If you have paid tax incorrectly on your house property you might receive a query to correct it. Hence, taxpayers who receive an SMS or any communication via call or email from ITD are likely to face some verification issues in their ITRs. Taxpayers can receive the SMS for three instances:

- Not filed ITR: ITR is not filed for the given assessment year and has a potential tax liability.

- Mismatch in Details: Even if the details provided by taxpayers and Information received to the ITD don’t match for that particular assessment year.

- Reporting of Significant Transactions: The Income Tax department has details of significant transactions during a financial year which is considered abnormal or out of line with the profile of the taxpayer.

The basis of calculating Income from house property u/s 23(1) of the Income Tax Act is through calculating the annual value. For instance, the annual value of house property is the determination of rent received or the amount of rent which property can potentially earn if let out, whichever is higher.

Taxpayers who have received any such verification issue needs to submit a response on those issues raised. Additionally, the response has to be submitted online by logging into the compliance portal.

Verification issue in the computation of tax liability on House Property

| Code | Description | Response |

| A1 | Total receipts as per taxpayer pertaining to the above information | Amount |

| A2 | Less: Amount relating to another year/PAN | PAN year-wise list |

| A3 | Less: Amount covered in other information | Amount |

| A4 | Less: Exemption/Deduction/Expenditure/ Set off of Loss | Exemption/Deduction wise list |

| A5 | Income/Gains/Loss (A1-A2-A3-A4) | Computed |

A1- Total receipts as per the taxpayer pertaining to the above information.

The gross value of the property can be let out. However, if the taxpayer has not received any rental payment they can show the amount as 0. But, suitable remarks are to be submitted under the remarks section.

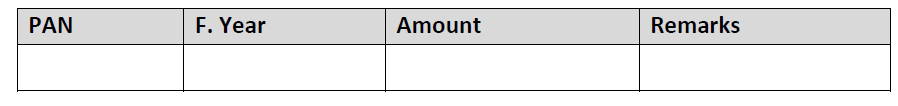

A2- Amount relating to another year/PAN.

If part of the income/receipts relates to someone else’s PAN or is considered for some other year then the List of details of such income is to be mentioned as per the table below:

A3- Amount repeatedly covered:

If any amount is mistakenly covered twice then it should be mentioned under the Remarks section of the previous table. Hence, this will nullify the repeated Income/Gains/Loss covered.

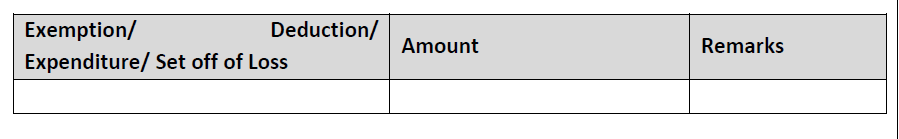

A4- Exemption/Deduction/Expenditure/Set off of loss:

This section has to certainly include a list of all the available allowances which are exempt. The taxpayer needs to then select the correct category from the drop-down list as under:

- Amount of rent which cannot be realized u/s 23.

- Tax paid to local authorities u/s 23

- Deduction under section 24(a) @30%

- Interest payable on borrowed capital u/s 24(b)

- Set off of Loss

- Others

The details are to be submitted as per the table mentioned below:

A5- Income/Gain/Loss:

This section includes the self-computation of income from house property chargeable to tax A5=(A1-(A2+A3+A4)). If your income computation exceeds the minimum of 2.5 lakh then you should file your ITR.

FAQs

Yes, it is certainly advisable to log in to the compliance portal. However, if a taxpayer doesn’t log in he/she will not be able to respond to the issues raised.

Upon examining the online response submitted by the taxpayer, ITD can raise an additional query request to seek further clarification from the taxpayer. Therefore, the taxpayer needs to respond to the additional query request as well.

If there are any e-Verification issues then it will be pushed to the compliance portal for e-verification. For instance, Email and SMS will be sent to the taxpayer informing about the issue raised. Then the taxpayers then need to respond to those issues raised.