one property. You can file ITR online using ITR Utilities or through registered e-Return Intermediary (ERI) like Quicko.

House Property Income Documents Checklist

PAN

Income Tax Department (ITD) issues Permanent Account Number (PAN). It is an alphanumeric ID of a taxpayer who is liable to pay taxes. PAN enables the department to link all transactions of the “Person” with his “Income”. Hence it is the most essential document while filing ITR.

Aadhaar

Aadhaar (Aadhaar Card) a 12 digit unique identification number issued by the UIDAI (Unique Identification Authority of India). It is mandatory for Resident Individuals to provide details of Aadhaar while filing ITR.

Utility Bill

While filing ITR taxpayers have to disclose the address of all the properties owned by them. Utility Bill contains property addresses and thus serves as a proof of address.

Rent Agreement

Rental Income is taxable income. Therefore, rent agreement between the owner and the tenant for a particular house property serves as proof of income earned during the financial year.

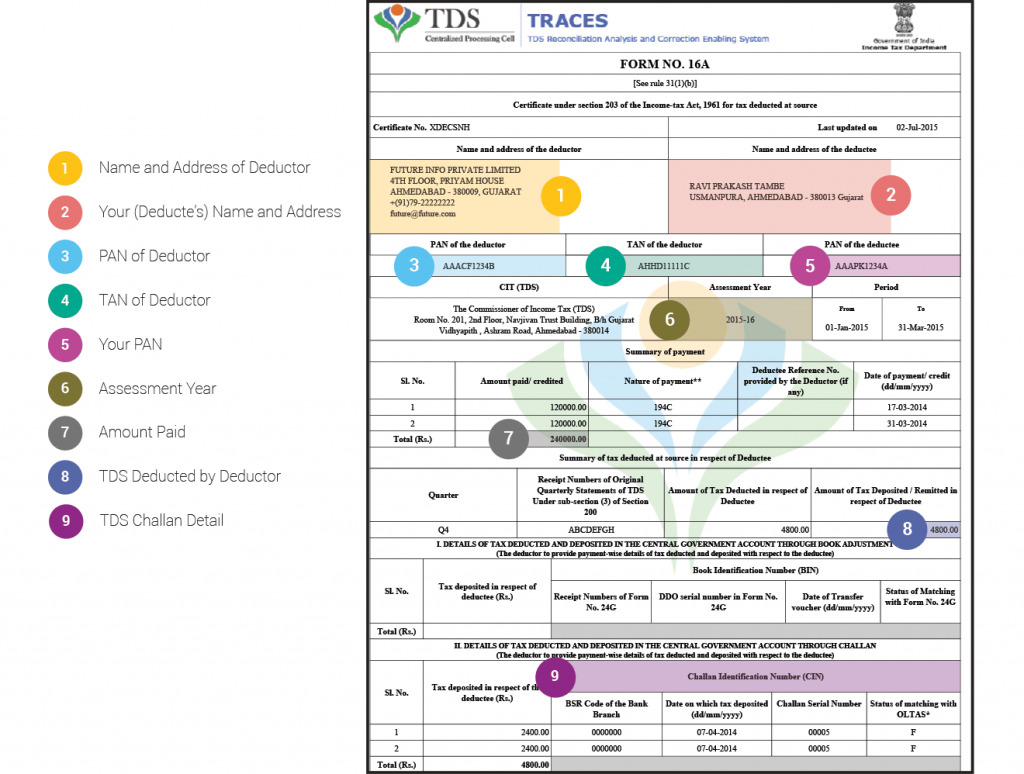

Form 16A

Form 16A will be provided if TDS is deducted on your rental income. While filing your ITR you can claim this TDS using Form 16A.

Home loan repayment certificate/ Interest Certificate from the bank

This certificate consists of capital amount, repayment amount, the interest charged, and co-ownership details. This serves as proof for claiming a deduction on Interest Repayment and Principal Repayment. And reduces your net taxable house property income.

Municipal Tax Receipts

Municipal tax is paid on properties. Taxes paid on let out properties can bring down your net taxable rental income. Therefore, Municipal Tax receipts are required while calculating the income from house property.

