When a business applies for registration under GST, the application is processed by a tax officer. Once the tax officer approves the application, a confirmation email is sent to the registered email of the applicant. This email is sent from email – donotreply@gst.gov.in. The Subject of the email is “Intimation of GSTIN generated on approval of the application for new registration.” It contains the GSTIN, provisional username, and password with which the applicant can login into the GST Portal.

GSTIN Login: Step-by-Step Procedure

- Access the GST Portal.

Visit the GST Home Page. Navigate to the Login option which is on the top right corner of the page.

- Below the Forgot Username title is the First Time Login section.

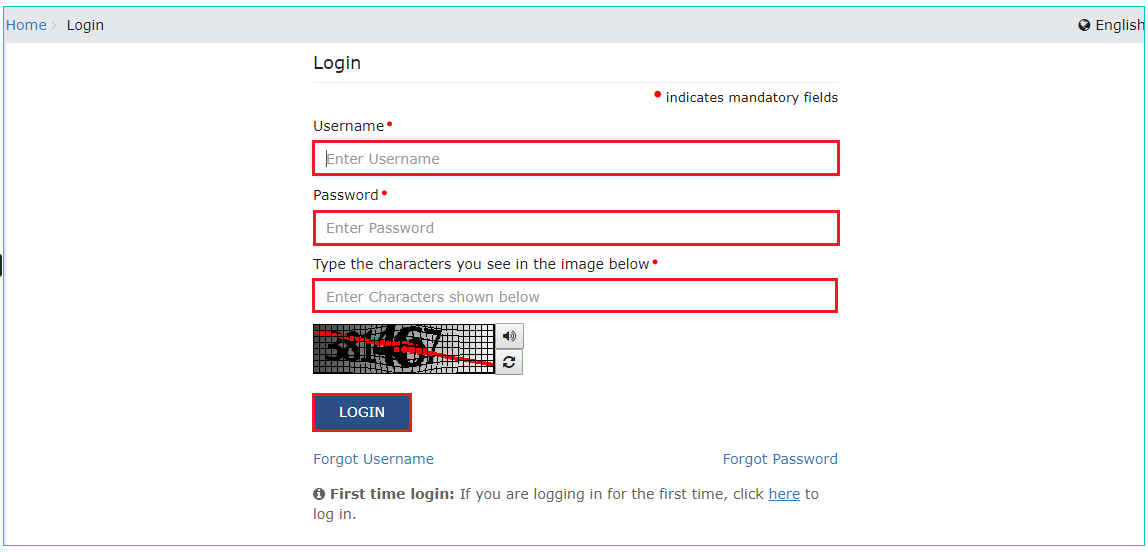

Click on the link highlighted in the image below.

- The New User Login Page will be loaded.

Hence, enter in the details such as the provisional ID, password, and the characters from the given image.

- Next step is to click on the login button.

Click on the option to login placed below the captcha code.

- On the new Credentials page, enter fields that comprise a new username, new password and confirm the new password

GST portal requires the details filled in here when logging in to their portal.

- Click on the submit button after filling out the required details.

Fill out the details of New Username and Password.

- Log in to the GST Portal.

Log in to the GST Portal using the new credentials.

- irst-time users have to file an amendment application to enter the bank account details

The portal prompts the users to do so after their first login. Click on the file amendment button.

- This will take the user to the bank account section of the portal.

User can add the necessary bank details here.

FAQs

The GSTIN Number is a unique 15-digit number. GSTIN has replaced TIN (Tax Identification Number). GSTIN is assigned to dealers and suppliers registered in GST.

As per Government Laws, any business with a turnover more than INR 20 Lakh would require a GSTIN number.

Basically, there are three types of GST, i.e Integrated Goods and Services Tax (IGST), Central Goods and Service Tax (CGST) and Union Territory Goods and Service Tax (UTGST)

Yes, an Individual can hold multiple GST numbers. However it is only allowed if that Individual own multiple business entities.

Hey @Joe_Fernandes

To understand the steps for logging in to the GST portal, please refer to this article.

The password the user has created while logging in for the first time is valid for 120 days.

GST Portal Login Link

Visit: https://ssoid.net.in/gst.html

Steps to Login on GST Portal:

Open the GST Portal

Go to www.gst.gov.in

Click on “Login”

This button is on the top right corner of the homepage.

Enter Your Credentials

Username: Provided during registration.

Password: Enter your password.

Captcha Code: Type the characters shown in the image.

Click on “LOGIN”

Forgot Password?

If you’ve forgotten your password:

Click on“Forgot Password” on the login page.

Enter your username and captcha.

OTP will be sent to your registered mobile/email.

Set a new password.

Common Uses After Login:

File GST Returns (GSTR-1, GSTR-3B, etc.)

Check Payment Ledgers

Download GSTR Reports

Apply for refunds, etc.

Access the official GST portal at www.gst.gov.in to file returns, pay taxes, and manage your GST compliance online. Use your credentials to log in and navigate seamlessly through returns, invoices, and dashboard services.