The Permanent Account Number (PAN) is one of the most important documents which is an identity proof. Therefore it is imperative that the information provided on the PAN card is correct or accurate. However, there are cases where the information printed on the PAN card is false or incorrect. In such cases, the applicants can apply for a change/correction in their PAN card through the UTIITSL portal.

There are many cases where individuals have more than one PAN. For instance, if an individual loses his/her PAN card and wants to reissue, but there are discrepancies in the address. In such cases to avoid the hassle involved in applying for re-issuance with an address change, sometimes a person may apply for a new one and end up having two PAN cards and thus has to surrender the duplicate PAN.

Steps to Apply for Change/Correction in PAN

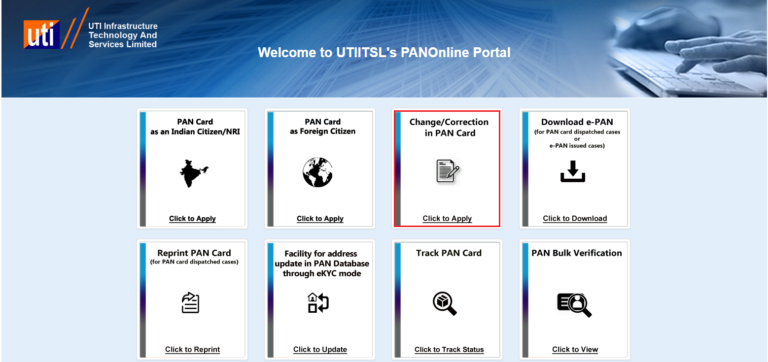

- Visit the UTIITSL portal.

Open the UTIITSL portal first to start the process

- Select For PAN Cards > Apply PAN Card.

Click on the For PAN Cards > Apply PAN Card option from the dashboard.

- Select “Change/Correction in PAN Card“.

Click on the “Change/Correction in PAN Card” option to select it.

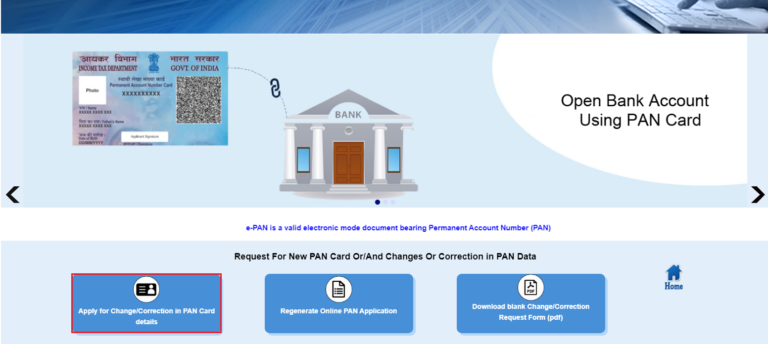

- Select “Apply for Change/Correction in PAN Card Details“

Click on the “Apply for Change/Correction in PAN Card Details” option. You can also download the Change/Correction Request form by clicking on the 3rd option.

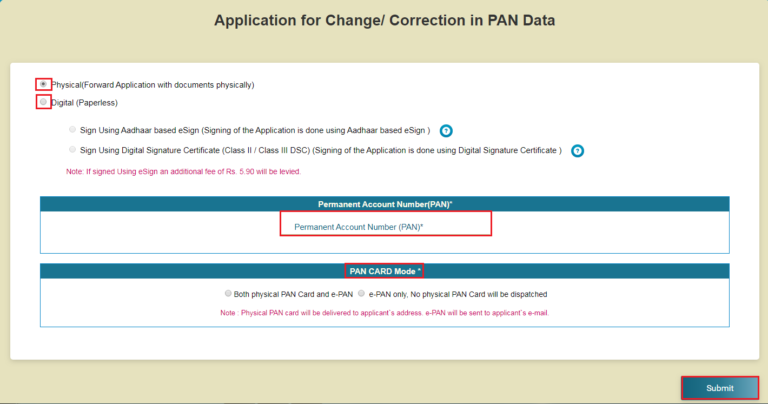

- Select the form of forwarding the documents

Hence, we move to the application page. Select the form of forwarding the documents by clicking on the respective check-box and enter your PAN number.

