Step by step instructions to track PAN card application status on UTI ITSL portal. The income tax department has outsourced the services in relation to the Permanent Account Number (PAN) to NSDL & UTI. The services provided by UTI are as follows:

- Application for PAN Card

- Correction/Changes in PAN Card

- Track PAN Card Status

- Bulk PAN Verification

Steps to Track PAN Card Application Status on UTI

Time needed: 3 minutes

- Visit the UTIITSL Portal

Click on For PAN Cards > Track Your PAN Card from the dashboard on UTIITSL portal.

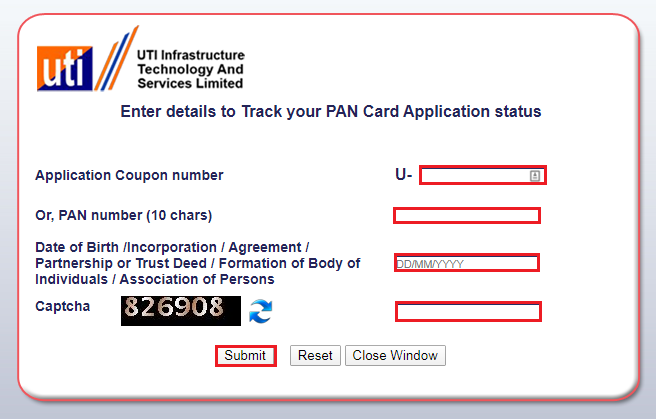

- Navigate to Track Your PAN Card Status page & Enter the following details:

– Application Coupon Code/PAN Number

– Date of Birth/Incorporation/Agreement/Partnership or Trust Deed/Formation of Body of Individuals/Association of Persons - Enter the “Captcha Code” from the image given below and click on the “Submit” option.

Therefore, the status of your PAN card will be displayed to you.

FAQs

No. Obtaining/possessing more than one PAN is against the law and may attract a penalty up to INR 10,000. Therefore, it is advisable not to obtain/possess more than one PAN.

Permanent Account Number (PAN), as the name suggests, is a permanent number and does not change. Changing the address or city, though, may change the Assessing Officer. Such changes must, therefore, be intimated to the nearest IT PAN Service Center for required corrections in the PAN databases of the Income Tax Department (ITD).

In case you had applied prior to notification of new form 49A on 29-5-2003 but have not received the PAN, you will have to apply afresh in new Form 49A at any IT PAN Service Center.