TRACES is the online portal for filing TDS Returns, correction of TDS Returns and downloading TDS documents. Section 197 of the Income Tax Act provides the benefit to deduct tax at nil rate or lower rate. Below is the process for issue of certificate u/s 197 for deduction of TDS at lower or nil rate.

- Deductee applies for the certificate by filing Form 13 with the Assessing Officer

- The Assessing Officer approves the application

- Deductee submits the certificate to the deductor

- Deductor submits the certificate details and validates the certificate before filing TDS Return

- Deductor can download the certificate from his account on TRACES – from the inbox or from the downloads

Process to download TDS Certificate under section 197 – Deductor’s Download

- Log in to TRACES

Log in to TRACES – Enter User Id, Password, TAN or PAN and captcha

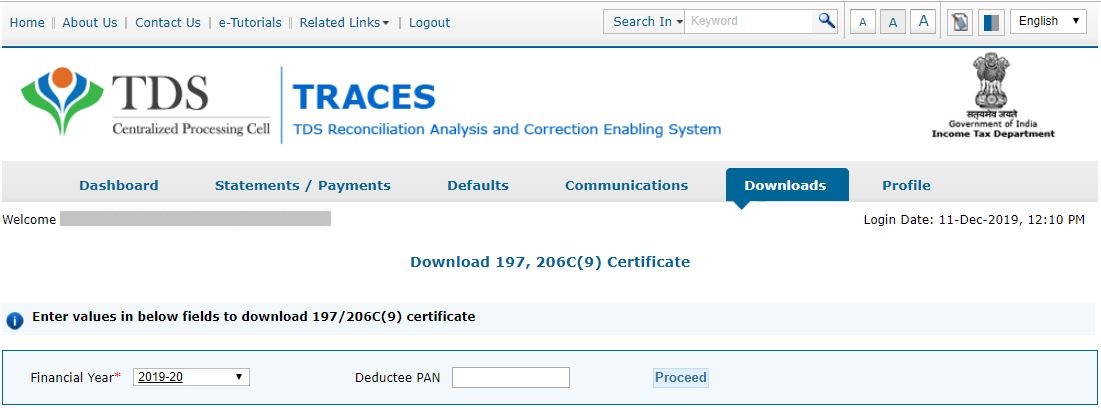

- Navigate to Download 197/206 Certificate

Go to Downloads > Download 197/206 Certificate

- Enter Financial Year, Deductee PAN or Request Number

Enter Financial Year, Deductee PAN or Request Number. A list of the available certificate will appear on the screen

- Download the certificate

Click on the hyperlink ‘Download / View Certificate‘ to download the certificate

Process to download TDS Certificate under section 197 – Deductor’s Inbox

Step 1: Log in to TRACES – Enter User Id, Password, TAN or PAN and captcha

Step 2: Go to Communications > Inbox

Step 3: Select the Category of Communication ‘Certificate u/s 197/206C‘. Click on ‘Go’. Click on a row to select and proceed

Step 4: The details of TDS Return and details of certificate will appear on the screen under the option ‘Action Required’

Step 5: Select the row ‘Issuance of Certificate‘, then click on ‘View Details‘ button to view communication details or click on ‘Download Certificate‘ to download the certificate

FAQs

As per the Income Tax Act, there is no specified deadline to submit application u/s197. However, it is advisable to make an application at the beginning of the financial year so that the TDS Return is filed with correct calculations.

An application for Nil/ Lower deduction of TDS is required to be filed in Form 13 to the Income Tax Officer, and the tax officer on being satisfied that lower deduction of TDS is justified shall issue a certificate for the same under Section 197.

It is the certificate given by the deductee to the deductor for the reduction of TDS on the payment to be done. This certificate is obtained by the deductee from the Income Tax Assessing officer on providing relevant information on income.

Hey @HarishMehta

Taxpayers or deductee cannot directly download form 16/form16A, the option to download Form 16/ 16A has been given to the Deductor. So, if you need Form 16 / 16A for TDS deducted by your current or previous employer or deductor you will have to contact them for the same. There is no option available on TRACES whereby you can download it yourself.

Hope this helps!

Hey @Dia_malhotra

Yes, individuals can still register as a taxpayer on TRACES even if they do not have TAN of the deductor by providing:

• Assessment Year

• Challan Serial Number and

• Amount of tax you have paid

Hope this helps!

In my Justification Report it shows an interest payable error whereas I’ve already paid the interest for that particular month According to the regulations what could be the reason for this?

Hi @saad,

According to regulations, interest payment default/errors may arise due to error in challan details , short deduction, short payment, late deposit of TDS amount. Here, you can file correction statement and revise the return.

Hope this helps!

Hi

I am not able to register the DSC despite many trials. I keep getting the error:

‘Error in establishing connection with TRACES Websocket Esigner. Please ensure that WebSigner Setup is installed and service is running on your machine and there are no proxies enabled on the browser while doing DSC activities’

Could you kindly help. I have tried all the instructions, as per below:

I have un-installed any previous versions of Java and emsigner.

I have installed Java 8, update 162 and 32 bit version on my Windows 10 machine

Downloaded TRACES-WebSigner-V2.0 and installed emsigner. The emsigner is running on my system.

Google Chrome is up to date. (Version 92.0.4515.131)

I have the DSC driver (e-pass 2003) installed.

I have rebooted and made sure the websigner (emsigner) is running.

When I go to my profile → Signature section, no window pops up, nothing loads, and if I click on ‘Request DSC’, I get the above error.

Could you point to me what I can do to make this work please. Do I need any physical device to generate tokens? I am logging in from the nri traces webpage. Thanks.

Preetham

@AkashJhaveri @Saad_C @Kaushal_Soni @Divya_Singhvi @Laxmi_Navlani can you help with this?

Hey @raopreetham, the first thing I would recommend you to do is to run the Emsigner as an administrator. Also, if it still does not seem to work, install the below mentioned JAVA fixer software and run it as an administrator and hopefully this would resolve your issue.

https://johann.loefflmann.net/downloads/jarfix.exe

The USB e-pass 2003 token device is particular type of a DSC.

Facing issues with TRACES Portal or registration? Get quick solutions for PAN verification, Form 26AS access, and TDS compliance all in one place.

Need help registering or navigating TRACES? Understand the steps for hassle-free TDS filing and compliance management.