The e-Filing Vault Higher Security service is available to registered users to enable higher security of their e-Filing portal account. The Vault adds a second level of authentication when logging into the e-Filing account and second factor authentication for password reset through one of the following options:

- Net Banking

- Digital Signature Certificate (DSC)

- OTP on mobile number registered with Aadhaar

- Bank Account EVC

- Demat Account EVC

Steps to Set Up e-Filing Vault Higher Security

- Visit the e-Filing Portal

Login to the account using valid credentials.

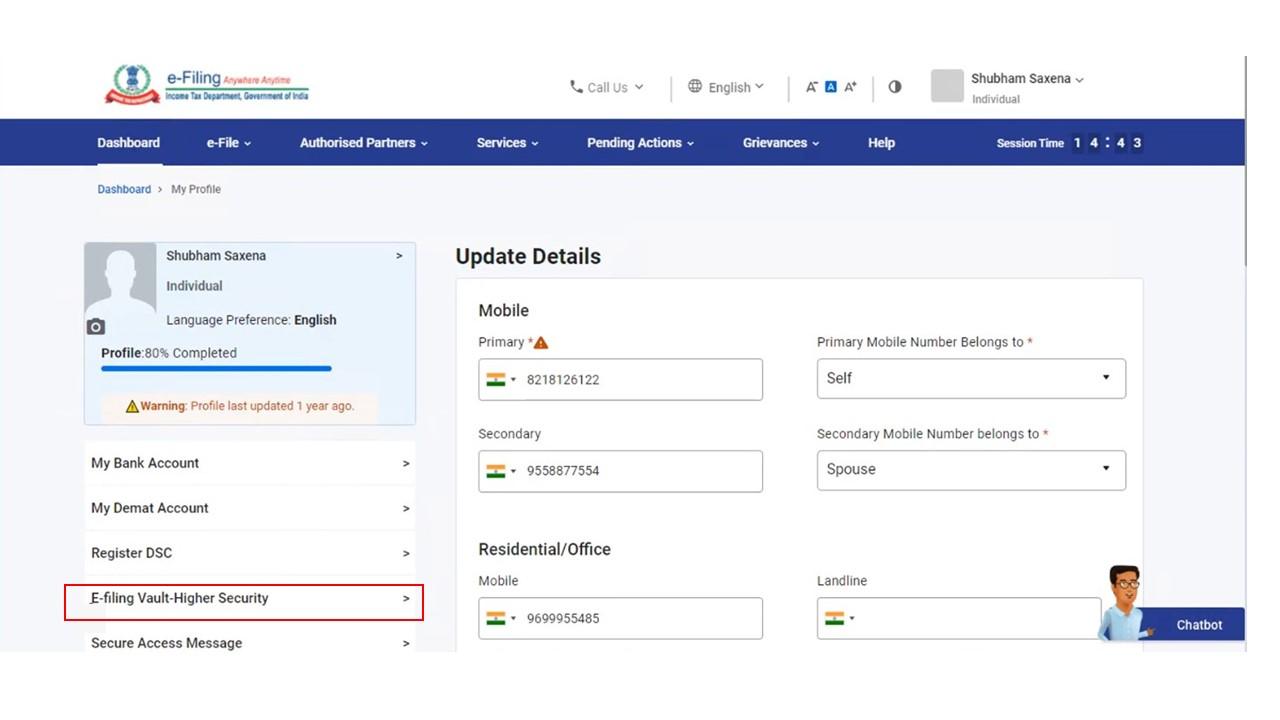

- e-Filing Vault Higher Security

Navigate to the My Profile page from the dashboard and click on the e-Filing Vault Higher Security option.

- Options to Enable e-Vault Higher Security

1. Enable OTP on Mobile Number registered with Aadhaar

2. Enable Bank Account EVC / Demat Account EVC / DSC / Through Net Banking

3. Deselect Higher Security Options - Enable OTP on Mobile Number registered with Aadhaar

After selecting this option, select the higher security option that you would like to apply. If you prefer second factor authentication using OTP on mobile number registered with Aadhaar, select that particular option.

- Pop up message

A popup message is displayed stating you need to be authenticated through Aadhaar OTP. Click Ok.

- Validate OTP

Generate the Aadhaar OTP if you don’t already have it and enter the 6 digit code and click on validate.

- Enable Bank Account EVC / Demat Account EVC / DSC / Through Net Banking

In the Set Higher Security for Login and Set Higher Security for Password Reset sections, select the higher security option that you would like to apply.

- Successful Validation

Based on the option selected, on successful validation, an information message is displayed. Click Ok.

- Deselect Higher Security Options

On the e-Filing Vault Higher Security page, you will see the option you selected for second-factor authentication for Login and Password Reset. Deselect the options where you do not need higher security and click Continue.