FAQs

A Self Occupied House Property is the one that you use as your own residence. This property can be in use by your children, spouse, and/or parents. Since there is no Income from such House Property, the gross annual value of this property is NIL (zero).

The assessee must be the owner of the properties. Identify the Gross annual value (GAV) of the house property. For self-occupied property, the GAV would be nil while for let out property the GAV will be the total rent received. Deduct municipal taxes paid by you (owner) towards the house property. Now you will realize the Net annual value of the house property. From NAV, deduct standard deduction of 30% and interest paid by you on a house loan. This will give you your Income from house property.

GAV- Municipal tax = NAV

NAV- Standard deduction- interest on borrowed capital= Income from house property.

Firstly, If your income falls under the taxable bracket you have to file your ITR without fail. Secondly, If you missed the deadline to file the ITR you can still file it but you may attract penalties. Moreover, If you don’t pay your taxes on time then if you are claiming any refunds they will get delayed. You will get lesser time to revise your ITR. and Lastly, You will have to pay interest on the taxable amount if you delay filing your ITR.

Every taxpayer whose income exceeds the Basic Exemption limit needs to file ITR. If your age is below 60 years and your income is more than rupees 2.5 lakh p.a then you are eligible to file your ITR.

Following are the basic documents required to file ITR:

-PAN

-Aadhaar

-Form 26AS

-Bank Account Details

-Tax Payment Challan

-Original Return (if filed)

Hey @TeamQuicko

Thanks for the blog! Just one quick question - Why do we have to report a quarterly breakdown of Dividend Income under IFOS?

Thank you!

Hey @TanyaChopra

This quarterly breakdown of Dividend Income under IFOS will help to calculate and determine penalty u/s 234C for the delay in payment of Advance Tax.

Hope this helps!

I had received dividend recently but I had noticed that TDS had been deducted. any idea as to why has it happened and is there a way I can claim this TDS?

Hey @HarshitShah

After the introduction of Budget 2020, dividend income is now taxable in the hands of the shareholder; and is also subject to TDS at 10% in excess of INR 5000 u/s 194 & 194K. Foreign Dividend is taxable at slab rates. TDS is not applicable to such dividends. The taxpayer should report such income under the head IFOS in the ITR filed on the Income Tax Website.

Hope this helps!

Hey @HarishMehta

Yes, dividend income is now taxable from FY 2021-22 onwards and it has to be reported under the head of IFOS.

You can read more about it here:

Hi @Maulik_Padh,

You need to pay Income tax on the net taxable income, i.e. after subtracting deductions, expenses, etc.

If the net taxable income is negative i.e. if there is loss, you can carry it forward when filing the ITR

Here are some of the articles which might help

Hi @ameyj

The amount of TDS deducted shall reflect in your Form 26AS only and it will also reflect the name of the deductor.

Using the name of the deductor you can find out on which share you have received the dividend and you can also cross-check the same in your bank statement.

Yes, you are right, TDS is to be deducted when the dividend paid exceeds 5000 INR in a financial year. However, the 5,000 INR limit pertains to all the dividends an individual gets in a year, or the total dividend per shareholder that a company pays out in a year, is left to interpretation, and hence registrars and share transfer agents (RTA) are not taking any chances and are deducting TDS even on small amounts.

Hope this helps

Hi @ameyj

You can submit a grievance on Income Tax Portal mentioning the issue and also attach the 26AS.

The other option is to leave it as it is and clarify it when the tax department sends the notice.

Hi @TeamQuicko

Consider that I have 10 shares each of 10 different Indian companies. Each of the 10 companies are declaring a dividend of INR 100 before the FY ends. Now I will be recieving 1000 as dividend from each company, thereby a total of 10,000.

The 5,000 dividend limit, is it applicable to each company / total dividend recieved by me in a year. If it is applicable to each company, then I would not attract TDS of 10% for dividend.

Also pl clarify, how would the company B know that I have got shares of Company A,C,D,E so on…

@Saad_C @Laxmi_Navlani @Divya_Singhvi @Kaushal_Soni @AkashJhaveri can you help with this?