H&R Block is a global online tax filing platform. It started its first Global Technology Center in India in October 2017. They had served the Indian market with various services, some of which have been mentioned below:

- DIY Tax Filing

- CA Assisted Tax Filing

- Informative Youtube videos & Articles

Although they have been involved in the Indian market for a couple of years now, they have decided to discontinue their services to the Indian taxpayers.

If you are an existing customer of H&R Block, you don’t need to worry about your tax preparation for the upcoming Financial Year. You can take the help of Quicko.

Given below are the services that are offered by us at Quicko:

Our DIY – Do It Yourself ITR filing allows you to simply upload your Form 16 on our platform and file your ITR within few minutes. You can also get our CA assistance on the same.

Our DIY- Do It Yourself TDS filing allows you to fill TDS Return required details like your TAN and PAN and employee’s details on our platform and file TDS Return within few minutes. You can also get our CA assistance on the same.

Our DIY- Do It Yourself GST filing allows you to generate invoices, built purchase orders, keep records, view reports, etc on our platform and file your GSTR within few minutes. You can also get our CA assistance on the same.

Taxpayers can avail all these services with our CA assistance. Following are some of the CA assisted plans:

Individuals, in order to file their ITR, have to own a PAN. Therefore without PAN one cannot file their ITR. Even NRIs are required to have their PAN. You can apply for PAN with the help of Quicko and get our CA Assistance on the same.

Proprietorship businesses and Entrepreneurs who wish to get the status of a company have to register their businesses with the Ministry of Corporate Affairs (MCA). You can apply to register your business with Quicko and get CS Assistance on the same.

You can now do Error-free bulk PAN verification with Quicko and get CA Assistance on the same.

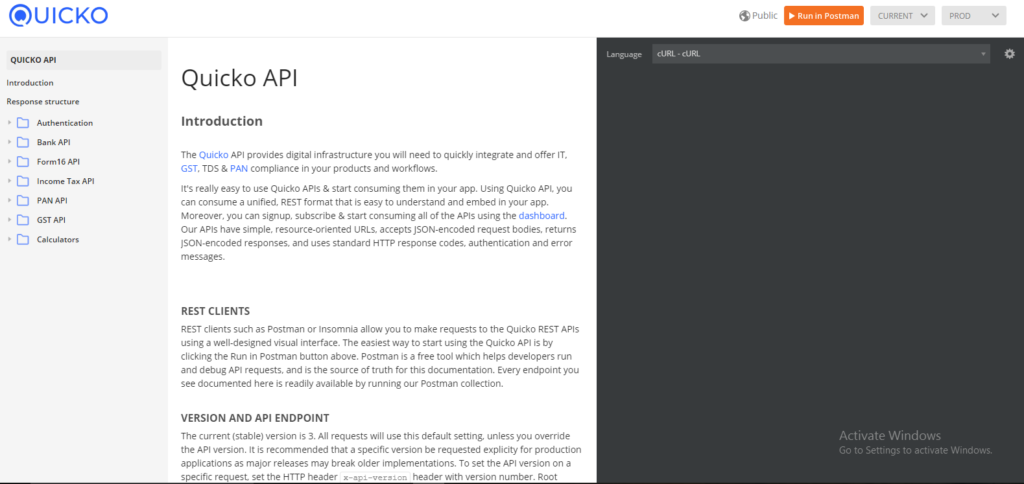

- APIs

- Provision of GST APIs

- Simple, RESTFul APIs to verify GSTIN details, create e-invoice, upload GSTR & reconcile ITC.

- Provision of PAN APIs

- The easiest way to verify PAN online by using Self-Served REST APIs. Provides seamless customer KYC and error-free payroll.

- Provision of GST APIs

Apart from that, we also believe in high engagement with customers, being up to date with the trends and providing them with higher customer satisfaction.

Hence, the following are some initiatives taken by us:

We at Quicko are on a mission to simplify taxes for all.