To understand your trading activity and its income tax compliance, you need documents like a Capital Gain statement, Tax P&L, Contract Note, and Ledger / Account Statement. However, before you get any of these documents you need to create your HDFC Securities Account and log in.

This article will guide you through the following:

How to download Tax Profit and Loss Report?

A Tax Profit & Loss Report is essential to calculate taxes on trading income. This report has details such as Date, Time, Script Name, Purchase price, Sale price, Segment and Quantity that help determine the Income Tax on Trading.

- Step 1: Log in to your HDFC Securities platform

- Step 2: Click on ‘Portfolio‘ then choose ‘Profit and Loss Statement‘

- Step 3: Now, select the Financial year, Asset Type, and other necessary filters and click on ‘Submit’

- Step 4: Then, click on Export Excel on the top right to download the report

File Your Tax Return

On Time , Online on Quicko.com

Open Your Account Today

File Your Tax Return

On Time , Online on Quicko.com

Open Your Account Today

How to download Contract Note for HDFC traders?

HDFC Securities sends a contract note for all transactions executed on the stock exchange to the respective trader. However, you can download it from their portal as well.

- Step 1: Visit the HDFC Securities portal and login to your account

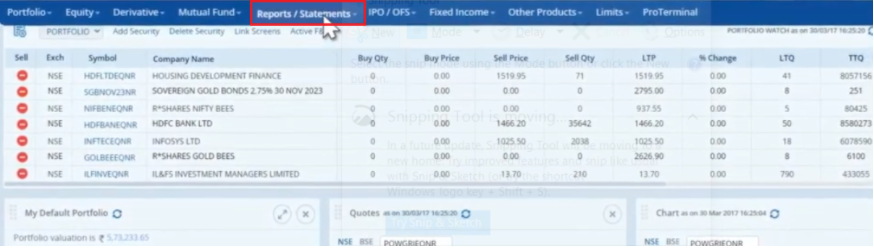

- Step 2: Next, click on ‘Reports/Statements‘ from the top ribbon

- Step 3: Then, click on ‘Common Contract Notes’ from the drop-down list

- Step 4: Enter the from and to dates in respective boxes and click on the ‘View Report‘ option

- Step 5: Finally, click on the ‘Contract Note Number‘ to view the report

FAQs

This statement is used to calculate your Tax liability. Therefore, it is needed to file ITR2 or 3.

A Demat account holds securities and certificates of stocks, shares, etc electronically while a Trading account lets you buy or sell those securities in the stock market.

No. The Contract Turnover is the sum of the purchase value and sales value. It is not considered for income tax purposes. However, the Trading Turnover or Business Turnover is the absolute profit i.e. the sum of positive and negative differences. Hence, this turnover is considered to determine the applicability of the tax audit and the applicable ITR form. Therefore, Trading Turnover is different from Contract Turnover.

HDFC

HDFC

Hey @TeamQuicko

Thanks for the blog! Just one quick question - Why do we have to report a quarterly breakdown of Dividend Income under IFOS?

Thank you!

Hey @TanyaChopra

This quarterly breakdown of Dividend Income under IFOS will help to calculate and determine penalty u/s 234C for the delay in payment of Advance Tax.

Hope this helps!

I had received dividend recently but I had noticed that TDS had been deducted. any idea as to why has it happened and is there a way I can claim this TDS?

Hey @HarshitShah

After the introduction of Budget 2020, dividend income is now taxable in the hands of the shareholder; and is also subject to TDS at 10% in excess of INR 5000 u/s 194 & 194K. Foreign Dividend is taxable at slab rates. TDS is not applicable to such dividends. The taxpayer should report such income under the head IFOS in the ITR filed on the Income Tax Website.

Hope this helps!

Hey @HarishMehta

Yes, dividend income is now taxable from FY 2021-22 onwards and it has to be reported under the head of IFOS.

You can read more about it here:

Hi @Maulik_Padh,

You need to pay Income tax on the net taxable income, i.e. after subtracting deductions, expenses, etc.

If the net taxable income is negative i.e. if there is loss, you can carry it forward when filing the ITR

Here are some of the articles which might help

Hi @ameyj

The amount of TDS deducted shall reflect in your Form 26AS only and it will also reflect the name of the deductor.

Using the name of the deductor you can find out on which share you have received the dividend and you can also cross-check the same in your bank statement.

Yes, you are right, TDS is to be deducted when the dividend paid exceeds 5000 INR in a financial year. However, the 5,000 INR limit pertains to all the dividends an individual gets in a year, or the total dividend per shareholder that a company pays out in a year, is left to interpretation, and hence registrars and share transfer agents (RTA) are not taking any chances and are deducting TDS even on small amounts.

Hope this helps

Hi @ameyj

You can submit a grievance on Income Tax Portal mentioning the issue and also attach the 26AS.

The other option is to leave it as it is and clarify it when the tax department sends the notice.

Hi @TeamQuicko

Consider that I have 10 shares each of 10 different Indian companies. Each of the 10 companies are declaring a dividend of INR 100 before the FY ends. Now I will be recieving 1000 as dividend from each company, thereby a total of 10,000.

The 5,000 dividend limit, is it applicable to each company / total dividend recieved by me in a year. If it is applicable to each company, then I would not attract TDS of 10% for dividend.

Also pl clarify, how would the company B know that I have got shares of Company A,C,D,E so on…

@Saad_C @Laxmi_Navlani @Divya_Singhvi @Kaushal_Soni @AkashJhaveri can you help with this?