As it usually takes a month from the date of filing for the Income Tax Department (ITD) to process tax returns. The taxpayers who have filed their Income Tax Return (ITR) for the Financial Year 2018-2019 onwards can update or change certain details in their ITR form. These updates can be made prior to the processing of the return. The user can change details of:

- Bank Account Details

- Address Details and,

- E-Mail ID/Mobile Number Details

Steps To Change ITR Form Details

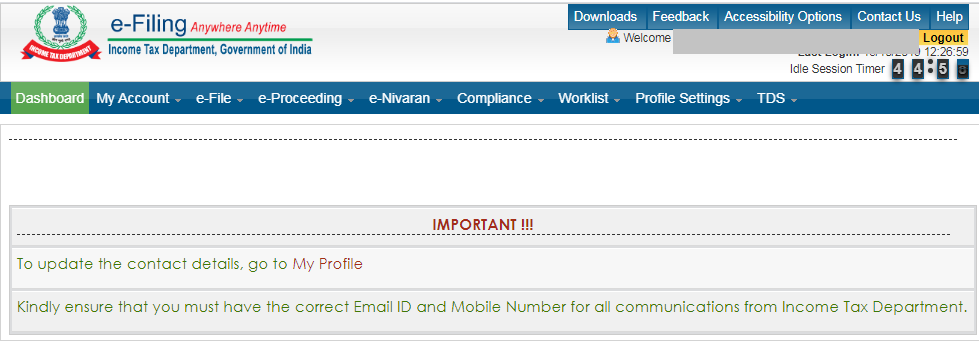

- Go to Income Tax e-Filing Portal

Log in using valid credentials.

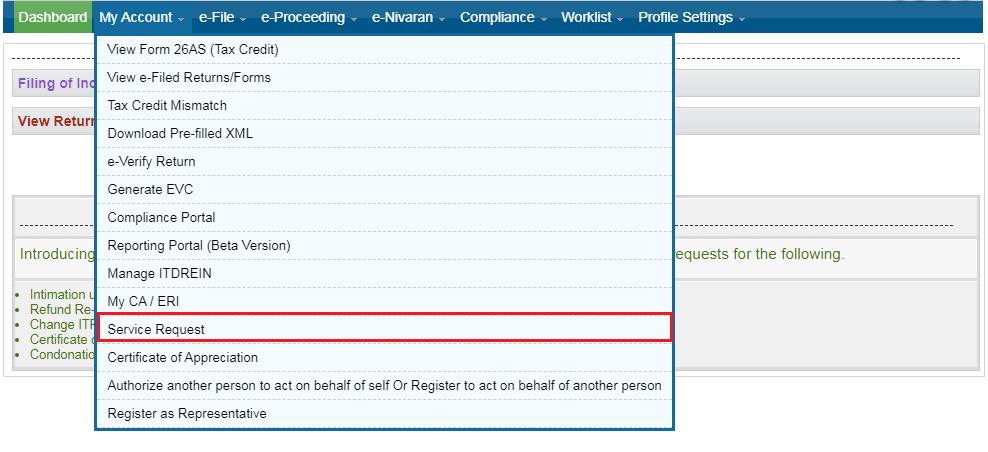

- Click on My Account

Go to Service Request

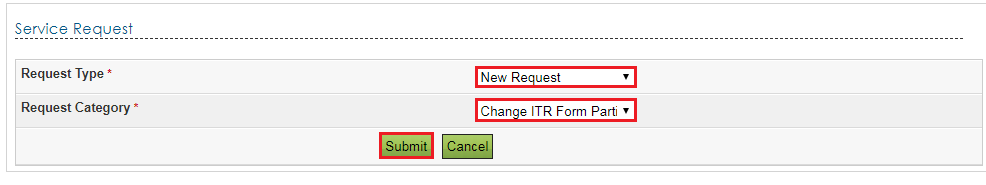

- Select “New Request” from the drop-down list.

Select “Change ITR Form Particulars” from the drop-down list.

