The ITD issues notice to identified persons for the non-filing of ITR on the compliance portal. The department uses an e-verification facility to narrow down the persons who are liable to file ITR but have yet to do it. Therefore, Compliance Portal helps the taxpayers and the department to identify cases of non-filing of return. The taxpayer must respond on the compliance portal as to the return has been filed or if it is in the process of filing.

Steps of submitting the ITR non-filing response on compliance portal

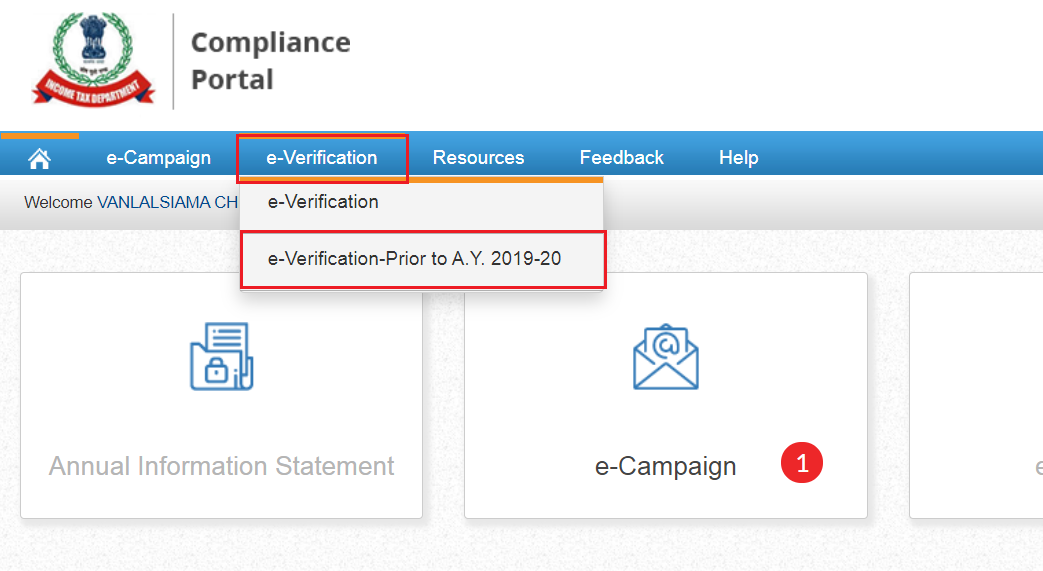

- Log in to the compliance portal with valid credentials.

Next, click on the e-Verification tab.

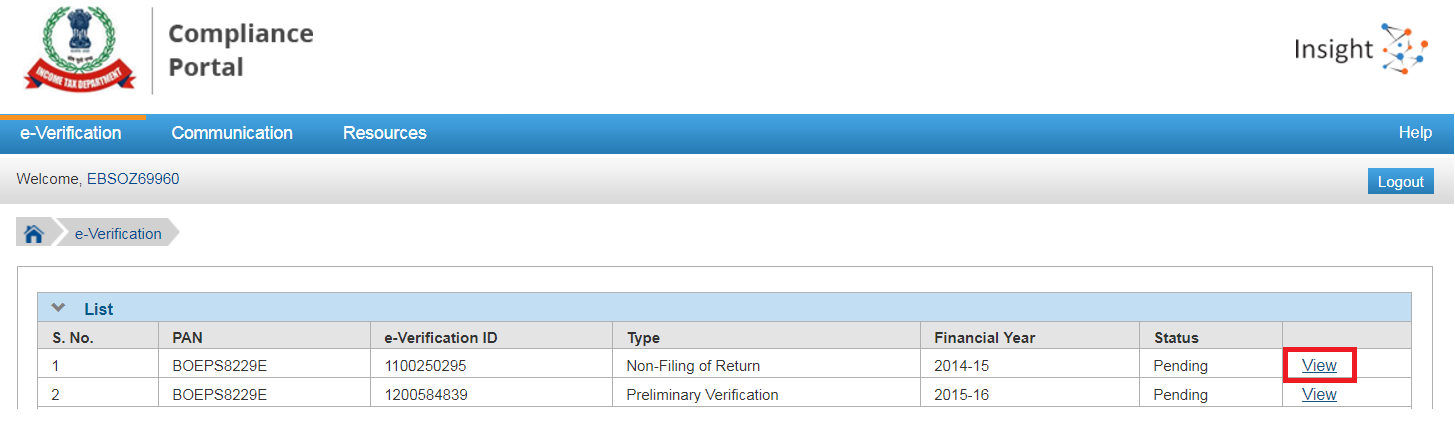

- A list of identified cases would be listed.

