Taxes are the backbone of any economy as they are the main revenue source for nations, especially developing nations like India. Income tax forms a major part of the revenue collected by the government which is utilised for developing infrastructure, controlling inflation, and many more. As responsible citizen of the country, everyone liable to pay income taxes should fulfill their obligations.

The taxpayer can pay taxes like Self-Assessment Tax, Advance Tax, TDS, TCS, etc.online through the E-filing portal or offline through the bank counter method. Through the e-pay tax option on the portal, taxpayers can pay tax online via net banking, debit card, UPI and credit card.

A taxpayer will be able to pay tax online by generating the challan (CRN) in two ways, via, pre-login or post-logging into the E-filing Portal.

How to Pay Tax without logging into the e-Filing Portal?

From the following steps, a taxpayer can pay tax online without logging into the e-Filing portal using a debit/credit card, net banking, or UPI from an authorized bank.

- Visit the e-Filing portal homepage

Navigate to e-pay Tax

- Enter the details

Enter PAN / TAN, confirm it and a mobile number linked with PAN (on which OTP will be sent), and click on Continue

- Enter the OTP

Enter the six-digit OTP received on the entered mobile number and click on Continue

- Verify the details

After the OTP verification, a success message will be displayed with PAN / TAN and name, click on Continue to proceed

- Select the type of tax payment

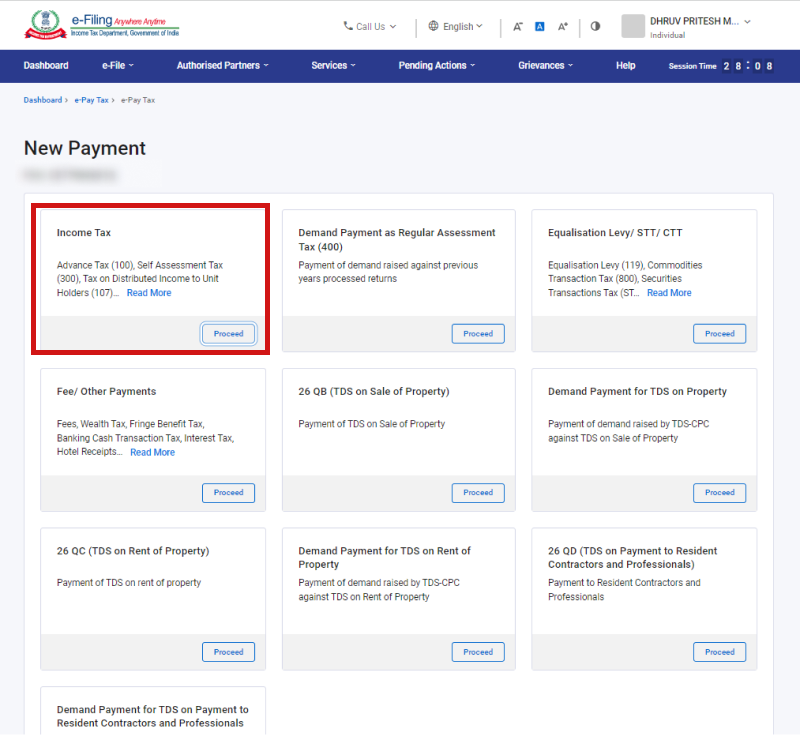

On the dashboard, click Proceed on the type of tax payment applicable.

- Select the Year and Type of Payment.

Now, select the Assessment Year and the Type of Payment (Minor Head) and click Continue

(The options in the dropdown are subjective to what type of payment is selected in step 5) - Tax Break-up details

On the screen, enter the Tax Break Up Details and click Continue

(Make sure the amount is not zero) - Choose payment method

Navigate to convenient payment mode from multiple tabs including Net Banking, Debit Card, Pay at Bank Counter, RTGS/NEFT, or Payment Gateway, and select the bank and, click Continue

- Verify payment details.

On the preview page, a taxpayer can verify the Payment Details and Tax Break Details and click on Pay Now to proceed

- Make tax payment

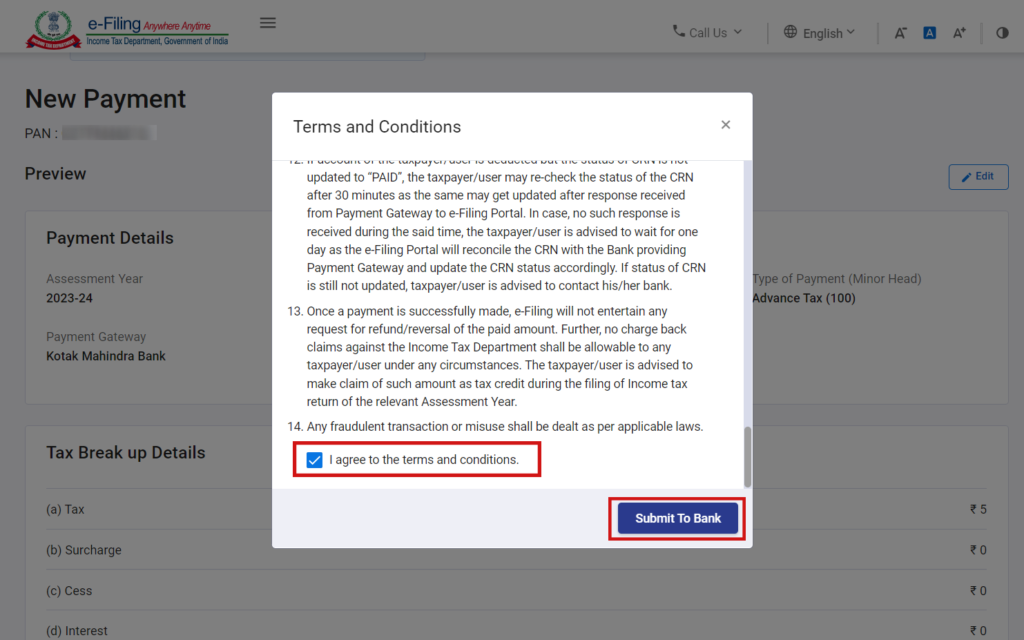

Read and select the Terms and Conditions and Click Submit to Bank (taxpayer will be redirected to the selected bank website to make the payment)

- Payment Successful.

