We invest in the stock market intending to earn a profit, but there are instances where certain stocks may underperform due to factors such as the company’s financials or other external influences. In such cases, investors may experience losses. However, the investor can use these unrealized losses with a strategy called tax loss harvesting. Essentially, tax loss harvesting involves intentionally selling shares with losses to offset realized gains before the end of the financial year to reduce the overall tax liability.

What is Tax Loss Harvesting?

- At the end of a financial year, some shares and mutual funds you are holding have an unrealized loss. Unrealized Loss means the stock has not yet been sold but if it is sold, there would be a loss since the average market value is less than the average buy value.

- Similarly, by the end of a financial year, some shares and mutual funds you have sold have a realized profit. Realized Profit means the stock has already been sold at a profit (Market Value > Buy Value).

Let us understand how it works from this example:

- The stocks that have an unrealized loss are sold and a loss is realized before the end of the financial year.

- This loss can now be set off against other profits and therefore it will reduce the tax liability.

- Thus, it is the harvesting of unrealized losses to save taxes.

If the trader wants to hold the stock, he can buy the stock again so that the portfolio remains unchanged. Generally, when looking at the difference, a trader would prefer to incur the transaction cost of entering into these transactions rather than paying higher taxes.

Example of Tax Loss Harvesting

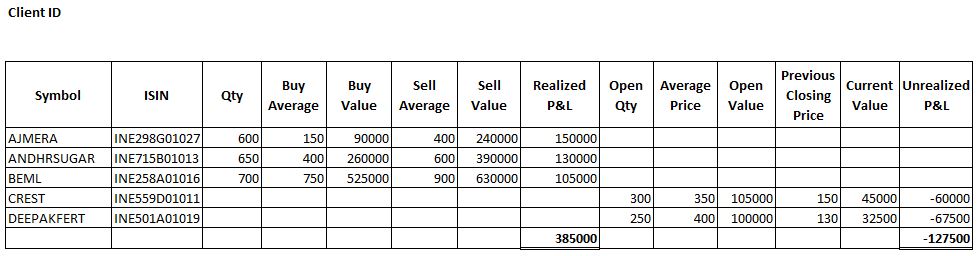

Below is a snapshot of the P&L Statement of a trader as of 28.03.2022. The tab refers to short-term equity trades.

Before Tax Loss Harvesting

| Particulars | Amount (INR) |

| Realised Profit | 3,85,000 |

| Unrealized Loss | 1,27,500 |

| Total Income | 3,85,000 |

| Tax Liability | 20,250 [15% of Rs. 1,35,000 (385000-250000)] |

After Tax Loss Harvesting

The trader can sell 300 shares of Crest and 250 shares of Deepakfert to realize a loss of INR 1,27,500

| Particulars | Amount (INR) |

| Realized Profit | 3,85,000 |

| Realized Loss | 1,27,500 |

| Total Income | 2,57,500 (3,85,000-1,27,500) The loss set off against Profit |

| Tax Liability | 1,125 [15% of 7,500 (257500-250000)] |

The trader can thus reduce the tax liability by doing Tax Loss Harvesting. Additionally, if the trader wants to keep the portfolio unchanged, they can buy 300 shares of Crest and 250 shares of Deepakfert again.

Taxation on Trading Income

The trader who plans to practice Tax Loss Harvesting should be able to calculate the income tax on trading income and the applicable tax rates. Based on the calculation of tax liability, the trader can decide whether to opt for it or not. The trader should analyze whether converting unrealized loss to realized loss will reduce taxes or not.

The taxpayer can treat the income from trading in equity shares or mutual funds as a Capital Gains Income or as Non-Speculative Business Income. This is based on the nature of trading.

Below are the applicable tax rates:

A. Trading Income considered as Capital Gains

| Equity Shares & Equity Mutual Funds | Debt Mutual Funds and other Securities | |

| LTCG | 10% over INR 1 lac | 20% with the benefit of indexation |

| STCG | 15% | Slab rates |

B. Trading Income considered as Non-Speculative Business Income – Income is taxable at slab rates as per the Income Tax Act

An opportunity for Tax Loss Harvesting is available in the case of trading in equity delivery and mutual funds. It is not available in the case of equity intraday, equity F&O, commodity trading, and currency trading since the trader squares off the position on the same day (intraday) and the last Thursday of the month (F&O).