Choose one and click on View:

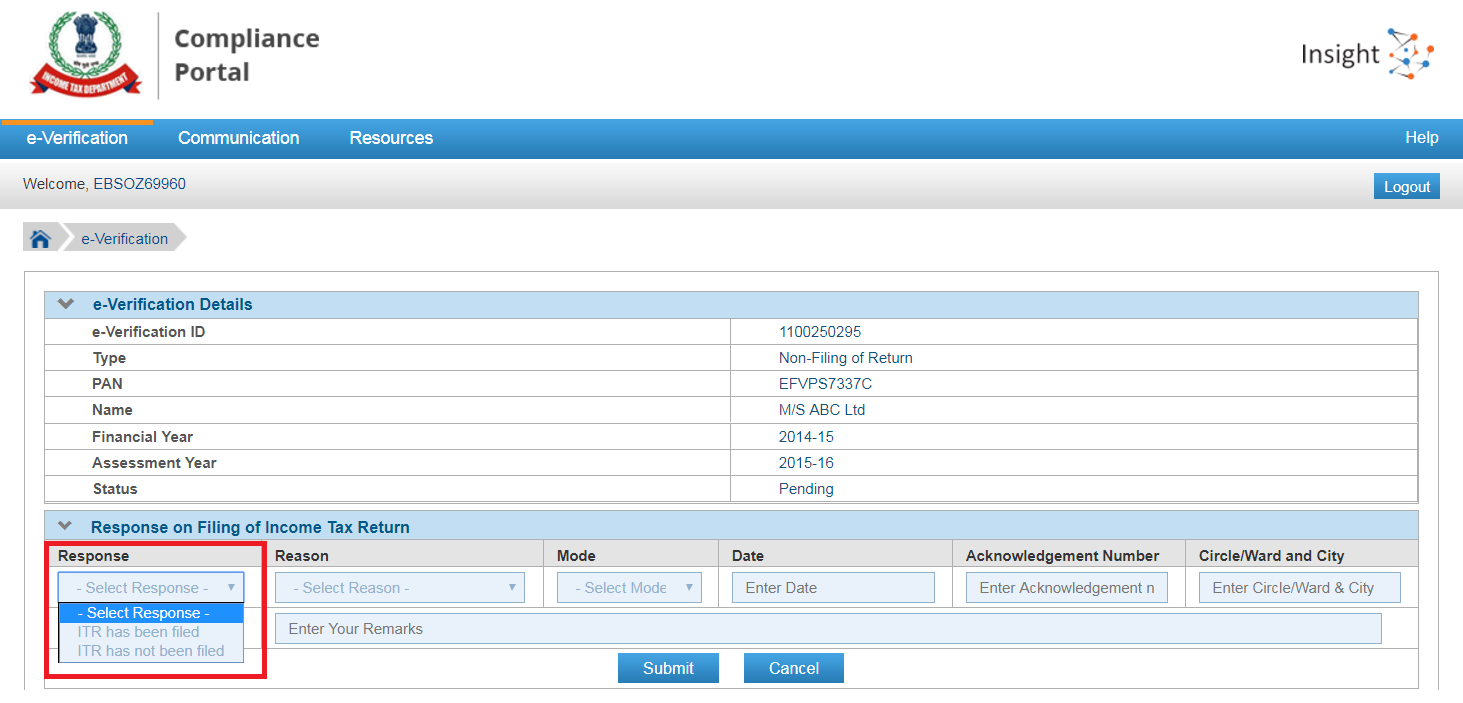

- Under the Response section.

Select either one of the options from the drop-down.

- If you select “ITR has been filed” mention the following information:

– Mode of Filing (paper or e-Filed).