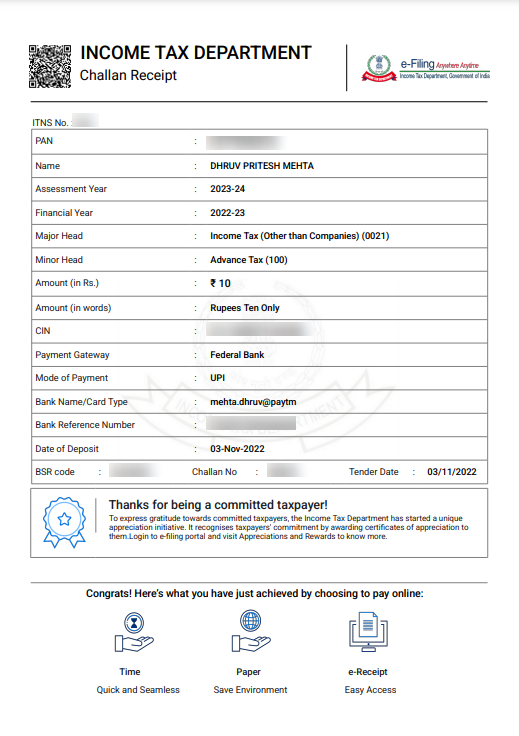

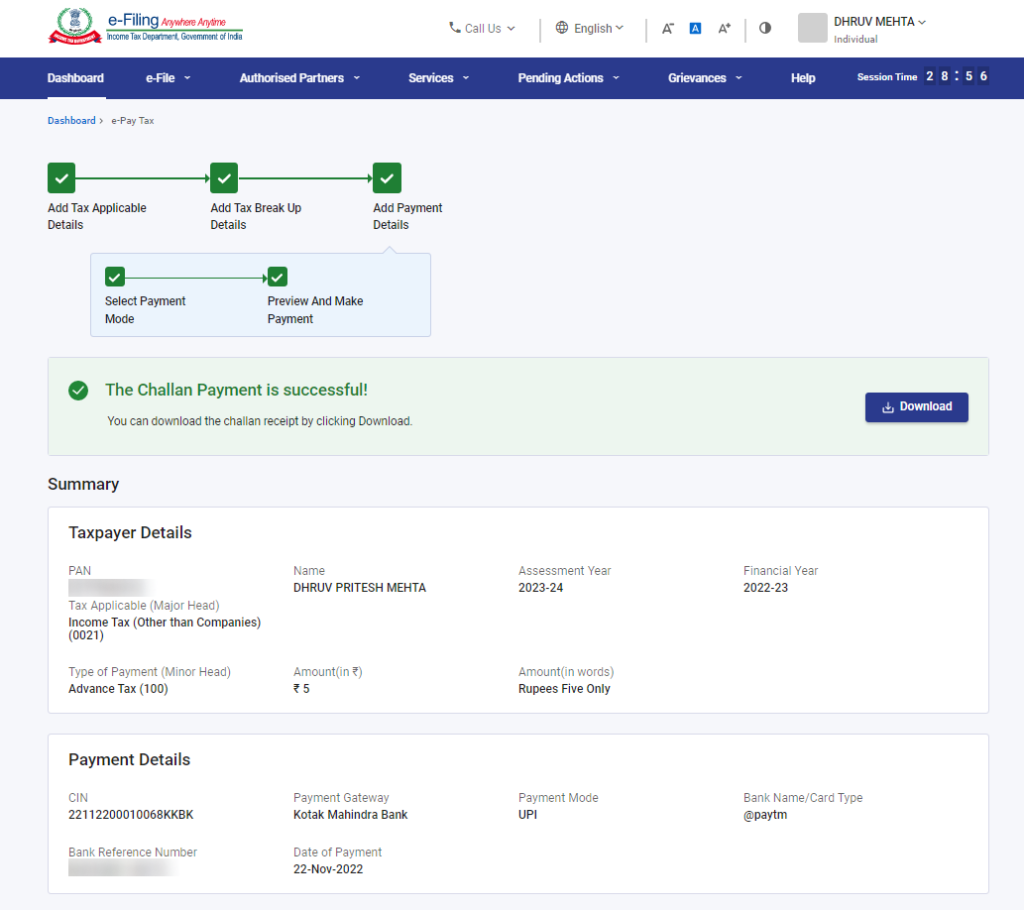

The taxpayer can view details under the summary section and download the Challan Receipt for future reference.

How to Pay Tax by logging into the e-Filing Portal?

