A taxpayer might receive a query for non filing of return if skip filing their ITR for a certain AY. However, transactions of the taxpayer who have not filed return of income for a specific assessment year and have potential liability or who are under obligation to file return of income, are displayed for feedback. Therefore, the e-Campaign is intended to examine whether the identified person who has not yet filed the return of income for the assessment year is liable to the same.

Steps to Access Non-Filing of Return on Compliance Portal

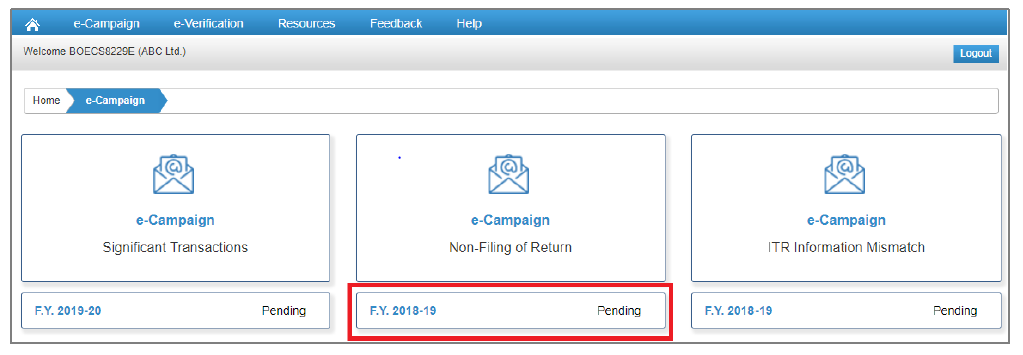

- Click on the e-Campaign portal option.

- Thereafter, click on the “Non-Filing of Return” option

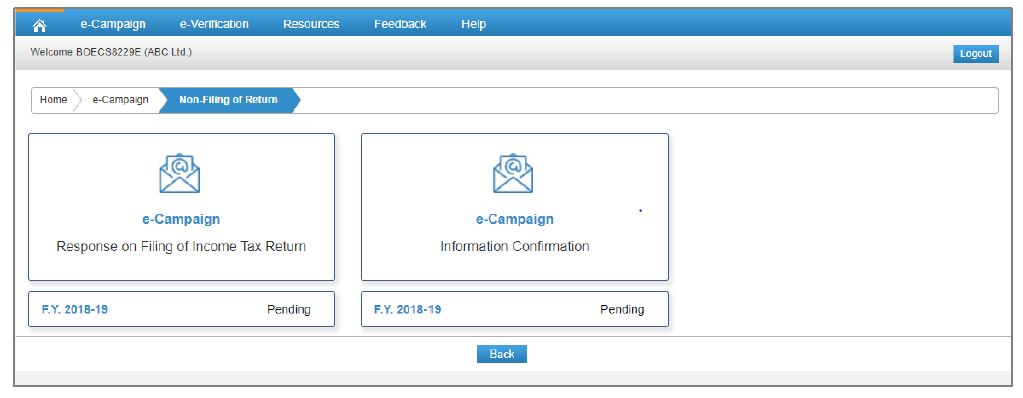

Choose from the options given in the next page.

- Next click on the Financial Year of the “e-Campaign, Non-Filing of Return“

The following options will be displayed:

– Response on Filing of Income Tax Return

– Information Confirmation

FAQs

You can view the notice and post a reply in the section “View and Submit Compliance.”

Once you click on the section you will have the option of “Filing of Income Tax return”. You can use this option to provide a response related to ITRs. You can either choose: “ITR has been filed” or “ITR has not been filed.”

In case, no response is received within 30 days of the issue of this intimation, the return of income will be processed after making necessary adjustment(s) u/s 143(1)(a) of Income Tax Act, 1961 without providing any further opportunities in this matter.

Follow the below steps:

1. Login to your compliance portal account

2. Click on e-Verification tab

3. Click on View button against the case

4. Select and submit the response