A taxpayer can raise a grievance on the GST Portal to seek help from the GST department to resolve an issue. To submit a grievance related to payment, a request for payment related grievance should be submitted. For any other issue, a grievance can be submitted on the Grievance Redressal Portal.

The grievance redressal portal is designed to lodge complaints about issues faced by taxpayers. Instead of sending an email to the helpdesk, the taxpayer can submit a grievance to get a faster solution to his problem.

Steps to report an issue or complaint on the GST Portal

- Go to the Grievance Redressal Portal

Access the Grievance Redressal Portal and Log in with your credentials.

- Click on Report Issue/Complaint

On the left hand side column, click on the Report Issue Icon.

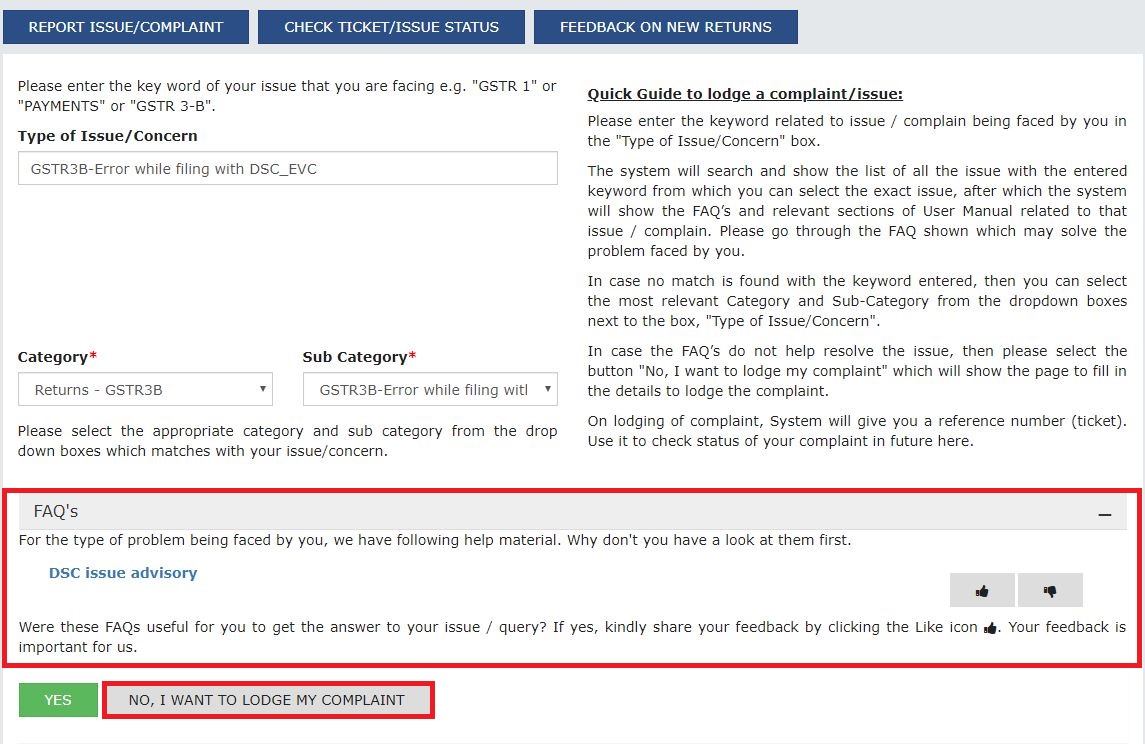

- In the Type of Issue/Concern, enter a keyword related to your issue or complaint

The system would display a list of issues related to the keyword entered.

- Select the exact issue. The system will display FAQs and help content related to the issue selected

You can refer the content and FAQs to search for the solution to your problem

- If the FAQs do not solve the problem, select the button ‘No, I want to lodge my complaint’.

In case the present FAQs on the GST Portal doesn’t solve your problem, click the ‘No i want to Lodge my Compliant’ Button.