(a.) Steps to pay tax by creating a New Challan Form

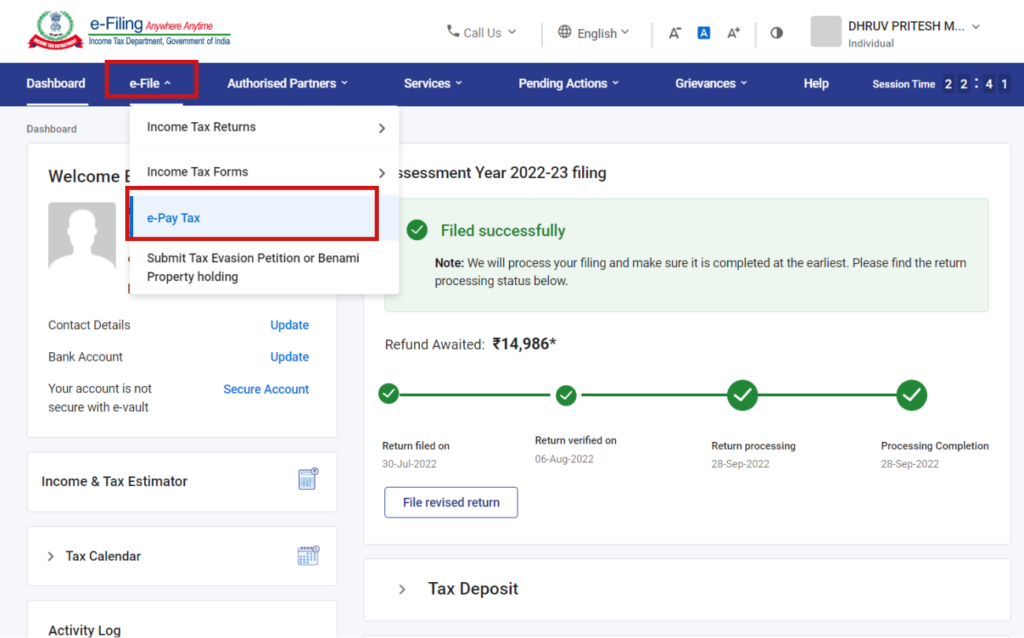

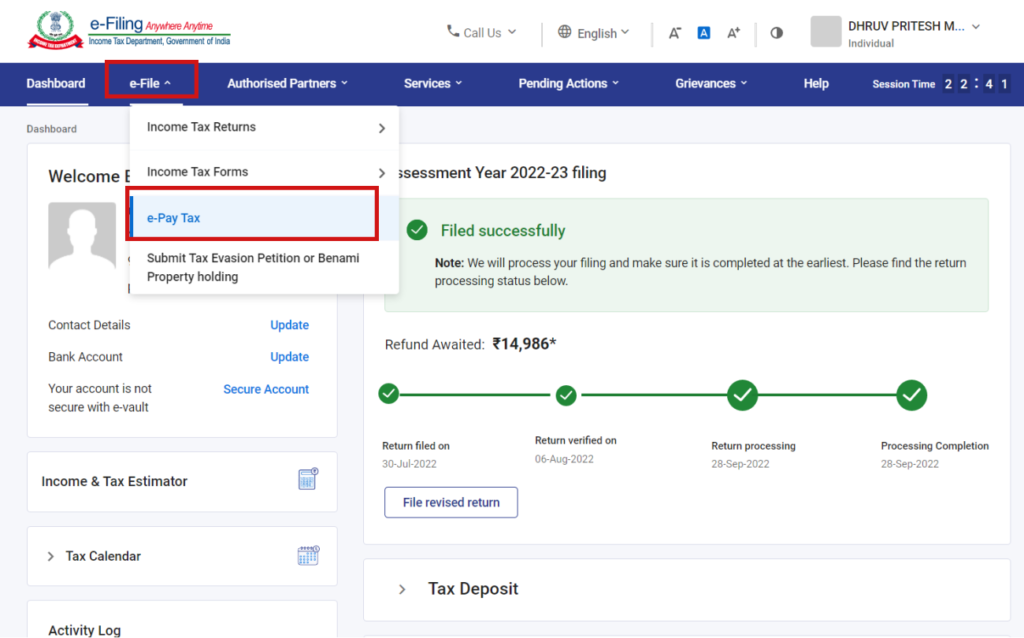

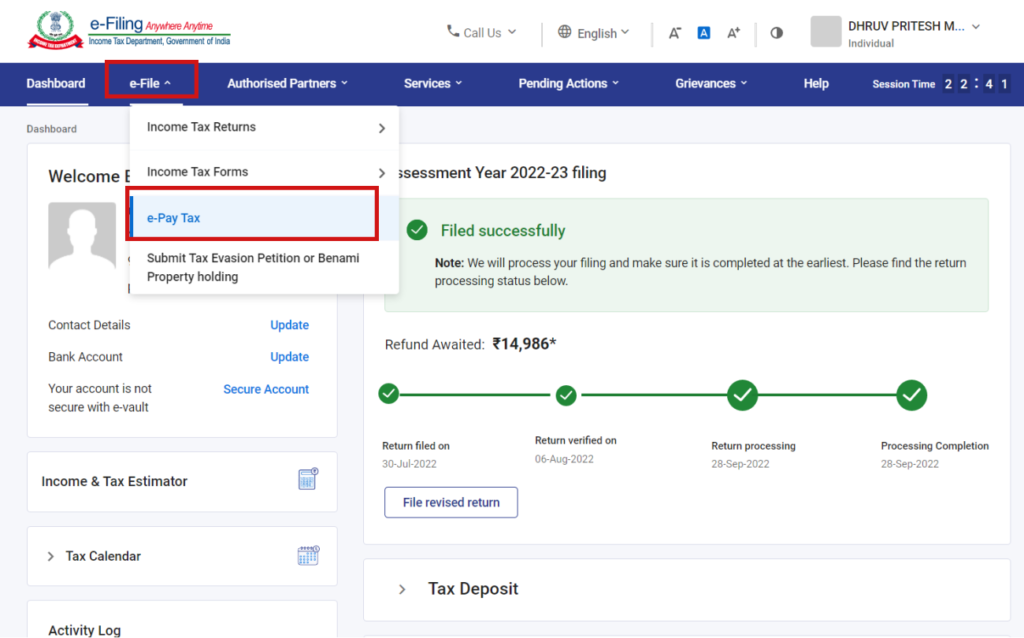

1. Login into the e-Filing Portal with PAN/ Aadhar/ User Id and Password. On the dashboard, navigate to e-File > e-Pay Tax