Rules for Set-Off

The trader who plans to practice Tax Loss Harvesting should be able to analyze which loss can be set off against which profits as per income tax rules for set off and carry forward of losses. However, the decision whether to convert the unrealized loss to realized loss should be made after analyzing against which incomes this loss can be set off. Therefore, if the loss cannot be set off against any existing profits, then the trader should not opt for it.

Equity Trading Income considered as Capital Gains:

- Long Term Capital Loss (LTCL) can be set off against only Long Term Capital Gains (LTCG).

- Short Term Capital Loss (STCL) can be set off against both Short Term Capital Gains (STCG) and Long Term Capital Gains (LTCG).

- LTCL and STCL cannot be set off against any other income.

Equity Trading Income is considered as Non-Speculative Business Income:

- The Non-Speculative Business Loss can be set off against any income except Salary Income.

Note: Traders having Salary Income cannot set off Non-Speculative Business Loss against such income. Thus, if there are no other incomes except Salary, the trader should not go for Tax Loss Harvesting.

FAQs

If you opt for Tax Loss Harvesting by selling the shares held for more than a year, it would be a Realised Long Term Capital Loss (LTCL). Additionally, LTCL cannot be set off against STCG (Short Term Capital Gain). Thus, in this case, Tax Loss Harvesting is not beneficial.

A trader can opt for Tax Loss Harvesting by selling the existing holdings on which there is an Unrealised Loss. Thus, the loss can be adjusted with realized profit to reduce the tax liability. However, if the trader wants to continue holding the stock to keep the portfolio unchanged, you can buy the shares again on the next trading day. However, you must ensure that the transaction cost of entering into a buy and sell transaction is less than the amount of taxes saved from Tax Loss Harvesting.

The loss from equity trading cannot be adjusted with Salary Income. Thus, the trader should not opt for it since it would not reduce the tax liability.

I want to opt for Tax Loss Harvesting to save tax but I still want to hold the stock. What should I do?

I have a Salary Income and I have an unrealized loss from Equity Trading Income. Will Tax Loss Harvesting help me save more on taxes?

Hey @Shweta_Saini

No, You can only set off long-term capital losses against long-term gains. However, you can set off short-term capital losses against both long-term and short-term capital gains.

Hey @riya_gupta

You can opt for Tax Loss Harvesting by selling the existing holdings on which there is an Unrealised Loss. Thus, the loss can be adjusted with realised profit to reduce the tax liability.

However, if you want to continue holding the stock to keep the portfolio unchanged, you can buy the shares again on the next trading day. However, you must ensure that the transaction cost of entering into buy and sell transaction is less than the amount of taxes saved from Tax Loss Harvesting.

Hope this helps!

Hey @TanyaChopra

The loss from equity trading cannot be adjusted with Salary Income. Thus, we would suggest not opting for Tax Loss Harvesting since it would not reduce your tax liability.

I have a Realised Short Term Profit of Rs. 3,00,000. However, there is an Unrealised Long Term Loss of Rs. 1,00,000. Should I opt for Tax Loss Harvesting by selling the shares to realize the loss?

Thanks in advance.

Hi @sushil_verma,

If you opt for Tax Loss Harvesting by selling the shares held for more than a year, it would be a Realised Long Term Capital Loss (LTCL). Additionally, LTCL cannot be set off against STCG (Short Term Capital Gain). Thus, in this case, Tax Loss Harvesting is not beneficial.

Hope this helps

Hey @kishore_varma, you can find out the details related to tax loss harvesting in this article:

Hi

I am writing this to seek your expert advice regarding Tax Harvesting:

Before the end of Fy 2022 ( on 29th March 2022 ), in order to do some tax harvesting, i had sold some securities from my Upstox account and bought the same from the ZERODHA account and vice versa as well.

Now when I am checking my TAX PNL in Zerodha my TAX PNL has been reduced as per the losses that I have booked but at the same time when I am checking my UPSTOX TAX PNL, they are showing the losses booked in the current Finacial Year. In fact, when I checked the other company’s TAX PNL the losses are adjusted in the same financial year but only Upstox is doing differently.

So wanted to understand which is the right away, do we have to consider the sales of securities that are done by all the brokers or UPSTOX that are following the share transfer date or T+2.

BTW Quicko integration is available in both Zerodha and Upstox and calculation is done on basis of the TAX PNL report which makes it confusing as it differ the logic

Thanks

Hi @shubhamwatta, to help you further I have sent a personal message to you. Please respond to it.