GST Portal i.e. www.gst.gov.in is the GST website of the government of India. On the GST Portal you can register for GST, file GST Returns, view input tax credit, apply for refunds, apply for cancellation, search GSTIN etc.

Using GST Portal before logging into an account

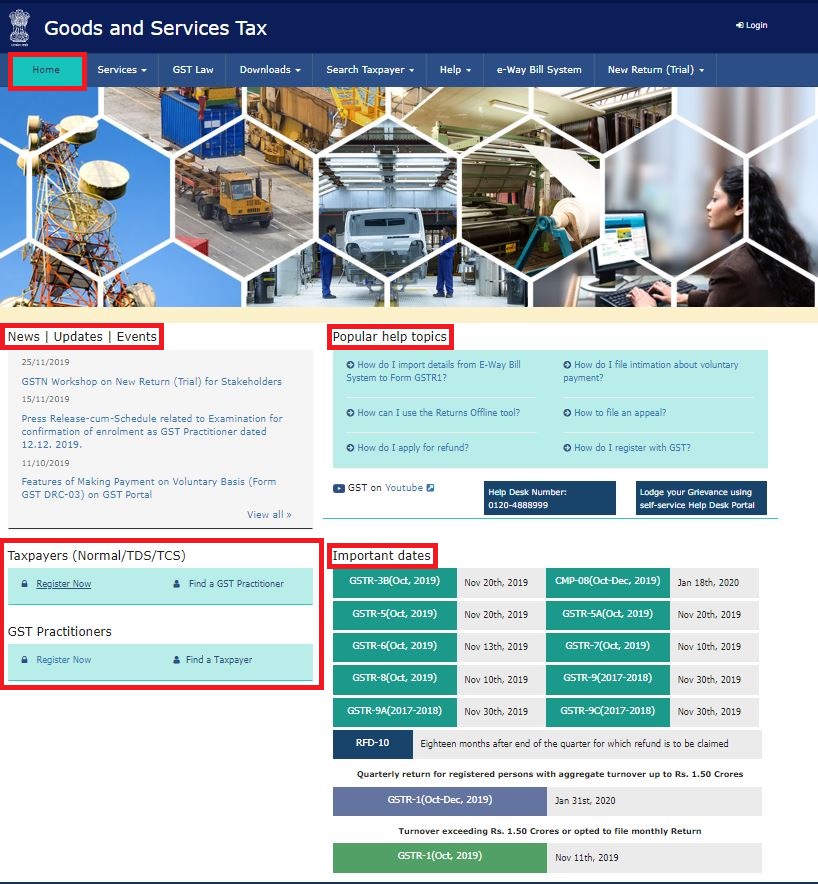

Home Page

- Latest News, Updates and Events are listed

- Most popular help topics

- Contact details – Help desk number

- Option to file a grievance using grievance redressal portal

- Important due dates to file GST Return forms

- Link to register as a taxpayer and link to find a GST Practitioner

- Link to register as a GST Practitioner and link to find a taxpayer

Services

- Registration – apply for registration, file clarification, track application status

- Payments – create challan, track payment status, file payment-related grievance

- User Services – generate user id for an unregistered dealer, check holiday list, search for GST Practitioner

