Employee Pension Scheme, better known as EPS was launched in 1995 by the Employees Provident Fund Organisation ( EPFO ). It is a scheme for salaried employees to make them self reliant at the time of retirement by providing a regular source of income. The benefit of this scheme can be availed only after completing 10 years of service and after the age of 58. As a part of your EPF account, the employer is supposed to contribute 12% of your salary. This 12% is further divided into 8.33% for EPS and 3.67% for EPF. This article will take you through all the important aspects associated with EPS 95.

It is important to note that as of September 1, 2014, monthly EPS is calculated on the employee’s actual salary if less than INR 15,000 and on INR 15,000 if salary exceeds this limit. Therefore, the maximum EPS contribution can be INR 1,250 per month.

What is the Eligibility Criteria to Avail EPS Benefits?

One must fall under the following criteria to be eligible to avail the benefits of their Employee Pension Scheme:

- A minimum of 10 years in service

- Must be a member of EPFO

- Age of retirement is 58. Although, one can also withdraw their EPS balance at the age of 50 years

Availing pension can also be extended for 2 years i.e. till the age of 60. If this extension is done then the pension is available at an additional 4% every year. Moreover, if you have worked for less than 10 years but are unemployed for more than two months then you can withdraw from your Employee Pension Scheme.

How is the Pension under the Employee Pension Scheme Calculated?

The pension amount is calculated on the basis of the pensionable salary and pensionable service.

Monthly Salary = Pensionable Salary X Pensionable Service/70

Pensionable Salary

Pensionable salary is the average monthly salary of the employee in the last 12 months of service.

Let us assume that Purva’s monthly salary is INR 15,000 and the EPS contribution is 8.33%. Therefore, in this case, the pensionable salary will be INR 1249.5 ~ to INR 1250 [(15,000*8.33)/100 = 1249.5] and her annual pensionable salary will be INR 15,000 (1250*12)

Pensionable Service

Pensionable Service is the actual service period that the employee has served. It is important to note that if an employee withdraws the EPS before completing the minimum service period, i.e., 10 years and switches to a new company, the contribution for the EPS scheme will have to be reset. The employee also needs to get the EPS Scheme Certificate every time he switches a job. It is important to keep in mind:

- The pensionable service period is calculated on a 6 months basis

- The minimum pensionable service period is 6 months

- Employees are also rewarded an additional 2 years of pensionable service for completing 20 years in service.

If the service period is 9 years and 4 months, then the pensionable service period considered is 9 years. However, if the service period is 9 years and 7 months, the pensionable service period is taken as 10 years.

Now, in the case of Purva let us assume her service period is 9 years and 7 months so, her monthly pension will be:

INR 15,000 (annual pensionable salary as calculated in the Pensionable Salary section) * 10 (years of Pensionable Service)/70= INR 2,142.85

What are the Types of Pensions Available under the Employee Pension Scheme?

There are mainly four different types of pensions available under the Employee Pension Scheme:

- Widow Pension: Under this, the pension will be available to the spouse after the demise of the employee. The spouse (widow) will receive the pension amount until death or remarriage. The minimum amount available under this pension is INR 1000.

- Child Pension: Child pension as the name suggests is given to the dependent child of the deceased employee. This pension is 25% of the widow pension and the child can receive it till he/she turns 25. The child pension is generated along with the widow pension.

- Orphan Pension: If the deceased employee does not have a surviving spouse, then the pension amount is received by the children. The orphan pension is not more than 75% of the widow pension. The benefit is available to two surviving children from oldest to youngest.

- Reduced Pension: If an employee after turning 50 decides to withdraw the pension, then they will receive the pension amount at a slashed rate of 4% for every year that is less than 58 years. This is known as a reduced pension. For example, if one withdraws their EPS amount at the age of 55 then he will get the pension at a rate of 88% (100% – 3*4) of the original pension amount.

How can I check my Employee Pension Scheme amount?

Follow the below-mentioned steps to check your EPS amount at any given point:

