A board meeting is a formal gathering of a Board of Directors. Most of the organizations, being public or private, profit or non-profit, are ultimately governed by a body commonly known as Board of Directors. The members of this body cyclically meet to discuss strategic matters. A Company is required to give application for GST Registration under the following situations:

- Voluntary registration

- Turnover exceeds the specified limit mentioned in the law

- Claim the Input Tax Credit (ITC) levied on purchases

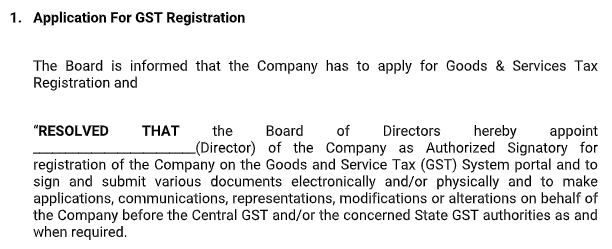

While obtaining GST Registration for a company, a Board Resolution may have to be passed by the Board of Directors of the Company authorizing a person to complete the registration formalities on the GST portal. It’s important to note that for obtaining GST registration for a company or LLP, a Digital Signature is required for the authorized signatory.

Thus, review your Board Meeting Minutes immediately after the meeting. When your board meeting minutes are complete and finished, make sure they are distributed to board members as soon as possible. Once the minutes are approved by a vote of the board during the next board meeting, they become part of the official record of the organization. It’s important that a copy of all minutes are kept in one place.

FAQs

The documents required for the registration are as follows:

– PAN Card

– Proof of Business Registration

– Proof of Address

– Proof of Bank Account

Identity Proof, Address Proof, and Photographs of the authorized person

– Other documents such as:

For Company – Memorandum of Association (MOA), Articles of Association (AOA) or Copy of Board Resolution or,

For LLP — Copy of Board Resolution & Digital Signature

No. An entity operating in multiple States will have to be registered separately for each of the States from where the taxable supply of Goods or Services is made.

A business needs to register themselves under GST if their aggregate turnover is above the threshold limit. Generally, the GST registration is compulsory only if the aggregate turnover of a business exceeds the threshold of Rs.40 lacs for goods (Rs.20 lacs for special category states) or Rs.20 lacs for services (Rs.10 lacs for special category states) during the financial year. However, in certain cases, mandatory registration is required even if the turnover is less than the prescribed threshold limit.