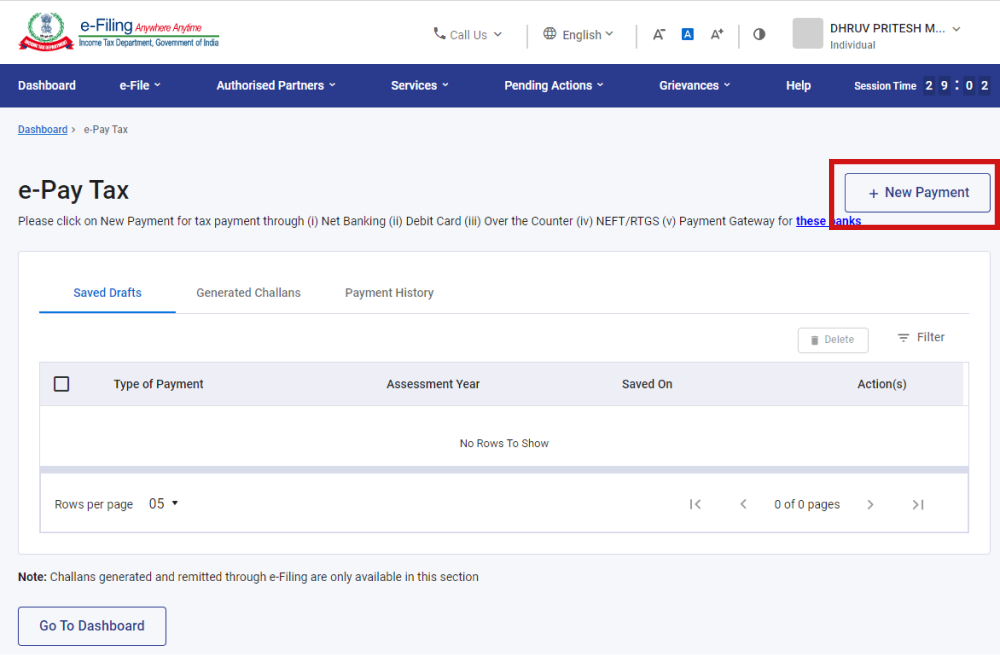

2. On the screen, taxpayer can view details of Saved Drafts, Generated Challans, and Payment History, click on the New Payment option to create a new Challan Form (CRN)

3. On the dashboard, click Proceed on the type of tax payment applicable.

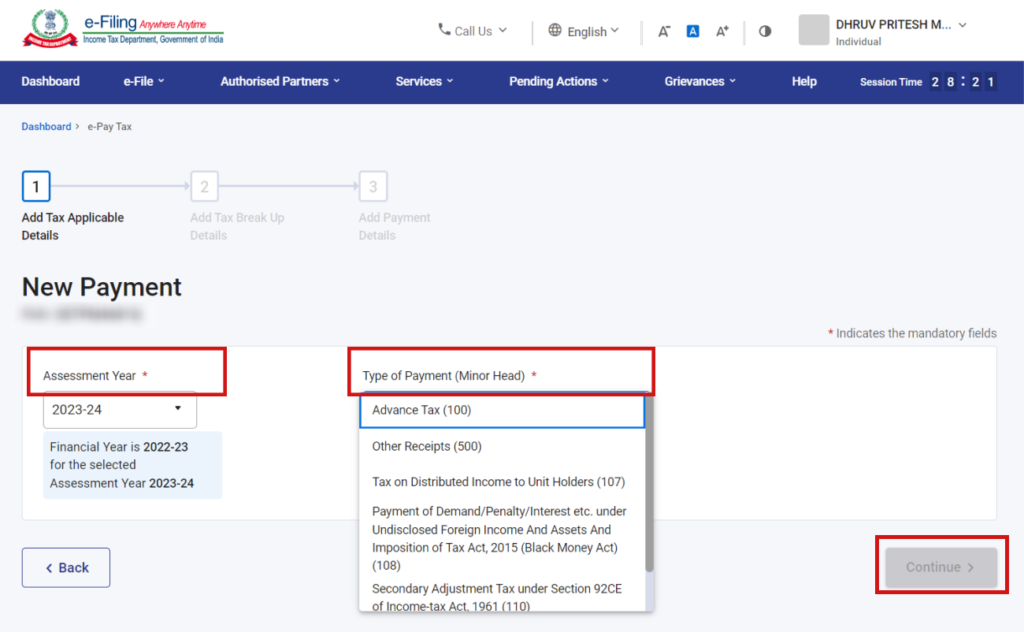

4. Now, select the Assessment Year and the Type of Payment (Minor Head) and click Continue

(The options in the dropdown are subjective to what type of payment is selected in step 3)

