Transfer of shares means the voluntary handing over of the rights and possibly, the duties of a member (as represented in a share of the company) from a shareholder who wishes to not be a member in the company any more to a person who wishes of becoming a member. Thus, shares in a company are transferable like any other movable property in the absence of any expressed restrictions under the articles of the company.

A company is required to hold a Board Meeting for the transfer of Shares. Meeting has to record such minutes for the transfer of shares and also pass the necessary resolution for the same and keep it on record.

Persons involved in the transfer

- Transferor

- Transferee

- Company

- Legal Representative, in case of a deceased.

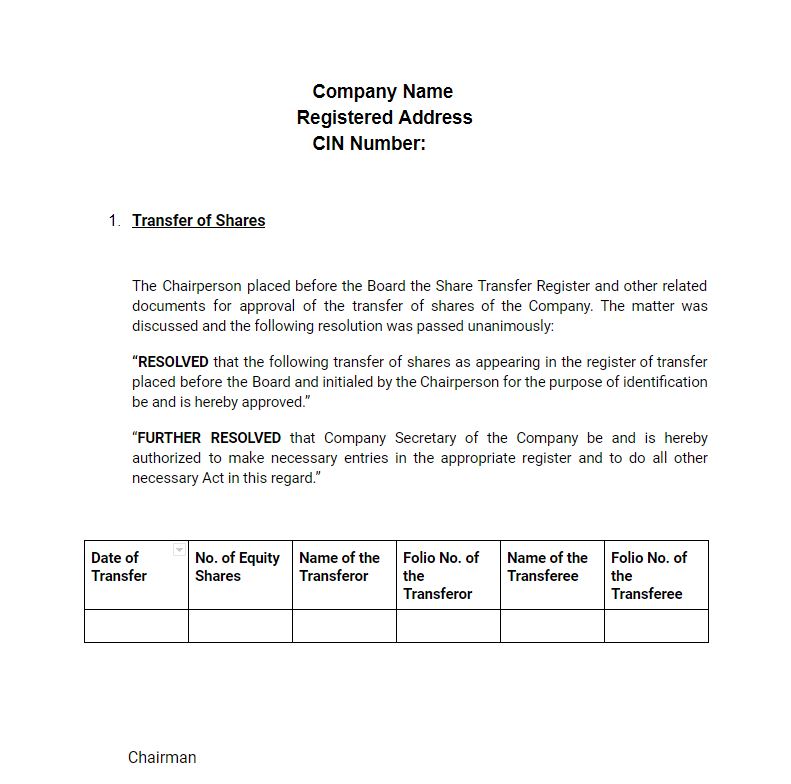

Sample Meeting Minutes : Share Transfer

Share transfer can between any 2 persons. Share transfer details must be recorded in the Board Meeting Minutes and it is also mandatory to pass the necessary resolution in the meeting and the keep it on record.

FAQs

The ledger folio number is allotted to each shareholder of the company, whereas the share certificate is issued after each allotment. For Example – If further shares are allotted to existing shareholders, the ledger folio will remain the same but the share certificate numbers will not be the same.

The stamp duty applicable on share transfer is at 0.25% on the market value on the date of execution of the transfer deed or consideration value whichever is higher. One can contact the nearest “General Post Office” for Share Transfer Stamps or getting Transfer deeds stamped.

Prepare a letter addressing the Company or the RTA of the Company mentioning the reason for your name change and clear details of your new name. Furthermore, enclose the attested copy proofs of name change i.e Affidavit, PAN card, etc. Also, enclose the original share certificate along with the letter.

Under what section/law a company is required to hold a Board Meeting for the transfer of Shares?