A taxpayer can apply for GST Registration on the GST Portal. Once the taxpayer applies for registration, the GST Department approves or rejects the application within 7 working days. Sometimes, the GST officer requires additional details and documents. In such a case, the status of GST Registration changes to “Pending for Clarification”. The GST officer would send an email and ask the taxpayer to submit clarification and additional documents for the GST Registration application.

GST Status – Pending For Clarification

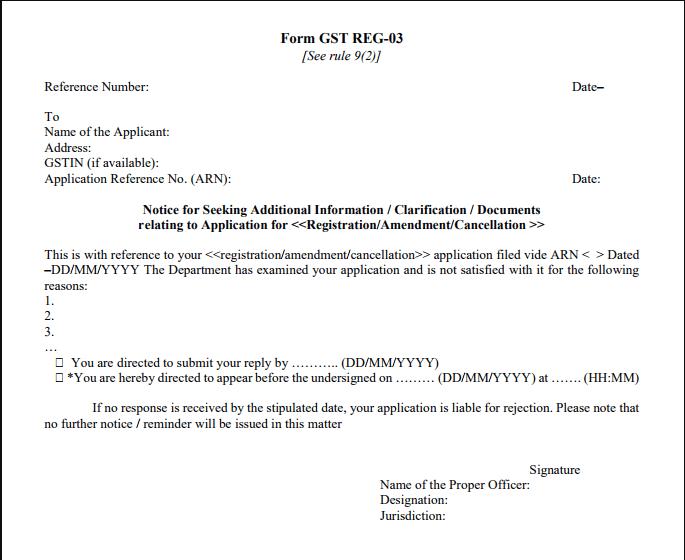

In cases where the tax officials are not satisfied with the application or the documents submitted for the GST Registration, a notice is issued to the taxpayers. The status of the application in such cases changes to “Pending for Clarification“. In such a case, the taxpayer should file an application to solve pending for clarification of GST Registration on the GST Portal.

Following are a few reasons for which such clarification is required to be submitted:

- The application does not contain all the necessary documents or information.

- The consent letter to use the premises for business purposes is not uploaded.

- The address in Consent Letter (NOC) does not match with the electricity bill or other supporting proofs.

- Documents uploaded as proof of address are not legible and clear.

The clarifications must be provided electronically or by uploading necessary documents. Further, the taxpayer has to respond within 7 days from the date of receipt of such an intimation. Taxpayers can log in to the GST Portal using their valid credentials. New Applicants can log in to the portal using their Temporary Reference Number (TRN).

Steps to file Clarification Application for GST Registration

In Case of New GST Registration

Follow the below given steps in order to file clarification:

- Go to GST Portal

Login to the GST Portal

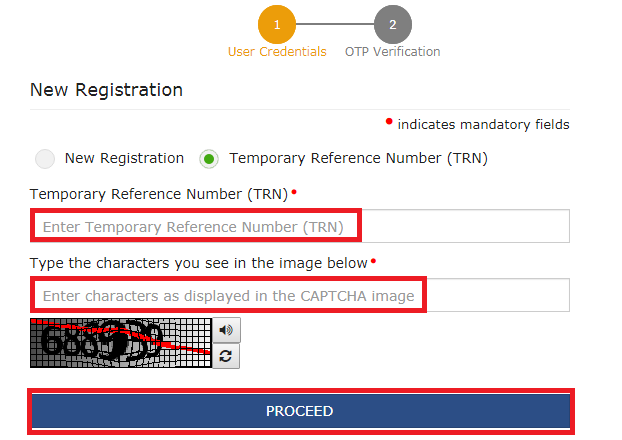

- Navigate to New Registration

Go to Services > Registration > New Registration

- Enter TRN

Click on the option Temporary Reference Number (TRN) and enter TRN generated . Enter the Captcha Code. Click on Proceed.

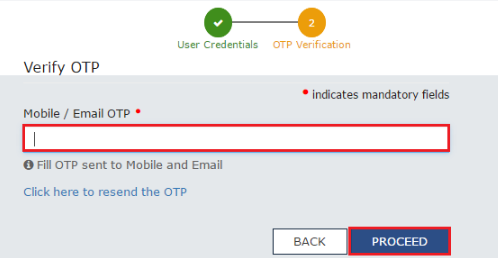

- OTP Verification

Move to the OTP Verification page. You will receive an OTP on the registered e-mail address or mobile number. Enter the OTP.