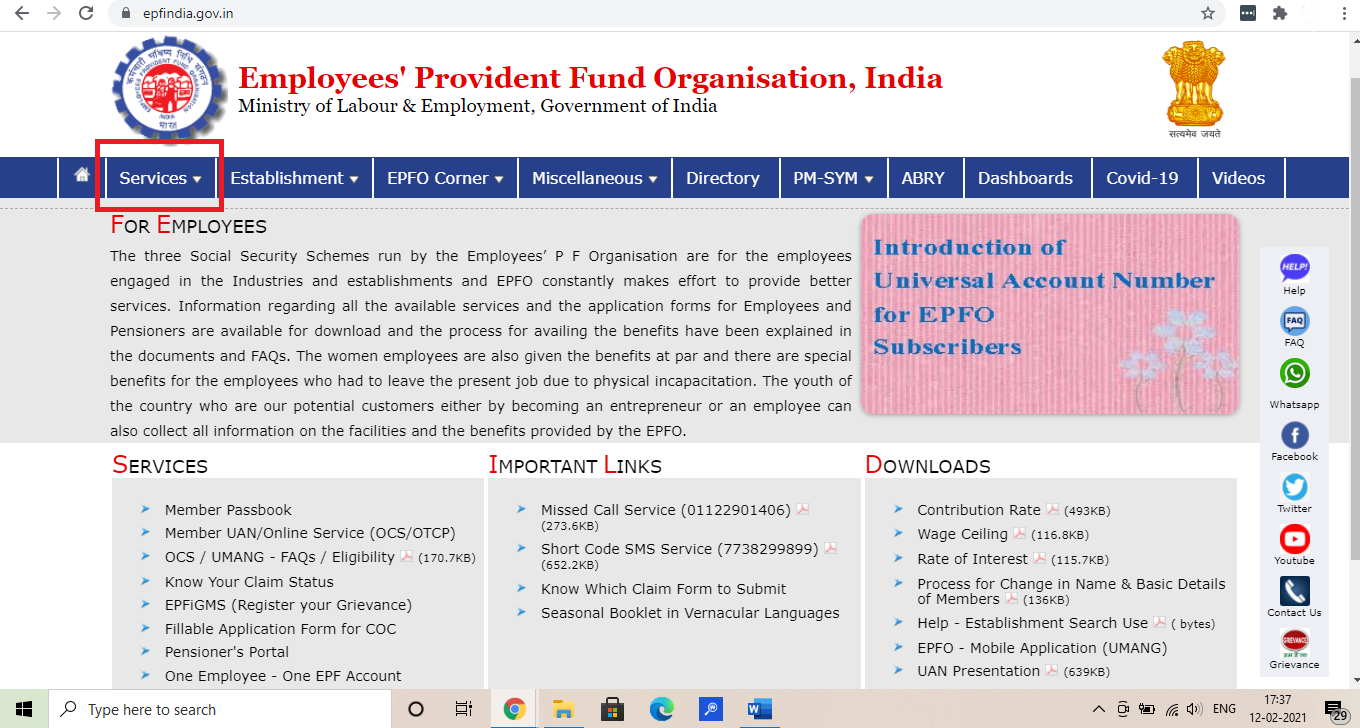

- Visit Employees Provident Fund Organisation Portal

Go to Employees Provident Fund Organisation Portal

- Click on ‘Services’

Now click on ‘Services’

- Select ‘For Employees’

Click on ‘For Employees’

- Go to Member Passbook

Under ‘Services’ click on Member Passbook

- Add your UAN and Passoword

Enter your UAN and Password

- Select ‘Member ID’ and see you EPS Amount

Click on the concerned Member ID and you can now see your EPS amount in your Pension Contribution column

You can also check your EPS amount in your EPS account passbook as well. You can download the passbook from the EPF pensioners portal.

FAQs

Yes, you are eligible for claiming orphan pension at 75% of the pension that would have been paid to your parent/parents.

Your Member ID of the EPF account is the same for EPS account. Your EPF, as well as, EPS contributions are deposited under the same Member ID.

In order to transfer EPS online, you have to log in to the EPF employee portal. Once logged in, you can request the transfer on the job change via the composite claim form. The amount will automatically be transferred to your new account.

Hey @sushil_verma

There are a wide range of deductions that you can claim. Apart from Section 80C tax deductions, you could claim deductions up to INR 25,000 (INR 50,000 for Senior Citizens) buying Mediclaim u/s 80D. You can claim a deduction of INR 50,000 on home loan interest under Section 80EE.

Hey @Dia_malhotra , there are many deductions that you can avail of. Your salary package may include different allowances like House Rent Allowance (HRA), conveyance, transport allowance, medical reimbursement, etc. Additionally, some of these allowances are exempt up to a certain limit under section 10 of the Income Tax Act.

For eg,

Tax on employment and entertainment allowance will also be allowed as a deduction from the salary income. Employment tax is deducted from your salary by your employer and then it is deposited to the state government.

The benefit Section 80EEB can be claimed by individuals only. An individual taxpayer can claim interest on loan of an electric vehicle of up to INR 1.5 lacs u/s 80EEB. However, if the electric vehicle is used for the purpose of business, the vehicle should be reported as an asset, loan should be reported as a liability and the interest on loan can be claimed as a business expense irrespective of the amount. (We have updated the article with the changes).

Thus, if you have a proprietorship business, you should claim interest amount as a business expense only if the vehicle is used for business purpose. However, if it is used for personal purpose, you can claim deduction of interest u/s 80EEB in your ITR since you would be reporting both personal and business income in the ITR (under your PAN).

As per the Income Tax Act, the deduction under Section 80EEB is applicable from 1st April 2020 i.e. FY 2020-21.

Hey @Sharath_thomas , we have updated the content according to the appropriate assessment year. Thanks for the feedback.

No issues. You’re welcome!

Hey @shindeonkar95

In case of capital gain income (LTCG/STCG), transfer expenses are allowed as deduction, except STT.

However, in case of business income (F&O, intraday), all expenses incurred for the business (including STT) are eligible to claim deduction in ITR.

Hope, it helps!

Hello,

Is it possible to claim deductions under S. 80CCF for Infra bonds bought in the secondary market and held to maturity?

There were a number of 10 year infra bonds issued in the 2010- 2013 period, which will start maturing soon. These are all listed on the exchanges (although hardly any liquidity or transactions in them). If I were to buy some of these bonds in the open markets and hold them in my demat to maturity (<3 years), is it possible to claim tax deductions (upto 20k per year) under 80CCF for buying?

I couldn’t find anything on this. Any help is appreciated.

Hello @Veejayy,

Yes you can claim deduction under 80CCF for investment made in specified infrastructure and other tax saving bonds bought in the secondary market and held to maturity.

Deduction under Section 80CCF can be availed only through investment in certain tax saving bonds, issued by banks or corporations after gaining permission from the government which shall be restricted upto 10,000 per year.

These bonds are generally long term bonds, having tenure of more than 5 years with a lock in period of 5 years in most of the cases. These bonds can be sold after the lock in period!

Also, interest earned on these bonds will be taxable.

Hope this helps!

Hi, I need to file my income tax for FY21, I am using Quicko platform for filing, I wanted to confirm if the ELSS investment amount for the FY21 is to be added in the section 80C, since I already the amount of Rs30,072 , should I add my ELSS amount to this existing amount and submit the total

Hey @Sheirsh_Saxena, yes, the investment amount needs to be added under 80C.