TRACES is the online portal for filing TDS Returns, correction of TDS Returns and downloading TDS documents. Conso File is the file with the data of the TDS returns processed for a relevant financial year, quarter and form type. To download a conso file, it is necessary that the status of the submitted return should be ‘Statement Processed with Default‘ or ‘Statement Processed without Default‘. Conso file will not be available in case of a paper return.

Steps to Download Conso File of TDS Return from TRACES

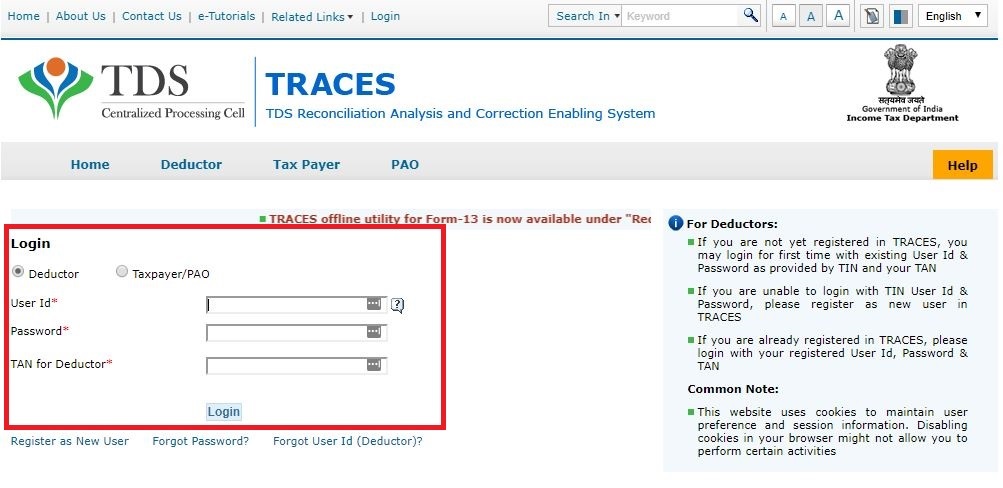

- Log in to your TRACES account

Log in to TRACES – Enter User Id, Password, TAN or PAN and captcha

- Navigate to Conso File

Go to Statements / Payments > Request for Conso file

- Select the Financial Year, Quarter and Form Type

Select the Financial Year, Quarter and Form Type for which you want to download the Conso File. Click on ‘Go’

- KYC Validation

Select either of the following for KYC validation:

1. Digital Signature Support KYC validation – Select if you want to use KYC validation using DSC

2. Normal KYC Validation (without Digital Signature) – Select if you want to use KYC validation without using DSC - Option 1: KYC Validation using DSC

Select the Financial Year, Quarter and Form Type for KYC validation using DSC. Click on ‘Validate DSC’

- Enter the password of DSC and enter the following details:

Enter the password of DSC and click on ‘ok’. Select the DSC certificate and click on ‘Sign.’ Enter the following details:

1. Enter the Token number of the TDS Return filed for the Financial Year, Quarter and Form Type selected in Step 5 above

2. Select the checkbox for Nil Challan or Book Adjustment

3. Enter the challan details – BSR Code, challan serial number, challan amount, the date on which tax is deposited

4. Enter unique PAN-Amount combination – Enter PAN as entered in TDS Return and amount deposited

5. Click on Proceed

Note: Enter the details of the latest TDS return or TDS correction return filed

- Request for Conso File

Success page will appear on the screen once the KYC details are validated. Click on ‘Request for Conso File‘

- Option 2: Normal KYC Validation without using DSC

1. Select the Financial Year, Quarter and Form Type for KYC validation using DSC

2. Enter the Authentication Code if you have finished the validation earlier and you have the authentication code

3. Enter the following details:

Enter the Token number of the TDS Return filed for the Financial Year, Quarter and Form Type selected in Step 5 above.

1. Select the checkbox for Nil Challan or Book Adjustment

2. Enter the challan details – BSR Code, challan serial number, challan amount, the date on which tax is deposited

3. Enter unique PAN-Amount combination – Enter PAN as entered in TDS Return and amount deposited

4. Click on Proceed

- Success Page with the Request for Conso File option

The success page will appear on the screen once the KYC details are validated. Copy the Authentication Code and paste it in the blank box. Click on ‘Request for Conso File‘

- Download the File

The request number will appear on the screen. You can download the file from tab “Downloads”

- Navigate to Requested Downloads

Go to Downloads > Requested Downloads and enter the Request Number or Request Date or View All. Select the applicable row. If the status is ‘Available‘, click on the download button

- Password to open the file

Click on HTTP Download button to download the file. A zip file is downloaded. The password to open the file is TAN_Request Number in capital letter. For example: ABCD12345E_410543

FAQs

You can download Conso file in form of a zip file from your account on TRACES. You can extract the zip file and open it using password TAN_Request Number. Eg: If the TAN is AAGH85852E and Request Number is 86528, the password is AAGH85852E_86528.

Justification Report contains details of defaults or errors while processing the TDS Return filed by the deductor. Conso File contains details of the TDS returns processed for a relevant financial year, quarter and form type. Both these files are helpful for filing a correction TDS Return.

1. Submitted – Successful submission, Request in processing

2. Available: Conso file available for Downloading

3. Disabled: Duplicate request submitted for downloading

4. Failed: User is advised to contact CPC(TDS)

Hey @HarishMehta

Taxpayers or deductee cannot directly download form 16/form16A, the option to download Form 16/ 16A has been given to the Deductor. So, if you need Form 16 / 16A for TDS deducted by your current or previous employer or deductor you will have to contact them for the same. There is no option available on TRACES whereby you can download it yourself.

Hope this helps!

Hey @Dia_malhotra

Yes, individuals can still register as a taxpayer on TRACES even if they do not have TAN of the deductor by providing:

• Assessment Year

• Challan Serial Number and

• Amount of tax you have paid

Hope this helps!

In my Justification Report it shows an interest payable error whereas I’ve already paid the interest for that particular month According to the regulations what could be the reason for this?

Hi @saad,

According to regulations, interest payment default/errors may arise due to error in challan details , short deduction, short payment, late deposit of TDS amount. Here, you can file correction statement and revise the return.

Hope this helps!

@AkashJhaveri @Saad_C @Kaushal_Soni @Divya_Singhvi @Laxmi_Navlani can you help with this?

Hey @raopreetham, the first thing I would recommend you to do is to run the Emsigner as an administrator. Also, if it still does not seem to work, install the below mentioned JAVA fixer software and run it as an administrator and hopefully this would resolve your issue.

https://johann.loefflmann.net/downloads/jarfix.exe

The USB e-pass 2003 token device is particular type of a DSC.

hello, i want to cancel the TDS on sale of property (26QB) which i created in hurry. i have made login and tried the TRACES refund option. But the total amount of TDS is “Consumed” and Max refund amount is zero.

What is my option now? TDS was paid on 16th Oct ( 6 days back). Hoping for a solution on this.

Hi @nisshant

26QB is the challan cum return statement. As soon as you file the form, TDS amount paid by you gets utilized. There are few corrections that are allowed in form 26QB. You can refer to the article below. You cannot get the refund of the taxes paid through an online method. You can contact concerned Assessing Officer (AO) of the Income Tax Department (ITD).

You can also contact Aaykar Sampark Kendra (ASK) on Toll Free No. 1800-180-1961 to ask for help.

Hope this helps!

Hi @Jatin_Sahu

Yes, you can file 26QB correct request with registering a DSC and file te new request.

Here’s a read for your reference on TRACES: Form 26QB Correction DSC/ AO Approval - Learn by Quicko