- Select the mode of PAN card & Submit

Additionally, select the mode of PAN card you would like to receive. (e-PAN and/or Physical PAN Card). Thus, click on the “Submit” option.

- Enter the details under the “Personal Details” section and click on the “Next” option

Therefore, a reference number will be given to you which shall be used for future reference until the application number is generated. Hence enter the details under the “Personal Details” section and click on the “Next” option at the bottom of the page.

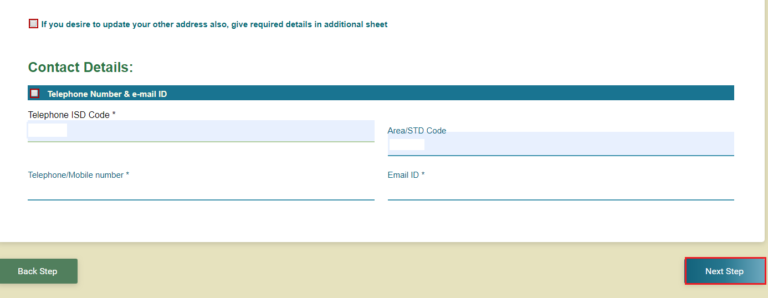

- Fill in the required details in the “Contact Details” section and click on the “Next“.

Hence, we move to the “Contact Details” section. Fill in the required details and click on the “Next” option.

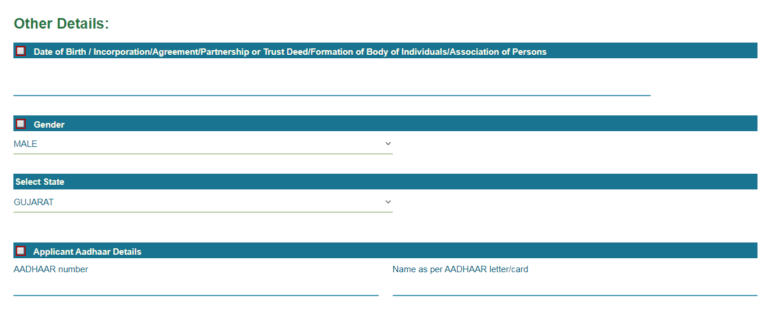

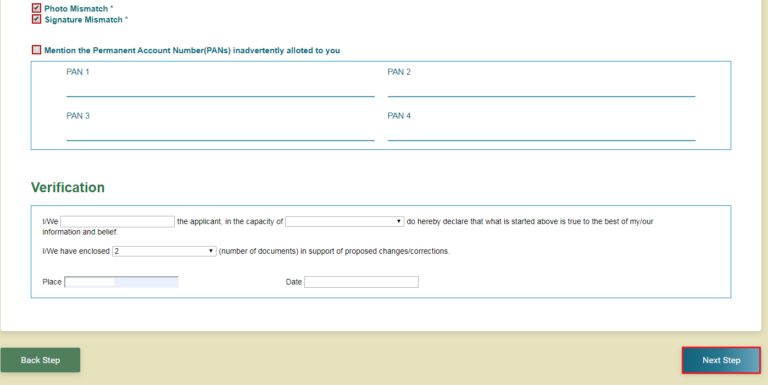

- Fill in the required details in the “Other Details” section and click on the “Next“.

Hence, we move to the “Other Details” page. Enter the details and click on the “Next Step” option.