- Refunds – track application status

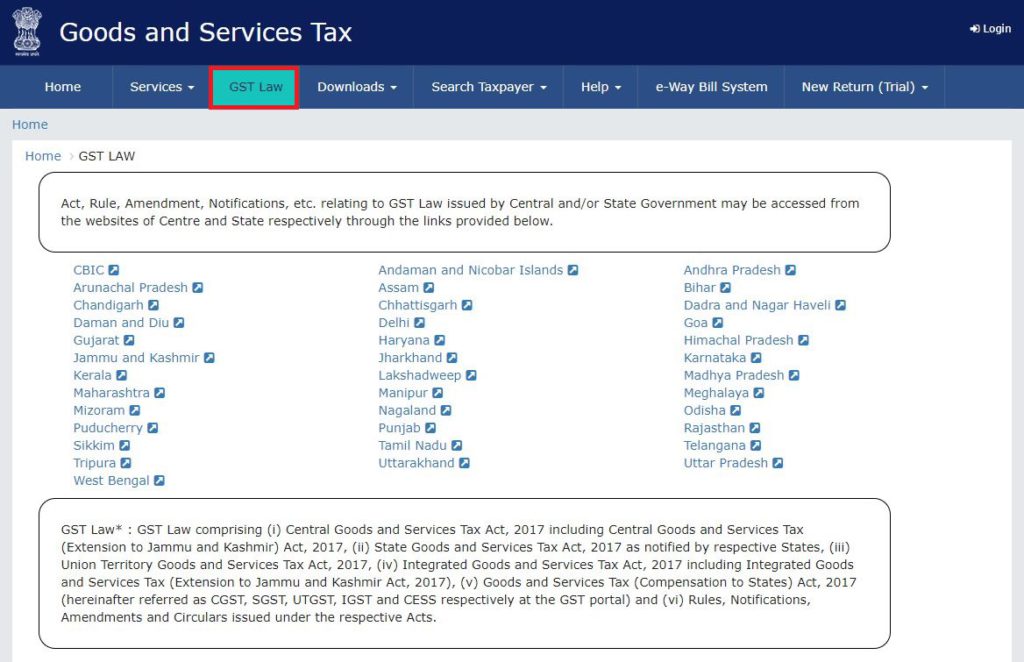

GST Law

Here you can access the Act, Rule, Amendment, Notifications etc relating to GST Law issued by Central and/or State Government from the websites of Centre and State respectively through the links provided

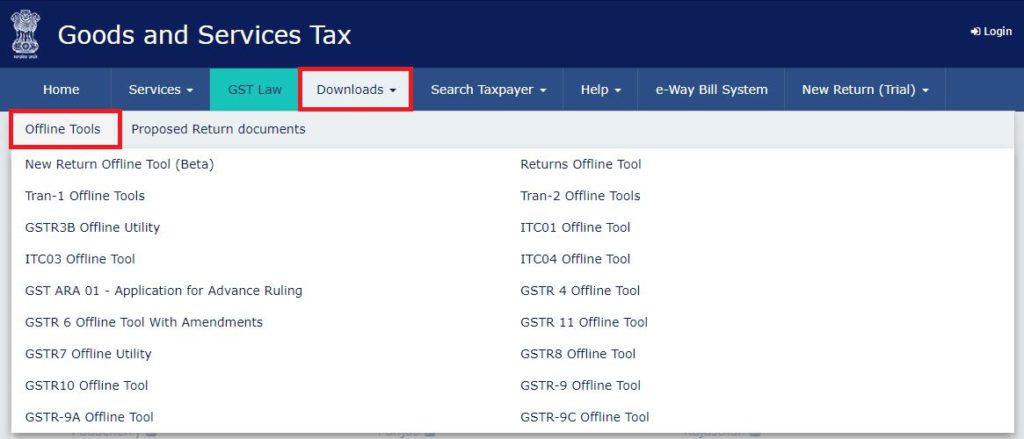

Downloads

- Offline Tools – Download the offline tools to file GST Return

- Proposed Return Documents – Return formats of new GST Return

Search Taxpayer

- Search by GSTIN/UIN – option to search a taxpayer using GSTIN or UIN

- Search by PAN – option to search a taxpayer using PAN

- Search Composition Taxpayer – option to search a taxpayer who has opted in or opted out of composition scheme. It can be searched using GSTIN/UIN or State

Help

- System Requirements – for using GST Portal, for using DSC, for installing web socket installer

- User Manuals, Videos and FAQs – content in form of training kits, quick videos, user manuals and FAQs to explain the GST Law and GST Compliances

- GST Media – connects to the Youtube channel of GSTN i.e. Goods and Services Tax Network

- Site Map – site map of the entire GST Portal

- Grievance Redressal Portal – taxpayer can raise a complaint regarding problems faced by them while working on the GST Portal

