A company should file Form SH-7 with ROC paying the applicable fees within 30 days from the alteration in authorised capital. A company should file SH-7 on MCA Portal in the following circumstances:

- Increase in Share Capital independently

- Increase in the Share Capital due to order of Central Government

- Company redeems any Preference Shares

- Consolidation or Division

- Increase in the number of Members

Documents for Form SH-7: Alteration in Authorised Capital

- Notice of Extraordinary General Meeting (EGM)

- A certified true copy of the Ordinary Resolution

- Altered Memorandum of Association (MOA)

- Altered Articles of Association (AOA)

Instructions to file Form SH-7

- Enter the CIN of Company.

Enter a valid ‘Corporate Identity Number’ (CIN). Click Pre-fill to automatically populate the name, registered office address and email id of the company. If there is any change in the email ID, enter the new valid email ID.

- Select the purpose of filing the Form.

Select the purpose of the form from the available options.

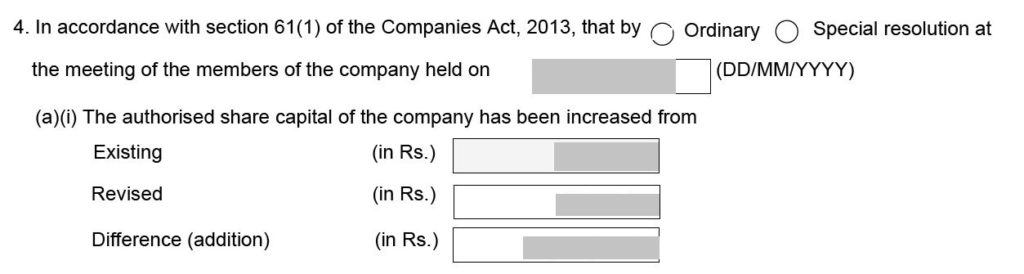

- Enter details of alteration in the Authorised Capital.

Enter the details of Board Resolution passed and details of alteration in Capital.

- Stamp Duty.

Enter details of stamp duty paid.

- Attach Documents.

Attach all the required supporting documents.

- Director details and DSC.

Enter the Director details and attach Digital Signature of Director signing the Form.

FAQs

Whenever a company alters the following things:

1. Its share capital or number of members independently

2. Increases the share capital by conversion of debentures/loans

As an order of the Central Government, then a return has to be filed. The return has to be filed with the registrar within 30 days of such alteration. The return shall also be filed where the company redeems any redeemable preference shares.

Stamp duty can be paid electronically through the MCA portal. Following documents are required to do so:

-Notice of extraordinary general meeting

-A certified true copy of an ordinary resolution

-Altered Memorandum of association

-Altered Articles of association, if any.

According to section 117 (2), if the company fails to file the agreement under subsection (1) then it will attract a penalty. If the agreement is not filed before the expiry of the period specified under Section 403 with an additional fee, the company shall be punishable. The fine in such a case shall not be less than 500000 to 250000 rs. Every officer of the company who is in default, including liquidator of the company, shall be punishable with a fine of 100000 to 500000 rs.

Hello @Sofiyah_Valiante

If the Articles of Association does not contain a clause to increase the authorised share capital, one needs to alter the AoA first, file it with RoC in MGT-14 and then file SH-7.

You can learn more about changing the share capital here:

Hope this helps!

@Sakshi_Shah1 could you help with this ?

Hello! @Shristi_Nitin

To claim the refund, you can file the Refund Form available on MCA Portal. You can read more about refund related queries here - FAQs On Refund Process

Can you tell me how can I raise my company’s authorized share capital?

Hey @Sofiyah_Valiante

A company can raise it’s authorised share capital by filing e-Form SH-7 with RoC. It shall be accompanied by certified true copy of resolution and notice along with explanatory statement, and altered MoA/ AoA.

Hope this helps!