MCA has made it mandatory for the director to verify their PAN and DIN Details.

All existing Directors are expected to provide or update their details as per Income tax PAN Database with the DIN database. And make sure that there is no mismatch in PAN and DIN details. This service can be used to verify the details of Director as per DIN database with PAN database.

Steps to Verify DIN-PAN Details of Director

- Go to the MCA Portal.

Access the mca.gov.in. Click on MCA Services > DIN Services > Verify DIN PAN Details of Director

- Enter DIN/ DPIN of a director and click Submit.

In the DIN Services, enter the DIN/DPIN on the box below Verify DIN/DPIN-PAN Details of Director/Designated Partner.

- Enter PAN of a director and click on Submit.

Name of a director will be displayed as per DIN Database.

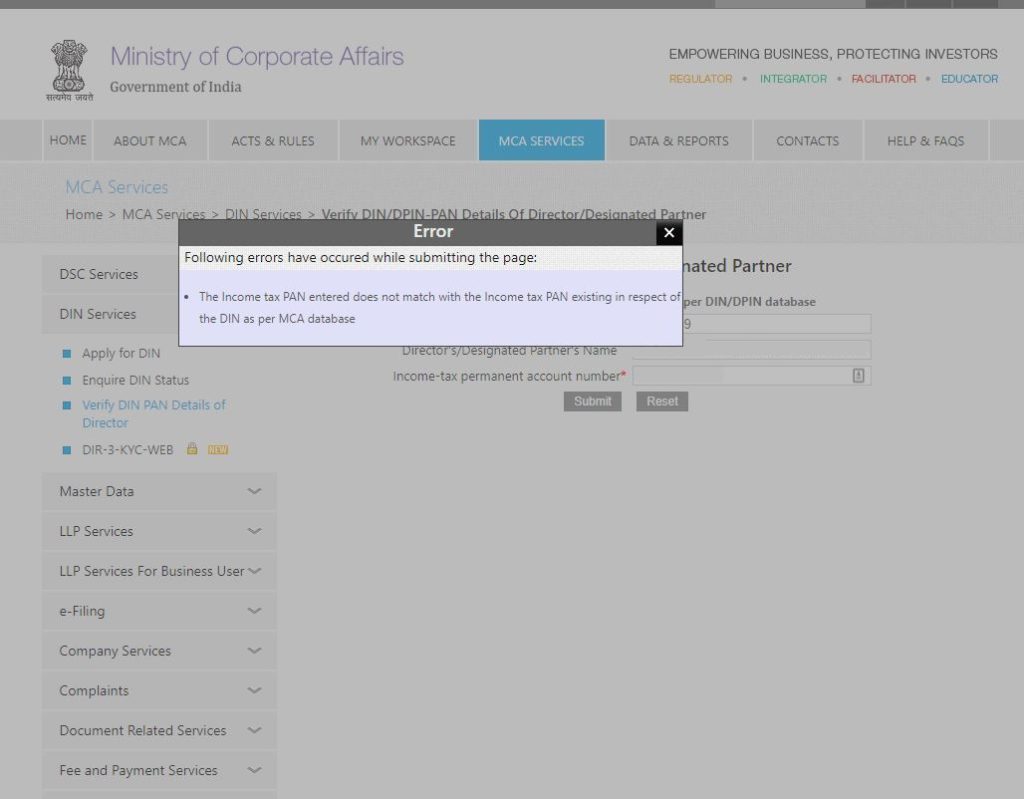

The following error will be shown if there is a discrepancy in the DIN and PAN details.

FAQs

The user will be shown the details as per PAN database when DIN details are not matching with PAN database, Only those fields which are not matching. You can file DIR-6 and update the Income Tax PAN details to solve the discrepancy.

This usually happens in DIN allotted before the implementation of DIR-3 form. You can file DIR-6 form and update the PAN details.

You need to file DIR-3 KYC with penalties and once it will be processed by MCA. Your DIN status will be active again.

How can I know the status of my DIN applied through DIR-3?