The OTP is valid for 10 minutes. Click on Proceed

- File Clarification

Taxpayer can then file the clarification by entering required details

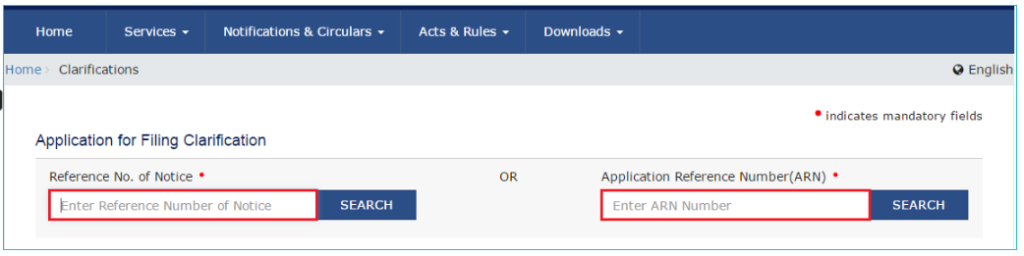

In Case of Existing GST Registration

- Visit the Login Page of the GST Portal and log in using valid credentials.

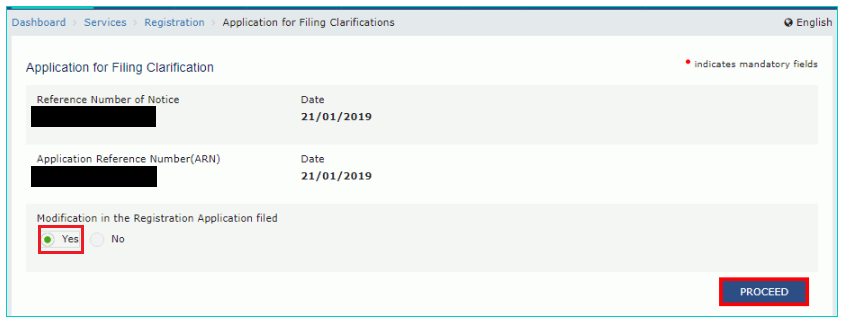

- Go to Services > Registration > Application for Filing Clarifications

- Enter the Reference number of Notice or the Application Reference Number (ARN) in the respective field.

In Case of New GST Registration

- Under the “Modification in the Registration Application” field, select the “Yes” option.

- Click on the “Proceed” option.

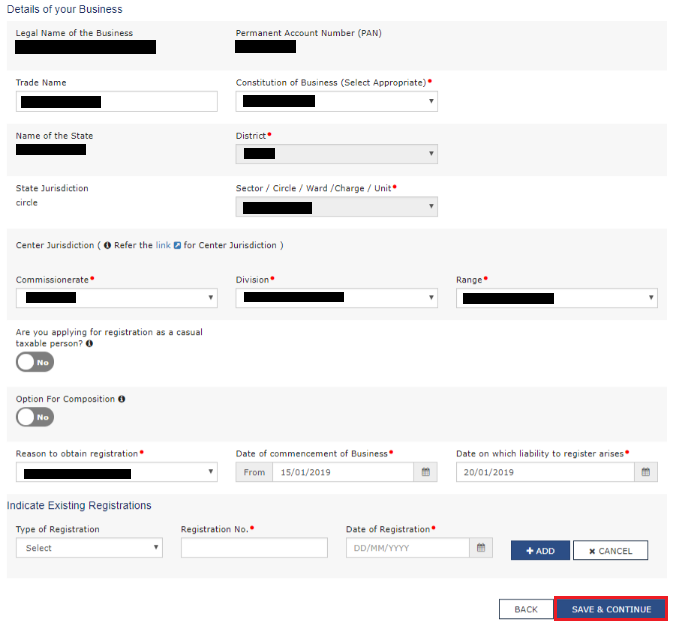

- Hence, the original application is available in the editable mode. Edit the necessary details in the application form.