- Click on submit

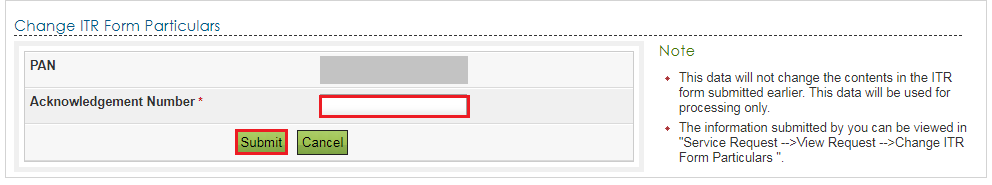

Enter the acknowledgment number

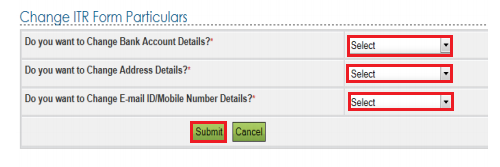

- Enter the correct details in the respective field

Bank Account Details, Address Details or E-Mail ID/Mobile Number and click on submit.

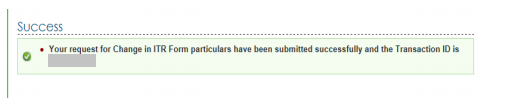

- A success message will be displayed on the screen.

The process is finished.

FAQs

Yes. A taxpayer can make changes to filed ITR before it gets processed by the CPC Bangalore. You can make changes online from Income Tax E-filing Portal or by filing Revise ITR.

No. You can only make changes to primary information using change in ITR Form Particulars function.

A taxpayer can file ITR online using any of the following options:

1. Visiting Income Tax E-filing Portal,

2. Using ITR Utility issued by the IT Department,

3. Using Online Platforms like Quicko.

Hey @TeamQuicko

Thanks for the blog! Just one quick question - Why do we have to report a quarterly breakdown of Dividend Income under IFOS?

Thank you!

Hey @TanyaChopra

This quarterly breakdown of Dividend Income under IFOS will help to calculate and determine penalty u/s 234C for the delay in payment of Advance Tax.

Hope this helps!

I had received dividend recently but I had noticed that TDS had been deducted. any idea as to why has it happened and is there a way I can claim this TDS?

Hey @HarshitShah

After the introduction of Budget 2020, dividend income is now taxable in the hands of the shareholder; and is also subject to TDS at 10% in excess of INR 5000 u/s 194 & 194K. Foreign Dividend is taxable at slab rates. TDS is not applicable to such dividends. The taxpayer should report such income under the head IFOS in the ITR filed on the Income Tax Website.

Hope this helps!

Hey @HarishMehta

Yes, dividend income is now taxable from FY 2021-22 onwards and it has to be reported under the head of IFOS.

You can read more about it here:

Hi @Maulik_Padh,

You need to pay Income tax on the net taxable income, i.e. after subtracting deductions, expenses, etc.

If the net taxable income is negative i.e. if there is loss, you can carry it forward when filing the ITR

Here are some of the articles which might help

Hi @ameyj

The amount of TDS deducted shall reflect in your Form 26AS only and it will also reflect the name of the deductor.

Using the name of the deductor you can find out on which share you have received the dividend and you can also cross-check the same in your bank statement.

Yes, you are right, TDS is to be deducted when the dividend paid exceeds 5000 INR in a financial year. However, the 5,000 INR limit pertains to all the dividends an individual gets in a year, or the total dividend per shareholder that a company pays out in a year, is left to interpretation, and hence registrars and share transfer agents (RTA) are not taking any chances and are deducting TDS even on small amounts.

Hope this helps

Hi @ameyj

You can submit a grievance on Income Tax Portal mentioning the issue and also attach the 26AS.

The other option is to leave it as it is and clarify it when the tax department sends the notice.

Hi @TeamQuicko

Consider that I have 10 shares each of 10 different Indian companies. Each of the 10 companies are declaring a dividend of INR 100 before the FY ends. Now I will be recieving 1000 as dividend from each company, thereby a total of 10,000.

The 5,000 dividend limit, is it applicable to each company / total dividend recieved by me in a year. If it is applicable to each company, then I would not attract TDS of 10% for dividend.

Also pl clarify, how would the company B know that I have got shares of Company A,C,D,E so on…

@Saad_C @Laxmi_Navlani @Divya_Singhvi @Kaushal_Soni @AkashJhaveri can you help with this?