A board meeting is a formal gathering of a Board of Directors. Most of the organizations, being public or private, profit or non-profit, are ultimately governed by a body commonly known as Board of Directors. The members of this body cyclically meet to discuss strategic matters.

A Company is required to apply for GST under the following situations:

- Voluntary registration

- Turnover exceeds the specified limit mentioned in the law

- Claim the Input Tax Credit (ITC) levied on purchases

Once the Company receives the GSTIN from the GST department, it has to convene a Board Meeting and inform the Board regarding the GST details and record the same.

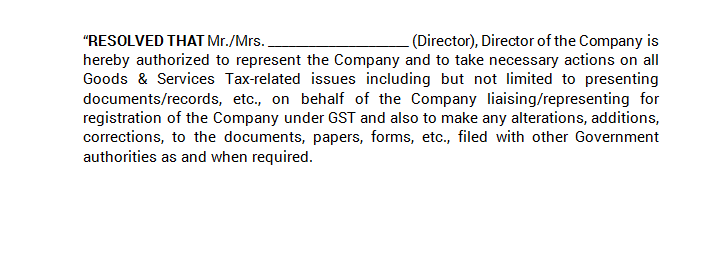

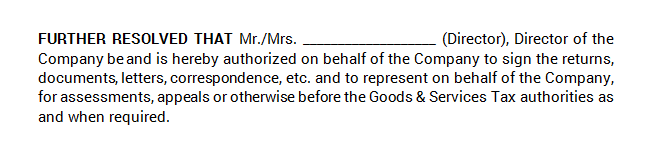

Furthermore, a resolution authorizing _______ must also be passed in the Board Meeting to authorize a person on behalf of the Company to sign the returns, documents, letters, correspondence, etc., to represent on behalf of the Company to appear before GST authorities as and when required.

Thus, review your Board Meeting Minutes immediately after the meeting. When your board meeting minutes are complete and finished, make sure they are distributed to board members as soon as possible. Once the minutes are approved by a vote of the members during the board meeting, they become part of the official record of the organization. It’s important that a copy of all minutes are kept in one place.

FAQs

Those who fail to register under GST even though they are required to mandatory to do so will have to pay a penalty equal to 10% of the tax amount or INR 10,000 whichever is more.

Once the GSTIN is obtained, every registered business must display this number on the name-board placed at the entry of its registered office or factory.

The following records/documents are to be maintained as per the GST law:

– Outward and inward supply of Goods and Services

– Stock register

– ITC availed

– Output tax payable and paid

For a particular Financial Year, accounts or records must be kept for at least 72 months from the date of the due date of filing the annual return for such Financial Year.

Hey @HarishMehta

A company can apply for GST registration while incorporation through the form AGILE PRO. It is not mandatory to apply for GST registration at the time of incorporation.

Hope this helps!

No, you don’t have to apply for GST registration when you incorporate a company. Incorporating a company and obtaining GST registration are two different steps. You need to apply for GST only if your business meets certain conditions prescribed in GST law, such as:

Many companies decide to apply for GST right after incorporation if they expect to exceed the threshold soon or need GST registration for specific business reasons, such as issuing GST invoices or calming input tax credits, so, simply incorporating does not required GST registration; it depends on the nature and scale of your business activities.