– Ward and City (if filed by paper).

– Date of Filing.

– Acknowledgment number.

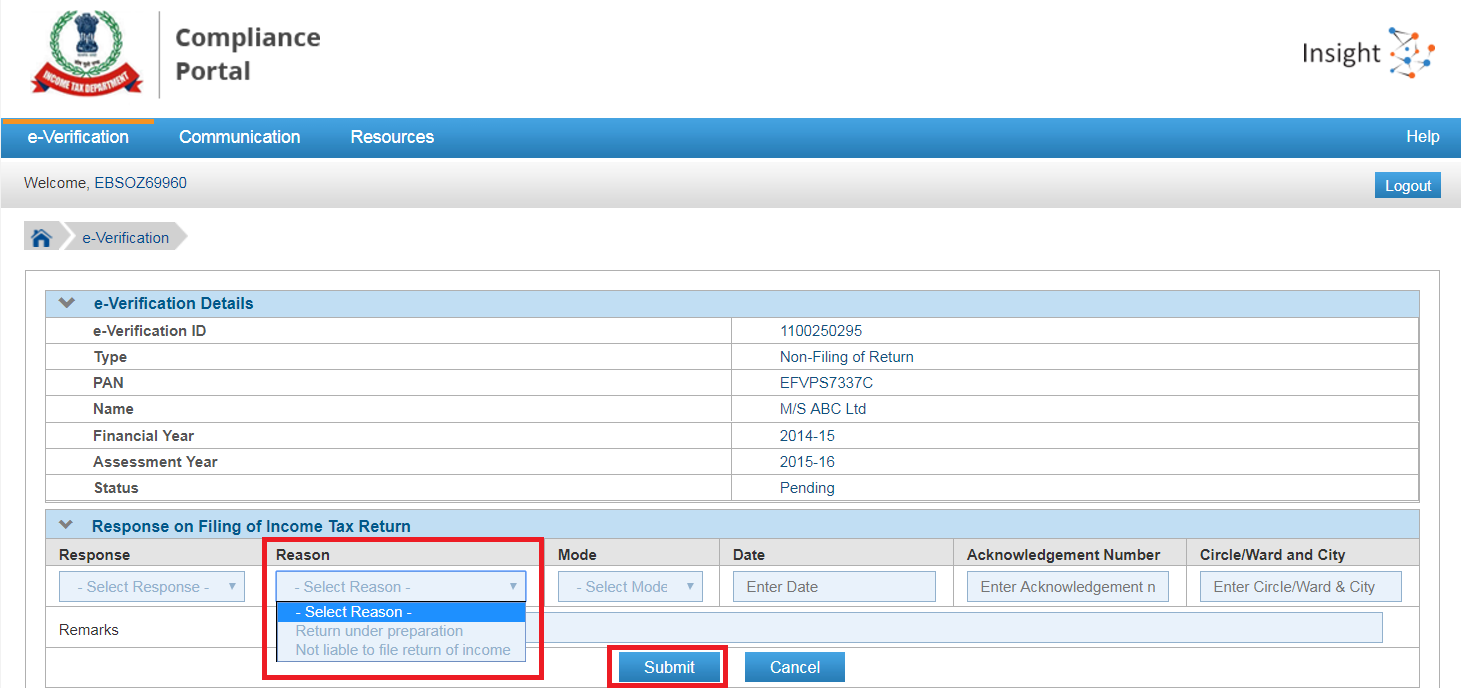

Enter remarks if any and click on Submit. - If you select ‘ITR has not been filed’ then under the Reason section provide either response:

– Return under preparation.

– Not liable to file the return of Income.

Finally, click on Submit.

FAQs

The compliance portal will have all issues related to e-verification issue. Additionally, Email and SMS will be sent to the taxpayer informing about the issue raised.

The taxpayer needs to log into the compliance portal to check the details of the issues generated. They must do this as soon as any form of communication has been received. Finally, they need to submit an adequate response to satisfy the issue.

The responses submitted online by the taxpayers will be verified by the Income-tax department. Hence, if the response is satisfactory, the case will be closed. Additional queries are to be raised until the response received is satisfactory. However, adequate proceedings are initiated if the response is not satisfactory.