The main purpose of establishing a section 8 company is to promote non-profit objectives. Therefore, it intends to apply its profits, if any, or other income in promoting its objects. Therefore there should be no distribution of dividends to its shareholders. Thus, section 8 company has to file various incorporation forms. Further, NPO/company has its objective of promotion of:

- Arts,

- Commerce,

- Charity,

- Education,

- Protection of the environment,

- Science,

- Social welfare, ect.

Section 8 Company : Incorporation Forms

Here is a list of Section 8 Company Incorporation Forms:

| Name of Forms | Purpose of Forms |

| RUN | Application with ROC for Name Approval |

| INC-7 | Application for Incorporation of Company |

| INC-8 | Declaration to apply for PAN and TAN |

| INC-9 | An affidavit from each director and subscriber |

| INC-12 | Application for Issue of License of Section 8 Company |

| INC-13 | Memorandum of Association |

| INC-14 | Declaration from a Practicing CA or CS |

| INC-15 | Declaration by each subscriber |

| INC-16 | License to operate as Section 8 Company |

| INC-22 | Notice of the location of the Registered Office |

| DIR-2 | Consent of Directors |

| DIR-3 | Application to ROC to obtain DIN |

| DIR-12 | Appointment of Directors |

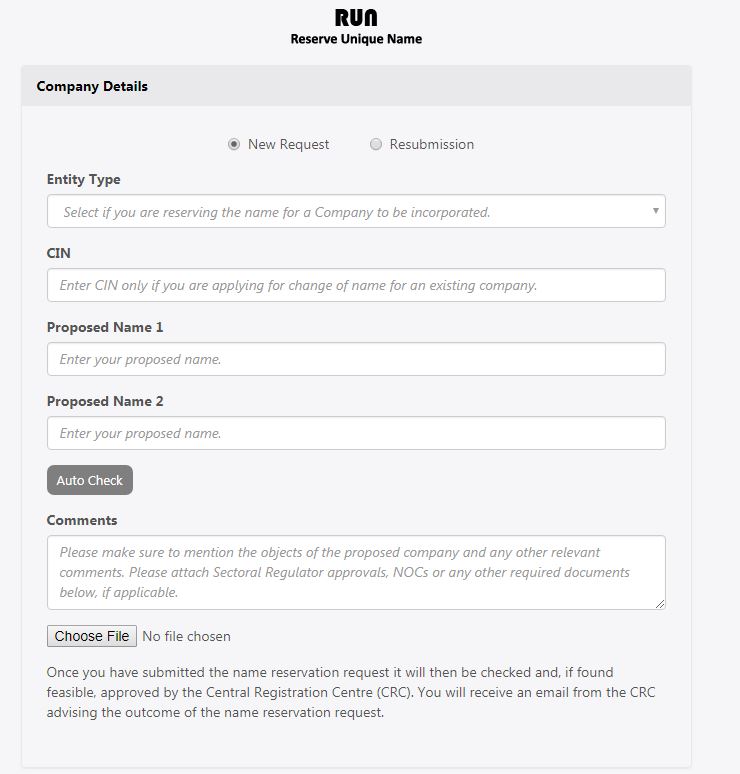

Form RUN

Form RUN is filed for the reservation of the name of the proposed company. Furthermore, applicants can access the free name search facility available on the MCA portal before quoting the name in the form. Moreover, the Registrar may on the basis of information and documents filed as an application, reserve the name for a period of 20 days from the date of the application.

Form INC-12

Form INC-12 is filed for obtaining the license to operate as a Section 8 company. Along with this form for, applicants are required to attach following documents:

- Draft MOA as per Form INC-13

- Draft AOA

- Declaration as per Form INC-14 (Declaration from Practicing Chartered Accountant)

- Declaration as per Form INC-15 (Declaration from each person making application)

- Estimated Income & Expenditure for next 3 years.

- List of Promoters and directors of company.

In addition, subscription pages of the MOA and AOA shall be signed by each subscriber. Along with their name, address, description, and occupation, in the presence of at least one witness

Section 8 Company Incorporation Form INC-7

The e-form INC-7 deals with the incorporation of the new company. However, the name of the proposed company should also be reserved with MCA before initiating the filing of INC-7. The following information and documents are to be attached along with INC-7:

- Memorandum and articles of the company duly signed by all the subscribers.

- An affidavit from each of the subscribers and first directors in Form -INC 9. Stating that they are not guilty of any offense or misfeasance.

- Declaration in Form INC 8 that all the requirements of the Companies Act have complied.

- Form INC 22 for proof of registered office address (Rental agreement, sale deed etc.).

- Address and Identity proofs of all the subscribers to MOA and first directors of the company.

FAQs

Registrars of Companies of respective jurisdictions are authorized to issue licenses to Section 8 Companies. Furthermore, they have been delegated with the powers of the Central Government to issue a license to Section 8 Companies.

a Section 8 Company?

No. Rule 20(1) of the Companies (Incorporation) Rules, 2014 states that only a limited company registered under this Act or under any previous company law shall make an application to the Registrar for the issue of license. Therefore, a company with unlimited liabilities cannot be registered as a Section 8 Company.

Yes, Section 8 Company can receive donations. These companies are a form of a non-profit organization. Therefore they can avail of several tax exemptions. Especially the donors who contribute to such companies. Hence, under Section 80G of the Income Tax Act, 1961, the donors can claim the tax benefit against the donation they have made to the company.

Hello @Heer_Mandaliya

In order to incorporate a Section-8 Company, following forms are required:

You can read more about provisions governing a Section-8 Company here:

Hope this helps!