What is Gross Salary

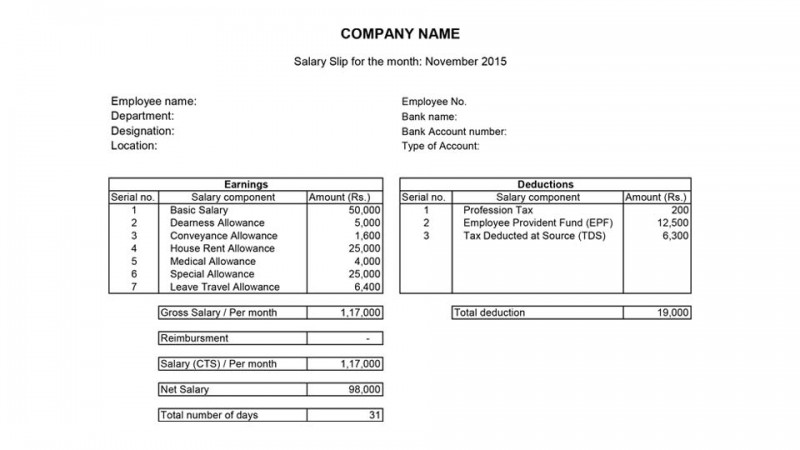

In simple words, gross salary is the monthly or yearly salary an employee receives before any deductions are made from it. The gross salary an employee receives is never equal to the CTC or the Cost to Company.

Components of Gross Salary

The gross salary can also be the gratuity and EPF subtracted from the CTC. Following are the components of the gross salary:

- Basic Salary

- HRA

- Special Allowance

- Conveyance Allowance

- Educational Allowance

- Medical Allowance

- LTA, etc

Understanding Components of Gross Salary in Detail

- Basic Salary: Basic salary is the amount paid to an employee before any deductions are made or extra components are added to the salary. The basic salary is always lower than the gross salary or the take-home salary.

- Perquisites: These are considerable amount of benefits received by an employee as a result of their position in an organization and are payable in addition to the salary received by them.

- Salary Arrears: Most of us are well versed with the term arrears. To define, arrears refers to an amount that is paid as a result of a hike or increment in your salary.

- House rent allowance: A House Rent Allowance is also one of the major salary components paid by the employer to their employees for accommodation expenses. Also, the HRA is applicable to both salaried and self-employed individuals.

Difference Between Gross Salary and Net Salary

| Gross Salary | Net Salary |

| It is the amount of salary after adding all benefits and allowances but before deducting any tax | It is the amount that an employee takes home |

| An individual’s gross salary includes allowances like medical allowance, conveyance allowance, etc | Net Salary = Gross Salary – All deductions like income tax, pension, professional tax, etc. It is also known as take-home salary |

Calculate PF on Gross Salary

The calculation of gross salary for the purpose of PF calculation is different than that used in the context of the payroll. Let us consider PF Gross to denote the salary to be considered for PF calculation.

PF Gross includes basic, Dearness Allowance, Conveyance, Other Allowance, etc. It excludes House Rent Allowance, Bonus, etc. as per the provisions of the PF Act.

Gross Salary under Section 17(1)

Section 17(1) includes the following amounts alongwith their salary:

- Wages

- Any advance of salary

- Any fees, commission, perquisites, or profits in lieu of or in addition to any salary or wages

- The contribution made by the Central Government or any other employer in the previous year, to the account of an employee under a pension scheme, referred to in Section 8OCCD.

- Any payment received by an employee in respect of any period of leave not availed of by him; (Leave encasement or salary in lieu of leave).

- The aggregate of all sums that are comprised in the transferred balance as referred to in sub-rule (2) of Rule 1] of Part A of the Fourth Schedule, of an employee participating in a recognized provident fund, to the extent to which it is chargeable to tax, under sub-rule (4) there, i.e., the taxable portion of transferred balance from an unrecognized provident fund to the recognized provident fund.

- The annual accretion to the balance at the credit of an employee participating in a recognized provident fund, to the extent to which it is chargeable to tax under Rule 6 of part A of the Fourth Schedule.

FAQs

You will be able to find both either in Salary Slip or Form 16. Employer provides salary slip or Form 16 to each employee.

You can increase your Net Salary/Take Home Salary by planning your tax-saving investments u/s 80C and other Chapter VI-A deductions. This will reduce your taxable income and TDS on Salary. But it is only possible if you provide your investment declaration to your employer correctly in Form 12BB.

Hi, CTC or the Cost To Company is the cost company bears for an employee - it includes basic salary and other allowances like HRA, Dearness Allowance, Conveyance Allowance, etc.

Whereas, take-home salary is computed after deducting taxes & contributions from CTC.

You can refer the guide on the difference between CTC and Take Home Salary on our learn center.

query : my annual salary is 18 lakhs . how much drawings can i show in my books of accounts ? is there any criteria for the drawings amount ? can i deduct drawings as expenses from my salary ?

Hi @HIREiN

The gross salary reduced by eligible deductions u/s 10 is taxable. You cannot claim any expenses from your salary.