An income tax notice is a written communication sent by the Income Tax Department to the taxpayer, serving various purposes. These notices can request additional information, seek clarification regarding tax return details, remind taxpayers to file their income tax returns, or inform them about tax audits and assessments. Hence, it is crucial for taxpayers to comprehend the nature of the notice and promptly respond by providing the requested information or documents. However, failure to respond to such notices can lead to consequences, including the imposition of interest, penalties, fines, or even potential legal consequences like imprisonment.

Reasons for issuance of Notice

The taxpayer may receive a notice from the department for various possible reasons. However, following are the primary factors that can lead to the issuance of a notice:

- Non-filing of ITR

- Mismatch in tax credits

- ITR filed without payment of tax dues.

- Non-disclosure of income

- Scrutiny assessment

These are commonly observed causes for receiving a notice. Nevertheless, a taxpayer may receive a notice for any other unforeseen circumstance.

Communication of Notice

The income tax department communicates the notices through email or text. Whenever the department finds errors or discrepancies in the return, they send a notice to taxpayers on their registered e-mail ID and mobile number.

Identifying the validity of Notice

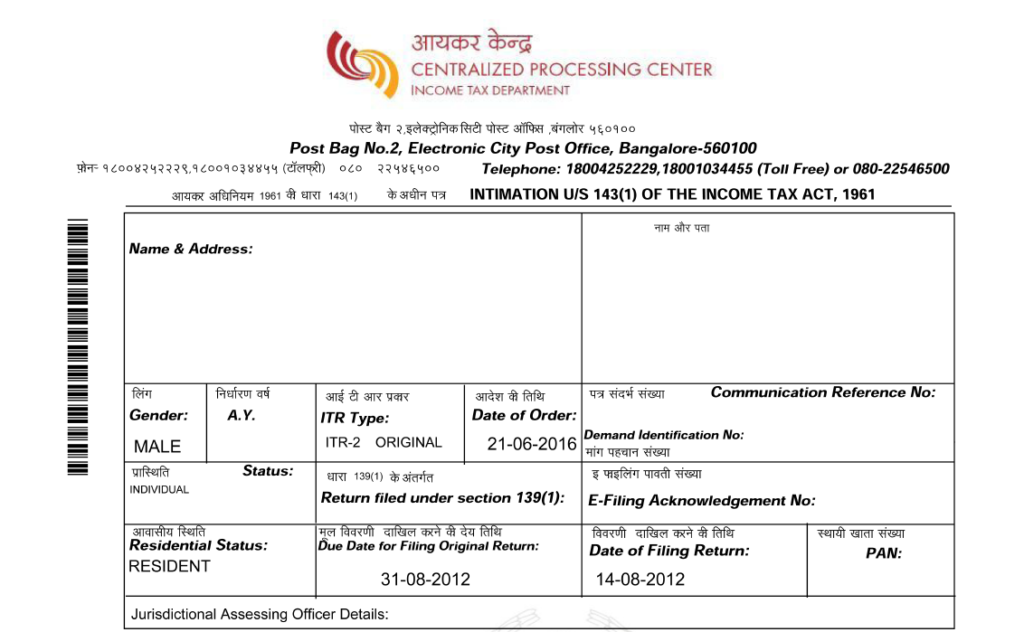

Before taking any action in response to an Income Tax notice, the taxpayer must confirm its legitimacy and that it is directed towards them. This can be done by carefully checking the basic details outlined in the sample notice below:

The taxpayer needs to check:

- Name and address

- PAN number

- Assessment year, type return, ITR type

- Name and designation of issuing officer

- Communication reference number

Note: Generally, notices are password protected. Hence the password to open the notice is PAN in lowercase and the date of birth (DDMMYYYY) is without any space. Eg: PAN is AAAPA1234A and the date of birth is 01/01/2000. The password would be aaapa1234a01012000.

Common reasons for Notice and their resolution

| Section | Reason for Notice | Resolution |

|---|---|---|

| 139(9) | For filing a defective return | Identify the defect mentioned and submit a return in response to the notice of defective return notice u/s 139(9). |

| 142 | For not filing the income tax return or for the scrutiny of documents & accounts in support of the return filed. | File the return within the time limit mentioned in the notice. Submit a valid response if you are not required to file a return. Present before the assessing officer with books of accounts and supporting documents if demanded by the Assessing Officer. |

| 143(1) | For adjustment or additional tax demand if an error or incorrect information is detected in the return. | Pay outstanding tax dues if any. Correct the errors and file rectification return u/s 154 if required. |

| 143(2) | For scrutiny assessment after a detailed inquiry by assessing officer. | Your case has been selected for scrutiny. Hence, you should provide all the relevant information, pieces of evidence as demanded by IT authorities. |

| 148 | For reassessment, if the officer believes some income has escaped assessment. | Provide all the relevant information, evidence as demanded by IT authorities. |

| 156 | For dues (tax, interest, penalty, fine or any other sum) payable by the assessee) | Submit a response to a notice from e-Filing account. Pay tax if you agree. Provide a reason if you don’t agree with the demand. |

| 245 | For adjustment of a refund with any demand due | For dues (tax, interest, penalty, fine, or any other sum) payable by the assessee) |

Dealing with Income Tax Notice

- Don’t ignore the notice

Once the taxpayer receives the notice, they need to verify the details and promptly reply to the same within a provided period. However, if a taxpayer fails to respond to such notice then they might have to face consequences such as penalties. - Check the notice for your basic details

Check PAN name, assessment year, assessing officer, and income tax ward details. Further, make sure that the notice includes all correct details and that there are no ambiguities. - Identify the reason for the notice