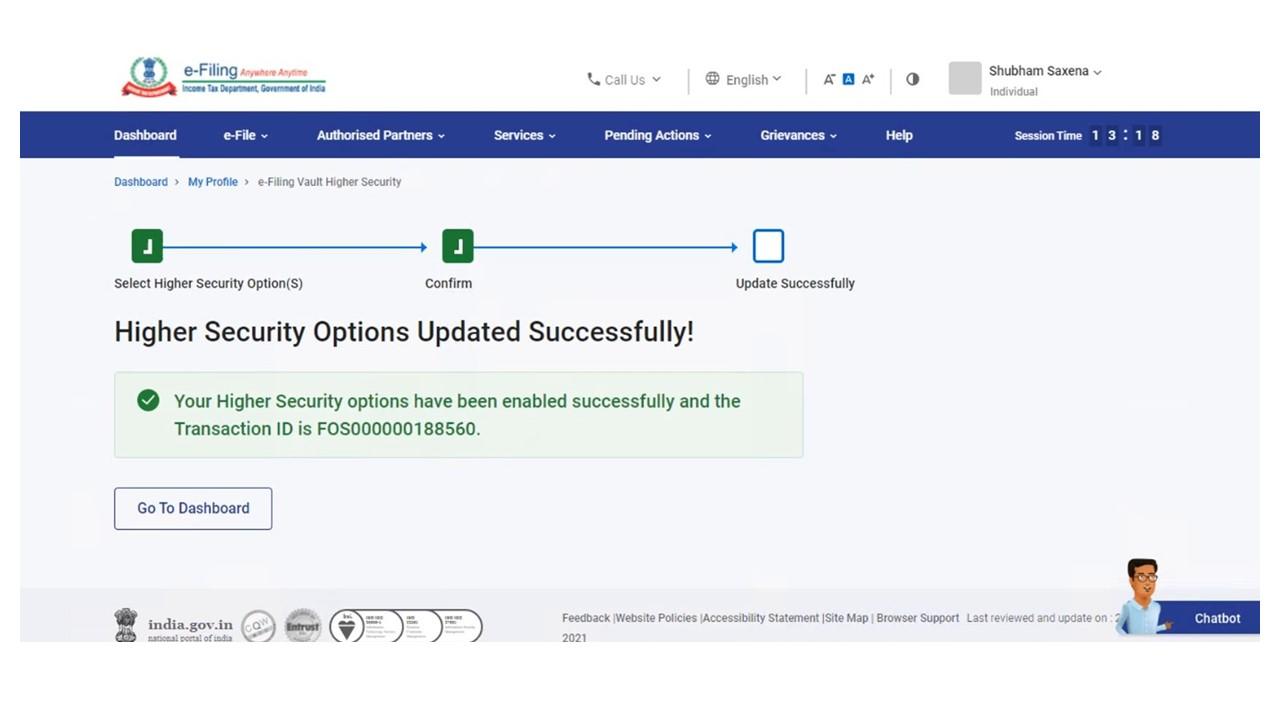

- Confirm the changes

On doing so, you will receive a success message on the screen which will also contain the transaction ID.

FAQs

Second-factor authentication is a functionality to enable higher levels of security to your e-Filing account. This ensures another level of security apart from validating the user ID and password registered on the e-Filing portal. Using e-Filing vault service, you may choose the login option which will appear by default whenever you try to login.

While multiple higher security methods can be opted by you for login and password reset, you are required to choose one from the options opted while actually logging in to the e-Filing portal or resetting your password.

You will have to choose the higher security options again in the new portal as the same information is not migrated owing to technical reasons. If you prefer to choose DSC as a higher security option, you will have to first register the DSC on the new e-Filing portal.

Hey @TeamQuicko

Can you tell me about ITD’s new ITR filing utility for AY 2021-22?

Hey @HarshitShah

To improve the tax filing process, the Income Tax Department has decided to do away with the excel and java-based utility and has launched a new offline JSON-based utility for the AY 2021-22. The new utility will help taxpayers import prefilled data and edit it before filing the income tax return (ITR).

The taxpayers can download the pre-filled data from the income tax e-filing portal and fill in the rest of the data. This imported prefilled data can be edited to change basic information such as address and all. Currently, the utility can be used to file ITR1 to ITR 4. ITD has also released a step-by-step guide to using the utility.

Hope this helps!

Is it possible to file ITR online without an account on the Income Tax e-filing portal?

What should be done in case of discrepancies in actual TDS and TDS credit under Form 26AS?

Hey @Amitabh_Verma

It is mandatory to create an account on the Income Tax e-filing portal to file your ITR online. It is a hassle-free quicko process. One can register on the portal by providing relevant details such as user type, PAN, first name, surname, date of birth, and fill in the registration form.

Hey @Niraj

Many times mismatches and discrepancies in actual TDS and TDS credit under Form 26AS happen because of wrong information provided in the TDS return. One can approach the employer/deductor to file a revised TDS return after making the necessary corrections.

The income-tax department allows an assessee to mention the reason for mismatch in the online portal in answer to a notice sent by them.

Hope this helps!

Hi, actually I filed ITR 1(A.Y. 2013-14) due to notice served in Jan month.

The ITR is pending for verification. Ask the options aren’t available for me client i.e Aadhar verification,evc etc. Only thing is I got my clients DSC. but option of DSC for e-verification is not showing. I can’t send CPC to Bengaluru since it will take time. How can I use DSC to e-verify my already filed return

Hi @Arsheen

The option to e-verify ITR using DSC is to be selected while filing. Once you have filed your ITR only option available for e-verification is EVC/Aadhar OTP or sending ITR V to CPC Bangalore. You have 120

days from the date of e-Filing to e-verify your ITR.

So if 120 days are not over you can send the signed ITR V to CPC Bangalore to get it e-verified and processed.

Hope this helps

Hi @Sharath

It is suggested to file ITR as NRI in India if you have trading transactions even if there are losses.

If you do not file ITR then there are high chances of your PAN getting flagged by the IT department for non-filing of ITR.

Also, If you file the ITR on time you can take benefit of carry forwarding the losses and setting off those losses against the profits in future years.

I have started an HUF by infusing funds by collecting gifts from HUF members. If I invest in Shares, Equity MF, from that Capital (Collected as gifts from members), and earn income in the name of HUF, will that income be clubbed with the income of the members?

In a way that will be the outcome of the business (trading and investing of shares) done by HUF. And there will be a degree of efforts and luck involved, not a fixed income instrument as FD, etc.