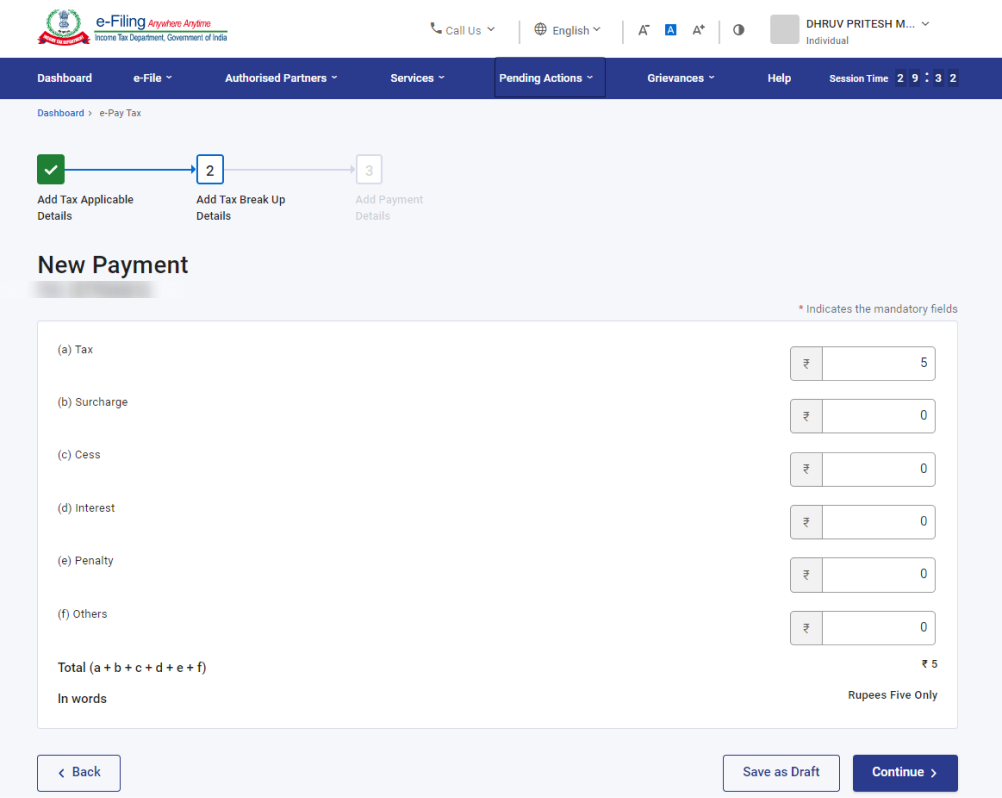

5. On screen, enter the Tax Break Up Details and click Continue

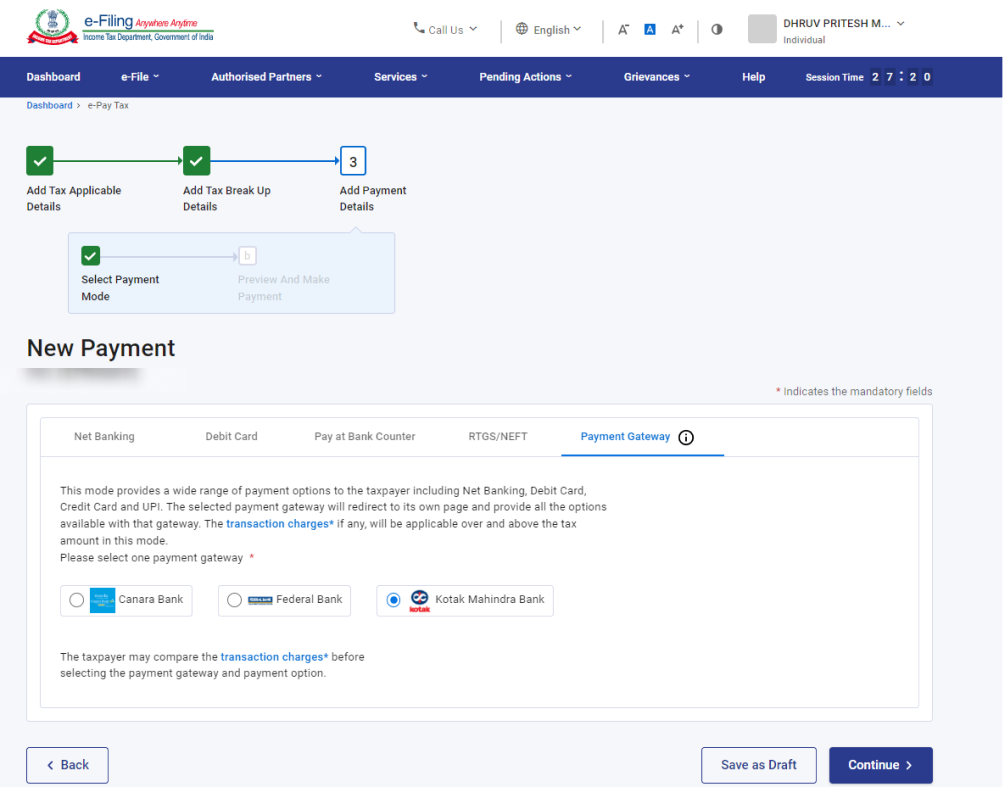

6. Navigate to convenient payment mode from multiple tabs including Net Banking, Debit Card, Pay at Bank Counter, RTGS/NEFT, or Payment Gateway, and select the bank and, click Continue

Note:

- Only authorized banks have access to the Net Banking and Debit card facilities; for all other banks, the online tax payment options are RTGS/NEFT or Payment Gateway.

- For the Pay at Counter option, payment above 10,000/- is not allowed through cash. The particular mode of payment does not apply to a taxpayer being a company.

- Moreover, the Pay at Counter option doesn’t apply to a person to whom provisions of section 44AB of the Income-tax Act, 1961 are applicable as per Notification 34 / 2008 of CBDT.

- The Payment Gateways option will direct to its own page and provide all the available options including net banking, debit card, credit card, and UPI.