In most cases, you can identify the reason by reviewing it. This may include TDS discrepancies, return defects, or undisclosed information. - Check the validity of the notice

The IT department follows defined time limits for issuing notices. Hence, when a taxpayer receives a notice, it’s crucial to check the section mentioned in the notice, as it determines the timeframe for issuance. For example, a notice u/s 143(3) for scrutiny assessment must be delivered within 9 months of the end of the financial year in which the return was filed. If it’s delivered later than this period, it will be deemed invalid. - Provide Supporting evidence

The department would ask you to provide the documents and information to support your defense. Hence, the best way to respond to notice is with the help of supporting documents. - In time response

It is important to reply to the notice received within the period as mentioned in the same. Further, if the taxpayer is unable to gather the documents or information asked by the department they should convey such to them, and a time limit for response can be extended. - Take professional help

In cases where the taxpayer is unable to understand the notice, they can take the help of professionals such as Chartered Accountants.

How to respond to the notice?

Once the taxpayer verifies the validity and reasons for issuance of the notice, they need to respond to the notice from the income tax portal. The department may ask for any supporting evidence or information with regard to the filed return, hence in such case the taxpayer have to attach the documents as asked by the department while responding to the notice.

For submitting a response, the taxpayer can follow below-mentioned steps:

- Login to the e-filing portal and Navigate to Pending Actions > E-Proceedings from the dashboard.

- Download Notices

Click on the option to View Notice option for the notice on which the taxpayer wants to submit the response. Once the tab is opened taxpayer can download the notice. For example, here we are selecting 143(1) adjustment notices.

- Respond to Notice

Click on the option to submit a response for responding.

- Proceed to e-verify your response

Once the taxpayer responds to the notice, they are required to e-verify the provided response for submitting it.

- Successful Verification

On successful e-verification, a success message will be there along with a Transaction ID. You will also receive a confirmation message on your email ID registered on the e-filing.

Consequences of non-response

The taxpayer must furnish a response to the notice within the stipulated time frame mentioned in the notice. Failure to do so may result in the department imposing penalties, interest, or fines. Additionally, in certain cases, the department may specify provisions for imprisonment.

FAQs

To respond, log in to your account on the Income Tax e-filing website. Then navigate to the pending actions tab and select e-proceeding options.

The intimation is for verifying calculations or arithmetic errors. However, the notice is generally issued when there are any mismatches of data or un-disclosed income

Generally, the time limit to submit the response is 15-30 days, however, it will differ according to the nature of the notice.

Upon receiving a notice, the taxpayer can opt to submit a revised return. Further, in this case, they need to respond, indicating that they have already filed a revised return in response to the notice.

Hey @TeamQuicko

What is the time limit in which I need to respond to the notice under section 139(9)?

How can I respond to the notice received online?

How much time it will take to process the refund once response to notice u/s 139(9) is filed?

Hey @HarshitShah

It is very common to receive a notice from the Income Tax Department. The notice sent to you might be a routine inquiry or a request for clarification. There is no need to worry when you get a notice from the Income Tax Department. You will have 15 days time in which you will need to respond to the notice/file revised ITR.

Hope this helps!

Hey @SonalYadav

You can login to your account on the Income Tax e-filing website by entering your credentials i.e. User ID (PAN), password, and captcha code.

Next, you need to click on the ‘e-file’ tab and select ‘Response to outstanding Tax Demand’ option.

Hope this helps!

Hey @ViraajAhuja47

In case of any defects in the Income Tax Return, Assessing Office can issue notice u/s 139(9). If you have filed a return within 15 days of issue of notice, then it will generally take 60 days to process the return once it is sent for processing.

Hope this helps!

Hey @HarishMehta

It is mentioned in the notice that in case one does not respond in the stipulated time, the return will be processed by restricting the credit for the TDS proportionately.

To give an example: There are 2 incomes mentioned in Form 26AS as below:

Salary from A - 100000 & TDS deducted - 10000

Salary from B - 200000 & TDS deducted - 20000

In case you have not reported either of the above income in ITR then you may receive a notice for the mismatch.

Thus, in the above example if you don’t respond in the time, then ITD will add the income of both of the above but will not give the credit of TDS not mentioned in ITR and process the return.

Hence, it is always advisable to respond to the Income Tax Notice in the given time period.

Hope this helps!

Hi @Shweta_Saini ,

Notice u/s 144(1) is issued in the following cases:

-When ITR is not filed within due date by a taxpayer

-When a taxpayer fails to provide a response to an inquiry of AO (Assessing Officer) for filed ITR,

-When a taxpayer fails to provide a response to assessment notice for filing ITR.

Here, AO can assess the total income or loss of a taxpayer based on the information gathered by them. AO usually gives the taxpayer an opportunity to present their case and provide necessary documents. Hence response to 144(1) can be given after looking at the cause of the notice and with supporting documents.

Attention XXXXX4061X, Your PAN has been flagged for not filing of ITR for A.Y-2020-21. Please file your ITR or submit online response under e-Campaign tab on Compliance Portal (CP). Access CP by logging into e-filing portal (My Account) - ITD

Please help i want to avoid any problems

Hey @SreeSSXP

Since you had high value transactions and ITR has not been filed for AY 2020-21, ITD has flagged your PAN. Thus, you have to file ITR before March 31, 2021 and respond to the transactions on IT Portal.

You can reach out to us on help@quicko.com or alternatively get in touch with us at +91-7575831310 so someone from our team can get in touch with you for process, pricing and discounts?