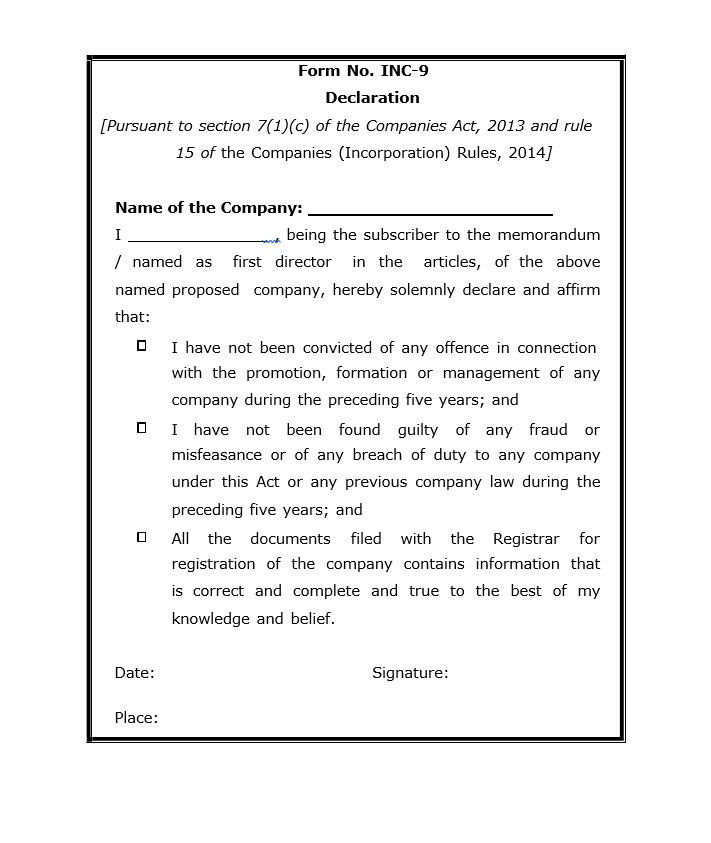

While filing SPICe INC-32 form for incorporation of a company, Form INC-9 for declaration by Subscriber / First Director of a company needs to be attached. It is a mandatory attachment while filing SPICe INC-32 on MCA Portal. This declaration contains the following information:

- Name of Proposed Company,

- Declaration regarding the Correctness of Information Provided in SPICe Form,

- Name of the Subscriber/ First Director,

- Declaration regarding No Conviction or Offence Registered under Companies Act, 2013

- Declaration regarding No Fraud or Misfeasance Committed under Companies Act, 2013

Who needs to attach INC-9?

Form INC-9 needs to be attached by all the proposed companies while filing SPICe INC-32. Following individuals needs to provide INC-9:

- All the subscribers of the new company,

- All the First Directors of the new company.

Notarized and Apostilled INC-9 is only required in case of NRI Subscriber/ First Director.

Form No. INC-9 – Subscriber Declaration

When to attach Form INC-9?

INC-9 needs to be filed as an attachment to SPICe INC-32. Hence it needs to be prepared and signed by subscriber/ first director before the filing of SPICe INC-32.

Steps to Attach Form INC-9 – Subscriber Declaration

Since this is an attachment of SPICe INC-32. You first need to gather Declaration from all the Subscribers and First Directors of the company. Create a single PDF file of the same. And follow the below steps.

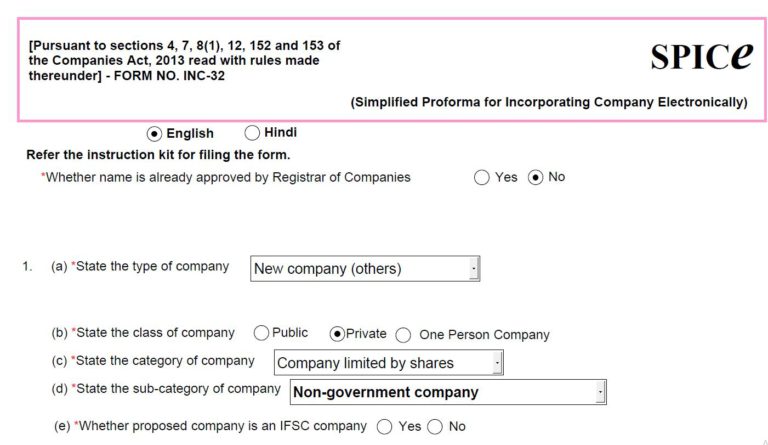

- Open SPICe Form INC-32

Open the SPICe Form INC-32 – form for incorporation of company

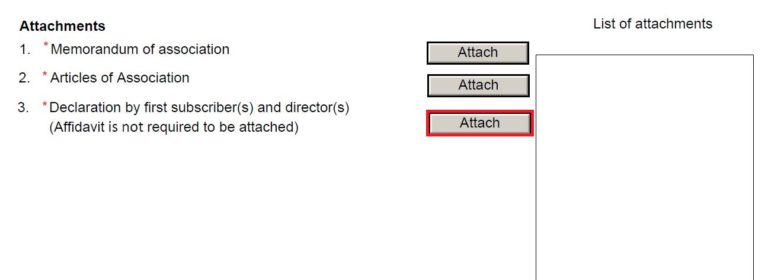

- Navigate to Attachments

Go to Attachments, click on Attach against Declaration by first subscriber(s) and director(s)

FAQs

Affidavits as per Section 7(1)(c) of the Companies Act, 2013 is not required. Only declaration by the first subscriber(s) and director(s) in form INC-9 is mandatory.

Declaration by the subscribers and the first directors in INC – 9 shall now be auto-generated in PDF format and submitted electronically.

INC-9 shall be auto-generated in pdf format and would have to be submitted only in electronic form in all cases, except where:

(i) Total number of subscribers and/or directors is greater than 20 and/or

(ii) Any such subscribers and/or directors has neither DIN nor PAN

Hey @Dixita

Yes, INC-9 is an e-Form to be filed at the time of incorporation along with other incorporation forms. Care must be taken that the forms are through the ‘Linked Forms’ category on MCA and in the following order:

Hope this helps!