What is Non-Filers Monitoring System(NMS)?

Non-Filers Monitoring System, or NMS, is a monitoring system of IT Department that identifies the people who are liable to file taxes (i.e., with annual income more than 2,50,000) but haven’t done so. Upon identifying such non-compliant taxpayers, the system automatically sends a non-compliance email to taxpayer’s registered email address for Non-filing of IT Return. Monitoring system uses

- AIR (Annual Information Return) filed by Financial Institutions

- CIB (Centralised Information Branch)

- TDS Statements to identify such taxpayers.

Every year I-T Department notifies non-filers through SMS and email.

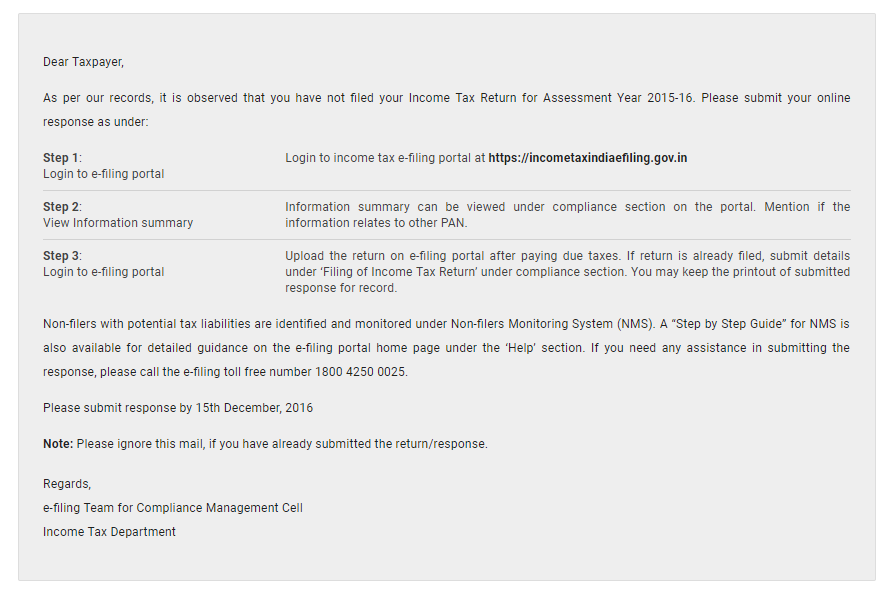

Sample email from Non-filers Monitoring System

How to respond to NMS compliance email?

Here is a step by step guide on how to deal with non-filers monitoring system email

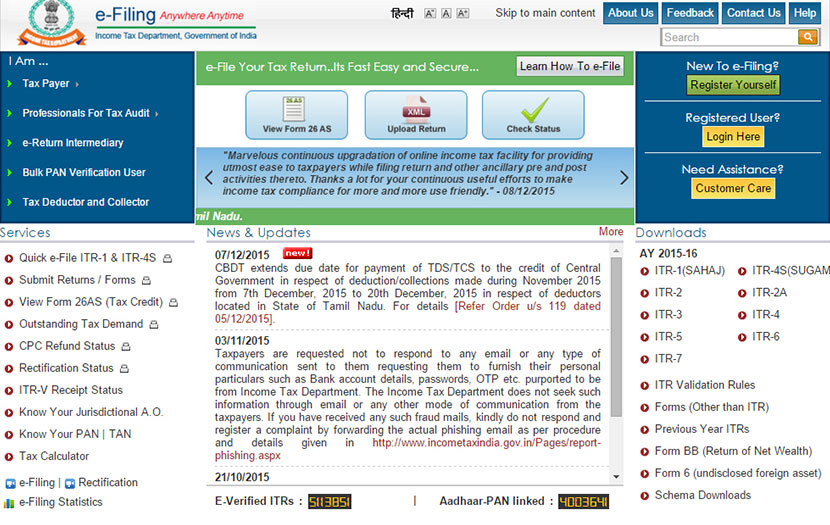

- Visit Income Tax Portal

Login Income Tax Website.

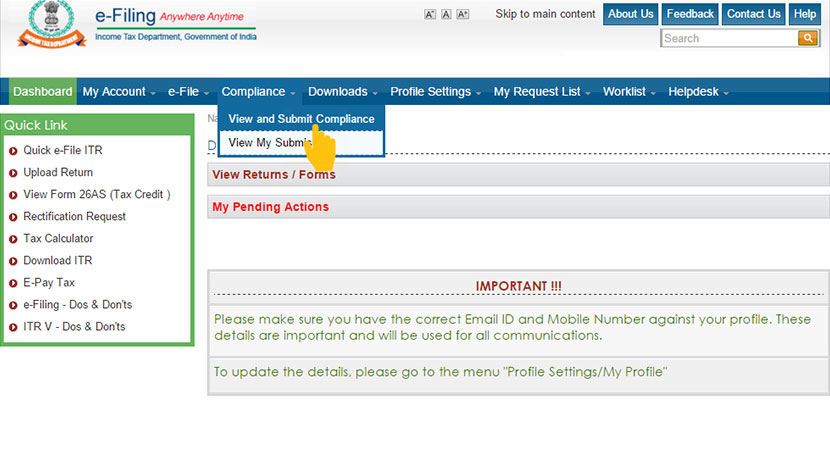

- Navigate to Compliance

Click on View and Submit Compliance.