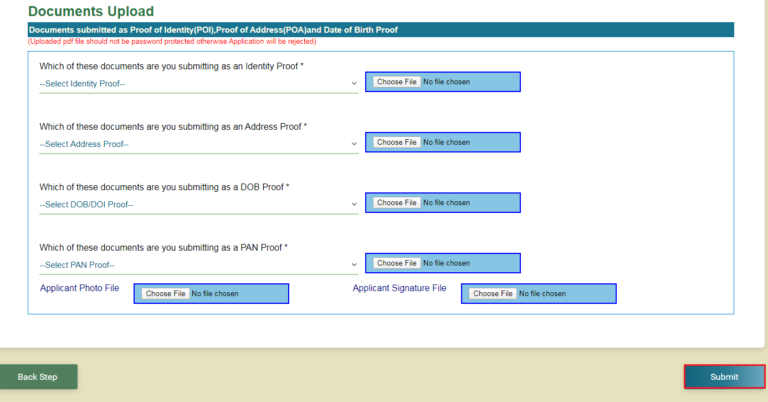

- Upload all of your supporting documents & click on the “Submit” option

Finally, we move to the “Upload” page. Here, you are supposed to upload all of your supporting documents. Once this process is done, click on the “Submit” option to continue.

- Make Payment

After completing the above process, you will be directed to the payment gateway. Upon successful completion of the payment, the process of change or correction in the PAN card will be initiated.

FAQs

Any Indian person or HUF applying to make changes in the current details in their Pan Card has to submit:

– A valid government approved ID proof copy (either Aadhaar Card or Driving License or Passport, etc.)

– Valid address proof copy (DL, utility bill, domicile certificate, etc.)

– A valid proof of date of birth (Voter ID card, DL, passport, etc.)

– The individual applicants should also provide two passport size photographs with their application.

You can submit the application in the form “Request for new PAN card or/and Changes or Correction in PAN data” in the following cases:

– When you already have PAN but want a new PAN card,

– When you want to make some changes or corrections in your existing PAN details

How do I know the AO code and AO type for a PAN card application? Can I choose anyone listed for my state?

What are the steps to download a PAN card PDF?

I recently misplaced my PAN card and I want a new one with the old PAN number. How should I proceed?

How can I get my pan card acknowledgement number?

How can I check my PAN card details online?

Hey @TeamQuicko, what is the minimum age required for getting a PAN card?

Hey @SonalYadav,

No - you cannot randomly select your AO code and type just based on the state. In TIN-NSDL PAN application you need to select AO based on the description provided on the AO in the Help utility for AO selection after you select State and City, as shown in the image below -

So once you select State and City - you’ll see a list of AO’s with different descriptions. Most common one - if you’re salaried with income below 20 lacs as seen in this example it will be WARD 7(1)(4) in Ahmedabad, as we chose Ahmedabad as the city for this example.

Similarly AOs will be different for Government sector employees, business owners, etc. Once you select that AO, AO type and code will automatically be filled in the respective fields of your application.

If you’re still confused regarding your AO, you’re best suited to get professional help for the same. Choose Quicko’s PAN Application Plan and have your PAN application handled by professionals in hassle free manner.

Hope this helped! Feel free to reach out in case of further queries.

Hey @SonalYadav

To get an e-PAN or a PDF version of PAN card - you can:

Steps to apply for Reprint/Duplicate e-PAN via NSDL website

Note: If during the application process the session times out or you wish to continue later - you can click on Registered user tab and use your token number to resume the application

Among these options, e-KYC through Aadhaar is the easiest, since you don’t need to submit further documents as proof of your identity and your e-KYC is completed using Aadhaar OTP.

It usually takes 15–20 days to receive the duplicate PAN card.

You also get an instant e-PAN from the Income Tax Department.

Following is the sample of an e-PAN:

Hope this helps!

Hey @HarshitShah

Go to Know Your PAN and enter your Name, Date of Birth and mobile number to fetch your PAN details from Income Tax database.

Or, you can get your old PAN Number from:

Once you fetch your PAN number, you can apply for a reprint of your PAN on Quicko or on NSDL website - refer Team Quicko’s answer to How can I get a new duplicate copy of my pan card

Hope that answered your question! In case you need further assistance, feel free to send us a message or mention a comment below.

Hey @ViraajAhuja47

It is very easy to get an acknowledgement number

You can get this number Online or Offline:

If you have applied for a new Pan Card or have applied to change any data in the existing Pan Database, the acknowledgement number can be found in Pan Acknowledgement sheet or on the Pan Acknowledgement form that has been provided to you.

If you applied online for PAN, the acknowledgement number will be delivered to your given Email Id.

After getting the acknowledgement number you can track you PAN status using NSDL website.

Hope this helps!