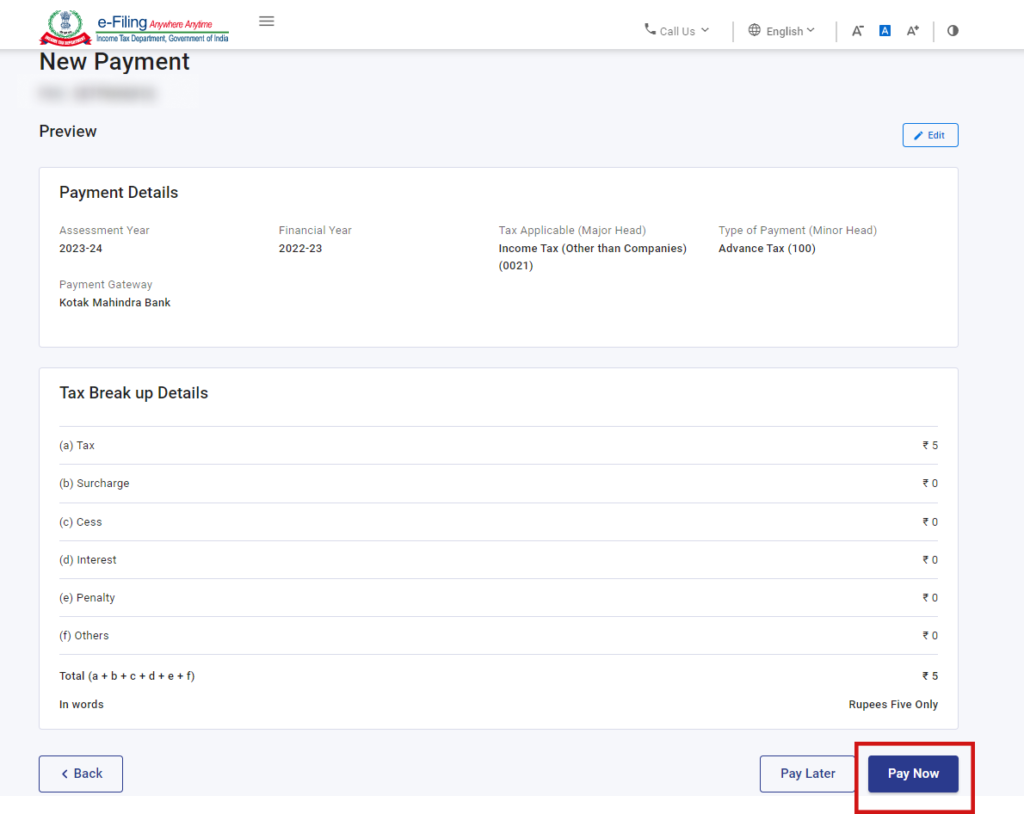

7. On the preview page, verify the Payment Details and Tax Break details and click on Pay Now to proceed

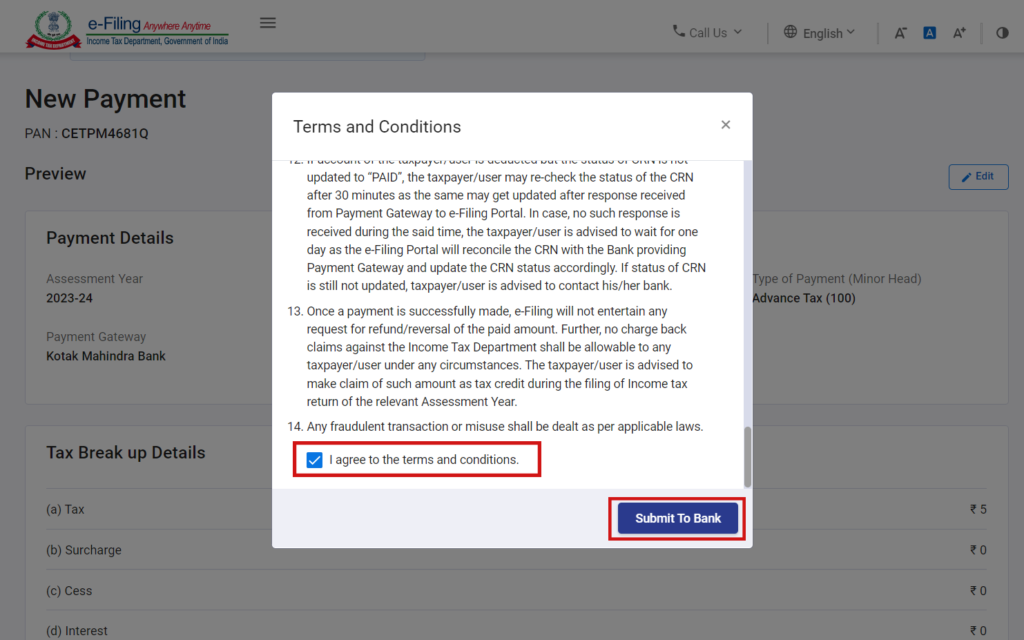

8. Read and select the Terms and Conditions and Click Submit to Bank (taxpayer will be redirected to the selected bank website to make the payment)

