Applicants can avail of the service of “Reprint of PAN Card” when a PAN card has already been allotted to them. In this case, a new PAN card with the same details as the previous PAN card will be issued to the applicant. Hence, there will be no change in the details of the PAN. If there are any changes that are to be made in the PAN card, the applicants can file a request under the “Change/Correction in PAN Card” from the UTIITSL portal.

Steps to Apply for Reprint of PAN Card

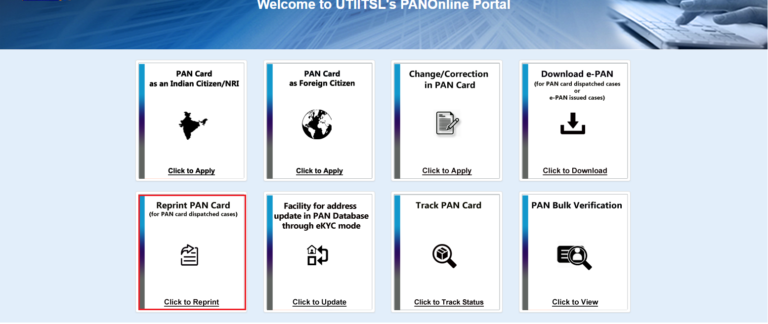

- Visit the UTIITSL portal.

You have to visit the UTIITSL portal first to apply for reprint of PAN

- Click For PAN Cards > Apply PAN Card

Click on the For PAN Cards > Apply PAN Card option from the dashboard.

- Select “Reprint PAN Card“.

Click on the “Reprint PAN Card” option to select it.

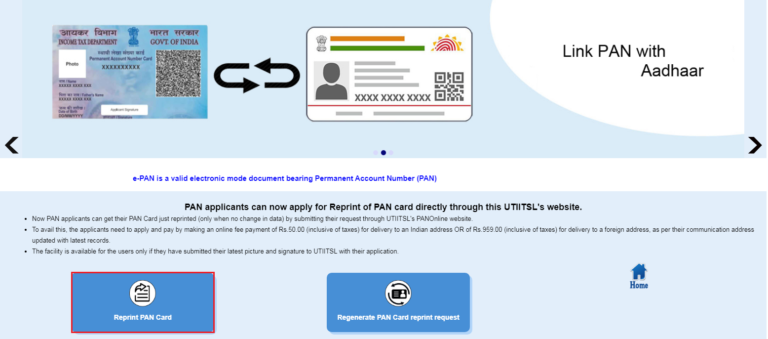

- Click on the “Reprint PAN Card” option

Hence, you will be given two options to choose from. Click on the “Reprint PAN Card” option if you are applying for the reprint for the first time.

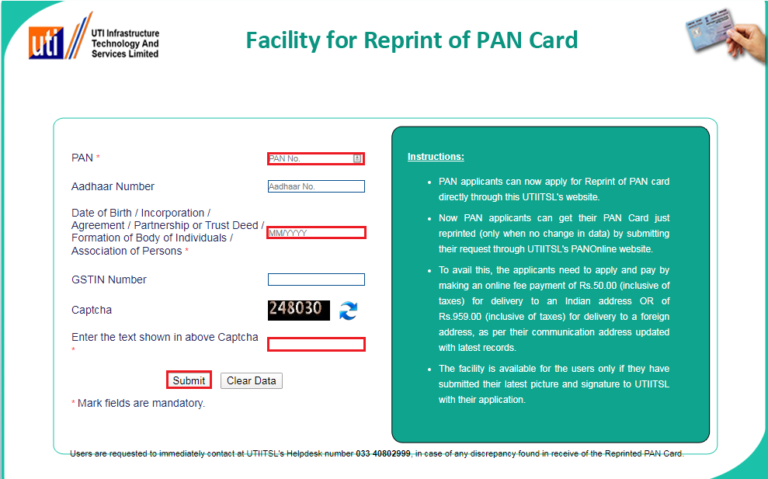

- Enter the required details related to Identity Proofs

Hence, we move to the application page. Enter the following details in the respective fields:

– PAN Number

– Aadhaar Number (Optional)

– Date of Birth / Incorporation / Agreement / Partnership or Trust Deed / Formation of Body of Individuals / Association of Persons

GSTIN Number (Optional) - Enter the Captcha code and Submit

Enter the Captcha code from the image given and click on the “Submit” option.

Hence, the application will be successfully submitted after the completion of the payment which is done online.

FAQs

The applicants will have to pay a fee of INR 50 for the delivery to an Indian address or INR 959 for delivery to a foreign address. This fee stated above is inclusive of all taxes.

The facility of “Reprint PAN Card” is available for the users only if they have submitted their latest picture and signature to UTIITSL with their application.

You can submit the application in the form “Request for New PAN Card Or/and Changes or Correction in PAN data” in the following cases:

1. When you already have PAN but want a new PAN card,

2. When you want to make some changes or corrections in your existing PAN details

How do I know the AO code and AO type for a PAN card application? Can I choose anyone listed for my state?

What are the steps to download a PAN card PDF?

I recently misplaced my PAN card and I want a new one with the old PAN number. How should I proceed?

How can I get my pan card acknowledgement number?

How can I check my PAN card details online?

Hey @TeamQuicko, what is the minimum age required for getting a PAN card?

Hey @SonalYadav,

No - you cannot randomly select your AO code and type just based on the state. In TIN-NSDL PAN application you need to select AO based on the description provided on the AO in the Help utility for AO selection after you select State and City, as shown in the image below -

So once you select State and City - you’ll see a list of AO’s with different descriptions. Most common one - if you’re salaried with income below 20 lacs as seen in this example it will be WARD 7(1)(4) in Ahmedabad, as we chose Ahmedabad as the city for this example.

Similarly AOs will be different for Government sector employees, business owners, etc. Once you select that AO, AO type and code will automatically be filled in the respective fields of your application.

If you’re still confused regarding your AO, you’re best suited to get professional help for the same. Choose Quicko’s PAN Application Plan and have your PAN application handled by professionals in hassle free manner.

Hope this helped! Feel free to reach out in case of further queries.

Hey @SonalYadav

To get an e-PAN or a PDF version of PAN card - you can:

Steps to apply for Reprint/Duplicate e-PAN via NSDL website

Note: If during the application process the session times out or you wish to continue later - you can click on Registered user tab and use your token number to resume the application

Among these options, e-KYC through Aadhaar is the easiest, since you don’t need to submit further documents as proof of your identity and your e-KYC is completed using Aadhaar OTP.

It usually takes 15–20 days to receive the duplicate PAN card.

You also get an instant e-PAN from the Income Tax Department.

Following is the sample of an e-PAN:

Hope this helps!

Hey @HarshitShah

Go to Know Your PAN and enter your Name, Date of Birth and mobile number to fetch your PAN details from Income Tax database.

Or, you can get your old PAN Number from:

Once you fetch your PAN number, you can apply for a reprint of your PAN on Quicko or on NSDL website - refer Team Quicko’s answer to How can I get a new duplicate copy of my pan card

Hope that answered your question! In case you need further assistance, feel free to send us a message or mention a comment below.

Hey @ViraajAhuja47

It is very easy to get an acknowledgement number

You can get this number Online or Offline:

If you have applied for a new Pan Card or have applied to change any data in the existing Pan Database, the acknowledgement number can be found in Pan Acknowledgement sheet or on the Pan Acknowledgement form that has been provided to you.

If you applied online for PAN, the acknowledgement number will be delivered to your given Email Id.

After getting the acknowledgement number you can track you PAN status using NSDL website.

Hope this helps!