TAN is the short form for Tax Deduction and Collection Account Number. It is a 10 digit alphanumeric number, issued to a person who is required to deduct or collect tax on payments made by them. It is to be obtained by all persons who are responsible for deducting tax at source (TDS) or who are required to collect tax at source (TCS).

Who needs TAN?

Every person who deducts or collects tax at source has to apply for the TAN. Since it is mandatory to file the following documents with the Income Tax Department:

- TDS statements i.e. Return

- TCS statements i.e. Return

- Annual Information Return

- Challans for payment of TDS/TCS

- TDS/TCS certificates

As prescribed above, if a person fails to obtain or fails to quote a TAN, a penalty of INR 10,000 will be imposed.

Understand TAN Number

It is 10 digit alphanumeric number which is explained in further detail below:

- First, 4 digits of alphabets, the next 5 digits of are numeric and the last digit is an alphabet.

- The First 3 alphabets represent the jurisdiction code, 4th alphabet is the initial of the name of the holder who can be a company, firm, individual, etc. For example, it is allotted to Mr. Atul of Ahmedabad may appear as under:

The combination of all the above items give TAN it’s unique identity.

How to apply for TAN?

You can apply for TAN using Form 49B. There are two modes for form submission:

- Submit to nearest TIN Facilitation Center

- Apply online via TIN-NSDL Website

Apply via TIN-FC

An application for allotment is to be filed in Form 49B and submitted to any TIN-FC. Addresses of TIN-FCs are available at the TIN-NSDL website. You can download the Form 49B, fill it, and send it to the nearest TIN-FC.

Online Application

You can also apply online from the TIN-NSDL website. Following are the steps:

- Go to TIN NSDL

- Go to Services > TAN > Apply Online

- Prepare Form 49B with the required information

- Save the Acknowledgment, sign it and send it to TIN NSDL within 15 days.

Documents required for TAN

Following are the documents required for the application:

- PAN of applicant

- Personal Information of Deductor like Name, Address, Contact Details, etc,

- Incorporation certificate of companies

- Digital Signature Certificate (DSC) of Responsible person of Company

- Details of Responsible Person

Steps to file an Application Form for TAN on the TIN-NSDL Portal

Follow these steps to file an online application for the TAN on the TIN-NSDL portal.

- Visit the Tin-NSDL portal.

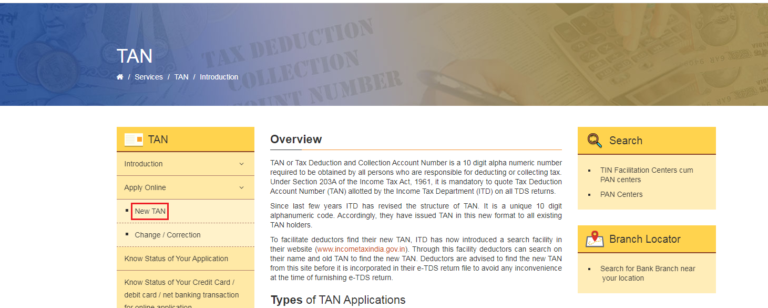

Click on the Services > TAN option from the dashboard on the TIN-NSDL portal.

- Select the “New TAN” option

From the “Apply Online” drop-down list.

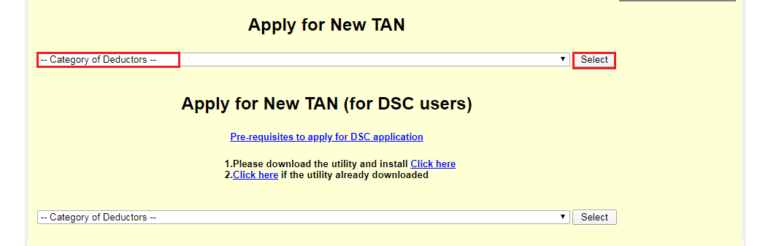

- Go to “Apply for New TAN” section and select the “Category of Deductors” from the drop-down list.

Select the applicable category.

- Click on the “Select” option

After selecting the “Category of Deductors”

- Enter all the details in TAN Application Form 49B

Click on the “Submit” option.

- click on the “Confirm” option.

Enter the captcha code from the given image to complete the verification process of the registration.

- Click on the “Agree” option below the “Terms and Conditions” section.

Go through Terms and Conditions before you agree.

- Choose the appropriate option the payment to complete the registration process.

Payment can be done through Card or Net Banking.

- Download the TAN Application Acknowledgement

It will be available to you in the PDF format which can be downloaded or printed if required.

You can also track the status of the TAN application from the TIN-NSDL portal.

Steps to View TAN Application on TIN NSDL Portal

- Visit the TIN-NSDL portal and select the “TAN” option from the “Services” drop-down list on the TIN-NSDL Portal dashboard.

- Select the option to know the Status of the TAN application

- Select the “TAN – New/Change Request” option from the “Application Type” drop-down list

- Enter the captcha code from the given image before submitting.

How to File an Application to Cancel TAN?

- Click on Services > TAN from the dashboard on the TIN-NSDL portal.

- From the “Apply Online” drop-down list.

- Select the “Category of Deductors” from the drop-down list. Thereafter, click on the “Select” option.

- On the corrections/change application page.

- Click on the check-box on the left side of the margin.

- Payment can be done through Debit Card, Credit Card, UPI, Internet Banking, or BharatQR.

Therefore, after completing the payment process, an acknowledgment screen will be displayed with following information:

- Unique 14-digit acknowledgment number

- Status of applicant

- Name of applicant

- Contact details

- Payment details

- Space for Signature

Steps to View TAN Application on TIN NSDL Portal

- Select the “TAN” option from the “Services” drop-down list on the TIN-NSDL Portal dashboard.

- Choose the “Know Status of Your Application” from under the “TAN” Section.

- Enter the 14-digit acknowledgment number in the respective field.

- Enter the captcha code from the given image before submitting.

FAQs

You can track the application status either on TIN-NSDL or using track your TAN status tool.

No, you can not have more than one TAN. If a duplicate is allotted, you must surrender the duplicate it.

If you submit Form 49B without a digital signature, you must send a signed copy of Acknowledgement to TIN NSDL. TIN-NSDL will only process your application once they receive signed acknowledgment. It should take 1-2 weeks to receive your Tax Account Number post that.

Hey @Sofiyah_Valiante ,

TAN is the short form for Tax Deduction and Collection Account Number.

It is a 10 digit alphanumeric number. The first 3 alphabets represent the jurisdiction code, 4th alphabet is the initial of the name of the holder who can be a company, firm, individual, etc.

It is to be obtained by all persons who are responsible for deducting tax at source (TDS) or who are required to collect tax at source (TCS).