- Also, upload the additional documents wherever required.

In Case of Existing GST Registration

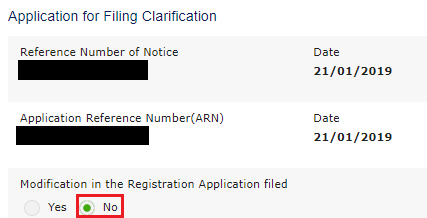

- Under the option for Filing Clarification, select the option “No”

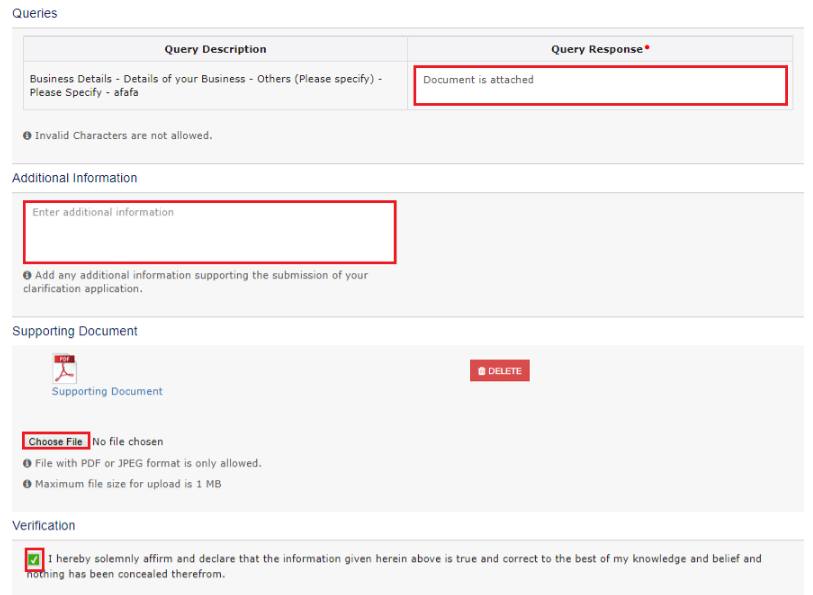

- Enter your response under the respective field.

- Enter the necessary information supporting the clarification application.

- Upload the necessary supporting documents.

- Click on the Verification checkbox.

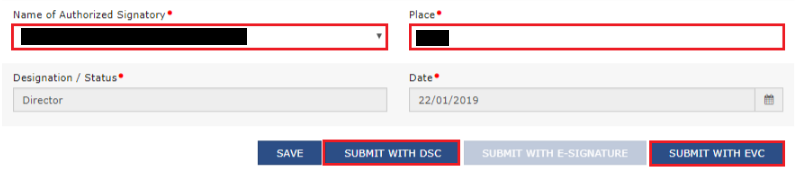

- Select the “Name of Authorized Signatory” from the drop-down list.

- Enter “Place” from where you are filing your application.

- Finally, you can submit the application by using either the DSC or the EVC option.

In Case of DSC

- Proceed forward with the DSC option.

- Select the desired signature required for the application.

- Finally, click on the “Sign” option.

In Case of EVC

- Proceed with the EVC option.

- The applicant receives an OTP on the registered e-mail address and mobile number. Enter the OTP in the respective field.

- Finally, click on the “Validate OTP” button.

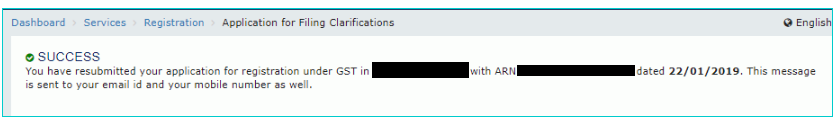

Hence, after the process is complete, a success message appears on the screen. The taxpayer shall also receive a message of confirmation. The e-mail is also sent to the authorized signatory.

FAQs

Application for GST Registration is rejected only if required data are not filled correctly or adequate proof of identity, address of premises, and pan card no is not matching.