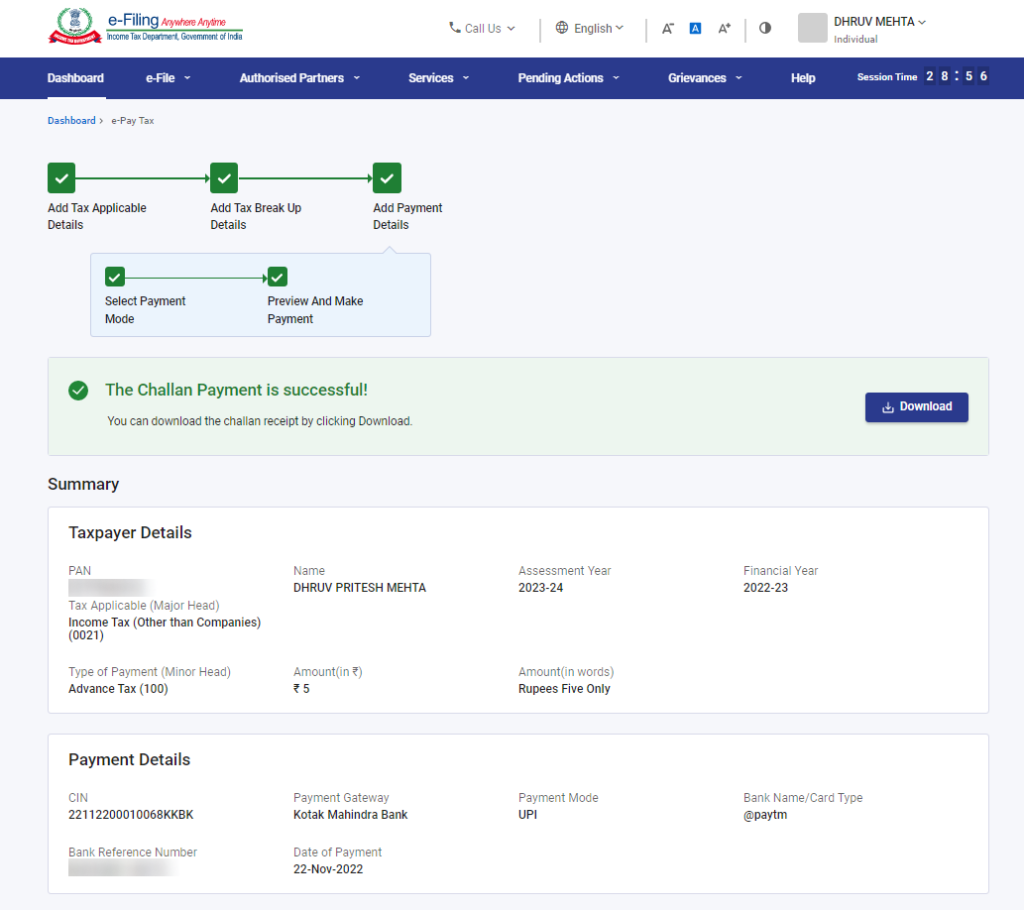

The taxpayer can view details under the summary section and download the Challan Receipt for future reference

(Taxpayer will receive a confirmation message on your email ID and Mobile number registered with the e-Filing portal.)

(b.) Steps to pay tax for previously Saved Drafts

1. Login into the e-Filing Portal with PAN/ Aadhar/ User Id and Password. On the dashboard, navigate to e-File > e-Pay Tax

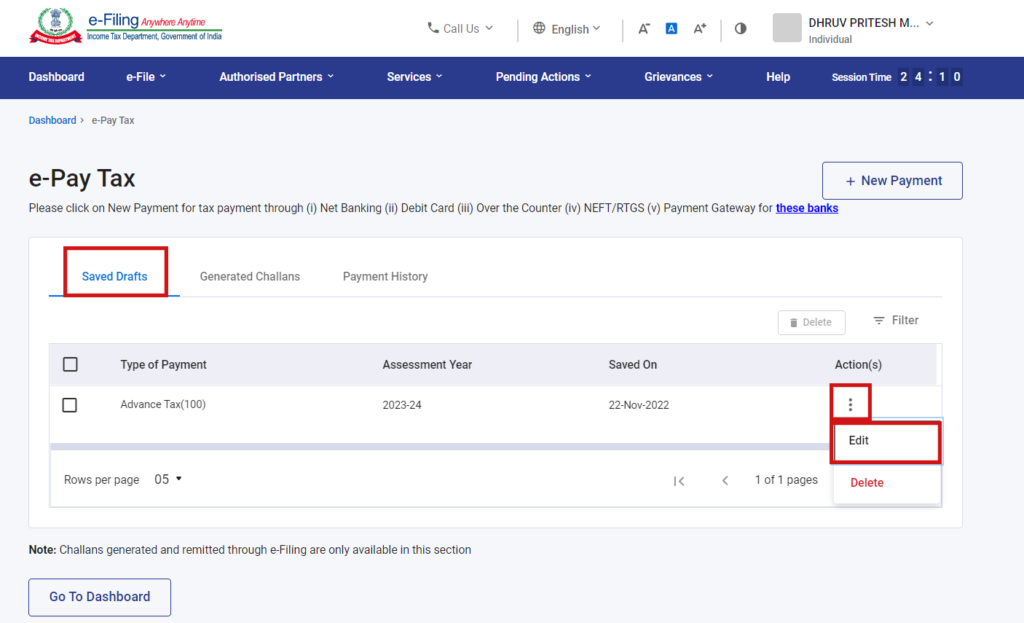

2. On the screen, view details of Saved Drafts, Generated Challans, and Payment History, navigate to the Saved Drafts menu, click on three dots > Edit under the Action(s) column for the draft selected.

(These are the drafts that have been saved while creating a new Challan Form for which challan has not been generated, taxpayers can resume from the step left.)

