A board meeting is a formal gathering of a Board of Directors. Most of the organizations, being public or private, profit or non-profit, are ultimately governed by a body commonly known as Board of Directors. The members of this body cyclically meet to discuss strategic matters.

All Companies registered in India are required to conduct an Annual General Meeting and file the Company Annual Return with the Ministry of Corporate Affairs. In the Company’s Annual General Meeting, the Board of Directors of the Company is required to present the Directors Report to the shareholders along with audited financial statements and Auditor’s report.

Thus, review your Board Meeting Minutes immediately after the meeting. When your board meeting minutes are complete and finished, make sure they are distributed to board members as soon as possible. Once the minutes are approved by a vote of the members during the board meeting, they become part of the official record of the organization. It’s important that a copy of all minutes are kept in one place.

FAQs

The financial statement, including consolidated financial statements, if any, shall be approved by the Board of Directors before they are signed on behalf of the Board by the Chairman of the company. The Chairman is authorized by the Board or by two directors out of which one shall be managing Director if any, and the Chief Executive Officer, the Chief Financial Officer and the company secretary of the company, wherever they are appointed. In the case of One Person Company (OPC), only by one director, for submission to the auditor for his report thereon.

Only large organizations are required to produce directors’ reports. Small companies or micro-entities are exempt. A private limited company is no longer considered a small company, and must, therefore, submit a directors’ report.

Usually, the Directors’ report includes the following:

– The names of the persons who, at any time during the Financial Year, were Directors of the Company

– The amount that the Directors recommended should be paid by the way of dividend

– A statement in respect of disclosures provided to the auditors

Hey @emmy

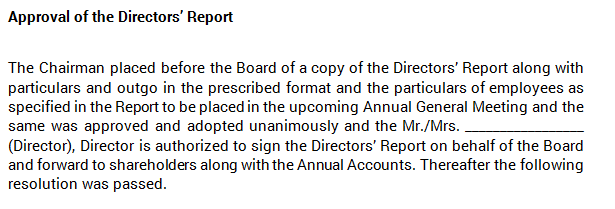

The Boards’ Report shall be approved in the Board Meeting and the Boards’ Report shall be signed by chairperson of the company if authorised, if not the report shall be signed by at least two directors, one of whom shall be a managing director, or by the director where there is one director.) and shall be signed by chairperson of the company if authorised, if not the report shall be signed by at least two directors, one of whom shall be a managing director, or by the director where there is one director.) and shalll be signed by chairperson of the company if authorised, if not the report shall be signed by at least two directors, one of whom shall be a managing director, or by the director where there is one director.) and shall be signed by chairperson of the company if authorised, if not, the report shall be signed by at least two directors, one of whom shall be a managing director, or by the director where there is one director.

Hope this helps!

Who can be director of a company?

Hello @emmy

In order to be a Director, the following conditions must be satisfied:-only an Individual can be a Director -The individual shall not be a minor -The proposed Director shall have been allotted DIN and must submit his/ her consent in DIR-2 to act as a Director -The proposed director shall be of sound mind and capable to enter into a contract and such individual shall not be an insolvent.

You can read more about provisions regarding Directors of a company here:

You can learn more about roles and duties of a director here:

Hope this helps!

Which form is to be filed in case of resignation and what is the due date?

Hi @emmy

e-Form DIR-12 needs to be filed with RoC within 30 days of resignation of a director along with a copy a certified true copy of board resolution for this purpose and resignation letter.

Hope this helps!