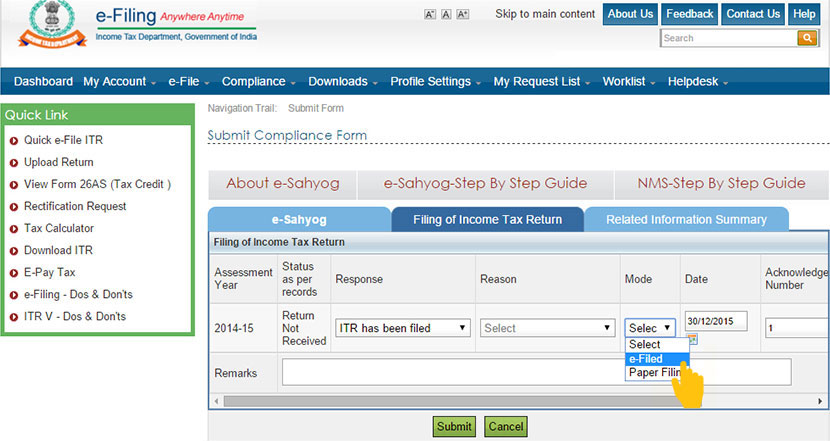

- You will see the Submit Compliance Form.

Navigate to Filing of Income Tax Return.

- Navigate to Asssessment Year for which Return Not Received.

You have two options to respond:

A. ITR has been filed,

B. ITR has not been filed. - If you select option (A), you need to provide:

1. Mode of filing the ITR,

2. Date of filing the ITR,

3. An acknowledgement Number. - If ITR was e-Filed,

details will be prefilled automatically.

- If you select option (B), you need to provide one of the following reasons:

1. Return under Preparation,

2. Business has been Closed,

3. No Taxable Income,

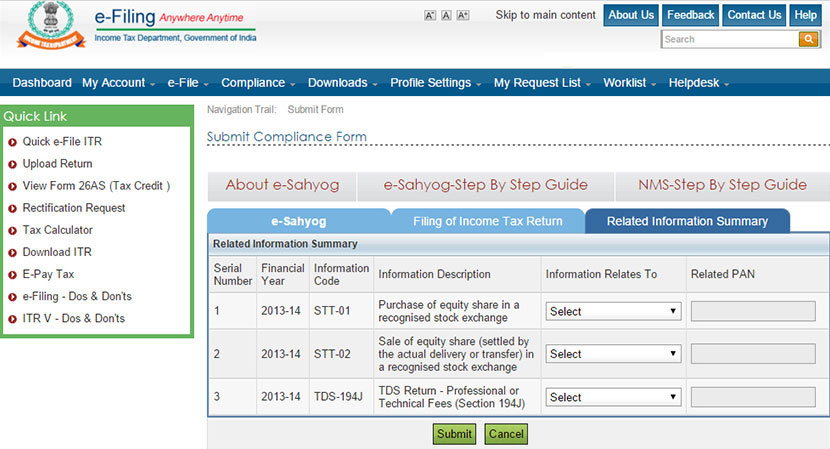

4. Others. - Navigate to Related Information Summary.

It gives a detailed information summary.

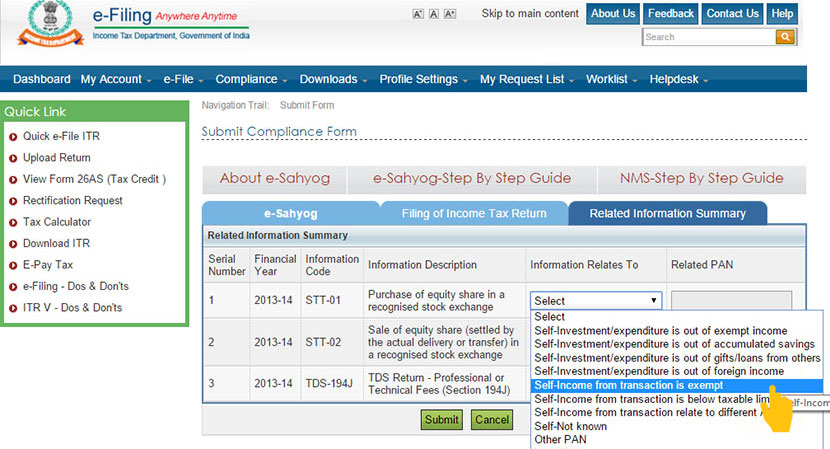

- Choose a relevant option under Information Related To against each transaction mentioned

Provide additional information if required.

- Following are the options available to a taxpayer under Information Relates To tab:

1. Self-Investment/ expenditure is out of exempt income

2. Self-Investment/ expenditure is out of accumulated savings

3. Self-Investment/ expenditure is out of gifts/ loans from others

4. Self-Investment/ expenditure is out of foreign income

5. Self-Income from a transaction is exempt

6. Income from a transaction is below taxable limit

7. Self-Income from transaction relate to different AY

8. Self-Not Known

9. Other PAN

10. Not Known

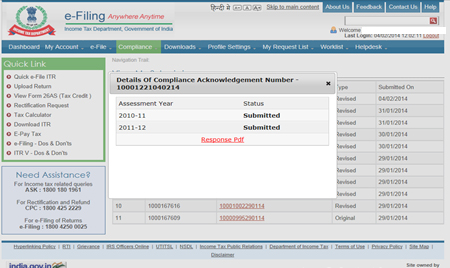

11. I need more information - Upon submission you will see following screen.

Download Response.pdf for your future reference.

FAQs

Step 1: Open the income tax e-filing website and log in to your account with User ID and password.

Step 2: Click on ‘e-File’ tab and select the option ‘e-File in response to notice

In case, no response is received within 30 days of the issue of this intimation, the return of income will be processed after making necessary adjustment(s) without providing any further opportunities in this matter.

The income tax department may issue a notice under Section 271F for non-filing of IT Return. You may have to pay a penalty of up to Rs. 5,000 for missing the deadline. If you have a genuine explanation for not filing and if the officer is satisfied with the reason, you may not have to pay the penalty.