3. On Add Tax Applicable Details page Select the Assessment Year and the Type of Payment (Minor Head) and click Continue

4. Now, follow steps 5 to steps 8 from (a.) Steps to pay tax by creating a New Challan Form.

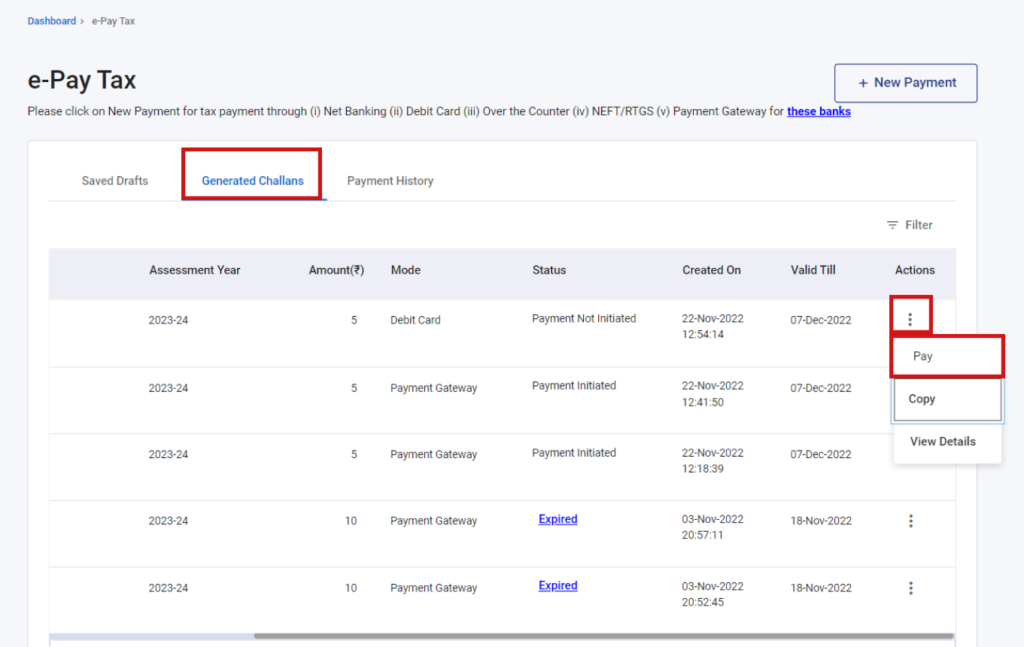

(c.) Steps to pay tax for previously Generated Challan Forms (CRNs)

1. Login into the e-Filing Portal with PAN/ Aadhar/ User Id and Password. On the dashboard, navigate to e-File > e-Pay Tax

2. On the screen, view details of Saved Drafts, Generated Challans, and Payment History, navigate to Generated Challans menu, and click on three dots > Pay under the Action(s) column for the draft selected.

(These are the generated challans for which the payment has not been made, by clicking on Pay taxpayer can resume the payment from the saved challans)

3. Read and select the Terms and Conditions and Click Submit to Bank (taxpayer will be redirected to the selected bank website to make the payment)

The taxpayer can view details under the summary section and download the Challan Receipt for future reference

(Taxpayer will receive a confirmation message on your email ID and Mobile number registered with the e-Filing portal.)

FAQs

Taxpayer can download the challan receipt (pdf file) by login into the e-Filing portal

Navigate to e-File > e-Pay Tax > Payment History menu, and click on three dots > Download under the Actions column for the challan selected.

There are convenience charges and goods and services tax (GST), which is applicable as per the terms and conditions prescribed by the respective Originator Bank and subjective to certain payment methods.

Tax payments can be made using:

– Debit Card and Net Banking from an authorized bank,

– RTGS/NEFT

– Payment Gateway (includes Debit Card / Credit Card / Net Banking of Non-Authorized Banks or UPI)

Hi @Manoj_Kumar12

To file and pay the taxes for AY 2023-24, it is not yet enabled on the e-Filing Portal.

Meanwhile, on Quicko, you can begin Prepare your Income Tax Return

and E-File your ITR.

Quicko is an online DIY tax planning and filing platform.

Here’s how you can pay tax online.

You can also book a MEET for expert assistance with your taxes.

Hope this helps.

Hey @Hemanth_S,

The E-mail generated is regarding a tax payment that was initiated but was not completed. However, in case you have already paid the tax and the challan has been generated, there is no action required to be taken from your end.

I received this mail today, what does this mean, any action needed from my side ?

and one more email i received previous

Hi @dontknow

It seems to be like a reminder email from the ITD for the challan generated by you but the payment is not done.

You will be able to see your challan details on your e-filing portal.

In case you’re not aware of this, as mentioned in the email please reach out to the ITD on the mentioned number.

I paid self assessment tax for AY2023-24 in July23 online & filed my return in which the ax paid was auto captured by the system. However on sept23 second week i received a mail from tax depp stating that the amount of self assessment tax paid is kept on hold as bank has not responded so contact bank. E mail query to bank was confirmed as intimated to tax deptt, please contact recipient. Tax challan status still shows as no record found. Please inform what is the remedy to further resolve the impasse.

Hey @A_K_Lalla,

In such a case, you can confirm with the bank if the payment was successful and check if the amount is debited from your account.

If the payment was successful, you can raise a grievance on the IT portal and get in touch with them on the helpline number as well. Moreover, you can also get in touch with your AO(assessing officer) and seek guidance.

Hello @Robin_Ghosh,

No, Self Assessment Taxes paid cannot be carried forward to the next financial year.

If there had been excess TDS, that can be carried forward.

Hi @TeamQuicko

During generating challan for self assessment tax (300) from IT website, the page has 6 options - TAX, SURCHARGE, CESS, INTEREST, PENALTY & OTHERS. The final amount is the sum of all the 6 items.

Now, is it mandatory to bifurcate the amount in the applicable heads ? Will it be ok if I put the entire amount in “TAX” heading and keep Cess, Interest etc. as zero ?

Hello @Kaustav_M

No, it is not mandatory to bifurcate the tax amount. You can only put the entire amount in the tax column.

Hope this helps!

For self assessment tax ,it is o.k to put the entire amount in " Tax" heading and keep cess, interest etc as Zero.