Income Tax Department (ITD) issues Permanent Account Number (PAN) an alphanumeric ID in a form of card to any “person” who applies for it or to whom the department allows the number without an application. Every Permanent Account Number allotted and PAN card issued is valid for a lifetime. In a situation where the PAN holders lose their PAN or damage it, the ITD issues a duplicate PAN card to the PAN holder.

There are two ways to apply for the Duplicate PAN card:

- Online Method

- Offline Method

There are many cases where individuals have more than one PAN. For instance, if an individual loses his/her PAN card and wants to reissue, but there are discrepancies in the address. In such cases to avoid the hassle involved in applying for re-issuance with an address change, sometimes a person may apply for a new one and end up having two PANs.

How to Surrender PAN Card Online

Follow the steps given below to surrender your PAN card:

- Visit the TIN-NSDL portal

Visit the TIN-NSDL portal and select the “Changes/Correction in existing PAN Data/Reprint of PAN Card” option from the “Application Type” drop-down list. Enter the PAN details of the PAN card you wish to retain here.

- Enter the required details

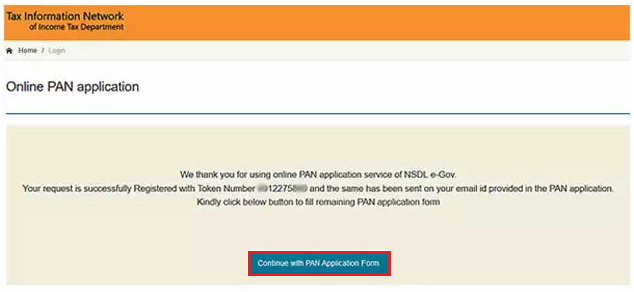

Hence, fill out the form entirely and click on the “Submit” option. A “Token Number” is generated. You can take a screenshot of the screen in case you might require the token number for future reference. Click on the “Continue with PAN Application Form” option.

- Enter the PAN details

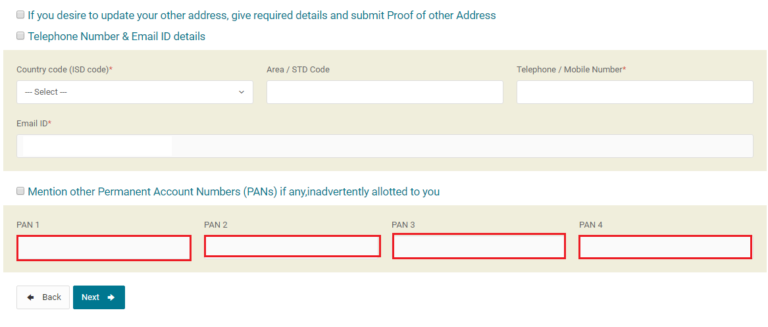

Enter the PAN number of the PAN you wish to surrender under the “Contact & Other Details” section.

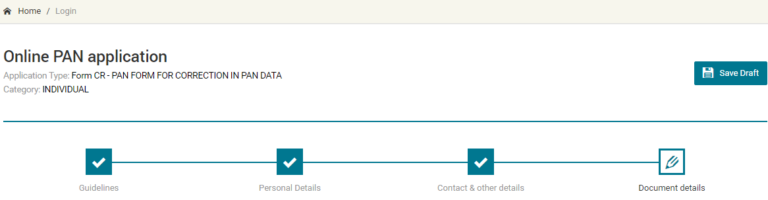

- Upload the required documents

Upload the scanned images of your photograph, signature and the required documents. If an individual is requesting the surrender of PAN, they themselves should sign the acknowledgment receipt, else they must be signed by the authorized signatories.

- Complete the payment process

Hence, complete three sections of the form and click on the “Submit” option. You will then be shown a preview of your application form. Proceed forward to complete the payment.

Thus, once the payment is successful you will be able to download print the acknowledgment form for future reference and as proof of payment. Therefore, you have to send a printed copy of the acknowledgment form to the NSDL e-Gov along with two photographs. Furthermore, label the envelope as “Application for PAN Cancellation” and the acknowledgment number. Hence, send it to the following address:

NSDL e-Gov at ‘Income Tax PAN Services Unit,

NSDL e-Governance Infrastructure Limited,

5th Floor, Mantri Sterling,

Plot No. 341, Survey No. 997/8,

Model Colony, Near Deep Bungalow Chowk,

Pune – 411 016

FAQs

You may fill and submit the PAN Change Request application form by mentioning the PAN which you are using currently on top of the form. All other PAN/s inadvertently allotted to you should be mentioned at item no. 11 of the form and the corresponding PAN card copy/s should be submitted for cancellation along with the form.

If you wish to cancel/ surrender your PAN (which you are currently using), then you need to visit your local Income Tax Assessing Officer with a request letter to cancel/ surrender your PAN.

Any one of the following documents can be submitted as proof of PAN surrendered:

1. Copy of PAN card

2. Copy of PAN allotment letter

No other documents are acceptable as valid proof of PAN surrendered.

If any proof of PAN surrendered is not available, then the application will not be accepted.