A taxpayer can file a payment related grievance from his account on the GST Portal. All other grievances can be filed from the grievance redressal portal. The taxpayer who has filed a complaint on the GST Portal can check the status using the Grievance Tracking Number.

Steps to check the status of a payment-related grievance under GST Portal

- Go to the GST Portal

Access the GST Portal and Login with your Credentials.

- Go to Services > Payments > Grievance Against Payment (GST PMT 07)

On the home page of GST Portal, click on Services (on the toolbar). Under the Payments Section click on the Grievance Against Payment (GST PMT 07)

- Click on the tab Enquire Status and Enter the Grievance Number or Date Range.

Click on the option to search.

- The search results will appear on the screen

– If you searched using grievance number, details of the filed grievance will appear

– If you searched using a date range, all the filed grievances between the entered dates will appear on the screen along with the grievance number - Following details are displayed on the screen

– Grievance Number – unique number issued for each grievance filed

– Raised On – the date on which the grievance was filed on the GST Portal

– Grievance Type – the type of grievance filed

– Status – Submitted or Resolved

– Remarks – Any note or comment related to the grievance

To view the details of grievance filed, click on the hyperlink on the Grievance Number

Steps to check the status of a grievance filed on grievance redressal portal

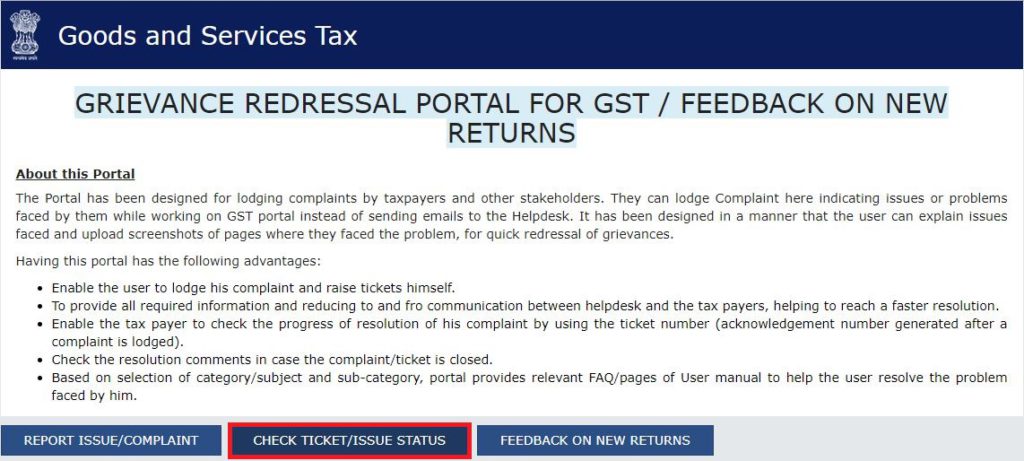

1. Go to the Grievance Redressal Portal

2. Click on Check Ticket/Issue Status

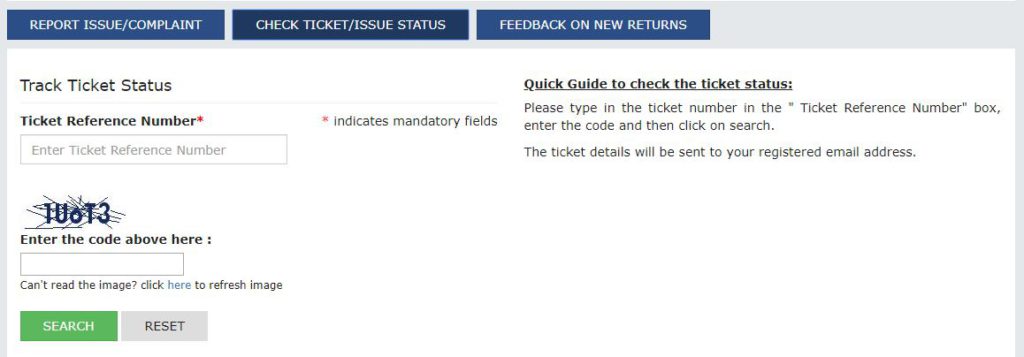

3. Enter TRN i.e. Ticket Reference Number which was generated when the grievance was earlier filed

4. Enter the captcha and click on Search. The ticket details are sent to the registered email address

FAQs

You can file a Grievance/Complaint on the GST Portal by going to the Services > User Services > Grievance / Complaints and Submit the grievance form thereafter.

To check the status of Payment related grievance on the GST portal, go to Services > Payments > Grievance Against Payment (GST PMT 07).

To check the status of a grievance filed on the grievance redressal portal of GST, go to the Grievance Redressal Portal. Click on Check Ticket/Issue Status > Enter TRN > Submit.

Hey @Joe_Fernandes

To understand the steps for logging in to the GST portal, please refer to this article.

The password the user has created while logging in for the first time is valid for 120 days.

GST Portal Login Link

Visit: https://ssoid.net.in/gst.html

Steps to Login on GST Portal:

Open the GST Portal

Go to www.gst.gov.in

Click on “Login”

This button is on the top right corner of the homepage.

Enter Your Credentials

Username: Provided during registration.

Password: Enter your password.

Captcha Code: Type the characters shown in the image.

Click on “LOGIN”

Forgot Password?

If you’ve forgotten your password:

Click on“Forgot Password” on the login page.

Enter your username and captcha.

OTP will be sent to your registered mobile/email.

Set a new password.

Common Uses After Login:

File GST Returns (GSTR-1, GSTR-3B, etc.)

Check Payment Ledgers

Download GSTR Reports

Apply for refunds, etc.

Access the official GST portal at www.gst.gov.in to file returns, pay taxes, and manage your GST compliance online. Use your credentials to log in and navigate seamlessly through returns, invoices, and dashboard services.