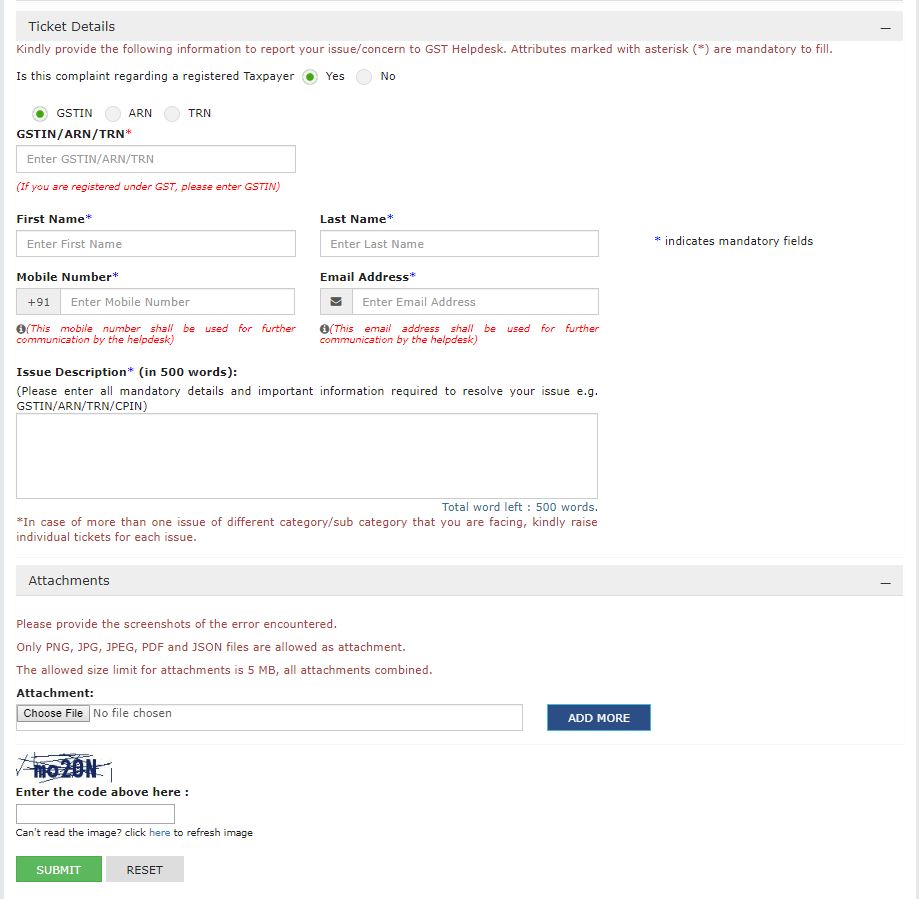

- Enter the details of the issue:

– GSTIN i.e. GST Identification Number or ARN i.e. Acknowledgement Reference Number or TRN i.e. Temporary Reference Number

– First Name and Last Name

– Mobile Number and Email

– Description of the issue in 500 words - Click on choose file to upload a supporting document related to the grievance

Hence, it is important to have the supporting documents for filing Grievance. Enter the captcha and click on Submit

- A success message will appear on screen with a TRN i.e. Ticket Reference Number.

The taxpayer can track the status of the ticket using the TRN.

FAQs

For reporting an issue or complaint on the GST Portal, click on Report Issue/Complaint. In the Type of Issue/Concern section, enter a keyword related to your issue or complaint. The system would display a list of issues related to the keyword entered. Choose a relevant FAQ. If the FAQ doesn’t solve your issue then select the button ‘No, I want to lodge my complaint’.

To check the status of a grievance filed on the grievance redressal portal of GST, go to the Grievance Redressal Portal. Click on Check Ticket/Issue Status > Enter TRN > Submit.

To check the status of Payment related grievance on the GST portal, go to Services > Payments > Grievance Against Payment (GST PMT 07).

Hey @Joe_Fernandes

To understand the steps for logging in to the GST portal, please refer to this article.

The password the user has created while logging in for the first time is valid for 120 days.

GST Portal Login Link

Visit: https://ssoid.net.in/gst.html

Steps to Login on GST Portal:

Open the GST Portal

Go to www.gst.gov.in

Click on “Login”

This button is on the top right corner of the homepage.

Enter Your Credentials

Username: Provided during registration.

Password: Enter your password.

Captcha Code: Type the characters shown in the image.

Click on “LOGIN”

Forgot Password?

If you’ve forgotten your password:

Click on“Forgot Password” on the login page.

Enter your username and captcha.

OTP will be sent to your registered mobile/email.

Set a new password.

Common Uses After Login:

File GST Returns (GSTR-1, GSTR-3B, etc.)

Check Payment Ledgers

Download GSTR Reports

Apply for refunds, etc.

Access the official GST portal at www.gst.gov.in to file returns, pay taxes, and manage your GST compliance online. Use your credentials to log in and navigate seamlessly through returns, invoices, and dashboard services.