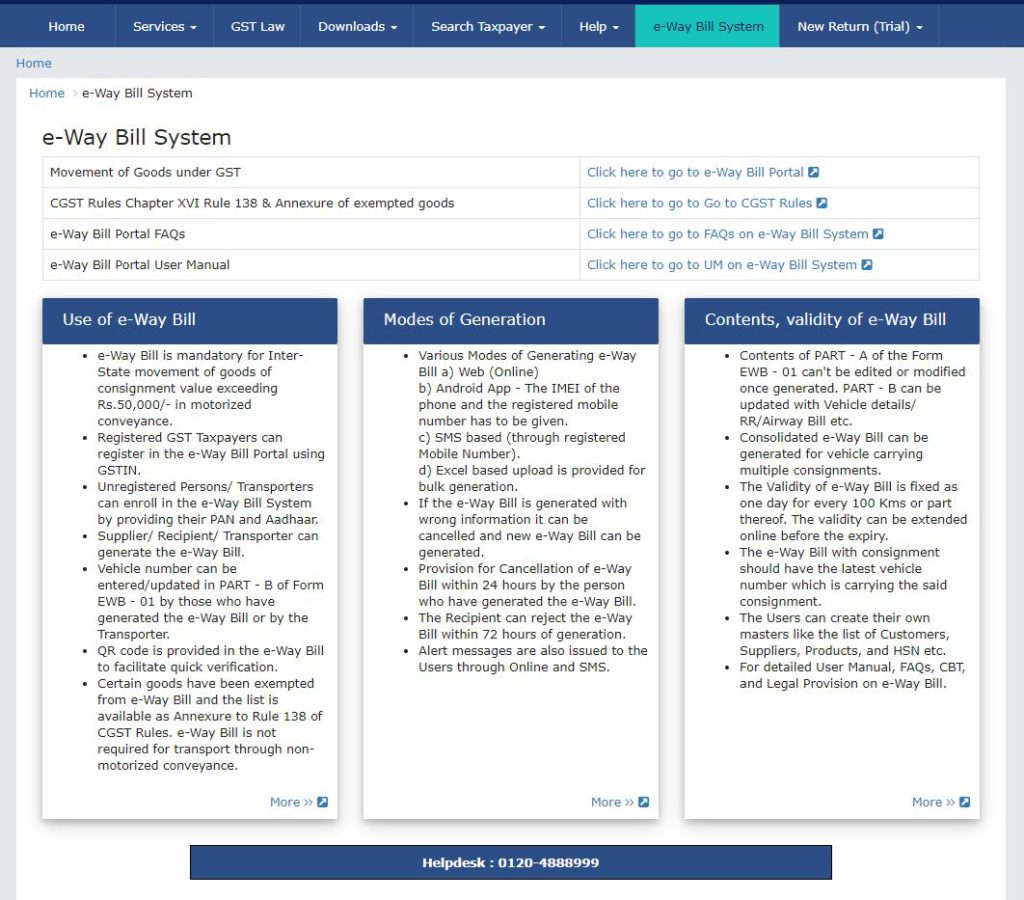

E-Way Bill System

Information page regarding the e-way bill system under GST. Use of e-way bill, modes of generating e-way bill, contents of e-way bill, validity of e-way bill. It also provides links to visit the E-Way Bill Portal and related content.

New Return Trial

- New Return Prototype – prototype of offline tool to file new GST Returns to allow taxpayers to learn about the new return and get feedback on it

- Offline Tools for New Return – link to download the offline utility to file New GST Returns and instructions to use the same

- Top Suggestions and Feedback – displays a list of top contributors who have given good suggestions and feedback

FAQs

Once the user is logged into www.gst.gov.in following are the services available to the user:

1. Application for Registration for Normal Taxpayer, ISD, Casual Dealer

2. Application for GST Practitioner

3. Opting for Composition Scheme (GST CMP-02)

4. Stock intimation for Composition Dealers (GST CMP-03)

5. Opting out of Composition Scheme (GST CMP-04)

6. Filing GST Returns

7. Payment of GST

8. Filing Table 6A of GSTR-1 (Export Refund)

9. Claim Refund of excess GST paid (RFD-01)

10. Transition Forms (TRAN-1, TRAN-2, TRAN-3)

11. Viewing E-Ledgers

12. Furnish Letter of Undertaking(LUT) (RFD-11)

Apart from the above-mentioned services, browsing notices received, filing ITC forms, and engage/disengage GST practitioner are some of the other services provided by the GST Portal/GSTN.

A user needs the emSigner software to sign online documents on the GST Portal.

The pre-requisites for installing the emSigner are provided as below:

1. Windows 32 / 64 bit OS

2. Java 1.6 JRE 1.6.0_38+, Java 1.7, Java 1.8

3. Windows: Admin access to install the emSigner component

4. Any one of the following ports should be free- 1585, 2095, 2568, 2868, 4587

Follow these steps to recover GST ID:

1. Login to GST Portal and log in

2. Click on Forgot Username at the bottom of the page

3. Submit your GST Registration Number (GSTIN) or any Provisional ID or UIN. Click on Generate OTP

4. Enter the OTP received

5. You shall receive your User ID in your e-mail

It’s not possible to find GSTIN using the name of the taxpayer/business. It can be mainly done by either searching through GSTIN or UIN of the business or by entering the PAN of the taxpayer/business.

Hey @Joe_Fernandes

To understand the steps for logging in to the GST portal, please refer to this article.

The password the user has created while logging in for the first time is valid for 120 days.

GST Portal Login Link

Visit: https://ssoid.net.in/gst.html

Steps to Login on GST Portal:

Open the GST Portal

Go to www.gst.gov.in

Click on “Login”

This button is on the top right corner of the homepage.

Enter Your Credentials

Username: Provided during registration.

Password: Enter your password.

Captcha Code: Type the characters shown in the image.

Click on “LOGIN”

Forgot Password?

If you’ve forgotten your password:

Click on“Forgot Password” on the login page.

Enter your username and captcha.

OTP will be sent to your registered mobile/email.

Set a new password.

Common Uses After Login:

File GST Returns (GSTR-1, GSTR-3B, etc.)

Check Payment Ledgers

Download GSTR Reports

Apply for refunds, etc.

Access the official GST portal at www.gst.gov.in to file returns, pay taxes, and manage your GST compliance online. Use your credentials to log in and navigate seamlessly through returns, invoices, and dashboard services.