The applicant must reply in FORM GST REG-04 within 7 days. However, if the officer is not satisfied with the reply, he can reject the application. Furthermore, he shall pass an order in FORM GST REG -05. However, if the proper officer does not take any more action then it is assumed to be changed.

In cases where the tax officials are not satisfied with the application or the documents submitted for the GST Registration, a notice is issued to the taxpayers. The status of the application in such cases is changed to “Pending for Clarification.” Taxpayers have to provide clarifications on receiving the notice.

After a taxpayer receives “pending for clarification” status in GST, the taxpayer has to log in to the GST portal. Taxpayers can log in to the GST Portal using their valid credentials. New Applicants can log in to the portal using their Temporary Reference Number (TRN). To resolve the status taxpayers have to provide additional details and documents as asked by the tax officer.

Hey @HarshitShah

GST Registration is the application for GST Number or GSTIN(GST Identification Number). Under the GST(Goods and Service Tax) Regime, it is mandatory for to have GSTIN to collect, pay GST and claim the Input Tax credit.

For GST registration, the dealer has the following options:

Voluntary Registration: The business does not have the liability to register under GST, however, can apply for GST Registration. This usually is when the businesses are willing to take advantage of the Input Tax Credit facility

Registration under Composition Scheme: Composition scheme is a voluntary and optional scheme for registering under GST. Under the composition scheme, the compliance is simpler and lesser returns are to be filed. The tax is to be filed at a fixed rate. If the business turnover is in between INR 40 Lakhs and 1.5 Crores, they can opt for GST Registration under Composition Scheme

No Registration: In the case, when your business does not fall under the conditions for compulsory registration you do not require GST Registration

Hope this helps!

What documents do I need for a new GST number?

Hey @SonalYadav

To get a GST Number or GSTIN in India, you will be required to Register under GST(Goods and Service Tax)

Usually, you receive the GST Number within 4–7 days of GST Registration application is submitted.

Follow these steps to register under GST on GST Portal:[1]

PART A of the GST Registration Application

Now let’s start with the PART B of the GST Application

The PART B of GST Application has various tabs. You will be required to enter the relevant details and upload relevant documents.

Usually, GST Number or GSTIN is allocated within 4–7 days from submitting the GST registration application.

Hope this helps!

Footnotes

[1] GST Registration Process online on GST Portal: Guide | Help Center | Quicko

Hey @Shweta_Saini

You can opt out of Composition Scheme from your account on GST Portal. Once the taxpayer type is updated to Regular in your profile, you can start filing GST Returns under the regular scheme. If you are facing any issues while making the withdrawal application, you can create a grievance on the GST Portal.

Do let us know if you have any further queries.

I want to be able to claim input tax credit for GST paid. Should I opt for the GST composition scheme or regular scheme?

Hey @Joe_Fernandes

If you wish you claim Input tax credit, you should opt for GST Regular Scheme.

Read more about the difference here.

1.composite scheme dealer inward supplies detailes(purchases invoices ) uploaded manadatory show in gstr4 annual return.

2.composite dealer late fees and interest calculate procedure.

Hi @Sundaraiah_Kollipara,

As per Rule 62(3)(a) of CSGT Rules, 2017 (Part A_Rules) A composition taxpayer has to furnish

As per the instructions given below FORM GSTR-4 of CGST Rules, 2017 (Part B_Forms), the following information relating to inward supplies (rate-wise) needs to be provided

But as per clarification by GST department, when the auto-population feature for inward supplies which was available on the GST portal was not working. Reporting in table 4A of GSTR-4 is not mandatory.

Further, late fee of Rs. 200 per day is levied if the GSTR-4 is not filed within the due date. The maximum late fee that can be charged cannot exceed Rs. 5,000. Interest is also calculated at rate of 18% p.a on tax liability.

You can read our below articles for more insights:

A retail pharmacy store dealer composite scheme registered in gst act recently.dealer purchase of medicines different tax rates(1 ,12,18 percent)and sale to counter sales through on Google pay and phone pay online mode and cash mode sales two types amounts received.my doubt: dealer how to accounting entry passed procedure in books

@AkashJhaveri @Kaushal_Soni @Divya_Singhvi @Laxmi_Navlani can you?